Best Swing Trading Brokers With APIs 2026

Looking to automate your swing trades or supercharge your analysis with custom tools? The right broker with a powerful, accessible API (Application Programming Interface) can give you the edge you need.

We break down the best swing trading brokers with APIs—so you can spend less time clicking and more time capitalizing on market momentum.

How SwingTrading.com Chose The Best Brokers For APIs

For every broker featured in our shortlist, we carried out hands-on testing of their API offering. Our investigation looked closely at connection stability, data refresh rates, integration ease, and the clarity of developer resources. Our finding were logged.

We then sorted providers by their overall ratings, revealing the top brokers with API access for swing traders.

How To Choose A Broker For Their API

- Access to historical data is fundamental. Effective swing trading strategies often require multi-year price history at various intervals, such as daily, 4-hour, or hourly charts. A broker API should provide clean, accurate historical data with sufficient depth and granularity to support meaningful backtesting and technical analysis.

- Real-time data support is equally important. While swing trading does not require microsecond updates, access to timely market data—preferably via WebSocket streaming—is critical for monitoring price movements, confirming setups, and triggering trades as candles close. APIs that rely solely on polling can introduce unnecessary latency or miss market shifts.

- The range of supported order types significantly affects trading flexibility. A broker API should enable not just basic market and limit orders, but also advanced types such as stop-limit, bracket orders, and OCO (One-Cancels-Other) orders. These features allow for automated risk management and more efficient trade execution.

- A robust paper trading or sandbox environment is vital for safe strategy testing. This allows you to simulate real trading conditions, debug logic, and evaluate performance without risking capital. The quality of the paper environment—especially how closely it mirrors live market behavior—can affect the reliability of test results.

- API rate limits and throttling policies should be reviewed carefully. Swing trading strategies that scan multiple symbols or update positions based on technical conditions may require frequent API calls. APIs with restrictive rate limits or aggressive throttling can hinder performance or lead to incomplete data retrieval and missed signals.

- Language support and integration options also matter. REST APIs are common and suitable for most use cases. Still, native support for Python, via SDKs or libraries, is highly beneficial for traders who rely on that language for development. FIX protocol may be offered, but it is typically more suited to institutional use cases.

- Authentication and security protocols should be secure yet manageable. APIs should offer key-based access with the ability to regenerate or revoke tokens easily. More advanced options like OAuth provide added protection, particularly for users integrating with external platforms or hosting scripts in remote environments.

- Developer documentation and community support play a key role in the overall usability of a broker’s API. High-quality, up-to-date documentation with code samples, clear explanations, and error handling guidance accelerates development. An active user community or developer forum can provide valuable insights, troubleshooting help, and best practices.

Using a broker’s API changed how I approach swing trading—suddenly, I wasn’t just reacting to the market, I was coding my strategy into it.The biggest surprise wasn’t the automation—it was how the process exposed weaknesses in my setups and forced me to think more systematically.

What Is An API For Trading?

A trading API is a programmable interface that allows you to interact directly with a broker’s platform to automate trade execution, fetch real-time and historical market data, and manage positions based on predefined strategies.

Unlike scalping or high-frequency APIs, swing trading APIs prioritize reliability, data depth, and support for complex order types over ultra-low latency.

They typically offer access to REST endpoints for order management and WebSocket streams for live price updates. This enables you to build custom systems that scan for technical setups, backtest strategies on historical data, and place trades when specific conditions are met—removing emotional bias and improving consistency over time.

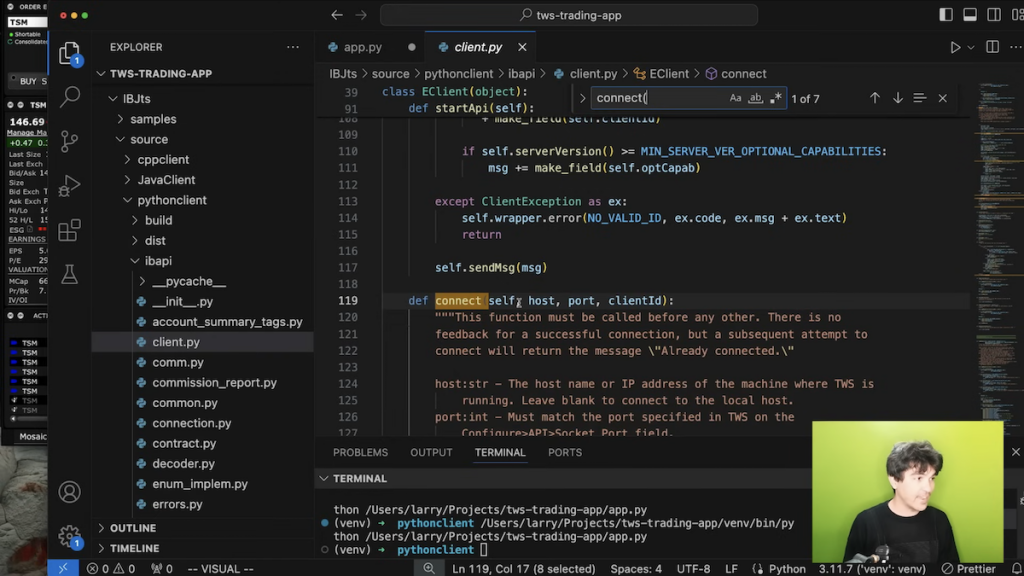

Interactive Brokers supports its TWS API with informative video tutorials

Pros Of Swing Trading APIs

[pros]

Automated strategy execution: APIs allow you to programmatically define entry and exit conditions using indicators like RSI, moving averages, or candlestick patterns. Once triggered, your code can place limit, stop, or market orders automatically—eliminating delays and emotional decisions.

Access to real-time & historical data: Most APIs provide REST endpoints to fetch intraday and end-of-day data, and WebSocket streams for live price feeds. This data is essential for scripting accurate backtests and identifying patterns like breakouts, mean reversion, or momentum shifts.

Custom alerts & risk controls: With API access, you can code dynamic alerts that respond to technical levels (e.g., price crossing a trendline) and implement automated risk management—such as adjusting position size based on volatility or setting trailing stops that update with price movement.

[/pros]

Cons Of Swing Trading APIs

[cons]

Steeper learning curve: APIs require basic programming knowledge (typically in Python or JavaScript) and understanding of concepts like HTTP requests, JSON, and authentication tokens. Beginners may find it challenging to troubleshoot errors or handle API limitations without technical experience.

Rate limits & downtime: Most broker APIs enforce rate limits on data requests and order submissions, which can disrupt strategies that rely on frequent polling or rapid updates. Additionally, scheduled maintenance or unexpected API downtime can cause missed trades or delayed executions.

Limited broker feature access via API: Not all features available on a broker’s web or desktop platform are accessible through its API. You may find gaps such as missing indicators, restricted access to extended-hours data, or a lack of support for certain order types—limiting the flexibility of your strategy.

[/cons]

The real challenge came when the API went down mid-trade—no alerts, no exits, just silence. That’s when I learned the importance of building fail-safes and not relying on automation blindly. An API is powerful, but it’s only as solid as the infrastructure behind it.

Bottom Line

The best swing trading brokers with APIs offer a potent edge for swing traders looking to automate strategies, run data-driven backtests, and execute trades with precision.

While they open the door to custom tools and improved efficiency, they also come with a learning curve, rate limits, and potential gaps in functionality.

Choosing the right broker ultimately comes down to balancing ease of use, data access, and the level of control you need to support your swing trading goals.