Best Swing Trading Apps 2026

Mobile tech has come a long way—today’s smartphones and tablets pack the power of a desktop in your pocket. For swing traders, that means complete control anytime, anywhere.

In this guide, we’ll break down what to look for in a top-tier swing trading app and reveal the best mobile-friendly brokers of 2026.

How SwingTrading.com Chose The Best Trading Apps

We’ve compiled a list of the best mobile-friendly brokers for swing trading, based on a detailed assessment by SwingTrading.com that examines over 200 factors across each platform.

For traders who specialize in swing trading—particularly those using instruments like CFDs—we focused on the features that truly impact short-term strategies: competitive spreads on high-volume assets, customizable leverage options, and benefits tailored to active traders.

These mobile platforms offer more than just standard functionality. They excel in real-world conditions, provide tools well-suited for swing trading, and have been thoroughly tested by experienced users.

How Mobile Trading Apps Work

Mobile trading apps give swing traders the flexibility to monitor markets, analyze price action, and execute trades from virtually anywhere.

But not all mobile trading experiences are created equal. Many small or offshore brokers offer a mobile-optimized website rather than a true, dedicated mobile app—and for serious traders, that’s a significant drawback.

Unlike web-based platforms rendered in a mobile browser, trading apps can utilize native device features, such as push notifications, biometric login (Face ID or fingerprint), and offline watchlist syncing.

These enhancements are crucial for swing traders who need to react quickly to price swings, news events, or technical setups.

In contrast, mobile-friendly websites often feel clunky, load more slowly, and may lack real-time responsiveness or key trading tools. They also tend to be less secure and less reliable when markets are volatile.

For swing traders who rely on timing and execution, using a fully functional app—rather than a stripped-down mobile site—can make the difference between catching a profitable move or missing out.

How To Check If A Broker Has A Mobile Trading App

To check if a broker offers a mobile app suitable for swing trading, start by visiting the broker’s official website.

Most reputable brokers prominently list their mobile app features on the homepage or under a dedicated ‘Platforms’ or ‘Trading Tools’ section.

Look for mentions of iOS and Android compatibility, along with screenshots or feature summaries. Alternatively, head to the Apple App Store or Google Play Store and search for the broker’s name.

Then, try the app yourself. Most brokers offer demo accounts that let you explore the mobile platform without risking real money. Testing the app firsthand is the best way to confirm whether it fits your swing trading strategy.

Easily find and download top trading apps on the Google Play Store

How To Choose A Mobile Trading App

When finding the best mobile trading applications, consider these factors:

Mobile App Usability & Performance

Since swing trading relies on capturing price movements over a few days to weeks, you need to analyze charts, monitor positions, and execute trades, even while away from your desk.

An intuitive, well-designed app makes this seamless, allowing you to navigate between charts, watchlists, and trade without frustration or delay.

Performance is equally crucial. A laggy or unstable app can cause missed entries or exits, especially during high-volatility periods when timing is everything.

Reliable execution, real-time price updates, and swift order placement are crucial for managing trades efficiently and preserving gains when swing trading, which often depends on technical signals and price action.

Watchlists & Customizable Layouts

Watchlists enable you to track your preferred assets in real-time, making it easier to monitor price action and spot setups without constantly searching for tickers.

Whether you’re following stocks, forex pairs, commodities, or crypto assets, a well-organized watchlist helps you stay focused on the markets that matter most to your strategy.

Customizable layouts take this a step further by allowing you to tailor the app interface to your specific workflow.

For swing traders who rely on technical analysis, being able to set up default chart timeframes (such as 4-hour or daily), apply favorite indicators, and arrange tools in a way that suits your trading style can significantly speed up decision-making.

Instead of wasting time reconfiguring settings every time you open the app, you get instant access to the information you need, exactly how you want to see it.

Price Alerts & Notifications

Swing trading involves holding positions for several hours to days, so timing your entry and exit points around key price levels or technical indicators plays a big part.

Real-time alerts enable you to automatically monitor price movements, trend reversals, or breakout levels, allowing you to act quickly when market conditions align with your strategy.

Push notifications sent directly to your mobile device can help you stay connected to the markets even when you’re on the go.

Whether it’s an alert that a stock has reached a support level or crossed a moving average, these updates keep you informed in real-time, allowing for timely decision-making.

This is especially important for part-time traders or those managing trades around other commitments. Without reliable alerts, you risk missing key opportunities or failing to exit trades when conditions change.

A mobile app that offers customizable, accurate, and instant price alerts helps you stay disciplined and responsive, two qualities that are essential for successful swing trading.

Mobile notifications have transformed how I manage my swing trades. Instead of constantly checking charts, I get real-time alerts right on my phone, keeping me connected wherever I am.This peace of mind lets me focus on other things while still catching important price moves—helping me make smarter, timely decisions without the stress.

Mobile Research, News & Educational Tools

Market-moving news and earnings reports can trigger the very price swings swing traders aim to capitalize on, so having up-to-date headlines and analysis directly in your mobile app helps you spot opportunities early and avoid surprises.

The ability to react in real time to news—without switching between platforms—can make the difference between catching a move or being caught off guard.

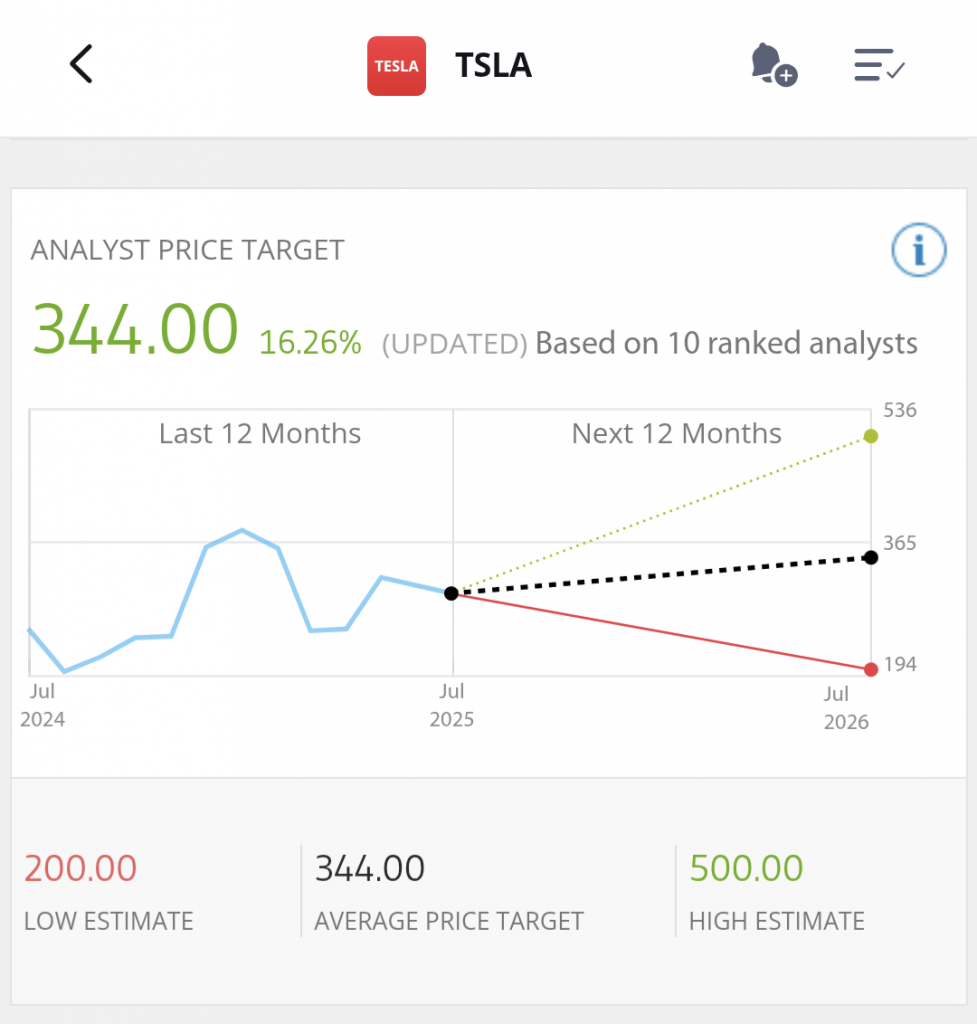

Research tools, such as analyst ratings, fundamental data, and market sentiment indicators, also support more informed decision-making.

While swing trading is often driven by technical analysis, blending in strong fundamental context—especially around catalysts like earnings or economic events—can enhance trade selection and timing.

Having these insights readily available on mobile ensures you’re always in touch with the bigger picture, even when away from your desktop.

Educational resources are equally important, especially for newer swing traders. Apps that include tutorials, market explainers, or strategy guides can help you sharpen your skills and avoid common mistakes.

Whether you’re refining your entry methods or learning how to manage risk more effectively, having learning tools built into your mobile platform allows you to grow as a trader while staying active in the markets.

eToro’s app shows analyst price targets, helping you gauge potential market moves

Customer Support

When managing trades over several days, there’s always the potential for issues like delayed orders, funding problems, or account discrepancies.

Fast, reliable support ensures these problems don’t spiral into costly mistakes, especially when you need to act quickly in a volatile market.

For swing traders who often trade during key market hours or across different time zones, 24/7 or extended-hours support can be a significant advantage.

When you rely on your mobile app to manage open positions on the go, knowing that help is just a tap away provides peace of mind and helps protect both your capital and your confidence.

Bottom Line

To choose the best mobile-friendly broker for your needs, focus on platforms that combine reliable execution with advanced charting and alert features.

Ensure the app supports your preferred instruments and offers low trading costs to maximize profitability.

Prioritize swing trading apps with user-friendly interfaces, strong security, and responsive customer support to help you trade confidently from anywhere.

FAQ

Is Desktop And Mobile Trading The Same?

Desktop and mobile trading offer similar core functions, but they’re not exactly the same. From my countless hours swing trading on both, desktop platforms typically provide more advanced charting, multi-window setups, and faster data processing—ideal for deep technical analysis.

Mobile apps, while more streamlined, are ideal for monitoring trades, managing positions, and reacting quickly on the go. For swing traders, using both together often gives the best balance of flexibility and precision.