Axi is a popular global broker that offers various trading products across a range of financial markets. The firm boasts competitive trading conditions, as well as a suite of educational content and analytical tools to meet the needs of both beginner and seasoned swing traders. This 2026 Axi review will explore all aspects of the broker, from its regulation and security standards to its payment options, account types and trading platforms.

What Is Axi?

Company Details

Axi is an online broker that specialises in derivatives markets. These encompass global equities, indices, commodities, forex and cryptocurrencies. The broker serves more than 60,000 clients in over 100 countries, with an annual trading volume exceeding $2.5 trillion.

Key members of staff include Rajesh Yohannan (CEO), Louis Cooper (CCO), Simon Hodgkiss (CRO) and Simon Turner (CIO). Axi is the official online trading partner of Manchester City Football Club.

History

AxiCorp Ltd. is a digital trading brokerage founded in 2007. It was formerly known as AxiTrader but rebranded to Axi in October of 2020. The firm has its headquarters in Sydney, Australia, alongside offices in London, UK, China and the UAE.

Markets

Axi clients can speculate on a range of markets through CFD derivatives, which support both long and short positions:

- Forex – 80+ major, minor and exotic pairs

- Shares – 10 UK, 10 EU and 30 US company shares

- Indices – 31 cash and futures CFDs on global equity, industry and thematic indices, including the volatility 75 (VIX75)

- Commodities – Cash CFDs on seven precious metal pairs, covering gold, silver and platinum, plus futures CFDs on five energies, three metals and three agricultural products

- Cryptocurrencies – 11 popular cryptos as cash CFDs against the USD

You can earn direct dividend payouts from any share CFDs held. Crypto instruments are only available to professional clients due to FCA regulations. It is also possible to hedge your portfolio using Axi assets, which many use with swing trading to reduce risk and losses.

Note, ETFs and Bond CFDs are not available.

Trading Platforms

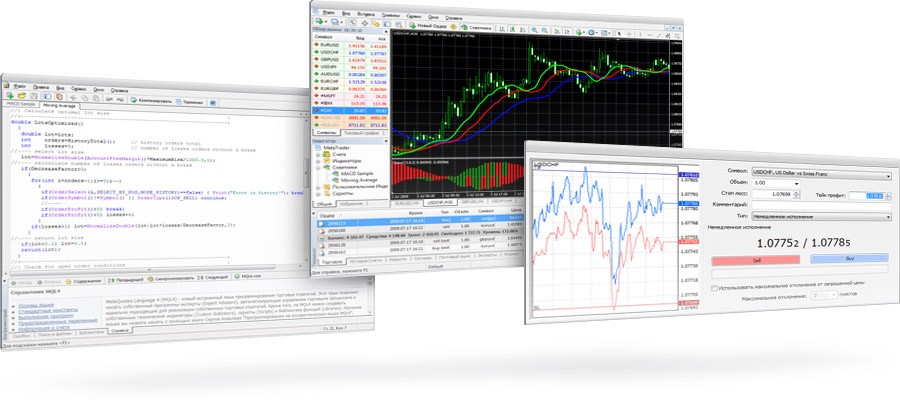

MetaTrader 4

Axi offers its clients desktop, browser-based and mobile platform solutions through MetaTrader 4. The third-party software provides a wide range of trading tools over a low latency network. MetaQuotes created MT4 in 2002 and it has been the world’s leading forex trading platform for nearly two decades. MT4 is available for download on Windows, Mac and Linux computers via the link on the broker’s website.

MT4 is simple for beginners and full of advanced functions for professionals. The platform offers a wide range of built-in and customisable features, alongside a wealth of online resources created by its users, such as custom indicators, signals systems, charting tools and automated trading bots (or EAs).

Notable features include:

- Nine timeframes

- Financial statements

- Alerts & notifications

- 39 available languages

- Fee & portfolio reports

- 30 technical indicators

- Four pending order types

- Integrated trading signals

- Fully customisable charts & tools

- Automated trading through its MQL4 programming language

MetaTrader 4

Trading Platform Extensions

MT4 Forex VPS Hosting

Axi clients can subscribe to an MT4 forex VPS hosting service from external third-party providers. This helps to ensure trades are never disrupted by no connection issues. A virtual private server hosting service uses an external web server to keep algorithms running 24 hours a day, limiting downtime.

MT4 NexGen

The NexGen add-on for MT4 offers advanced management tools, sentiment trading and enhanced ordering. The comprehensive software package allows you to integrate several useful features:

- New Terminal Window – Additional post-trade features, including templates, group functions and OCO- management

- Sentiment Indicator – View how others are trading for insights into live market trends and opportunities

- Economic Calendar – Tag major events with personalised alerts to keep on top of things

- Correlation Trader – Cut down on management errors and find new opportunities

- Alarm Manager – Free yourself from your screen with alert management

- Trade Journal – Automate your analysis and reporting of trade activity

MT4 NexGen

Autochartist

Autochartist is a popular market analysis software with a range of useful functions:

- Performance Statistics – Review detailed stats for up to six months to analyse past trade setups for best success

- Continuous Scanning – The search for market opportunities never stops, providing continuous tips and alerts

- Free Market Reports – Market Snapshot emails with 24 – 48 hour market outlooks and thrice-daily reports

- Automated Analysis – Insights and notifications on forecasts and advanced chart patterns

- Volatility Analysis – Useful help with analysing market volatility and risk levels

- Favourites – Remove clutter and filter opportunities with success probability

Autochartist

Myfxbook Autotrade

The Myfxbook Autotrade application is a third-party plugin that offers social and copy trading capabilities. Clients can follow other traders, share their own strategies and store all their systems in one place.

Investing in a variety of strategies and systems from other customers provides portfolio diversification over several markets and approaches. The tool also allows you to monitor your performance and analyse your trading results to optimise your system with automated statistical analysis.

PsyQuation

All Axi clients can access PsyQuation and PsyQuation Premium for free. These packages use machine learning AI algorithms to optimise and improve every aspect of your trading setup. The software package aims to work like an automated trading coach, analysing your history and highlighting potential pitfalls based on your behaviour. The unique ranking system measures risk, skill and behaviour to track progress and push you to do better. Additional features include advanced trade alerts and public leaderboards with equity curve and portfolio analysis.

Mobile App

Axi clients can access the broker’s trading platform with both Apple (iPhone) and Android (APK) devices via the MetaTrader 4 app. This can be downloaded from either the Apple App Store or Google Play Store and the experience is similar to the web and desktop platforms, so traders can easily move across devices.

The application has a clean interface and is easy to use. However, there are some key differences between the mobile and desktop platforms. Market execution and simple pending orders only are available on mobile and indicators are limited to a default list.

Copy Trading

Copy trading can also be executed by connecting your MT4 trading account to the Axi Copy Trading app. From here, you can explore the interconnected Axi community using a variety of filters to find the traders and investors that meet your investment objectives. Next, you can choose those you wish to copy and begin imitating their every move. Your account will then perform the requested trade on your Axi account via the MT4 app.

Trading Accounts

Clients can open one of three live account types, the Standard, Pro or Elite account. The Standard account sits as the default, while the Pro options provide improved retail spreads. The Elite account sits at the top of the ladder and is only for verified professional clients.

Every account is free to set up, though each has its own application procedure. Axi also offers Islamic accounts, with no swap fees or interest payments.

Similarities across accounts include a minimum trade size of 0.01 lots, full access to the broker’s assets, five-digit pricing, free VPS, leverage rates up to 1:500 and access to the full range of MT4 plug-ins and add-ons. Clients can register for individual, joint or corporate accounts.

Standard Account

- No commissions

- $0 minimum deposit

- Spreads from 0.4 pips

- Negative balance protection

- AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD & USD

Pro Account

- $0 minimum deposit

- Spreads from 0.0 pips

- $7 round turn commissions

- Negative balance protection

- AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD & USD

Elite Account

- Spreads from 0.0 pips

- AUD, EUR, GBP & USD

- $25,000 minimum deposit

- $3.50 round turn commissions

- No negative balance protection

Demo Account

Axi offers a free 30-day demo account, which can mimic each of the main account types. Demo accounts receive $50,000 of virtual funds to practise placing trades and analysing the market in a risk-free, real-time simulated environment. This is a great place to trial the broker, explore new assets and learn about the financial markets.

Setting Up An Account

Setting up an account with Axi is straightforward. To do so, traders must input know-your-customer (KYC) information, including a variety of personal and financial information. You then answer questions relating to your investment experience, financial situation and future goals. You must also upload your ID (passport, driver’s license or national ID card) and proof of residence (bank statement, utility bill, etc).

The broker may take a few days to verify your account. Once this is confirmed, you can fund your account with as little or as much capital as you would like.

Axi Leverage

Retail clients from the UK and EU-regulated areas can access leverage rates of up to 1:30, while professionals and international customers can reach a much higher limit of 1:500. Trading on margin increases risk exposure, however, so investors should proceed with caution.

Fees

The Standard trading account offers commission-free trading with spreads from 0.4 pips. Pro and Elite accounts boast raw spreads while charging $7 and $3.50 round-turn commissions, respectively. Setting up an account is free, though a year of inactivity will incur a $10 per month charge. Axi also charges swap fees for positions held open overnight.

Payments

Deposits

Accounts are available in USD, EUR, GBP, CHF, AED, CAD PLN, INR and SGD. Account funding can be done via Visa and Mastercard credit cards, bank wire transfer, PayPal, Apple Pay and the e-wallets Sofort, Giropay, iDeal, Neteller and Skrill. You can also make deposits using Polish Internet Banking and Global Connect. Deposits are fast, free and fully encrypted.

Withdrawals

Withdrawals are free with Axi but must be done through the same account and method as your deposits. All requests take one or two business days to process once the broker has received them, though this can vary with the bank used. International transfers can take between two and five working days. The firm may also require extra information to prove that the beneficiary account is under the correct name, as third-party remittances are not permitted.

Axi Regulation

Axi (formerly known as AxiTrader) is a trading name of AxiCorp Limited, registered in England and Wales under registered number 06378544. The UK Financial Conduct Authority authorises and regulates AxiCorp Ltd. (Reference Number 509746). The broker is also authorised and regulated by the Australian Securities & Investments Commission (ASIC), AFSL number 318232.

Axi is also the trading name of AxiTrader Limited (AxiTrader), which is incorporated in St Vincent and the Grenadines under number 25417 BC 2019 by the Registrar of International Business Companies and licensed by the Financial Services Authority. Axi is also regulated by the DFSA.

Note, the New Zealand Financial Markets Authority suspended Axi’s brokerage license in 2019 for failing to adequately audit its financial statements.

Security

Axi clients are automatically members of a compensation fund, which acts as an insurance policy covering up to $20,000 per person. This protects each trader’s capital in case the broker goes under. Additionally, all client funds are held in segregated bank accounts and negative balance protection is available to Standard and Pro account-holders.

Unfortunately, two-factor authentication (2FA) is not on offer.

Axi Customer Support

Clients can contact customer support 24/5, from Sunday 22:00 GMT to Friday 23:59 GMT. Customer service is fast, reliable and available in 14 languages. Contact methods include telephone, live chat, email and WhatsApp messenger.

- Phone: +44 203 544 9646

- Email: service@axi.com

Axi also has a social media presence on various community forums, including Facebook, Twitter, YouTube, LinkedIn and Telegram.

Advantages

Benefits of trading with Axi include:

- Regulated

- Tight spreads

- Demo account

- Crypto trading

- Commission-free

- Transparent prices

- MT4 download for Mac

- Limited withdrawal problems

- Several third-party extensions

- Performance monitoring tools

Disadvantages

Downsides of opening an account with Axi include:

- No 2FA login

- No MT5 or cTrader

- Limited equity products

Trading Hours

The Axi trading platform is online 24/7 and all positions can be held over weekends and major holidays, though this brings a level of risk with it. Each asset will follow individual opening times during which positions can be opened and closed. For example, crypto trading is available 24/7, while forex is limited to 24/5 and UK stocks will follow the LSE trading times.

Axi Verdict

Axi is a competitive and reliable broker, boasting a wide range of markets and instruments that can be used for day, position or swing trading. Regulation from the FCA, ASIC and SVGFSA ensure that clients are treated fairly and funds are held securely. The only trading platform on offer is MT4, although account holders can integrate several free platform extensions that support copy trading, AI-based strategy optimisation and automated journalling.

FAQ

Is Axi A Good Or Bad Broker?

Axi is a competitive broker that offers a good range of assets, platform tools, payment methods and account types. The firm boasts regulatory oversight from several reputable agencies and trading conditions are cheap, with raw spreads and commission-free options.

Where Can Axi Be Used?

Axi is available to clients in many countries throughout the world, including Australia, Belgium, Thailand, Indonesia, Canada, the Philippines, Dubai, Malaysia, the UK, India, Norway and the UAE. However, given the nature of its financial instruments, the firm does not accept clients from the USA, Japan, Singapore, Colombia, Iraq and Iran.

Is Axi Safe & Legitimate?

Three major financial authorities regulate Axi, the FCA, ASIC and SVGFSA. These all require rigorous security standards, transparent financials and adequate protection of client capital. The brokerage has a variety of positive reviews, awards and achievements, adding to its safe and reliable reputation.

Does Axi Offer A Demo Account?

Axi clients can open a free 30-day demo account to trial the firm’s services, explore new assets or test out strategies. Paper trading accounts are loaded with up to $50,000 in virtual funds and operate in a real-time simulated environment. This is to give the best indication of success in real markets.

What Is The Minimum Amount Of Capital I Need To Trade With Axi?

Axi does not implement a minimum deposit limit for its Standard and Pro accounts. Therefore, clients can begin trading with as little as $1.