Best Swing Trading Brokers With Synthetic Indices 2025

Whether you’re a seasoned pro or a new swing trader, the right broker is crucial to tapping into the potential of synthetic indices.

Dig into the best swing trading brokers with synthetic indices that combine cutting-edge platforms and competitive trading conditions, giving you the edge you need to thrive in this dynamic market.

How SwingTrading.com Chose the Best Synthetic Index Brokers

Our rankings are based on a blend of expert reviews and analysis of 200+ data points. We focused on key factors that matter to swing traders, including the variety of synthetic indices offered, trading conditions (like leverage, spreads, and execution speed), and platform performance.

We also open accounts with each broker to get firsthand experience. This lets us assess how the platform handles real market movements, test out charting tools, and evaluate features like risk management settings and the overall user experience.

How To Choose The Right Brokers For Synthetic Index Trading

Platform Reliability And User Experience

A reliable and user-friendly trading platform is essential for swing trading synthetic indices.

Platforms with fast execution, stable connections, and clear charting tools help you enter and exit positions precisely, especially during key market setups like breakouts or reversals.

An intuitive interface also reduces the chance of errors, ensuring a smoother trading experience.

Competitive Fees And Spreads

High spreads, commissions, or hidden fees can significantly reduce profits, especially during volatile swings.

It’s important to compare brokers’ fee structures to identify those offering competitive and transparent pricing.

This lets you focus on your strategy without worrying about unexpected costs impacting your trades.

Asset Variety And Liquidity

Not all brokers offer the same range of synthetic indices. A diverse selection—such as different volatility indices or Boom/Crash indices—provides more opportunities and flexibility.

Brokers with high liquidity on these instruments also ensure smoother trade execution, reducing the risk of slippage during entry and exit.

Regulation And Trustworthiness

Regulation and trustworthiness are crucial when trading synthetic indices, particularly through brokers outside of mainstream markets.

To safeguard your capital and peace of mind, you should choose regulated brokers with transparent policies, secure fund management, a reputation for timely withdrawals, and responsive customer support.

Regulatory bodies like the UK’s FCA and Europe’s CySEC are recognized for their rigorous oversight and strong consumer protection measures.

When engaging in swing trading, choosing a broker regulated by such authorities provides an extra layer of security, ensuring that market volatility or broker-related problems are less likely to put your funds or positions at risk.

Tools, Education And Support

The best brokers offer access to synthetic indices and provide robust educational resources, trading tools, and responsive customer service.

Quality educational content, such as webinars, guides, and tutorials on synthetic index trading, can enhance your skills while dedicated support teams help resolve issues quickly and efficiently.

What Are Synthetic Indices?

Synthetic indices are specially designed trading instruments that simulate the behavior of real-world markets but are generated by mathematical models rather than influenced by external events.

Unlike traditional assets like forex, stocks, or commodities, synthetic indices are created to mimic market volatility and price movement while operating 24/7, providing a consistent trading environment for traders.

These indices are popular because they offer predictable risk profiles and aren’t swayed by economic data releases, political instability, or market holidays.

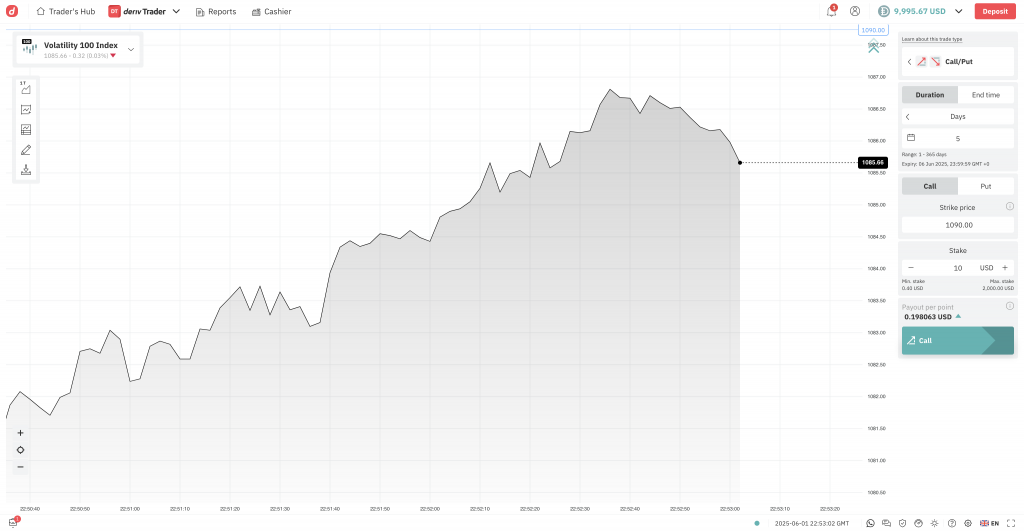

A key feature of synthetic indices is their controlled volatility. For example, the Volatility 100 Index (VIX) replicates the dynamics of a highly volatile market, while the Volatility 10 Index offers a more stable, low-volatility experience.

Swing traders favor these indices because they can identify clear trends and capitalize on short-to-medium-term price swings without worrying about sudden news events that could disrupt positions.

By targeting a swing downward and applying proper risk management, you can take advantage of the high volatility without the distractions of external market influences.

Swing trading the VIX 100 on Deriv requires balancing risk and opportunity

What Are The Pros Of Trading Synthetic Indices?

Synthetic indices offer a swing trading environment like no other – where you can focus purely on price patterns and technical signals without external distractions.

Their steady price action and consistent behavior make them a valuable tool for traders who thrive on strategy and analysis rather than guesswork.

One key advantage is the precision and predictability these indices provide. Swing traders often look for clear support and resistance levels, trendlines, or breakout patterns to plan their entries and exits.

Synthetic indices respond well to technical analysis because their movement is driven by consistent mathematical algorithms rather than unpredictable news or economic events.

This allows you to spot and act on technical setups with greater confidence.

Additionally, synthetic indices’ high liquidity and tight spreads make them attractive for swing traders who need efficient trade execution.

Since these indices are designed to mirror real-market behaviors, they offer sharp yet manageable price swings, allowing you to capture profits within a defined timeframe.

I’ve appreciated how precise and manageable the price action can be. For example, when trading the Boom 500 Index, I spotted a clear flag pattern on the 4-hour chart.

Recognizing its potential for a breakout, I timed my entry just as the price broke above the flag’s resistance line. I set my stop-loss below the pattern and calculated my profit target based on the measured move.

The price surged upward exactly as anticipated, and I was able to close my position for a solid gain.

Ultimately, synthetic indices provide swing traders with a clean, controlled environment where technical patterns can play out predictably, offering consistent opportunities to profit from bullish and bearish market conditions.

IG’s platform provides excellent real-time charting tools for synthetic indices

What Are The Cons Of Trading Synthetic Indices?

While synthetic indices offer many advantages for swing traders, there are a few notable drawbacks.

One of the biggest challenges is overtrading. Because synthetic indices are available 24/7 and aren’t influenced by news events, it’s easy to fall into the trap of always trying to catch the next move.

Early in my trading career, I was glued to the screen, entering trades impulsively just because the market was open. This led to several losses that could have been avoided if I had followed a structured trading plan.

Another downside is the lack of real-world fundamentals. With forex or stocks, you can often use economic data, earnings reports, or geopolitical news to anticipate price moves.

However, synthetic indices are driven purely by mathematical models, which means fundamental analysis is useless here.

I recall trying to apply my knowledge of market sentiment to a synthetic index, expecting it to behave similarly to major forex pairs during a risk-off event.

The index, of course, ignored this entirely, and I took an unnecessary loss. It was a clear lesson in understanding the unique nature of these instruments.

Additionally, volatility can be a double-edged sword. While you can profit from sharp swings in synthetic indices like the VIX, you can also experience sudden, unexpected price spikes that trigger your stop-loss before the trade direction plays out.

These rapid moves, especially during low-liquidity times like late-night trading sessions, can be frustrating and lead to losses if you’re not careful with position sizing and risk management.

Synthetic indices require a disciplined approach and an understanding of their unique mechanics. Without these, it’s easy to get caught in risky trades, over-leverage, or misinterpret price movements, ultimately eroding profits.

Bottom Line

Swing trading synthetic indices presents a unique opportunity to capitalize on predictable price movements in a market that operates 24/7.

Choosing a top swing trading broker with synthetic indices is essential to unlocking this potential, as factors like platform reliability, competitive fees, regulation, and quality support all impact trading success.

Swing traders can confidently navigate this exciting and dynamic market by carefully selecting a trusted broker with access to diverse synthetic indices and strong trading tools.

FAQ

Are Synthetic Indices Riskier Than Traditional Markets?

Synthetic indices can be riskier than traditional markets due to their designed high volatility and continuous 24/7 trading.

However, real-world news or events do not affect them, which can reduce unpredictable shocks.

With proper risk management, synthetic indices can offer controlled opportunities for swing traders despite their inherent volatility.