Best Swing Trading Brokers With Instant Deposits 2025

Timing is everything in swing trading, where capturing short- to medium-term price movements can significantly impact profits. That’s why having access to brokers that support instant deposits is essential, allowing you to fund your accounts and enter positions quickly without delay.

In this guide, we highlight the best swing trading brokers with instant deposits, including through debit cards, e-wallets, and even cryptocurrencies.

How SwingTrading.com Chose The Fastest Deposit Brokers

As part of our testing process, we investigate the payment speeds of every broker we review. We specifically flag those offering near-instant deposits. Only brokers meeting this standard were shortlisted.

From there, they were ranked based on their overall rating, factoring in platform quality, fees, and swing trading tools.

What To Look For In A Broker With Fast Deposits

When selecting a broker, it is essential to consider key factors such as deposit fees, processing speeds, supported payment types, and transaction limits, all of which are crucial for fast and dependable funding methods.

Understanding these details ensures you’re always prepared to take advantage of market opportunities the moment they arise, without unnecessary delays or unexpected costs.

Instant Deposit Availability & Methods

Instant trading deposits are designed to give you fast access to your funds – often within seconds or minutes – so you can act quickly on short- to medium-term market setups.

This is especially helpful for swing traders, who need the flexibility to enter positions without waiting for slow bank transfers to clear.

The process typically starts when you choose a supported instant deposit method during the funding step of your broker’s platform. The most common options we see during our broker tests include:

- Debit and credit cards: These are often the fastest and most widely accepted methods. Once your card details are verified, the funds are typically credited to your trading account immediately.

- E-wallets: Services like PayPal, Skrill, and Neteller offer fast, secure transactions. Since these platforms act as intermediaries, the deposit can be completed in seconds once the user is authenticated.

- Cryptocurrencies: Some brokers now accept instant deposits in crypto like Bitcoin, Ethereum, or USDT. While blockchain confirmations are still required, the process can be relatively quick depending on network congestion and the broker’s wallet system.

- Bank wire transfers: In certain regions, brokers partner with real-time payment networks (like SEPA Instant in Europe or Faster Payments in the UK) to speed up traditional bank transfers.

Once the payment is submitted, the broker’s system detects the transaction and credits your trading account automatically using internal approval protocols. You’ll typically see the balance updated immediately, and in many cases, the funds are available for trading right away.

That said, the actual ‘instant’ nature depends on the broker’s infrastructure and integrations. Brokers with robust payment gateways and real-time transaction monitoring are better equipped to process deposits promptly.

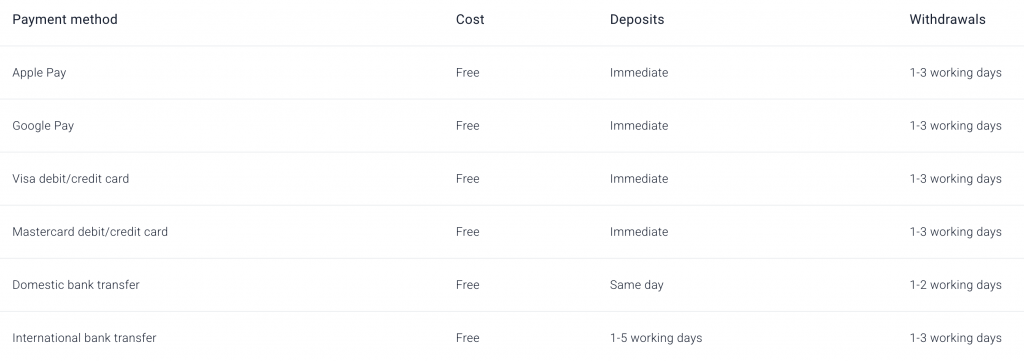

Pepperstone clearly lists its funding options and transaction times, and you’ll see many are ‘Immediate’

Instant Deposit Flexibility

Flexibility is a key consideration when choosing a broker that offers instant deposits, particularly for swing traders who may need to fund their accounts quickly and in varying amounts.

The best brokers we’ve used offer a wide range of deposit options, with clear minimum and maximum limits, enabling both small account traders and those with larger capital to operate efficiently.

Some platforms support minimum deposits as low as $10, while others may require a minimum deposit of $200 or more. On the higher end, instant deposits can be capped per transaction, per day, or week—limits that vary depending on your chosen payment method and account verification level.

Deposit Fees

Deposit fees are another factor. While many brokers we’ve evaluated advertise free deposits, some charge small transaction fees, particularly for instant payment services such as e-wallets or cryptocurrencies.

These fees can eat into your capital over time, which is something you should consider when making frequent top-ups or scaling into positions.

Currency support also affects deposit flexibility. A broker that accepts multiple base currencies—such as USD, EUR, GBP, or AUD—helps you avoid unnecessary conversion fees when funding your account.

Some brokers even allow deposits in cryptocurrencies and automatically convert them to your trading currency, though this convenience often comes with a spread or handling fee.

Finally, flexibility also means having access to multiple instant funding methods, such as debit and credit cards, e-wallets, bank transfers, and even local payment gateways in select regions.

Do Regulations Affect Instant Deposits?

Global financial regulations play a significant role in determining how and when you can make instant deposits with brokers.

While many brokers aim to provide real-time or near-instant funding options, their ability to do so is often limited by local compliance requirements tied to anti-money laundering (AML) laws and know-your-customer (KYC) procedures.

For instance, KYC regulations require brokers to verify a client’s identity before allowing full access to trading features, including deposits and withdrawals. This can delay the first-time deposit process, especially if identity documents or proof of address need manual approval.

Even with e-wallets or cryptocurrencies, a broker regulated in a strict jurisdiction (such as the US, EU, or UK) may not release funds for trading instantly until all KYC checks are completed.

AML rules are just as critical. To prevent fraud or illicit transfers, some brokers limit the speed or size of instant deposits, especially if they come from high-risk regions or unverified payment methods.

In some cases, international traders may find that specific payment options advertised as ‘instant’ are disabled due to their country’s financial restrictions or the broker’s licensing limitations.

I once tried to make an instant crypto deposit on an EU-based platform, but it was flagged for AML review. I had to submit extra documents, and the delay cost me nearly a whole day.It was a clear reminder that even ‘instant’ methods can be slowed by regulation, especially with crypto.

Limits & Risks With Fast Trading Deposits

While instant deposits can be a game-changer for swing traders looking to act quickly on market setups, they come with specific limits and risks that are important to understand before relying on them.

Most brokers we’ve evaluated impose deposit caps, which can be daily, weekly, or even per transaction. These limits vary depending on the payment method and your verification level.

For example, debit card deposits may be capped at $5,000 per day, while e-wallets or cryptocurrencies may have higher or lower thresholds, depending on the broker’s policies.

This can become a hurdle if you want to scale into positions or fund your accounts quickly after a large withdrawal.

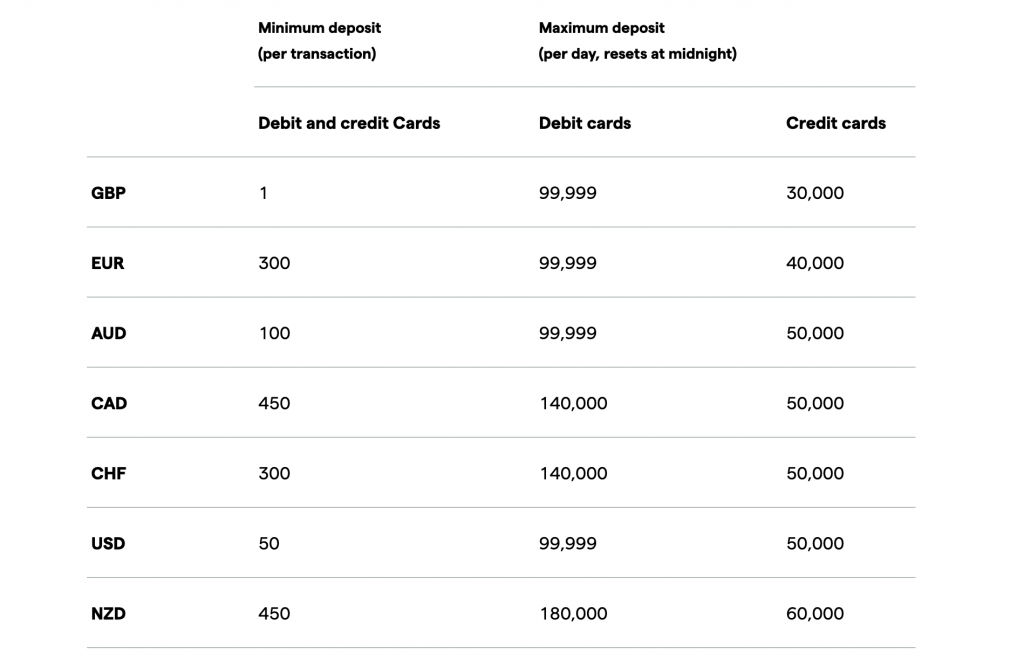

Minimum and maximum deposit amounts vary considerably at IG

Fraud protection is another key area of concern. Because instant deposit methods are often tied to easily reversible payment systems – such as credit cards or e-wallets – brokers must implement safeguards against unauthorized transactions or chargebacks.

In some cases, even legitimate deposits can be held for manual review if flagged by the broker’s risk systems, mainly when originating from new devices or locations. You may also be subject to holds or delays when withdrawing funds linked to instant deposits, as a measure to protect the broker from fraud.

I once tried to deposit a larger-than-usual amount via credit card for a swing trade on a high-volume stock, but the broker’s daily limit blocked it. I had to split the deposit over two days and missed my entry.Since then, I have consistently checked deposit caps and maintained a backup funding option.

Support With Deposits

Whether you’re experiencing a delay in a supposedly instant deposit or need help verifying a payment method, I know from firsthand experience that having responsive support can mean the difference between entering a trade on time or missing the window altogether.

Key customer support features to look for include 24/7 availability, particularly via live chat, since markets can move fast outside of standard business hours.

A dedicated support line for funding and withdrawals is also valuable—some brokers silo this into a separate department, which can be a time-saver.

Additionally, check if the broker offers multilingual support, especially if you’re trading from a non-English-speaking country, and whether they provide in-platform help widgets or AI chatbots for quick answers.

Equally important is the response time and resolution quality. You want a broker that doesn’t just respond quickly, but solves your issue without a lengthy back-and-forth. Access to real human agents—not just automated responses—can be vital when troubleshooting failed deposits or unexpected delays.

I once used an e-wallet to fund my account before a breakout, but the deposit silently failed. Support later confirmed it was a verification issue—too late, as the move had already happened.Since then, I only use brokers with fast support and clear deposit tracking.

Bottom Line

Many reputable brokers now offer instant deposit options, making it easier for you to capitalize on market opportunities quickly. However, deposit speed often depends on the payment method—debit cards and e-wallets are usually faster than bank transfers or crypto.

Keep in mind that regulatory checks like KYC and AML can delay deposits if not completed in advance, even when using ‘instant’ methods. It’s a good idea to verify your account early to avoid any last-minute issues.

Also, be aware of minimum deposit requirements and potential fees, as they can vary by broker and reduce your available capital.

FAQ

What Is An Instant Trading Deposit?

An instant trading deposit is a fast way to fund your brokerage account, with funds typically available within seconds or minutes. This is ideal for swing traders who need to act quickly on market setups.

Popular instant deposit methods include debit cards, e-wallets like PayPal, Skrill, and Neteller, as well as cryptocurrencies such as Bitcoin, Ethereum, and USDT.

Are Instant Trading Deposits Guaranteed?

Even if a broker promotes instant deposit capabilities, there’s no guarantee that your funds will be available immediately. Various factors can cause delays, such as the broker’s regulatory jurisdiction, the internal processing times of banks or payment providers, and the status of your account verification.

In some cases, deposits may be held for review during the onboarding process or flagged for compliance checks, especially for new clients or large transactions. Understanding these potential bottlenecks can help set realistic expectations when funding your account.