Best MetaTrader 5 (MT5) Brokers For Swing Trading 2026

Swing traders hold trades for a few days, maybe weeks, aiming to catch bigger price moves. That’s why the tools and setup you use in MetaTrader 5 (MT5) matter, and that’s also why you need a broker that offers excellent integration with MT5.

Fortunately, we’ve selected the best broker for swing trading on MT5 – all tested by experienced MetaQuotes users.

How SwingTrading.com Chose The Top MT5 Brokers

We chose the best MT5 brokers by ranking supporting brokers based on their overall ratings, focusing on features that matter most to MetaTrader 5 users, from multi-asset access and execution speed to support for Expert Advisors, custom indicators, and advanced charting.

Our team’s hands-on testing added a practical layer, helping us separate brokers that simply provide MT5 access from those that deliver a seamless, high-performance MT5 swing trading experience.

Why MT5 For Swing Trading

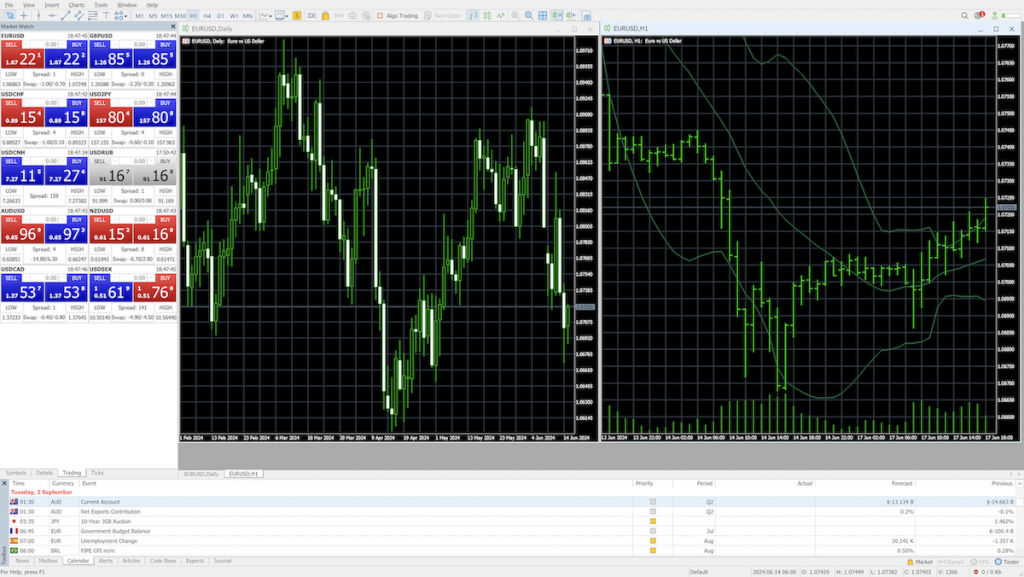

MT5 is built with more features than its older cousin, MT4. For swing trading, some of these stand out:

- More timeframes: You get 21 instead of MT4’s 9, which helps when analyzing daily and weekly trends.

- Economic calendar: Handy when you want to track events that could drive longer-term moves.

- Better order management: You can place more types of pending orders, which gives you flexibility when planning trades.

So if you trade swings, MT5 gives you more structure to plan and manage trades over several days.

MT5’s timeframes and order types help manage trades that last several days

What To Look For In An MT5 Broker

Charting Tools That Matter

Charts are your primary workspace. Swing traders need to zoom out and see the bigger picture. On MT5, look for a broker setup that:

- Supports daily and weekly chart views without lag.

- Lets you apply multiple indicators without slowing down.

- Allows drawing tools like trendlines and Fibonacci retracements, which are key for spotting entry and exit zones.

A good MT5 setup makes analysis smoother and saves you time.

When I switched to MT5, the most significant difference wasn’t the extra indicators—it was how easy it became to track trades across daily and weekly charts.The platform isn’t perfect, but having clearer timeframes and reliable order handling has saved me from second-guessing entries and exits.

Data Reliability & Pricing

Price accuracy is critical. Swing traders often hold trades across volatile news events. Delays or bad price feeds can ruin a position. Check if the broker’s MT5 platform gives you:

- Consistent pricing without significant gaps between bid and ask.

- Low slippage, especially during high-volume hours.

- Clear swap rates (overnight funding costs), since you’ll likely pay or earn swaps when holding trades for days.

It’s not about finding the lowest spread at all times. For swing traders, stable and honest pricing matters more.

Order Execution

Execution speed isn’t as urgent as it is for scalpers, but it still counts. When you place a stop or limit order, you want it filled close to the price you set. Look for:

- Reliable order fills without frequent re-quotes.

- Smooth execution during news events, since that’s when swings often take shape.

- Access to stop-limit orders, which give you better control of entries.

MT5 supports multiple order types. The broker should make sure they work as intended.

Swap & Overnight Costs

One of the most significant differences between day trading and swing trading is the use of swaps.

When you hold positions overnight, you either pay or receive swap fees. They can add up over weeks. On MT5, a broker should:

- Display swap rates clearly in the contract specs.

- Update swap values regularly so you aren’t caught off guard.

- Allow you to calculate potential costs directly from the platform before entering trades.

This matters more than spreads for swing traders. Even a good setup can fail if costs eat into your gains.

Holding trades overnight on MT5 taught me quickly that swap costs matter more than spreads. I’ve had setups play out exactly as planned, only to see profits trimmed by funding charges. Now I always check the swap info in MT5 before committing to a swing.

Hedging & Risk Tools

Swing traders often hedge positions or hold multiple trades across pairs. MT5 supports hedging, but brokers can enable or restrict it. Make sure you get:

- Permission to hedge positions on the same instrument.

- Margin rules that won’t wipe out your account if you hold several trades at once.

- Access to risk management tools like stop-loss and trailing stops that actually trigger when they should.

For swing trading, risk control is everything. The broker’s MT5 system should not block or limit these features.

Market Access

Swing trading often works best with liquid markets—forex, indices, commodities. MT5 brokers differ in what they offer. Check if:

- You have access to enough instruments to diversify swings.

- The broker provides CFDs on indices and commodities, as these often exhibit clean trends for extended periods.

- Data feeds for these markets are reliable on daily and weekly charts.

It’s not about having hundreds of instruments. It’s about having a clean, usable set for swing trading.

Account Types That Fit Swing Trading

Not every account type on MT5 is suitable for swing traders. For example:

- Ultra-low spread accounts may come with higher swaps.

- Commission-based accounts make more sense if you hold trades for a week.

- Some accounts may offer higher leverage, which isn’t always needed for swings but can help with flexibility.

Read the account specs carefully. The way fees are structured will affect how much you keep from longer-term trades.

Mobile & Web Access

Swing traders don’t need to watch the screen all day, but they still need to check trades on the go. MT5 has mobile and web versions. The broker should:

- Offer stable mobile trading apps with the same charting tools.

- Sync orders across devices without errors.

- Allow you to adjust stops or close trades easily from your phone.

This way, you can manage swings without sitting at your desk 24/7.

Using MT5 on my phone has been a lifesaver for swing trades. I don’t need to babysit charts all day, but being able to move a stop or close a position while I’m away from my desk has kept me out of trouble more than once.

Support For Strategy Testing

Before running a swing system, you should test it. MT5 has a built-in strategy tester. A broker should allow:

- Full access to historical data across daily and weekly charts.

- Smooth testing without platform crashes.

- Accurate spreads and swaps in backtesting.

Testing is essential for swing traders, since trades play out over longer cycles.

Stability Of The Platform

Swing trades don’t need lightning-fast charts, but you do need a stable platform. Look for:

- MT5 setups that don’t freeze during market opens.

- Reliable server uptime, since your trades may run for weeks.

- Quick reconnections if your internet drops.

If MT5 disconnects during a swing, you could lose control of your trades. Stability is as important as execution speed.

Final Thoughts

The best MT5 broker for swing trading is one that maintains steady and predictable trade execution over time, without unexpected costs or platform performance issues.

It’s less about flashy features and more about reliability, transparency, and a platform setup that matches the way swing traders actually work.