CMC Markets is an established online financial broker. It offers spread betting and CFD trading opportunities to international clients through several sophisticated platforms. This 2026 CMC Markets review will explore customer service options, account login and security, how to deposit to a live account, minimum deposit requirements, and more. Sign-up and start trading today.

What Is CMC Markets?

Company Details

CMC Markets UK Plc has more than 30 years of industry experience. The company values are to help clients realise their potential with the correct tools to succeed. Today, the firm has 300,000+ global clients, servicing from 13 office locations across the globe. The team of employees currently amounts to over 700, with the number of careers and jobs expected to increase as the firm continues to expand.

Our review found some pretty impressive statistics regarding the broker’s current performance. This includes 99.95% platform stability, 99.7% fill rate, 100% automated execution and £100 million invested in platform services. The current market cap is an impressive £699.4 million.

The latest news reports suggest that CMC Markets is considering a break-up strategy. According to Bloomberg, the company is working with stakeholders to split the online broker into two separate listed companies. This would create one business hosting spread-betting operations, and another non-leveraged business holding the technology and new investment products.

This broker review found the website and services particularly user-friendly with transparent information. Swing trading clients can rest easy knowing of its top-tier regulation, emphasis on education and reliable customer support.

History

CMC Markets UK Plc was incorporated on companies house as a public limited company in June 2004. It was listed as a constituent of the FTSE 250 index for the first time in June 2016. The company trades on the London Stock Exchange (LSE) under the ticker symbol CMCX. The general 2026 share price chat highlights some fluctuations, including a 52-week high of £1414 according to Yahoo Finance. A strong 12-month forecast is expected following a history of dormant averages and the upcoming break up strategy.

Market Screener analysts consider the future average target price to settle at around £370. The FT reports record profits and net worth for CMC Markets, with owner Peter Cruddas pocketing more than £55 million in dividends. The board also consists of a CTO and Legal Counsel.

The time of the next annual dividend valuation can be found online and will be based on company earnings at this date. For reference, the 2021 dividend yield was 6.30%. As a public limited company, the broker publishes quarterly results and full annual report details, including from 2019, 2020 and 2021. Details within these include a full press release, P/E ratio, trading update, holding costs and stock price overview.

Instruments

CMC Markets is ideal for all types of traders, whether you are just starting your investment journey, or are a more experienced speculator seeking exposure to a diverse portfolio of instruments. The firm offers one of the largest product catalogues available within the online brokerage community. The broker has a focus on professional-grade tools made simple. Services are split into two ‘pathways’, spread betting and CFDs.

The firm offers leveraged, tax and forex fee-free spread betting on all 11,000+ instruments available on the platform. This is a derivatives approach that involves speculating on the bid-ask spread quoted by the broker.

Clients can also take advantage of CFD trading on the full range of assets, with no stamp duty required on profits. These assets are also derivatives, with traders taking a position on whether the value of the instrument will rise or fall over whatever period they choose.

Markets

The broker offers 11,000+ trading instruments for retail clients to speculate on with CFDs or spread betting:

- Rates & Bonds – Invest in 50+ government bonds and rates for exposure to specific region economies.

- ETFs – Trade the performance of global exchange-traded funds. CMC Markets offers 1000+ funds to track themes, indices and trends within markets.

- Commodities – Speculate on the price of 100+ popular soft and hard commodities, alongside commodity indices. These include gold, silver, natural gas and crude oil trading.

- Share Baskets – Trade on global trends in emerging markets via exclusive themes and share baskets. Products include renewable energy, gaming, technology and US banks.

- Cryptos – Speculate on the values of 18 major tokens and altcoins, including Bitcoin (BTC), Ripple (XRP) and Ethereum (ETH). Three crypto indices are also available. Cryptocurrencies are not available to UK clients.

- Forex – Trade on a whopping 300+ major, minor and exotic forex pairs. The broker combines eight feeds from top tier banks to get the most accurate prices. Forex opportunities include EUR/GBP, USD/JPY and GBP/USD.

- Shares – Speculate on the performance of 9,000+ global shares via CMC Markets, from some of the world’s largest companies, including the 250 biggest UK shares and the most popular US stocks. For example, Apple, Barclays, Amazon and Tesla Motors.

- Indices – Trade on 80+ cash and forward indices based on global share index groups. Gauge the performance of industry sectors and country economics. CMC Markets index offering includes the FTSE 100 and 250, S&P 500, ASX 200, US 30 (Dow Jones) and more.

Trading Platforms

We were pleased to see a choice of online trading platforms offered to CMC Markets clients; a proprietary web trader and the industry-recognised MetaTrader 4. We have outlined the features of both terminals below.

Next Generation Web Trader

Reviews of the Next Generation web software are generally positive, noting an easy-to-navigate interface with a sleek design. It can be accessed from all major web browsers, including Google Chrome and Safari. The platform features advanced charting with 115+ technical indicators, 12 chart types and 35+ drawing tools. Additionally, the proprietary terminal supports fully customisable watchlists and a Reuters streaming feed. The trading platform combines professional-style features and security with lightning-fast execution.

Key Tools

- Layout Options – Create and save up to five different trading layouts within Next Generation. Switch easily and quickly between views to use the space more efficiently.

- Pattern Recognition Scanner – Scan 120+ popular products every 15 minutes for emerging chart patterns, including wedges, channels and head and shoulders formations.

- Price Projection Box – Technical analysis measuring techniques highlight where price action could go on the instrument’s chart. In-built testing tools are available to review the historical performance of patterns.

- Module Linking – Group products together for reactive data displays. For example, traders can link a client sentiment tool, chart and watchlist. Any amends made within one link will be processed for all links within the module.

- Client Sentiment – The platform refreshes analysis and level 2 market data every minute, which means insights are available in almost real-time. Filters can be used to view top clients and profit holders. View the positions of a particular product in percentages or monetary value to gain an understanding of client expectations within the market.

CMC Markets’ proprietary terminal supports multiple order types to suit all strategies, including swing trading. The fast and 100% automated execution provides flexibility to enter trades and gives traders more control over risk-management and margin calls. These include trailing stop-loss orders, take-profit orders and partially closed trades. The robust infrastructure handles 50,000+ prices per second via an API. For a premium, guaranteed stop-loss orders (GLSOs) can be executed at specific prices, regardless of market volatility or gapping.

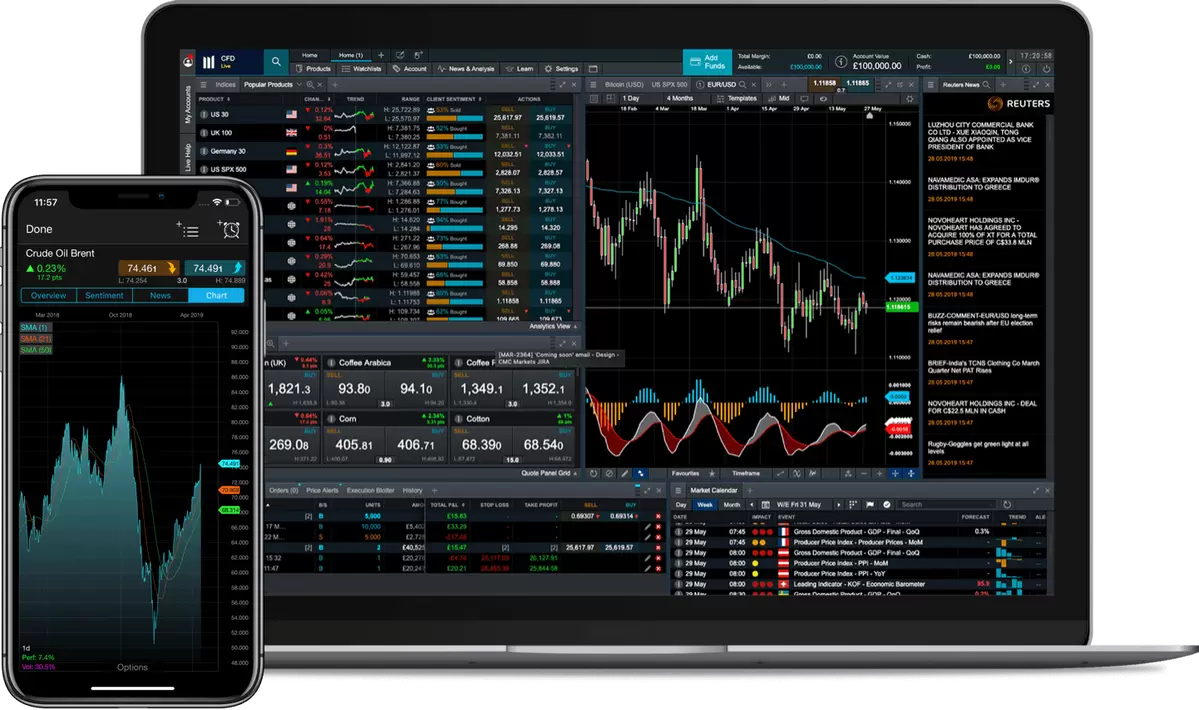

Next Generation Trading Platform

MetaTrader 4

As an alternative solution, CMC markets offers its clients the option to speculate with the MetaTrader 4 (MT4) trading software. This platform is industry-recognised and suitable for beginners. You can download the trading system to desktop devices or trade via web browsers. Currently, the broker does not offer MetaTrader 5 (MT5).

Features of MetaTrader 4 include:

- Historical data

- Nine timeframes

- Hedging available

- Live news streams

- Customisable charts

- 4 pending order types

- 3 order execution types

- Access to Expert Advisors

- One-click order execution

- Automated trading via APIs

- MQL4 programming language

- 30 built-in technical indicators

- User-friendly, multilingual interface

There is a helpful download guide and step-by-step user tutorial posted on the broker’s website.

MetaTrader 4

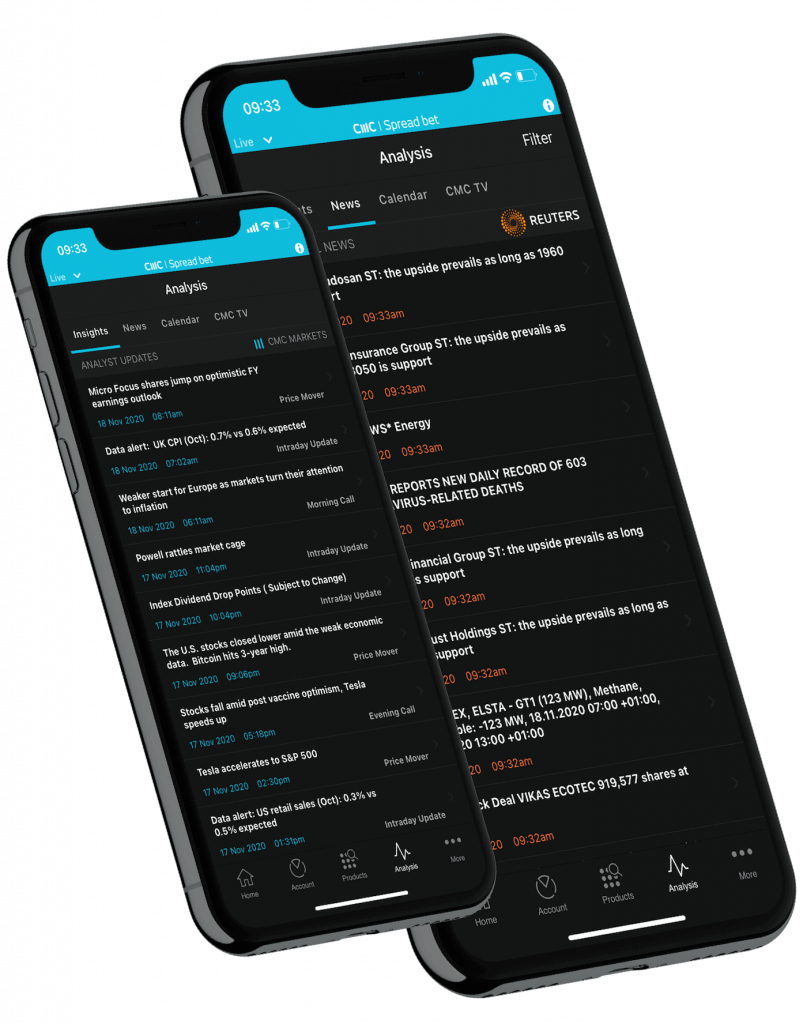

Mobile App

The CMC Markets mobile phone app lives up to its award-winning nature. Recent awards include no.1 platform technology and web-based platform from Forexbrokers.com. Swing trading clients can experience the full functionality of the web platform from portable devices. Access price alerts and notifications while on the move. Open, close and modify trades with ease. The app is also available for free download to iOS and Android devices.

Tools and features of the application include:

- Trading Tools – Advanced order ticketing, 40+ technical indicators and drawing tools.

- Instant Notifications – Set up alerts via push notifications, SMS or email. Never miss price movements with instant signals.

- Mobile Optimised Charts – Access 25+ technical indicators and 15 drawing tools. Features allow traders to place, edit and close trades directly from charts and graphs.

- Customisable Dashboard – Personalise your dashboard with the information and data required via a customisable app home screen. Simply remove, resize or move tiles to tailor a layout that suits you and your trading style best.

CMC Markets Mobile App

As with the web trader platforms, advanced security technology is implemented. This includes two-factor authentication (2FA), face recognition and password controls.

MetaTrader 4 is also available as a mobile app and can be downloaded free of charge from the relevant app store. Similarly, all features of the desktop version, including algorithmic trading are available in a mobile-friendly interface.

CMC Markets Leverage

For swing trading retail clients, the maximum leverage you can currently trade with is 1:30 (or 3.3% margin) for both spread betting and CFD trading accounts. Therefore, clients can open positions a maximum of 30x the size of their capital. This aligns with ESMA leverage capping restrictions. International clients can access higher leverage rates, which reach a maximum of 1:500.

Fees

CMC offers a relatively transparent fee structure. Below we outline the trading and non-trading costs to be aware of before opening a live account.

Spreads are built into the buy and sell price of instruments on the broker’s platform. These vary by asset, though are impressive vs other competitors. Forex pairs like EUR/USD and USD/JPY average around 0.7 pips, whereas indices like the UK 100 and Germany 40 are offered at 1 point.

CMC Markets applies a share commission charge on CFD accounts when entering or exiting a trade. These fees vary according to the share origin country. For example, UK shares are subject to a 0.10% commission fee (minimum £9). Overnight holding costs and rollover fees are applicable. High-volume traders can benefit from trading rebates (professionals only).

Guaranteed stop-loss order types can be added to trades for a premium. However, the broker does not specify the cost involved. It is good to see that CMC Markets refunds clients if the GSLO is not triggered.

CMC Markets implements a $10 per month inactivity fee after one year of account dormancy.

Account Types

The broker offers two live account options to suit different trading styles, the Spread Betting Account and the CFD Trading Account. These are both available to standard retail traders and allow access to all trading instruments. The main difference between the two accounts is their taxation requirements. Spread betting is free from capital gains tax charges and is only available in the UK and Ireland. CFDs are available globally and are subject to relevant tax declarations. Additionally, CMC Markets offers an Alpha Account for premium retail clients and a Pro Account specifically for professional investors.

Spread Betting Account

- No commissions

- GBP & EUR only

- £ per point trade size

- No minimum deposit

- Spreads from 0.3 pips

- Fractional trade sizes available

CFD Trading Account

- No minimum deposit

- Spreads from 0.3 pips

- Fractional trade sizes available

- Commissions from $10 on shares

- Ten account currencies, including USD, GBP, AUS and SGD

Similar functionality and features are available across both retail trading accounts. Additionally, swing trading clients can benefit from telephone trading, account netting, position hedging and a price depth ladder. Clients can complete account registration online to open a live account in a matter of minutes. The process may require you to provide identification verification documents, such as proof of residency, under know-your-customer (KYC) compliance.

Demo Accounts

Clients and readers can quickly open the CMC Markets demo account via its website. Simply complete the online registration form to begin. There is no expiry time limit for the paper trading accounts and clients can access unlimited virtual funds to test strategies risk-free.

Payments

Deposits

There are no minimum deposit requirements to open a live trading account. You can place a spread bet or CFD trade once there are sufficient funds to open a position. CMC Markets’ deposit and withdrawal methods are pretty industry standard. Swing trading clients can fund a live trading account via bank wire transfer, PayPal or major credit/debit cards. However, the firm does not allow Amex payments. Deposits are accepted in 10 major currencies and a £50,000 single transaction limit applies. The broker does not charge deposit fees, though third-party charges may apply.

Withdrawals

The broker does not charge for withdrawals. However, there is a £15 charge for express and international bank transfers. A withdrawal made before 14:00 GMT is processed the same day, though the time to receive funds varies depending on the method. You may only withdraw up to the total amount deposited from a credit/debit card. There are no apparent withdrawal limits for other methods.

CMC Markets Regulation

For clients with accounts held with CMC Markets Group in the UK, you can be assured of regulatory authorisation from the Financial Conduct Authority (FCA). This is a top-tier, industry-recognised authorisation that offers the highest level of client safety and advantages. This includes negative balance protection and segregated funds in top-tier banks.

Under this regulation, the broker has also published ‘pillar 3’ disclosure documents highlighting the company’s risk and control processes. Traders can also be assured of FSCS compensation up to the value of £85,000 in the case of business insolvency or bank liquidation.

Security

The broker adopts the latest technology advancements and practices to maintain comprehensive data security for each account. Third-party independent security analysis is conducted regularly. The firm encrypts all personal information that is sent or stored. Additionally, two-factor authentication (2FA) is applied to all accounts. This is an added layer of security that requires a verification code every time you log in to your online account.

Customer Service

The best online brokers prioritise customer service. CMC Markets excels at this, with a useful contact page and several methods available to connect with the team. Options include UK and global contact telephone numbers, email addresses and head office address details. Telephone lines are open 24/5.

It is good to see contact details are also provided for the broker’s international offices besides London, including France, Ireland, Australia, New Zealand and Germany. The broker’s commitment to international trading is evident here, with customer service available in 10 languages.

The broker also hosts a comprehensive FAQ service. The CMC Markets trading self-help platform is well organised into key categories with issue topics that include dividend yield advice, joint account conditions, terms of business explained or how to delete an account that is not working. The firm regularly updates social media accounts on LinkedIn, Facebook and Twitter with the latest investor relations news and broker forecast analysis.

- Phone: +44 (0)20 7170 8200

- Email: clientmanagement@cmcmarkets.co.uk

Promotions

CMC Markets does not offer any promotions or bonuses to UK or European clients. This includes a no deposit welcome bonus or other sign-up offers, as per FCA and ESMA trading regulations that restrict financial incentives. However, this may vary by jurisdiction.

Education & Analysis

Peer reviews on sites like TrustPilot highly rank its educational platform. A comprehensive suite of tools, training guides, news articles and webinars from a pool of quantitative analyst experts will ensure all traders have the skills and knowledge to trade confidently. Courses include trading with digital 100s, applying volume indicator formulas, RTS 28 compliance, and utilising graphs to help buy or sell patterns. A financial calendar is also available to wider market awareness.

We were pleased to see that CMC Markets utilises and embeds YouTube video content via its channel with live trading demonstrations and step-by-step tutorials. This is particularly useful to understand the context of the proprietary platform, given its advanced features. A search tool would make this page more user-friendly due to the number of topics covered. Nevertheless, the broker impressed us with its offering.

Analysis and research tools amplify the broker as one of the best in its class. Both CFD and spread betting accounts benefit from CMC Markets analyst insights, Morningstar quantitative reports, Reuters news and a market calendar, all free of additional charges. The Next Generation platform embeds fundamental and technical market analysis, including the OPTO magazine, so traders do not need to leave the interface

Advantages

Benefits of opening a CMC Markets account include:

- Transparent fee structure

- Comprehensive FAQ section

- Free deposits and withdrawals

- No minimum deposit requirement

- High level of product security, including 2FA

- Publicly traded company listed on the FTSE 250

- Best-in-class educational platform and research tools

- Top-tier regulation and access to compensation schemes

- Demo account with virtual funds and no expiry time limit

- Various customer contact options, including 24/5 telephone support

- 11,000+ global trading instruments available, including exclusive share baskets

- Access to sophisticated analysis tools, including pattern recognition and client sentiment

Disadvantages

However, the broker falls short in the following areas:

- No MT5

- No ECN execution

- Limited account options

Trading Hours

CMC Markets’ office opening and trading hours are industry standard. However, note that hours will vary by instrument. Typically the forex and indices market is available to trade 24 hours a day between Sunday to Friday. An investor calendar with CFD trading times is available on the broker’s website to stay up to date with upcoming public holidays and market closures. The platform will also show instruments by relevant market opening hours.

CMC Markets Verdict

CMC Markets is an excellent international brokerage, suitable for all types of financial speculators, including swing trading clients. Offering an impressive number of instruments, leading platforms, educational and research resources and well-reviewed customer service, this broker does offer it all. Globally established regulation and account security can give clients complete peace of mind when trading with this CMC Markets.

FAQ

Where Is The CMC Markets Headquarters Located?

CMC Markets Group consists of 13 global office locations, including Singapore, Canada and Germany, in which it operates as CMC Markets Germany GmbH. The CMC Markets UK Holdings Limited headquarters is registered at the address 133 Houndsditch, London, EC3A 7BX.

What Customer Service Contact Options Does CMC Markets Offer?

Clients can contact CMC Markets via telephone, email and post to head office addresses. You will also find a comprehensive FAQ section on the broker’s website. Topics include site downtime and why the platform’s tools may not work. Look out for the support logo on the website.

What Instruments Can I Trade With CMC Markets?

CMC Markets offers swing trading clients access to 11,000+ instruments. This includes ETFs, indices, forex, cryptos and commodities. Stocks and shares ISAs are not available.

Does CMC Markets Offer Educational Resources Suitable For Beginners?

Yes, the broker offers various tutorials, webinars and guides suitable for new traders. CMC Markets utilises YouTube video content to discuss and demonstrate strategies, opening positions and using the trading terminals. It is also good to see personal check-ins like an options quiz.

Can I Trade International Shares With CMC Markets?

Yes, CMC Markets broker allows traders to speculate on 9,000+ global shares from some of the world’s largest companies. For example, you can purchase CFDs on company stocks from Japan, Dubai, the US, Hong Kong, Australia and Kenya. Login to access major company stocks such as GME, Amazon and Apple.