Credit Ratings

Credit ratings measure the risk incurred when trading bonds and debts. They are an important factor to consider before investing in specific assets and companies. Read this article to gain an understanding of their role in trading economics.

What is a Credit Rating?

A credit rating refers to a borrower’s creditworthiness concerning a particular debt or financial obligation. An individual, corporation, state authority, or sovereign government, generally receives a credit rating if they seek to borrow money. Unsurprisingly, the better the rating, the more money they can usually borrow.

How it Works

A credit rating essentially determines how likely a borrower is to pay back a loan or bond within the agreed terms and dates. The chances of their loan application being approved are influenced by their rating. If they are seen as trustworthy and likely to pay the loan back, they receive a higher rating. On the other hand, a lower rating indicates they likely will struggle to make repayments and may default.

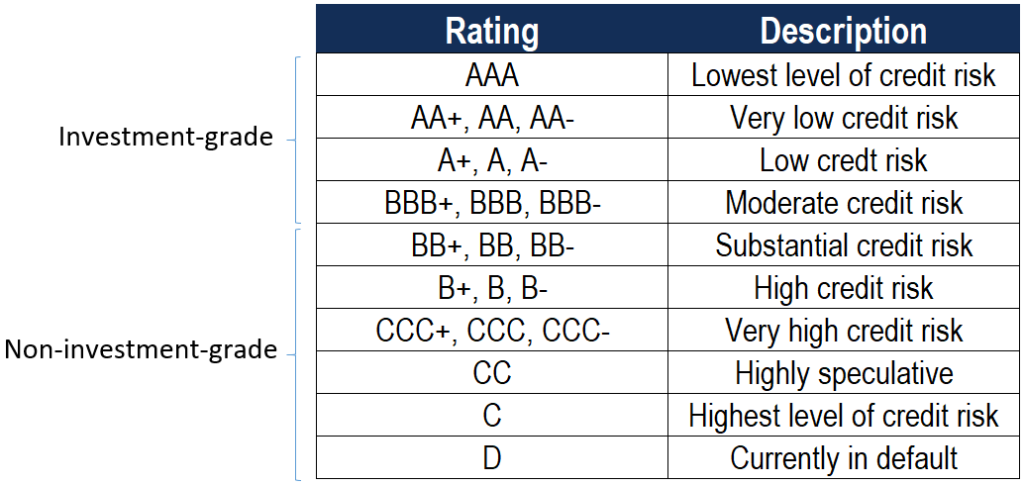

Agencies apply letter grades to indicate an entity’s rating. For example, Fitch Ratings has a scale that ranges from AAA to C or D, where AAA is the highest quality and lowest risk. Any rating from AAA to BBB is considered prime and relatively safe. A rating from BB down to C or D classifies the bond as speculative and not prime, meaning the entity is a credit risk.

Importantly, swing traders can use credit ratings to inform investment decisions, as they paint a picture of a company’s financial performance.

Factors Affecting Credit Ratings

In giving a rating to a company, an agency typically considers the firm’s borrowing and debt-paying history. If the company has previously defaulted on loans and missed payments, it will negatively impact its rating.

Agencies will also consider the company’s economic outlook and the wider industry’s potential. If the forecast is positive, a company’s rating will generally be higher. In contrast, if the future looks bleak, the rating will be lower.

Other key considers include:

- Company age

- Company size

- Current assets

- Current liabilities

- Number of court judgements

- Punctuality of filing accounts

- Director and management history

Why Credit Ratings Matter

Loans are critical for businesses, both for start-ups and large corporates. They can be used to fuel expansion, fund new product lines and cover expenses. Not being authorized for a loan can be detrimental to a company’s survival. With that said, a loan with a high-interest rate is difficult to repay.

Whether an entity gets approved for a loan is determined by its rating. It also decides the interest rate of repayments and influences the lenders that a company can apply to. A great rating will be more appealing to lenders than a company with a substandard score.

Credit ratings are also important for traders. They can inform decisions on whether to invest in corporate bonds or not. If the firm has a poor rating, your money could be at risk. Of course, some investors use this as an opportunity to short a particular company or bond.

The Credit Rating Industry

Whilst there are smaller firms, three key players dominate the credit rating industry:

- Fitch Ratings – John Knowles Fitch developed and introduced the AAA to D rating system in 1923. It has since gone on to form the foundations of credit ratings in the industry. Fitch Ratings merged with IBCA of London in the late 1990s while also acquiring other competitors in its bid to become a full-service rating agency.

- S&P Global – McGraw Hill Financial, Inc rebranded to S&P Global in 2016. The US financial powerhouse is headquartered in New York and alongside credit ratings, is well-known for its stock indices, namely the S&P 500. The agency also uses a scale ranging from AAA to D.

- Moody’s – In 1914, John Moody established the Moody’s Investors Service and began providing ratings for almost all government bonds in the following ten years. Fast forward to the 1970s and Moody’s had become a full-scale rating agency. Moody’s uses a scale ranging from Aaa to C.

Challenges

Relying on credit ratings in trading can cause issues. It’s difficult to accurately predict the future, therefore, ratings are intrinsically probabilistic. Furthermore, the assumptions included in rating models and different agencies’ assessments can all vary.

Another issue is the potential conflict of interest. Issuers pay for rating agencies to evaluate their bonds and loans. During the Mortgage Crisis of 2007-2008, this came to light. Agencies were forced to compete to keep their market share, leading to ratings that would usually be low grades (B to C) to pass as top grades (AAA). As a result, lots of sub-prime debt was considered low-risk. Unfortunately, this only emerged when the mortgage market collapsed.

Using Credit Ratings in Trading

Credit ratings may help traders decide whether they should invest in bonds:

- A short-term rating reflects the chance of defaulting on repayments within a year. It has become the most popular rating in recent years and is most relevant to swing traders’ time frames.

- Long-term credit ratings reflect the chance of a borrower defaulting at any given time in the future. A speculative-grade bond has a rating below BB (or Baa3 for Moody’s). This means the borrower is likely to default on loans and would not be considered a safe investment (unless you wish to go short).

Note, investors should not rely entirely on the scores offered by rating agencies. Instead, traders should conduct their own technical and fundamental research to develop a well-rounded view.

Final Thoughts

Credit ratings measure the likelihood of an entity repaying a loan or debt in full and on time. They can make or break a company’s chances of being approved for a loan. If you are thinking about trading using credit ratings, make sure you also consider wider market sentiment and do your own research. As evidenced in the 2008 financial crisis, ratings are not always accurate.

FAQ

Which Agencies Assign Credit Ratings?

Three agencies generally assign ratings: Moody’s, Fitch Ratings and S&P Global. There are other smaller firms, but these three dominate the market.

Is A Credit Score Important For Traders?

For trading, a credit rating is important while a credit score is less relevant. A credit score generally only applies to individuals rather than publicly-traded companies with stocks, who will instead have a credit rating.

Why Do Credit Ratings Matter?

Credit ratings show how likely an entity is to pay off its debt. They are important for traders because they can indicate whether corporate bonds are a sensible investment. They also help create a view of the viability and expected performance of a particular company.

What Factors Affect Credit Ratings?

A company’s debt repayment history, current assets, future potential, liabilities, age, size, number of court judgments, director’s history, and the punctuality of filing accounts, can all affect its credit rating. Fortunately, much of this information is publicly available online.

Can You Short Bonds?

Some traders choose to short bonds when a company has a low credit rating. Fortunately, many top brokers and platforms support shorting.