Eightcap is a global broker specialising in forex trading alongside indices, commodities and cryptocurrencies. Available in multiple jurisdictions, the company offers a suite of automated trading tools and analysis features. This broker review will explore the platform’s suitability for swing trading, covering leverage, spreads, withdrawals, plus the notable pros and cons. Find out whether to open an Eightcap account today.

What Is Eightcap?

Company Details

Operating as a market maker rather than an ECN broker, Eightcap offers low and no commission trading on popular financial markets.

The headquarters of Eightcap Pty Ltd are located in Melbourne, Australia. The firm is regulated by the Australian Securities and Investments Commission (ASIC).

International traders are registered with Eightcap Global Ltd, with its head office in Nassau in The Bahamas. Eightcap Global Limited is regulated by the Securities Commission of The Bahamas, amongst others.

There are also offices in additional locations such as London (UK) and Sofia (Bulgaria).

History

Eightcap was founded in 2009 and is managed by the current CEO, Joel Murphy. Since its inception over a decade ago, the broker has earned several prestigious awards for its services and performance, notably the ‘Best Global Forex MetaTrader 4 Broker’ at the 2020 Global Forex Awards.

In the past, Eightcap’s sponsorship partners have included the likes of the Scuderia Ferrari F1 team and Carlton Football Club.

Markets

Swing traders can invest in a range of popular markets:

- Forex – Clients can trade more than 40 major, minor and exotic currency pairs, with tight spreads from as low as 0.0 pips.

- Commodities – Only four instruments available: Brent crude oil, West Texas Intermediate crude oil, silver and gold.

- Stocks – Over 350 shares available to trade from the US, London, German and Australian stock exchanges.

- Indices – 11 popular indices too choose from, including the FTSE100 and US30, USDX.

- Cryptocurrencies – Over 250 crypto pairs including Bitcoin and Ethereum. You do not need your own crypto wallet and can execute trades using fiat currency.

Trading Platforms

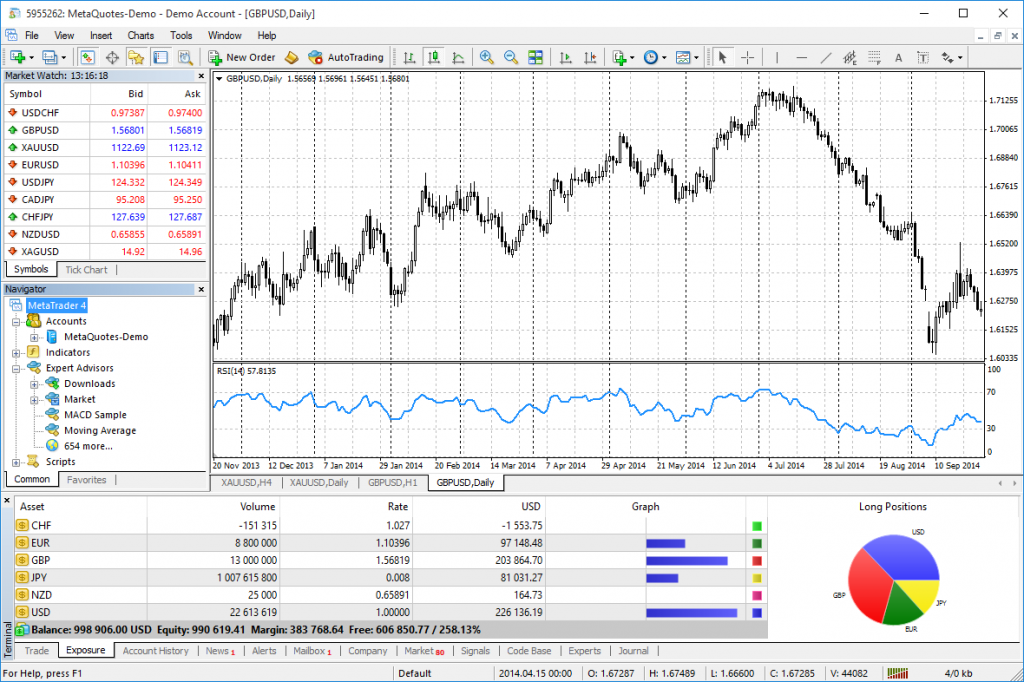

MetaTrader 4

MetaTrader 4 (MT4) is a user-friendly trading platform where customers can trade forex, commodities, indices and cryptos. MT4 is available to download for Windows desktops. To optimise the trading experience for users, MetaTrader 4 offers several notable features:

- Access to algorithmic trading robots (Expert Advisors)

- 30 technical indicators and 24 graphical objects

- Compatibility with the Eightcap VPS server

- Customisable trading windows and charts

- 9 timeframes for accurate price analysis

MetaTrader 4

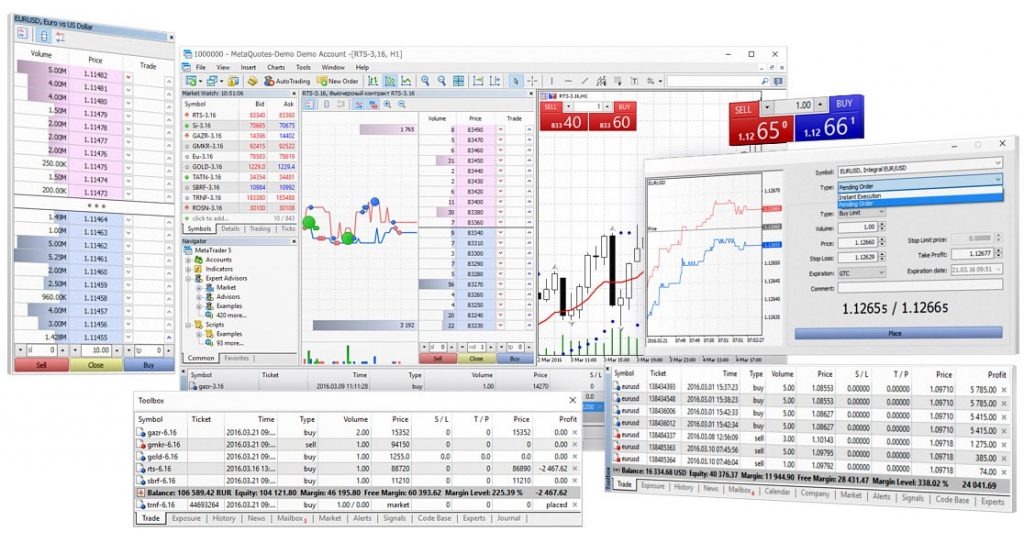

MetaTrader 5

Eightcap also offers the later iteration of the trading platform by MetaQuotes, which allows customers to trade the full market offering including stocks and shares. MT5 users can either download the desktop Windows application or access the WebTrader directly from their internet browser.

MetaTrader 5 is a world-leading platform which, in addition to many of the MT4 features, offers the following:

- 80 pre-installed technical indicators and graphical objects

- Build your own Expert Advisors (EAs)

- Depth of Market data (DoM)

- Built-in economic calendar

- 21 chart timeframes

- One-click trading

MetaTrader 5

Trading Tools

Capitalise.ai

Eightcap has created a free proprietary algorithmic trading robot and API. This bot takes a script of instructions and executes trades according to the data it has collected. There is the opportunity to practise with historical data to test your strategy before real-time implementation.

FX Blue Labs

This allows clients to customise trading screens with selected helpful widgets and charts. They can be specified to a strategy or trade that you are interested in and can be seamlessly synchronised to your MT4 and MT5 trading platforms.

There are several downloadable PDF guides on the Eightcap website showing how to install and set up the programme. Examples of applications include a correlation trader and a market manager.

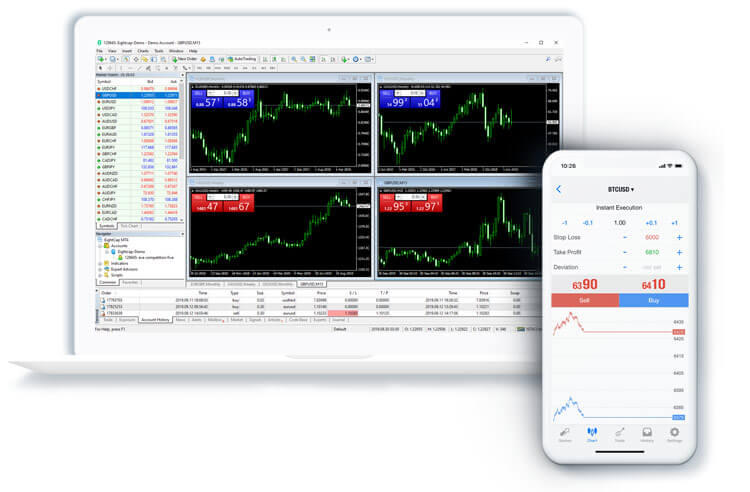

Mobile Apps

Both the MT4 and MT5 platforms are accessible via an intuitive mobile app, allowing users to trade from anywhere. The applications provide the same functionality as the desktop terminals, including access to real-time quotes, a full set of trade orders, complete trading history, plus a comprehensive suite of technical analysis tools.

MetaTrader mobile

To download the apps, search for the MetaTrader logo on the iPhone App Store or Android Google Play Store.

Eightcap Trading Accounts

Live Accounts

There are two account types that require funding with real money. You can login to or register an account via the Eightcap client portal.

Raw

The Raw account offers the tightest spreads starting from 0.0 pips. There is a minimum deposit of $100 and commission is charged at $3.5/£2.25/€2.75 per lot. Trades are limited to 0.01 lots minimum and 100 lots maximum. Users with this account have access to scalping, economic advisors and, for all customers except those under the ASIC jurisdiction, hedging.

Standard

This is the basic account type that is suited to novice traders. While Eightcap does not charge a commission, the spreads are wider at 0.5 t0 1.8 pips. Elements such as minimum deposit, trade limits and additional trading features are the same as Raw accounts.

Unfortunately, there is no option to open an Islamic account.

Demo Account

Eightcap provides a demo account with full access to the same markets as the Standard account. When you login, you simply select the platform you wish to practise with and the currency. Usually, the demo account only lasts for one month however, you can contact the support team to request more time.

Fees

When making a trade, Eightcap customers pay a fee either via a commission or the spread. Raw accounts are charged commission at a rate of $3.5/£2.25/€2.75 per standard lot. Standard account users have wider spreads than Raw accounts.

Eightcap also charges swap fees (known as rollover fees). The exact charges can be found on the MT4 and MT5 trading terminals. On Wednesday night, swaps are charged three times the usual rate to cover the swap fees for the weekend. This is important to note for swing traders who may hold positions for several days, as fees can quickly add up.

Eightcap Leverage

The leverage available depends on the entity you opened an account with. Traders based in Australia are limited to maximum leverage of 1:30, whilst international customers can execute trades with leverage up to 1:500.

Leverage allows you to take a position of higher value than what you have deposited in your account. Whilst this increases your exposure to the markets and provides access to greater potential profits, leveraged trading is also inherently risky, especially for beginners.

Payments

Deposits

- Credit/Debit Card – Deposit options include Mastercard and Visa with seven available currencies offered. Customers in China may use UnionPay for RMB transfers. Deposits are instant and free of charge.

- Bank Wire Transfer – Deposits via bank transfer typically take one to three business days. The fees charged will differ depending on the client’s bank.

- ePayments – Eightcap offers electronic payments via Skrill, Neteller, BPAY and POLi. Deposits with Skrill take one or two business days, are fee-free and can be made in either USD or EUR. Neteller deposits are instant, free and in either USD or EUR. Both BPAY and POLi payment services operate in AUD only and are fee-free. BPAY processes deposits in one or two business days whilst deposits via POLi are instant.

Withdrawals

- Credit/Debit Card – Using either Mastercard or Visa, you may only withdraw the amount that was initially deposited. Withdrawals for Australian customers take one business day while international clients can expect between two and five business days.

- Bank Wire Transfer – Withdrawals by bank transfer are processed within 24 hours. International banks may be charged a fee but check with your bank to confirm the amount.

- ePayments – Only Skrill or Neteller withdrawals are permitted. Withdrawals with Skrill incur a 1% fee and take two to three business days. The fees charged by Neteller are determined by the provider, but withdrawals are processed instantly.

Eightcap Regulation

Eightcap holds robust regulatory licenses around the world, allowing international traders to invest with peace of mind.

Eightcap Pty Limited is regulated by the Australian Securities and Investments Commission (ASIC) under license number AFSL 391441.

Eightcap Global Limited is regulated by the Securities Commission of The Bahamas (SCB) with license number SIA-F220, as well as the Vanuatu Financial Services Commission (VFSC) with license number 40377.

The company is also authorised and licensed by the Cyprus Securities and Exchange Commission (CySEC) under the company name Eightcap EU Ltd with license number 246/14.

Security

Eightcap has adopted policies to safeguard client funds. Firstly, as a regulated broker, Eightcap segregates customer funds from the company’s assets, with separate reliable and secure banks.

Additionally, Eightcap requires users to validate their account when registering by providing proof of address, identity and funds. This is a similar process to Know Your Customer (KYC). Accounts are also protected by Secure Sockets Layer (SSL).

Educational Content & Analysis

Eightcap provides an excellent educational library for clients, free of charge. Included in this resource is technical analysis covering financial news, market updates and guides on how the trading platforms work. Particularly useful for novice traders is the section on the fundamentals of trading and a help section on strategies to get an early head start to your trading career. There is also a wide range of tips and tricks that more experienced traders can benefit from.

Promotions

Eightcap runs a referral scheme where you can invite friends and family to sign up to receive a bonus. When the person registers and validates an account, they must deposit $100 and trade a minimum of 10 standard forex lots in the first month. Only then will you receive the $100 bonus.

There is also a trading credit bonus scheme for new Eightcap users. When you deposit a minimum of $100, you receive a bonus of $50. This bonus increases with larger deposit amounts, for example, deposits of $5,000 are entitled to a $1,000 bonus.

Eightcap used to run a ‘no deposit bonus’ scheme that acted almost like a rebate however, this has since been stopped, likely due to stricter regulation around promotional schemes.

Advantages

Our review found several benefits to trading with Eightcap:

- High leverage available for non-Australian customers

- MT4 and MT5 trading platforms available

- Excellent liquidity and tight spreads

- Leveraged forex and CFD trading

- Good user opinions

- ASIC regulation

Disadvantages

It’s also worth noting the drawbacks before signing up for a live account:

- Comparably high minimum deposit

- No negative balance protection

- Only a 30-day demo account

- No FCA regulation

Trading Hours

While forex can be traded 24 hours each day, markets are impacted by the trading hours of different exchanges around the world. For example, the Sydney stock exchange opens and closes at 7.00 am and 4.00 pm AEST (GMT+10) respectively, while the London stock exchange trading hours are 5.00 pm to 2.00 am AEST.

Cryptocurrency markets can be traded 24 hours a day, 7 days a week, meaning traders with full-time commitments or jobs during the week can trade at the weekend.

Customer Support

There are several ways to contact Eightcap customer support if you require assistance. When you contact the team, you can receive help in 10 different languages.

Contact options include:

- Email address (Eightcap Pty Ltd and Eightcap Global Ltd) – customerservice@eightcap.com

- Online live chat – logo in the bottom right-hand corner of the website

- Phone numbers – available on the support portal

Eightcap can also be reached on several social media channels, including Facebook, Twitter, LinkedIn, Instagram and YouTube.

Eightcap Verdict

Eightcap is a reliable broker for those seeking to swing trade on popular instruments. Users have access to the full suite of MetaTrader platforms, plus useful educational content. But whilst tight spreads and low fees also make this an attractive choice, the comparably high initial deposit and time-restricted demo account may deter some beginners.

FAQ

What Does Eightcap Do?

Eightcap is an online brokerage that facilitates trading on a variety of financial products such as forex, indices, stocks and shares, commodities and cryptos. Traders of all experience levels can sign up to one of the two available accounts to generate revenue from popular trading markets.

Is Eightcap Legit?

Yes, Eightcap is regulated by several global authorities, including the ASIC. With this in mind, traders can be assured that it is a legitimate broker and is not operating a scam.

Is Eightcap A Good Broker?

Yes, the the range of markets and tools make this a decent online broker. For user reviews of Eightcap, you can look at websites such as Trustpilot and Reddit. These are also good sources of information if you want to compare Eightcap vs other top brokers such as Pepperstone and Avatrade.

Can US Traders Register An Account With Eightcap?

No, traders from the USA cannot register for a live account. However, traders across the northern border in Canada can trade with Eightcap. The broker is also available in many other countries such as Malaysia and Thailand.

Where Is Eightcap Based?

Eightcap’s headquarters are based in Melbourne, Australia. The broker also has a London office and locations in the Bahamas and Bulgaria.