Fusion Markets is an Australian multi-asset brokerage offering over 170 tradeable instruments. Clients can access discounted investments on FX, indices, commodities and more on both the MT4 and MT5 platforms. This 2026 Fusion Markets review will cover the broker’s regulation, login security, bonuses, copy trading tools and more.

What Is Fusion Markets?

Company Details

Fusion Markets runs from its headquarters in Melbourne, Australia. The broker works with Gleneagle Asset Management to capitalise on relationships with the best liquidity providers. The adhering principles of the firm’s services are strong technology and support, with the company also boasting competitive commission rates and waived fees.

History

Fusion Markets Pty Ltd was founded in 2017, launching as a trading service for clients in 2019. It is owned and operated by forex industry veterans with a combined 50 years of experience.

Both the ASIC and VFSC oversee and regulate the broker’s activities, ensuring its practices are fair and its security protocols are up to standard.

Markets

The broker offers a good range of trading instruments for retail clients. These are suitable for all types of strategies, including swing trading.

The key financial markets available include:

- Forex: Speculate on 90+ currency pairs; majors, minors and exotics

- Share CFDs: Trade 50+ of the world’s largest US equities via stock CFDs

- Equity Indices: Some of the world’s largest equity markets across global index groups

- Soft Commodities: Several agricultural products such as cocoa, sugar and coffee futures

- Hard Commodities: Access trading opportunities on energies and precious metals including crude oil, natural gas and gold

Trading Platforms

Fusion Markets offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) terminals. These established, globally-recognised platforms are suitable from beginner level through to expert. You can download the trading platforms to PC devices or trade via all major web browsers, such as Chrome and Safari.

The platforms are robust yet user-friendly. The range of charts and graphs will suit all styles and strategies, including those executing swing trading. We outline the functionality of both terminals below.

MetaTrader 4

- Nine timeframes

- Multilingual interface

- Four pending order types

- Fully customisable charts

- One-click order execution

- Three order execution types

- MQL4 programming language

- 30+ built-in technical indicators

- MetaQuotes Language (MQL4) for programming strategies

- Direct access to expert advisors and automated trading systems

MetaTrader 4

MetaTrader 5

- 21 timeframes

- Custom indicators

- Six pending order types

- 80+ technical analysis objects

- Multi-threaded strategy tester

- Advanced Market Depth feature

- MetaQuotes Language (MQL5) for programming strategies

- Direct access to expert advisors and automated trading systems

MetaTrader 5

Both platforms operate following GMT +3 time zone offsets. The Fusion Markets FAQ page hosts a trading terminal self-help section with tips on client login security and guidance for download.

Mobile Trading

MT4 and MT5 are both available as mobile applications. Fusion Markets traders can download the apps to iOS and Android devices. Access the tools, features and functionality found on the web and desktop terminals. You can manage your account, open and close positions, check live pricing and view charts while on the go.

Fusion Markets Trading Accounts

Live Accounts

Fusion Markets offers two account types: the Classic Account and the Zero Account. Both provide access to all assets and there are no minimum deposit requirements. Trading accounts can be denominated in all major currencies, including USD, EUR and GBP. The main difference is in the trading costs.

- Zero Account – Commissions, tighter spreads

- Classic Account – No commissions, fees are built into spreads

It is quick and easy to sign up and open a new live trading account. Traders must complete the online registration form, upload identity documentation such as a passport and proof of residency. Once details have been approved, you can start trading straightaway.

You can switch between Standard and Zero Account types by contacting the broker’s customer support team.

Note, the broker does not currently offer an Islamic Account.

Demo Account

A free demo account is available to all new Fusion Markets clients on MT4 and MT5 terminals. A simple online registration form is required to start trading. Unlimited virtual funds are available to practise swing trading strategies risk-free and learn platform features and tools. It’s worth highlighting that the Fusion paper trading account will expire 30 days from registration.

Trading Conditions

- Margin stop out level 20%

- Maximum lot size 100 lots

- Up to 200 orders open at any time

- Market execution without requotes

- Minimum lot size 0.01 lots for FX and commodities, 0.1 lots for indices

Fusion Markets Leverage

The maximum leverage available to retail traders will depend on factors including country of residence and trading entity. The leverage you are using can also be changed in your account portal.

VFSC Clients

- Forex: up to 1:500

- Metals: up to 1:500

- Index CFDs: up to 1:100

Fusion Markets applies a maximum leverage offering based on account balance for VFSC traders.

ASIC Clients

- Shares: 1:5

- Indices: 1:20

- Major Forex: 1:30

- Minor Forex: 1:20

- Commodities: 1:10

Fees

Costs vary by account type. The Zero Account offers spreads from 0.0 pips plus a $4.50 commission. The Classic Account has fees pre-built into spreads. Fusion Markets spreads are floating and vary with current market prices. On average, the broker indicates the Zero Account is more competitive with the cost to trade averaging 0.5 pips vs the Classic Account at 0.9 pips. Our review found average spreads of 0.09 pips on the GBP/USD currency pair and 0.85 pips on the NAS100 index.

Swap charges also apply for any trades held overnight. Inactivity charges do not apply.

Payments

Deposits

There is no minimum deposit requirement to open a live account with Fusion Markets. The broker offers multiple deposit options with several major currencies accepted. These include USD, EUR, JPY, AUD, GBP and SGD.

Available payment methods vary by country but include:

- Skrill

- PayPal

- Neteller

- Fasapay

- Perfect Money

- Cryptocurrencies

- Credit/debit cards

- Bank Wire Transfer

The broker does not charge a deposit fee for any payment methods except international bank wire transfers. A maximum $30 fee is applicable for wire transfers to the broker’s Australian trust account. Note, third-party charges may also apply for some payment methods. This includes blockchain network payments for digital currency funding and Visa/Mastercard charges.

Most payment methods offer instant account funding. However, international bank wire transfers can take up to five working days to process.

Withdrawals

Withdrawals are returned to the original payment method. Fusion Markets does not charge a fee. However, a minimum withdrawal limit of $30 applies for bank wire withdrawals to cover potential external intermediary charges.

All withdrawals are processed the same day if requests are received before 11:00 GMT+3. The time for funds to be returned can vary. Allow 1-5 business days for credit/debit cards and bank wire transfers.

Fusion Markets Regulation

Fusion Markets is regulated by the Australian Securities and Investment Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). The ASIC is a well-regarded financial authority ensuring negative balance protection for all retail clients.

The VFSC is known for its more relaxed approach, so be aware that this regulation is not as reputable and robust as the protection offered by bodies such as the FCA. It allows for quick and easy company setup with limited client protection. Nevertheless, both financial authorisations offer segregated client funds. Investor protection and compensation schemes are not available.

Security

Traders should feel assured that MT4 and MT5 follow comprehensive safety protocols. Personal and financial data is exchanged with encryption between Fusion Markets and the terminal. Moreover, two-factor authentication (2FA) can be added to trading accounts. This added layer of security uses a verification code every time you sign in to your online account via an authenticator app or email address prompts.

Customer Service

The Fusion Markets customer support team can be contacted via telephone and email. The broker’s helpline services are available 24/5.

- Email Address: help@fusionmarkets.com

- Phone No.: +61 3 8376 2706

Additionally, traders are directed to a comprehensive FAQ page, organised by topic. Questions cover how to sign up to a live account, integrating API services, understanding margin calls and a link to the full terms and conditions of trading.

Unfortunately, social media accounts like Twitter do not appear to be refreshed with the latest broker news and updates.

Promotions

Fusion Markets does not offer any financial incentives, such as a sign up bonus, to new or existing clients. This aligns with ASIC guidelines, although the VFSC does not impose such restrictions.

Fusion Markets Trading Tools

DupliTrade

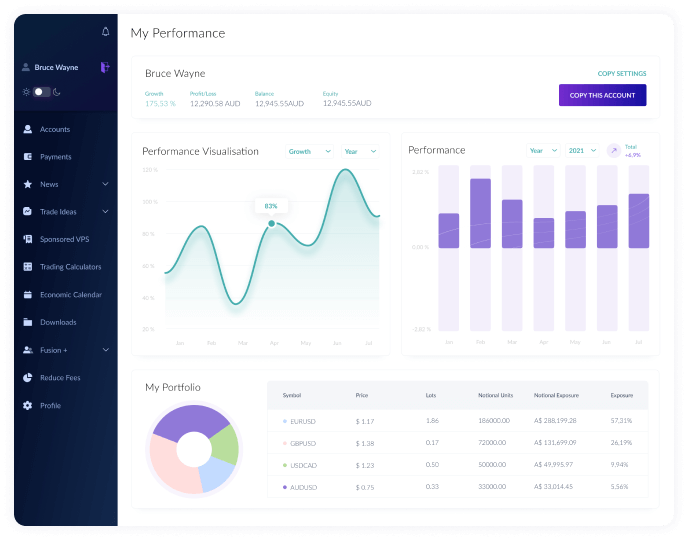

Fusion Markets offers clients access to an external copy trading platform. This tool allows traders to duplicate the actions of successful investors with proven success and track record history. Furthermore, it provides analysis on trades in the client portal, 24/5 customer support and a user-friendly interface with a customisable strategy view. You can also automate trades based on signals from experienced investors. Simply connect to your MT4 account and monitor moves in real-time.

DupliTrade

Fusion+

The broker offers its own social trading service. It is free as long as your account and follower account reach the minimum trading threshold. This limit is 2.5 lots of forex or metals traded per month. A $10 monthly charge will apply if this minimum cannot be met. You can also become a Fusion+ Money Manager and charge a 30% performance fee to clients via the platform.

Fusion+

Myfxbook AutoTrade

An alternative social trading platform can also be integrated into live accounts. This tool allows Fusion traders to follow and copy investors via one of the world’s largest online communities of forex trading. The third-party package also presents volume-based initiatives to ensure stable signal providers.

AutoTrade

VPS

Fusion Markets partners with New York servers to provide traders with a custom low latency solution. Clients can gain access to a complimentary VPS if they reach trading volumes of 20+ lots of forex or metals within 30 days. The VPS allows 24/7 connection to ensure fast trade executions from servers. Clients can choose between the MT4 VPS (powered by NYC servers) or MT5 VPS (powered by MetaQuotes).

Access to third-party solutions and their fees may vary. Be sure to understand the terms and conditions in your local jurisdiction before signing up.

Fusion Markets Education & Analysis

We were disappointed with the lack of educational resources and content available to swing trading clients. The broker does not offer any training or guidance materials, such as a keyword glossary, strategy outline or top tips. These would be particularly useful for new traders.

With that said, Fusion Markets does provide an economic calendar and trading calculator on its website. As a result, you can stay up to date with market events and calculate currency conversions, margins, swap rates and profit and loss ratios.

Advantages

- Regulated

- VPS access

- MT4 & MT5

- Low trading fees

- Flexible leverage

- Copy trading support

- No minimum deposit

- 30-day demo account

- Various funding methods

Disadvantages

- Wire transfer fees

- No Islamic account

- Limited instruments

- No investor compensation

- Lack of educational content

Trading Hours

The Fusion Markets trading hours vary by instrument. Typically, forex and commodities markets are available 24/5, between Sunday and Friday. A session timetable is also available on the broker’s website so you can stay up to date with upcoming public holidays, daily break sessions and market closures.

Fusion Markets Verdict

Fusion Markets boasts a range of attractive investing conditions and features for swing traders. Clients can choose between MT4 and MT5 to carry out advanced technical analysis and speculate on a range of CFDs. Moreover, the broker supports copy trading and offers flexible leverage rates from a minimum deposit of $0. However, there are some fees for wire transfer deposits and the educational content is lacking somewhat. Those interested can open a 30-day demo account with the firm to check out Fusion Markets’ services firsthand.

FAQ

Is Fusion Markets Legit?

Yes, Fusion Markets operates with relevant oversight from the Australian Securities and Investment Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). Therefore, it is a legitimate brokerage firm with adequate client protection measures in place.

Is Fusion Markets An ECN Broker?

Yes, Fusion Markets follows an ECN execution model. The firm utilises the relationship of Gleneagle Asset Management for the best direct-to-market prices from top liquidity providers. This innovative technology allows for lightning-fast execution while displaying the lowest possible spreads.

What Payment Methods Does Fusion Markets Offer?

Clients can fund Fusion Markets accounts via debit card, credit card, PayPal, bank wire transfer, crypto, Skrill and Perfect Money. Payments can be made in USD, EUR, JPY, AUD, GBP and SGD.

Is Fusion Markets Safe?

Fusion Markets operates under regulation from the ASIC and VFSC, the former of which is a particularly reputable authority. Also, the broker gives all clients negative balance protection and encrypts all terminal traffic.

Does Fusion Markets Have Any Restricted Access Countries?

Fusion Markets is available to most global clients. However, US clients cannot open accounts. Clients are also restricted from Zimbabwe, New Zealand, North Korea, Somalia and Sudan.