FXCM is a zero-commission trading broker based in the UK. The platform offers CFDs on stocks, forex, cryptos and more. In this 2026 review, we provide a comprehensive overview of the broker, from the login process and demo account to the spreads, fees and leverage on offer. We also give our verdict on FXCM’s algorithmic trading suite, including their API provision and python package. Find out whether FXCM could meet your swing trading needs.

What Is FXCM?

FXCM is a London-based online forex and CFD broker operating since 1999. Through its merchant banking arm, Leucadia Investments, the brand’s majority owner is Jefferies Financial Group LLC, an international investment bank with headquarters in New York. The operating company is known as FXCM Group, and includes subsidiaries such as FXCM Bullion.

In the UK, FXCM is regulated by the FCA, and its overseas divisions are registered with bodies such as ASIC (Australia), CySEC (Cyprus), and the FSCA (South Africa). Its long trading history and stringent regulations make it a trustworthy, reliable platform. The broker has also won multiple industry awards including Best Forex Mobile Trading App at the 2021 Global Trading Awards.

Markets

Clients of FXCM can trade forex and CFDs on shares, stock indices, commodities, and cryptocurrencies. Popular markets for CFD trading include gold, crude oil, Bitcoin and indices such as the NASDAQ 100 and S&P 500.

CFDs are simple financial instruments that state that the buyer must pay the seller the difference between the current price of an asset and its future price (at the CFD’s expiration date). While CFDs are often used in swing trading strategies successfully, they can be risky, especially when leveraged. It is also worth noting that CFDs do not allow the trader to take ownership of the underlying asset.

Currently, FXCM offers trading in 45 foreign exchange currency pairs. While their range of products is smaller than many of its competitors, the broker still offers a decent variety of majors, crosses, and exotics. Three forex index “baskets” have also been developed, which are currency indices designed to reflect the performance of the US dollar, Japanese Yen and emerging currencies. In theory, forex baskets allow traders to speculate on volatile instruments while reducing the risks associated with exposure to just one currency.

Account holders can access the following products:

- 7 crypto CFDs (not offered to UK customers)

- 12 commodity CFDs

- 15 stock index CFDs

- 219 stock CFDs

- 1 Bond CFD

Trading Platforms

FXCM provides access to several trading platforms, including its proprietary platform, Trading Station. Clients can also download MetaTrader 4 (MT4), NinjaTrader, and the social trading platform ZuluTrade. The range of platforms available to traders is impressive, with each system offering different advantages.

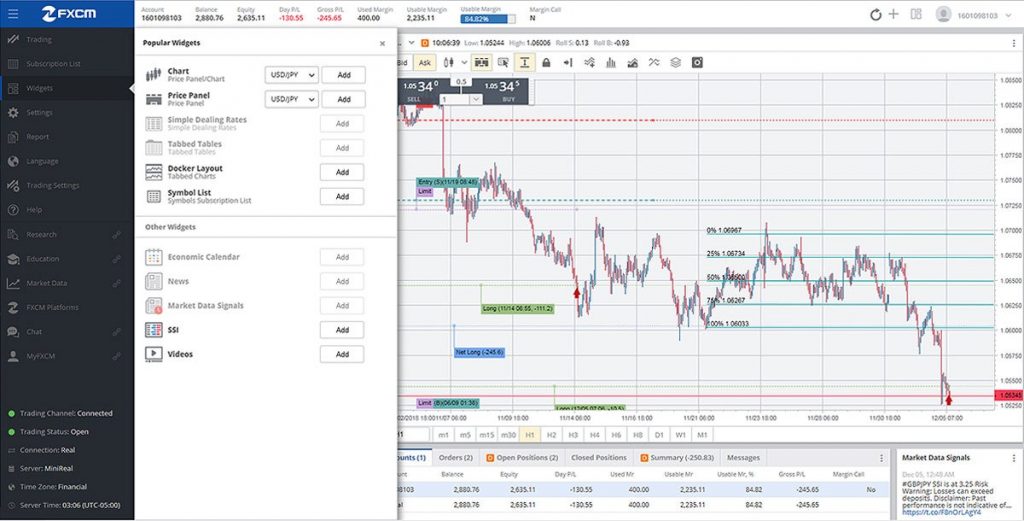

Trading Station

FXCM’s Trading Station is a forex and CFD trading platform. It is available in web, desktop and mobile app form. All three versions of the Trading Station system have been praised for their customisability, speed and user-friendly features.

TradingStation

Trading Station Desktop

Traders can download the desktop version of FXCM’s Trading Station platform, which provides the most comprehensive investing experience through the MarketScope 2.0 Package. In particular, clients have access to highly customisable tools and advanced charting capabilities.

Trading Station is generally easy to use, though traders who are used to other platforms might need some time to adapt. The platform supports 9 order types including limit, market, stop-loss, OTO (one-triggers-the-other), and if-then. However, some functions such as research are not yet fully integrated, and the login process is only one-step (which is less secure than 2FA).

Trading Station also offers:

- Reliable search functions

- Fast and stable performance

- Complex back-testing capabilities

Overall, the Trading Station platform can be considered a serious competitor to the market-leading MT4 platform.

Trading Station Web

The FXCM Trading Station web platform is more lightweight, but still possesses a decent range of attributes. The terminal has recently been relaunched as Trading Station Web 2.0 which is built-in HTML5, improving the performance for Mac users.

Like the desktop version, the web client is customisable and comes equipped with 52 indicators and 26 drawing tools. The web platform is also relatively simple to navigate. As a downside, traders can only access features like account management and research via separate web pages.

Trading Station Web supports the following order types: market, limit, stop, stop trailing and OCO (one-cancels-the-other).

FXCM Mobile App

The Trading Station Mobile app can be downloaded to iOS and Android devices, allowing clients to execute trades on the go. The mobile platform is easy to use and comes with the same order types as the web client. Overall, Trading Station Mobile offers a good smartphone trading experience compared to competitors.

TradingStation app

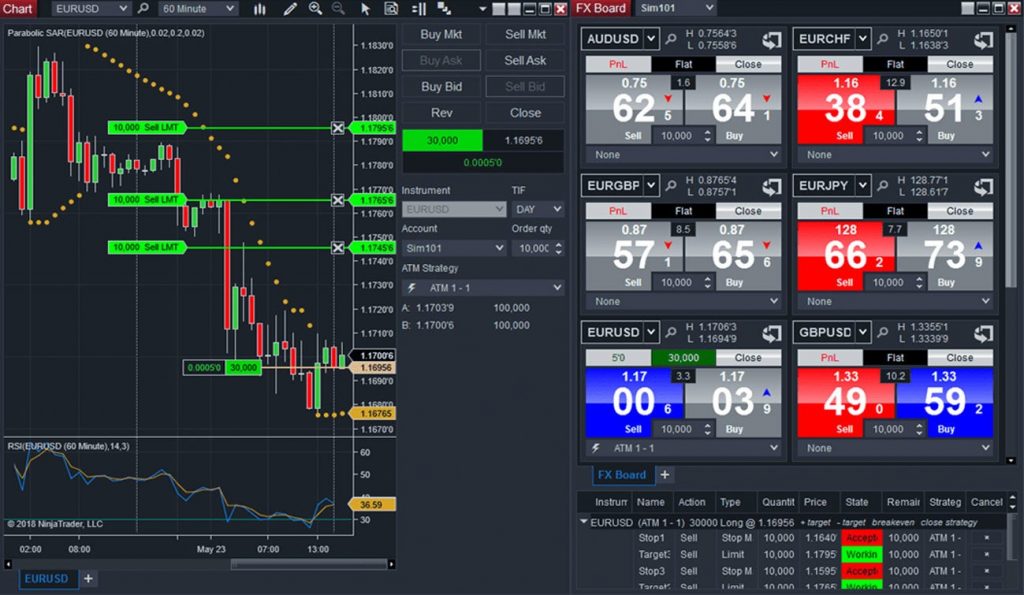

NinjaTrader

FXCM provides access to the latest version of NinjaTrader (NinjaTrader 8), which offers a range of performance improvements versus NinjaTrader 7. The platform allows users to create automated trading bots (strategies) and indicators using the NinjaScripts language. Traders can also choose from thousands of third-party NinjaScript add-ons to download.

The platform is primarily targeted at forex and futures traders, meaning that research features are limited compared to other platforms. NinjaTrader features an impressive range of technical analysis tools, with excellent charting and real-time analysis capabilities. In addition, the Chart Trader tool lets users execute and monitor trades directly from a chart. Other key features of NinjaTrader include:

- Advanced market replay and analyser tools

- Free platform guides and training videos

- Ability to place simulated trades

- Over 150 default indicators

- Multiple time-frames

NinjaTrader

MetaTrader 4

As with almost all other online brokers, FXCM clients can download MetaTrader 4, the most popular trading platform globally. MT4 is available as a desktop program for Windows, Mac and Linux users, as well as a web client and mobile app. The platform is a good all-rounder, offering a quick and reliable service with advanced analytics. In addition, MT4’s interface is easy to navigate and relatively intuitive, making it a good choice for beginners.

Via the MetaTrader marketplace, users can purchase a large number of automated trading bots and indicators. Its popularity means support is readily available online, with forums offering solutions to common problems such as off quotes errors. Compared to the other platforms, however, MT4’s range of order types is limited, with only profit target, stop loss and trailing stop functions available.

Other aspects of MT4 include:

- Extensive support

- Interactive charting

- Rich historical market data

- Live news feed and programmable alerts

- Programmable algorithms using the MQL4 language

MetaTrader 4

The MT4 mobile app is well-regarded in the forex community, providing FXCM clients with a feature-rich smartphone trading experience. It is available on both iOS and Android devices. The application features interactive charting, hundreds of instruments, and a full set of trade orders. The MT4 app is easy to navigate but can be slow on occasions.

Currently, FXCM customers cannot download and use the MetaTrader 5 platform, a more advanced version of MT4. MT5 is designed to suit CFD trading in particular, while MT4 remains superior for forex trading.

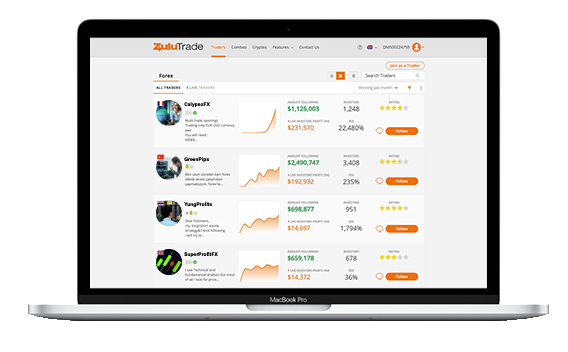

ZuluTrade

Through ZuluTrade, a popular social trading platform, FXCM clients can copy other traders’ actions. To follow the top traders, users are required to pay a subscription fee of $30 per month, though this is free for the first three months. It is claimed that the potential profits which can be made via copy trading will offset and exceed this amount.

ZuluTrade

Trading Model

FXCM uses a hybrid dealing desk/non-dealing desk model (also known as A and B book). This means they can act as a market maker and therefore the trader’s counterparty, potentially resulting in a conflict of interest. However, because STP execution is offered, transactions are executed at high speed which reduces the change of slippage (slippage means that trades are ordered at prices different from the ones they were executed at).

FXCM claims to have no live requotes, with the vast majority of trades executed with positive or net-zero slippage. Both scalping and hedging are supported.

FXCM Trading Accounts

Standard Account

The standard FXCM account is designed for forex and CFD traders of all abilities. There is no minimum deposit for this account, although each instrument has its own margin requirement. Traders are accepted from all over the world, including the US, Japan, New Zealand, Russia, France, Germany, Greece, India and Bulgaria. Traders can review the full list of accepted countries on the FXCM website. Unfortunately, residents of the USA and South Korea are not permitted to open a live account.

Fees for this account type are charged via the spread. Clients can use the Trading Station, Ninja Trader, MT4, or ZuluTrade platforms. Once the application is finalised, clients can login to the MyFXCM web client portal where they are able to deposit funds and begin trading. Muslim traders also have the option of opening a swap-free Islamic account.

Active Trader Account

The FXCM Active Trader account is targeted at expert clients, with a $25,000 minimum deposit requirement. Active Traders can access lower spreads, Java APIs and market depth for free. At the very highest tier, the FXCM Pro account caters to strictly professional traders.

Spread Betting Account

The FXCM spread betting account is available to UK customers only. Spread bets are a good alternative to CFDs as they can be traded with smaller bet sizes and are completely tax-free. Sign-up on the UK-based company website to start spread betting.

Demo Account

FXCM offers a demo account for each of its platforms, including Ninjatrader, Trading Station and MetaTrader, which it collectively refers to as the Forex Simulator. Traders will need to login to the demo account through each of the respective platforms.

Using a demo account is an excellent way for traders to practise trading strategies under live market conditions, before risking any capital. With the Trading Station demo account, clients have access to £50,000 of virtual funds. Traders interested in using the MetaTrader platform can use the demo account to download and test MT4 EA (Expert Advisor) functionality, scripts and indicators.

Leverage

As a regulated broker, FXCM is limited in the leverage it can offer to retail clients. Leverage allows traders to borrow money against the future price of an asset, reducing the amount of capital needed to open a position. Forex pairs can be traded with leverage of 1:30 for major pairs and 1:20 for non-major and commodity pairs, in line with the UK FCA regulations. Furthermore, CFDs can be traded with leverage of 1:10 for commodities and 1:5 for individual equities.

Customers cannot adjust the level of leverage used in trading, which is disappointing, as reducing leverage is an important part of risk management. While leveraged trades can be highly profitable, they can also result in large losses.

Margin Requirements

FXCM margin varies based on the account type and instrument being traded. A usable maintenance margin is a “good faith” deposit required to open a position. Margin requirements are set based on a 1k lot size for forex, and 1 contract for CFDs. On forex currency pairs, the margin is usually around £30 (£33.30 for the EUR/USD pair). Forex baskets have a much higher margin, typically over £400 (£495 for the JPY basket). CFDs on indices have margins similar to forex pairs.

For the full list of margin requirements, refer to the FXCM website.

Commission, Fees & Spreads

Like most brokers, FXCM generates revenue by taking its fees from the spread – the difference between the buy and sell price of an asset. By offering STP execution, FXCM can provide more accurate trading prices.

FXCM’s forex spreads are fairly typical for online brokers, with 1.2 pips and 1.4 pips on the GBP/USD and EUR/USD major pairs, both around the industry average. Gold spreads are more variable due to the volatile nature of the commodity, as with other brokers.

Overall, fees are comparable to brokers such as a Tradestation, though the spread on the EUR/GBP pair is relatively high, at 2.4 pips. However, FXCM does not charge any extra commission on trades, making its pricing transparent and generally affordable. This differentiates it from competitors such as IC Markets, who although offer spreads as low as 0 pips with their Raw Spread account, also charge a commission. The Active Trader account offers cheaper trading with more competitive spreads, though clients are charged a set fee per trade.

The fees charged on CFD trades are lower than many other brokers, for example the S&P 500 index CFD spread is 0.4 points. Holding a typical week-long CFD swing trading position worth $2,000 with 1:20 leverage costs around $2 in fees, with interest calculated at 5pm each day. Additionally, over 87% of FXCM trades are executed with positive or net-zero slippage, meaning effective spreads were lower than expected.

There are no fees charged for deposits or withdrawals (except for some bank accounts), but holding a position overnight may incur rollover fees. There is a $50 account inactivity fee charged if no trades are executed in a year.

Payments

Deposits and withdrawals can be transferred to and from FXCM via card, bank transfer, and e-wallet (Skrill, Klarna, Neteller, and Rapid Transfer). However, e-wallet options are not available to EU residents. To deposit funds into your FXCM account, log in to myfxcm.com, select ‘Deposit’ and follow the relevant instructions.

Mobile customers can also use the FXCM app to make debit/credit card deposits. The broker does not charge withdrawal fees on card transfers, but can charge up to $40 for bank transfers (which may also take up to 5 working days for international customers).

FXCM Security

As an FCA-regulated broker, FXCM is obliged to hold customer funds in segregated accounts. EU and UK customers are entitled to investor insurance, which protects funds if the company or its affiliates go bust. Retail (non-professional) clients are generally entitled to negative balance protection, though this depends on which FXCM affiliate you register with (only UK, EU, Australia, and South Africa customers are covered).

FXCM uses a one-step login for its platforms, which is less secure than the two-step process offered by some brokers. However, FXCM customers have the option of using a VPS (Virtual Private Server) for 30 base currency units per month, which is also offered by the MetaTrader 4 platform.

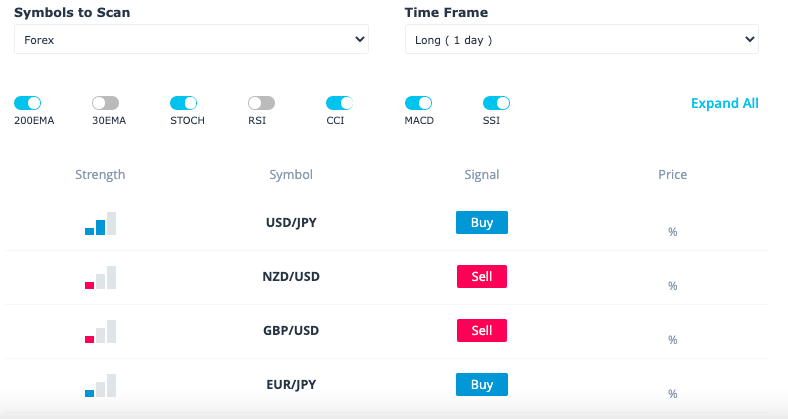

Research & Education

FXCM offers a good variety of research and analytical tools, primarily through the FXCM Plus platform. The platform features a range of trading signals and indicators, such as the SSI (Speculative Settlement Index). The website site also contains an economic calendar, a regularly-updated market news feed, live forex charts, and blog posts containing market insights. In addition, FXCM’s market scanner allows customers to screen forex pairs and CFDs using a customisable set of parameters.

Market Scanner

The educational resources available with FXCM are comprehensive, primarily consisting of a series of webinars, educational videos, and articles. Some basic videos on how to use the FXCM Trading Station platform are also available on YouTube. Helpfully, most of the educational package is available to demo account customers. The educational videos are informative, professional and succinct, and are accompanied by a series of PDF booklets. FXCM customers new to swing trading may find the education package particularly useful.

The FXCM site also features a pip calculator and several explanatory web pages covering topics as diverse as scalping, interest rates, and the IMF. Finally, customers can sign up for free SMS trading alerts.

Algorithmic Trading

FXCM has created an extensive algorithmic trading support bundle. The broker offers four free APIs (Application Programming Interfaces) to its customers, which provide a set of tools, protocols, and definitions for building trading software. Each of the four APIs (REST, FIX, Java, and ForexConnect) are linked directly to FXCM’s central server. In addition, FXCM has developed a Python coding package to support their REST API, fxcmpy. FXCM maintains a GitHub profile containing this package as well as other useful wrapper code.

Promotions

FXCM offers a $25 welcome deposit bonus for new customers (increased from their previous $20 offering). However, this is not a “no deposit bonus”, as customers must open an account and make an initial deposit of $50 to receive this.

On top of this, customers can take advantage of FXCM’s partnership with TradingView, with a year’s free access to TradingView Pro when they open a live account.

Advantages

Benefits of opening an account with FXCM include:

- Great range of trading platforms, including Trade Station, FXCM’s own highly-rated platform

- Extensive automated trading support

- Opportunity to open a joint account

- Regulated by several major bodies

- Zero commissions charged

- Low slippage rates

- Good user reviews

- Free mobile apps

Disadvantages

There are some aspects that FXCM could improve on:

- The range of tradable assets is smaller than other brokers

- Spreads may be lower elsewhere

- Options trading is not supported

FXCM Customer Support

FXCM’s customer service team can be reached via phone, email, WhatsApp and live chat (available on their website). Here, customers can discuss issues including withdrawal problems, a forgotten password, or how to close an account.

Below, we have listed the email and contact number of each of their international offices, including the UK. Unfortunately the Hong Kong (HK) office no longer exists. FXCM responds to enquiries promptly, although their offices are not open 24/7, with opening hours varying depending on territory.

Note that the general trading holiday schedule for 2026 can be found in the help section of the FXCM website.

UK (Forex Capital Markets Limited)

- Email: info@fxcm.co.uk

- Phone: +44 20 7398 4050

- Address: 20 Gresham Street, 4th Floor, London EC2V 7JE, United Kingdom

EU

- Email: info@fxcm.eu

- Phone: +357 22022619

- Address: Units 310, 312 and 315, the NBC Building, 33 Neas Engomis Street, 2409 Engomi, Nicosia, Cyprus

Australia

- Email: support@fxcm.com.au

- Phone: 1800 109 751

- Address: Level 13, 333 George Street, Sydney, NSW 2000, Australia

Canada (in partnership with Friedberg Mercantile Group Ltd.)

- Email: info@fxcm.ca

- Phone: 888 296-5012

- Address: 220 Bay Street, Suite 600, Toronto, Ontario, M5J 2W4, Canada

South Africa

- Email: info@fxcm.za.com

- Phone: +27 10 500 1906

- Address: 114 West Street, 6th Floor, Katherine & West Building, Sandton, 2196, Johannesburg, South Africa

Israel

- Email: sales@fcm.co.il

- Phone: +972 3 510 1317

- Address: 3 Kiriyat Hamada Street, Building C, 3rd floor, Jerusalem, Israel 97776

FXCM Verdict

The FXCM Group is a large consortium of regulated international brokers that supports trading in a respectable number of forex and CFD markets. In this review, we have seen that FXCM is a legitimate brand, offering a free demo account to new clients, extensive algo-trading support, plus a good selection of education and research tools. Swing trading clients can benefit from competitive spreads and minimal non-trading fees, through a choice of highly-rated platforms.

FAQ

Can I Trade Cryptos With FXCM?

In the UK, crypto USD pair forex products (including BTC/USD and XRP/USD) are only available to FXCM’s non-retail clients. Elsewhere, customers are free to trade several crypto-based CFDs.

How Do I Open An FXCM Account?

To sign up with FXCM, follow the ‘Open Account’ link on the broker’s website. The account opening process is straightforward, but new customers are required to fill in a KYC (know-your-customer) questionnaire and upload proof of identity and residency. Once sign up is completed, clients are provided with a myfxcm login.

Is FXCM A Regulated Broker?

FXCM is regulated by several authorities around the world. In the UK, FXCM is regulated by the FCA, while in Australia, Cyprus and South Africa, it is regulated by the ASIC, CySEC and the FSCA respectively.

What Trading Platform Does FXCM Use?

Clients can trade using MT4, NinjaTrader, and the broker’s in-house platform, Trading Station. Social trading is facilitated via the third-party site ZuluTrade.

How Do FXCM’s Spreads Compare With Other Brokers?

FXCM is able to offer market average spreads on most forex pairs and CFDs with its retail account. However, as it is not an ECN broker, commission is not added on top, which makes this broker affordable for swing trading.