FXTM is an online broker that offers a wide range of financial instruments, trading platforms and speculative features. With both STP and ECN accounts, plus an Islamic swap-free solution, both beginners and experienced swing traders can find what they need. This 2026 FXTM review will run through the company’s history and regulatory status, available markets, live accounts and fees. We also outline the pros and cons of signing up with FXTM.

What Is FXTM?

Company Details

The FXTM Group, also known as ForexTime Holding Company Ltd., is a retail brokerage that offers trading in forex, commodities, indices and stocks. Customers from around the world are accepted, including from Iran, Egypt, Kuwait and Zambia.

The company headquarters is in the FXTM Tower in Limassol, Cyprus and there are additional offices across the globe, including in London, UK and Lagos, Nigeria. The broker is regulated by three different authorities, including the Financial Conduct Authority (FCA). The firm’s owner is Andrey Valerievich Dashin, who also owns Alpari, another online broker.

History

FXTM was founded in 2011 and over two million users around the world have now signed up for an account. Since its launch, FXTM has received more than 40 awards, including the Best Trading Experience of 2021 by World Finance. The long list of accolades suggest that the brand is reliable and highly-rated by clients.

Markets

Live account can holders can speculate on the financial markets using a range of products:

- Forex – Over 60 major, minor and exotic currency pairs plus six forex indices, such as the GBP index and USD index are available. A maximum leverage rate of 1:30 is offered.

- Metals – Gold and silver can be traded against several different currencies, not just USD. Spreads start from 0.4 pips for XAGUSD and 0.0 pips for XAUUSD. Maximum leverage rates for gold and silver are 1:20 and 1:10, respectively.

- Commodities – Purchase CFDs on oil and gas energies, such as UK Brent oil and US natural gas. All leverage is limited to 1:10, with tight spreads offered.

- Indices – Trade CFDs on some of the most well-known global equity indices, such as the ND100m and WSt30m, which are spins on the Nasdaq 100 and Dow Jones. The HSI50 and SPN35 indices are limited to leverage of 1:10, while all other indices are capped at 1:5.

- Stocks – Trade CFDs on global stocks such as PayPal and Adidas. The leverage allowed is account and profile-dependent, so will vary according to your experience level.

While FXTM once offered crypto trading, it has since revoked this service. However, there is a fun ‘from pizza to space’ Bitcoin price tracker. Binary options are also not supported.

Trading Platforms

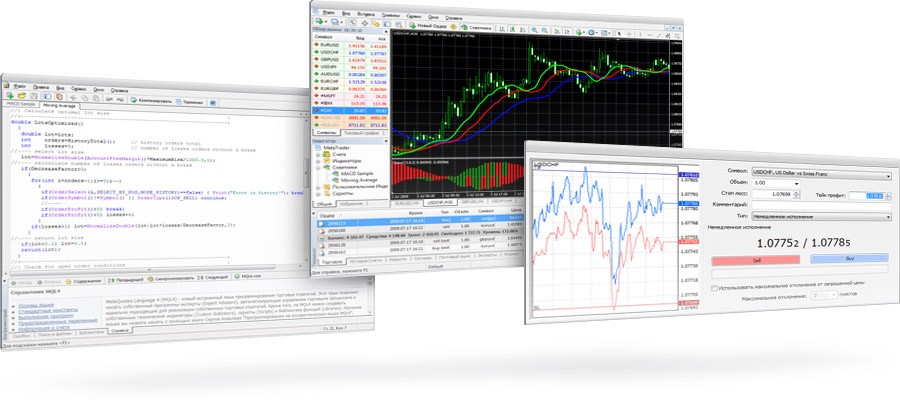

MetaTrader 4

FXTM accounts come with access to the world-leading MT4 platform. This platform is ideal for identifying and capitalising on market trends. Dedicated mobile apps are available for both Android and iPhone devices, a WebTrader platform for internet browsers and desktop clients for macOS and Windows computers.

The platform’s key features include:

- 39 languages

- Nine timeframes

- One-click trading

- Interactive charts

- Integrated signals

- Four pending orders

- Multi-account management support

- Over 30 built-in technical indicators

- Thousands of custom indicators online

- Automated trading support through MQL4

- Customisable trading views, indicators & tools

MetaTrader 4

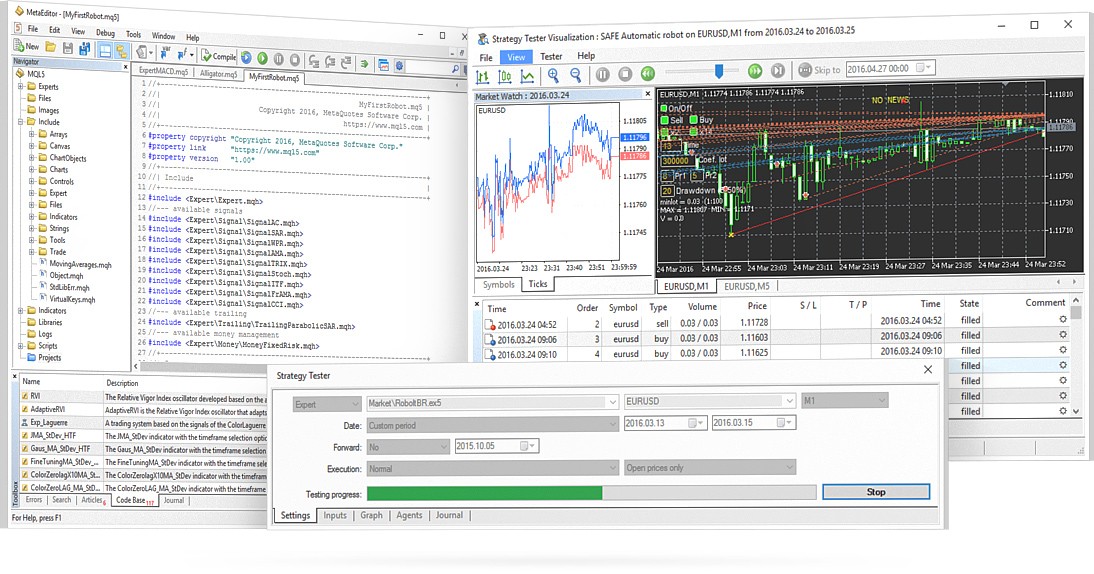

MetaTrader 5

- 39 languages

- 21 timeframes

- Interactive charts

- Integrated signals

- Six pending orders

- Multi-account management support

- Over 38 built-in technical indicators

- Thousands of custom indicators online

- Automated trading support through MQL5

- Customisable trading views, indicators & tools

MetaTrader 5

FXTM Trader App

- One-click trading

- Live currency rates

- Helpful trading dashboard

- Sync across several devices

- Easy position management

- Advanced charting tools and indicators

- Quick and easy deposits and withdrawals

FXTM Trader

Trading Accounts

Micro

Advantage

Advantage Plus

FXTM customers with an Advantage Plus account have unrestricted access to all available trading markets on the platform. The key difference with this account is that commissions are waived for spread markups.

Extra Accounts

Clients can open a demo version of each account type to practise investing in a risk-free environment. The paper trading accounts use digital funds in a simulated, real-time trading environment to give you a taste of the platforms, assets and account parameters available.

When you login to the demo account, you have the option to sign up for a strategy and trading investment manager. These managers are helpful and can provide useful tips and information about the financial markets and emerging trends.

All FXTM MT4 accounts are swap-free, providing a viable option for Muslim clients.

Fees

FXTM only charges commissions on Advantage Accounts. You can calculate estimates of the charges using the ‘Commission’ page, under the ‘Trading Accounts’ tab on the FXTM website. Overall though, the brand offers competitive spreads, with 0.6 pips available on major FX pairs, including the EUR/USD.

An inactivity fee of EUR/USD/GBP 5 is incurred if an account has no trading activity over six months. You will be charged the equivalent of any banking fees or 3% of the total withdrawal amount if you attempt to make a withdrawal without having made any trades.

Payments

Fund transfers can only be made using GBP, EUR or USD. There are no maximum limits for deposits or withdrawals, though a $50 minimum deposit is in place.

Deposits

- Credit Cards – Supported providers include Visa, Mastercard and Maestro. There are no deposit fees and processing takes up to two hours.

- E-Wallets – You can use Skrill, Moneybookers and Neteller wallets to deposit into an FXTM account. The processing times and deposit fees are the same as for credit cards.

- Wire Transfer – Bank transfers are only supported from accounts with Barclays Bank and Hellenic Bank. Deposits are free and processed in between three and five business days. Note that Hellenic Bank does not permit transfers using USD.

Withdrawals

- Credit Cards – Withdrawals are processed the same business day and incur charges of EUR/GBP 2 or USD 3.

- E-Wallets – Using Skrill, Moneybookers and Neteller, withdrawals are free and processed the same business day.

- Wire Transfer – Funds must be withdrawn via GBP or EUR and incur either a EUR 10 or GBP 5 charge. Processing can take up to 24 hours.

FXTM Regulation

The FXTM Group is licensed by four different financial regulators: the FCA, CySEC, FSCA and FSC of Mauritius. Regulation with all of these authorities requires strict handling of client funds, fair practices and decent security levels. The accountability and transparency that these agencies require suggest that this broker is legitimate and unlikely to be a scam.

The license number for FXTM with each regulator is as follows:

- The Financial Conduct Authority (UK): 777911.

- The Cyprus Securities and Exchange Commission: 185/12.

- The Financial Sector Conduct Authority of South Africa: 46614.

- Financial Services Commission of the Republic of Mauritius: C113012295.

Security

To protect customers’ funds, FXTM has adopted the policy of segregating client capital from the company’s assets. Additionally, clients are compensated if the broker defaults or becomes insolvent thanks to the Financial Services Compensation Scheme (FSCS). Trading platform logins are protected by two-factor authentication (2FA) and all data is encrypted.

MetaTrader 5 Mobile

Customer Support

If you wish to contact the FXTM customer support team, you have several options. Clients can request a callback, use the broker’s live chat function or send an email. Additionally, the company is active on social media, including WhatsApp, Telegram and Facebook Messenger.

- Email Address: support@fxtm.com

Bonuses

FXTM runs some promotional schemes in regions where these are not banned. For example, the 30% welcome bonus programme, in which accounts are given a bonus of 30% of each deposit they make within a certain time frame, up to a maximum of $200 per deposit. The broker has also offered no deposit bonus schemes in the past, which provide new customers with a free $30 to start trading. Finally, FXTM runs demo competitions, where users compete for the greatest profit percentage for prizes of up to $2,000.

Education & Analysis

FXTM provides a free education and market analysis service with which users have access to a large library of guides, videos and ebooks. These can help answer questions you may have, such as what is forex, how does it work, how does copy trading work and what is a suitable trading investment plan.

A particularly useful service for novice traders is the forex glossary, which helpfully defines many terms and abbreviations that you may come across, such as ‘exchange rate’ or ‘VPS’. Clients of all levels of expertise can take advantage of this service as it provides top tips on strategies you can adopt and reviews on potential trades.

A series of calculators to help determine potential revenue is provided on the website. First is the pip calculator, where you input the pip amount, currency pair, trade size in lots and deposit currency to determine the value of a pip. Then, there is the profit calculator, which will tell you the potential profits or losses depending on a certain outcome of a trade with a given currency pair, such as the USD/ZAR.

Advantages

Reasons to open an FXTM account include:

- Mobile trading

- Islamic trading

- Multi-regulated

- Wide range of assets

- MT4 & MT5 support

- ECN account options

- Comprehensive education & analysis centre

Disadvantages

Drawbacks of signing up with FXTM include:

- Withdrawal fees

- Inactivity fees

FXTM Verdict

FXTM is a reputable broker with several licenses across the globe with rigorous financial watchdogs. Furthermore, the firm offers STP and ECN account types, several popular trading platforms and hundreds of financial products. As a result, there is something to suit traders of all types, from intraday to swing and position traders. Frequent promotions can provide nice bonuses to new clients in certain jurisdictions and the education centre has lots of useful content for less experienced clients. Check out FXTM’s demo account today to get a free taste of what the broker can offer.

FAQ

Is FXTM A Market Maker & Dealing Desk Broker?

FXTM does not follow the controversial market maker execution model. Instead, the firm uses straight-through processing (STP) and electronic communications network (ECN) systems, depending on the account type.

Is FXTM A Legit And Regulated Broker?

Yes, FXTM is regulated by four different global authorities, three of which are considered top-tier. This suggests that the broker is legitimate, reputable and unlikely to be a scam.

Can US-Based Traders Sign Up To FXTM?

No, they cannot. Registration with FXTM is also restricted for traders from Japan, Canada, and Hong Kong.

Where Is FXTM Based?

The FXTM head office is in Limassol, Cyprus. There are offices around the globe and some region-specific accounts available, such as the Naira account, where users can trade using the Nigerian Naira with their own customer care. This account is just an adaptation of the three live accounts offered, though the minimum deposits are different. Unfortunately, there is not yet an option for ZAR accounts for South Africa-based customers, nor other countries such as Kenya, Pakistan, Ghana, Uganda and Zimbabwe.

Is FXTM An ECN Broker?

Yes, FXTM actually won the ‘Best ECN Broker’ award in 2020 from daytrading.com. The Advantage account follows an ECN execution model, offering raw spreads in exchange for a small commission.

Where Can I Find More Information Or User Reviews Of FXTM?

You can find reviews from previous users on websites such as YouTube, Trustpilot, Quora, Hello Peter, Reddit and Nairaland. Check out the ‘About Us’ section on the FXTM website if you wish to find general information about the company. You can also follow one of the broker’s many social media accounts for news and announcements, such as any new partners..