Markets.com is a leading online broker offering forex and CFD trading opportunities. Investors can trade 2,000+ popular assets including currency pairs, global shares, indices and commodities. Four powerful and user-friendly trading platforms are also available via web browser and mobile app. Our broker review will cover fees, customer support options, deposit methods, login security and more. Find out if you should sign up with Markets.com today.

What is Markets.com?

Established in 2008, Markets.com aims to offer seamless trading and investment opportunities in financial markets across the globe. The CEO and employees dedicate their careers to enhancing technology features for both new and experienced traders.

Today, the broker operates across the globe via four recognised entities; Safecap Investments Ltd, Finalto Trading Ltd, Finalto (Australia) Pty Ltd and Finalto (BVI) Pty Ltd. With this comes regulation from several financial authorities including from the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

The global brand, trademarked by Safecap, is a subsidiary of Playtech PLC. This is traded on the London Stock Exchange and is a constituent of the FTSE 250 index.

Products

The broker offers a good range of CFD and spread betting instruments for retail clients. These are suitable for all types of strategy, including swing trading.

The key financial markets available include:

- ETFs – Speculate on 65+ baskets of global securities

- Forex – 67 currency pairs available, including majors, minors and exotics

- Bonds – Profit from fluctuations in the value of European and US corporate and government bonds

- Shares – Trade on 2,000+ of the world’s major global companies including Apple, Netflix and Amazon

- Indices – Speculate on some of the largest markets across global index groups; cash or futures

- Cryptocurrencies – Trade on 25+ recognised digital currency coins including Litecoin, Ethereum and Bitcoin

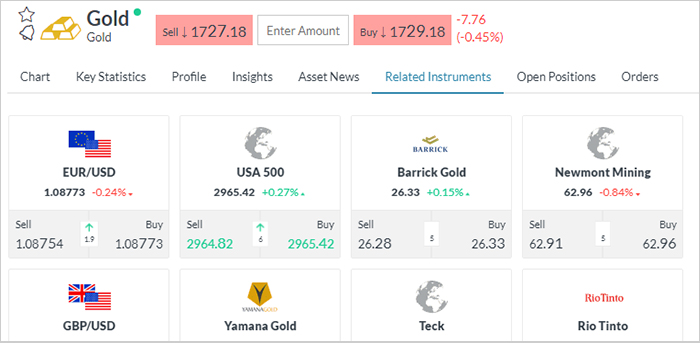

- Commodities – Access trading opportunities on soft commodities, energies and precious metals including Coffee, Natural Gas, Silver and Gold

- CFD Blends – Access combinations of several CFDs organised by theme. This includes Cryptoblend, social media and US technology. View past performance of ‘blends’ for portfolio transparency.

Traders should note that access to asset classes may vary by trading entity and country of residency. The Financial Conduct Authority, for example, has banned crypto derivatives trading at UK-regulated brokers.

Execution statistics are generally positive. The broker strives for full data transparency so traders can understand the level of service to be expected. Over 86% of all orders executed received positive or zero slippage in the last two years.

Markets.com Platforms

Markets.com offers traders various trading terminals: MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as proprietary platforms Marketsx and Marketsi. Smart, fast and customisable to your swing trading requirements, all options offer unique tools and functionality to trade the world’s markets.

The proprietary terminals are compatible with major web browsers only, there are no desktop download options. MT4 and MT5 can be used via major web browsers or can be downloaded to desktop devices.

Masketsx

Available in nine languages, Marketsx is a one-stop-shop for trading on the financial markets. The web trader is user-friendly with a simple design, whilst still offering advanced charting and technical analysis indicators.

Three basic order types can also be accessed: market, limit and stop. Email and SMS price movement notifications can be enabled to ensure you are in the loop with real-time data. ‘Trading cubes’ are a unique feature associated with the platform.

Our review was a little disappointed with the lack of customisable features. Unlike other industry-standard platforms, charts and workspaces could not be adjusted to suit personal preferences and viewing layouts.

Nonetheless, the Marketsx terminal does offer 14 trading tools. These are split into fundamental, technical and sentiment features, allowing clients to understand the markets and spot opportunities as they arise. Ideal for new investors, these include:

- Technical tools – Advanced charting and related instruments

- Fundamental tools – Financial commentary, advanced alerts, Thomson Reuters stock report

- Sentiment Tools – Blogger opinions, hedge fund investment confidence, insider trades, trading analyst recommendations and more

Marketsi

Third-party platform Marketsi enables shares-dealing and ETF trading. A highly customisable approach to investing, the platform allows for traditional swing trading strategies or creativity with the innovative strategy builder tool.

The industry-leading platform and personalised VIP service will help you make the most of the global markets without the need for intermediaries. Markest.com clients can choose to filter by sector, market cap, index and average daily volume to create bespoke investment plans.

Sophisticated tech-enabled research tools can also help clients analyse global stocks and share prices. New users can benefit from zero commissions for the first three months.

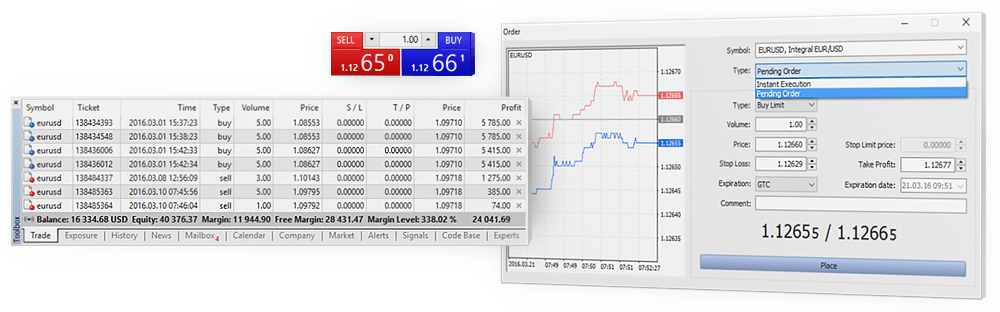

MetaTrader 4

An essential trading platform, MT4 is a globally-established and popular terminal. The platform boasts a multilingual interface with easy-to-use navigation and highly practical search tools. Execute trades instantly with the broker’s low cost pricing infrastructure. Functionality includes:

- Price movement alerts

- One-click order execution

- 30+ built-in technical indicators

- Automated trading via Expert Advisors

- Hedging tools and trading lots from 0.01

- Four pending orders and three order execution types

- Fully customisable charts with 9 available timeframes

MetaTrader 4

MetaTrader 5

MT5 is a multi-asset derivatives platform for trading forex, futures, stocks and CFDs. It is the most advanced and powerful online trading platform from MetaQuotes Software. Features include:

- One-click order execution

- Hedging and netting tools

- Built-in economic calendar

- 38+ built-in technical indicators

- Automated trading via Expert Advisors

- Six pending orders and four order execution types

- Advanced Market Depth feature and price movement alerts

- Unlimited number of customisable chart windows, with 21 timeframes

MetaTrader 5

Useful platform download guides and tutorials can be found on the broker’s website.

Mobile Trading

We were pleased to see Marketsx and Marketsi were both available as mobile applications. The apps offer seamless integration and native designs, regardless of the device being used.

Alternatively, MetaTrader 4 and MetaTrader 5 are also available as mobile apps. Markets.com traders can download any mobile app to iOS and Android devices from the relevant Google or Apple app store.

Simply sign in to the platform to access the tools, features and functionality found on the Markets.com webtrader and desktop terminals. You can manage your real or demo account, open and close positions, check live pricing and manage alerts while on the go.

Markets.com Accounts

Live Accounts

Markets.com offers just one account type. Access all assets with a minimum deposit requirement of $100 or equivalent currency. The broker also offers an Islamic and Joint account option.

Accounts can denominate in all major currencies including USD, AUD, DKK, EUR and GBP. It is quick and easy to sign up and open a new live trading account. Traders must complete the online registration form and upload identity documentation such as a passport and proof of residency. Once details have been approved, you can start trading immediately. Clients can switch between the demo and live account types via the platform navigation bar.

Traders should note that country restrictions apply. Markets.com does not accept retail clients from several countries including the USA, Canada and New Zealand. Accepted countries include the UK, South Africa, France, Germany, Denmark and most other countries. Check the broker accepts partners from your country of residency before applying for a real account.

Demo Account

Markets.com offers a demo account on all platforms, including MT4. These paper trading accounts will expire 90 days from registration if no trades are executed.

Unlimited virtual funds are available to practise swing trading strategies risk-free and to learn platform features and tools. The account operates using real-time market conditions, which is competitive if you compare Markets.com vs IG and XPG.

The demo solution is also mobile compatible so you can learn how to trade on all devices. A simple online registration form is required.

Fees

The broker provides a transparent fee structure so clients have access to all the information required before opening a trade. Markets.com offers floating spreads. This means there may be fluctuations throughout the trading period depending on market volatility and liquidity.

At the time of writing, we were offered an average spread of 0.9 pips on GBP/USD and EUR/USD currency pairs. Trading on the France 40 index was offered at 2 pips. These spreads are competitive in the market.

European clients with a real stocks trading account operate on a commission-based price structure. It is also good to see the first three months of trading are commission-free. A set base structure applies after this, on average 0.1% of the trading value.

Note that minimum fees may apply. Annual custody fees of 0.12% (maximum £10), stamp duty and other taxes may also apply. A 0.6% currency conversion fee applies for deposits from a denominated account currency to a base currency. Overnight rollover fees are applicable. A $10 per month inactivity fee is also charged after 90 days of dormancy.

Markets.com Leverage

Markets.com does offer leveraged trading. Maximum leverage opportunities vary by entity due to regulatory restrictions. Typically, investors trading under the BVI entity will have access to high margins as there are no capping limitations. We were offered up to 1:300 leverage on major forex pairs. For those under the UK, Cyprus and Australian broker tier, a maximum 1:30 leverage will be offered on major forex pairs and 1:10 on commodities trades including Silver.

Payments

Deposits

Markets.com does not charge an account funding fee but a $100 or equivalent currency minimum deposit is required. Payment methods vary by country of trading but include:

- PayPal – accepted in Europe only

- Debit/Credit Cards – accepted globally

- Bank Wire Transfer – accepted globally

- E-Wallets including Neteller and Skrill – accepted globally except for UK clients

Most payment methods offer instant account funding, however, bank wire transfers can take up to five working days.

Withdrawals

The broker does not have any withdrawal fees, however, third-party charges may apply. Our Markets.com withdrawal review found that minimum limits apply by payment method: credit/debit cards at $10/£10/€10 and bank wire transfers at $100/$100/€100.

Processing times vary by payment method, with bank wire transfers and credit card withdrawals taking up to five working days to process. E-wallets often provide faster fund processing.

Markets.com Regulation

The Markets.com group has regulated entities in the UK, Europe, Australia and the British Virgin Islands (BVI). Each entity is regulated by the relevant authority in their jurisdiction. It is the trader’s responsibility to ensure trading activity is carried out under the relevant entity and regulator. We outline global authorisation below.

UK

Products available: CFDs, Spread Bets and Strategy Builder

Markets.com is operated by Finalto Trading Ltd for UK clients. The entity is regulated by the Financial Conduct Authority (FCA). Traders under this authorisation can be assured of top-tier protection including segregated funds and negative balance protection. Additionally, swing trading clients have access to the Financial Services Compensation Scheme (FSCS) up to the value of £85,000 in the case of business insolvency.

Europe

Products available: CFDs, Share Dealing and Strategy Builder

Markets.com is operated by Safecap Investments Limited for European clients. The entity is regulated by the Cyprus Securities and Exchange Commission (CySEC). This is a top-rated regulatory body offering clients negative balance protection, segregated funds and FSCS investor compensation up to €20,000.

Australia

Products available: CFDs only

The broker is operated by Finalto (Australia) Pty Ltd for Australian clients. The entity is regulated by the Australian Securities and Investment Commission (ASIC). This is an established authorisation offering negative balance protection and segregated client funds. Electronic account verification is available for faster opening times. Loyalty awards and incentives are available to clients under this entity.

Global

Products available: CFDs and Strategy Builder

Markets.com is operated by Finalto (BVI) Ltd for global investors. The entity is regulated by the BVI Financial Services Commission (FSC). Similarly, the regulator offers negative balance protection and segregated client funds. Electronic account verification is available for faster opening times. Loyalty awards and incentives are available to clients under this entity.

When applying to a non-EU entity, traders will not be subject to European client protections. This includes maximum leverage capping limits and coverage under the Investor Compensation Fund. Local protections may apply.

Markets.com Security

Markets.com offers a safe and secure trading environment. Two-factor authentication (2FA) is available as an optional security enhancement for MT4 and MT5 accounts. Note, this is not currently available on proprietary terminals. Personal and financial data is exchanged with encryption between Markets.com and client terminals. In addition, robust firewalls and SSL technology are implemented.

Educational Content & Analysis

The Markets.com website features a wealth of educational content and tutorials. The broker provides excellent knowledge resources to ensure all traders have access to insights, opinions and education.

The Knowledge Centre is a hub of information suitable for new and experienced investors. Various learning tools can be used including e-learn books, latest news reports, insider analysis and live webinars.

XRay is a personal streaming service for financial commentary from experts in the field. These videos can be accessed via the platform for decision-making insights. The broker’s YouTube channel can also be used to view updated tutorial videos. Topics include using technical indicators or trading platform download guidance for PC or mobile devices.

Markets.com Promotions

Access to Markets.com bonus incentives varies by account registration location. Clients investing from the UK or European entity will be restricted. This is due to ESMA laws limiting the use of financial incentives for new or existing customers.

For clients outside the UK and Europe, our review found a history of promotions including a $25 no deposit bonus and a ‘refer a friend’ affiliates programme. Traders should always check minimum threshold requirements and understand terms and conditions before participating.

Advantages

This review uncovered several good reasons to trade with Markets.com:

- Live chat option

- Global regulation

- Mobile app compatibility

- Negative balance protection

- Free deposits and withdrawals

- Demo account with virtual funds

- Educational content and tutorials

- Access to proprietary terminals and MetaTrader 4 & 5

Disadvantages

There are a few drawbacks too::

- Copy trading not available

- No weekend customer support

- 2FA not enabled on proprietary platforms

- Trading country restrictions including US residents

Markets.com Trading Hours

Trading hours vary by instrument. Typically, forex market opening hours are 24 hours a day, 5 days a week. For further details, Markets.com provides a list of trading hours per asset, including upcoming holidays and market closure dates.

Customer Service

Markets.com offers 24/5 customer support. Methods include international contact numbers, an online contact form and an email address: support@markets.com.

A live chat function is also available on the broker’s website with the customer service team accessible 24 hours a day. It was a shame to see no support available over the weekend, however, our review was pleased with swift response times.

Social media channels including LinkedIn offer live news updates. In addition, a comprehensive FAQ section is hosted on the broker’s website, organised by category. Topics include registration help, applicable charges and how to close and delete an account.

Markets.com Verdict

It’s clear why Markets.com is an industry-recognised online broker. Investors can be assured of global regulation, a good range of asset classes, educational platforms and responsive customer support. We were pleased with the tools and services suited to both new and experienced investors, plus a wide range of educational tools and content.

FAQ

Is Markets.com Regulated And Is It Safe?

Markets.com is a secure and legitimate broker. All entities operate under global regulatory guidance with negative balance protection and access to investor compensation schemes. Safety protocols including login authentication, SSL technology and industry-standard encryption are also present. Review sites including Trustpilot and Reddit indicate a positive user experience.

What Deposit Methods Does Markets.com Offer?

Markets.com accepts several payment methods to deposit into a real account. These vary by entity but include bank wire transfers, credit/debit cards and PayPal.

Does Markets.com Offer Crypto Investing Opportunities?

Swing trading clients can trade cryptocurrencies with Markets.com. Access will vary by trading entity due to regulatory restrictions, however, digital currency coins available to invest include Ripple (XRP) and Litecoin (LTC).

Does Markets.com Offer A Demo Account?

Yes, Markets.com offers a demo account on the MetaTrader and proprietary platforms. These are a great way to practise swing trading strategies risk-free, with real-time pricing and conditions.

What Trading Platforms Does Markets.com Offer?

Clients can access four trading platforms: MetaTrader 4, MetaTrader 5, Marketsi and Marketsx. The Marketsi platform is designed for share-dealing and investing, while Marketsx is used for CFD trading.