Moneta Markets is an online CFD broker offering more than 300 tradable assets. As a subsidiary of the VGL Group, the firm leverages over ten years of industry experience and more than $100 billion in monthly trading volumes. This 2025 review will cover all aspects of trading with Moneta Markets, including platforms, fees, account types and more.

What is Moneta Markets?

The brokerage was registered in 2019 and is headquartered in Vanuatu. When you trade with Moneta Markets, you enter an agreement with its parent company, Vantage Global Limited FX. This company has been operating since 2009 and is licensed by multiple regulatory bodies.

The group has over 70,000 live accounts collectively, with more than 1.5 million trades executed each month. Client funds are held in an Australian AA-rated bank with a market capitalisation of $93 billion and over 12 million customers.

Markets

Users can trade 24/5 across a choice of platforms with access to over 300 CFD instruments:

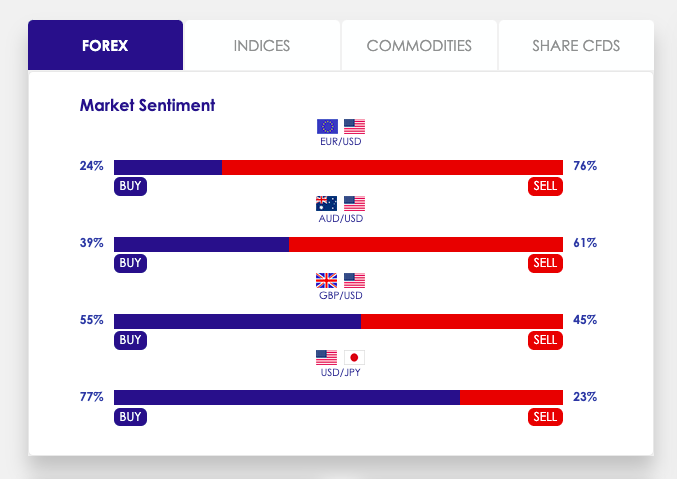

- Forex: 44 FX pairs including EUR/USD, AUD/USD, GBP/USD and USD/JPY

- Commodities: 19 of the most widely traded commodities including gold, oil, silver and natural gas

- Indices: 16 of the most liquid global indices including the S&P, FTSE, DAX, NIKKEI and HANG SENG

- Shares: 226 US, UK and European share CFDs including Apple, Google, Facebook and Netflix

- Cryptos: Six of the most popular cryptocurrencies including Bitcoin and Dash

Leverage limits vary depending on jurisdiction and asset but can be as high as 1:500.

Note, the FCA banned the sale of crypto CFDs in the UK.

Platforms

Moneta Markets offers trading services on proprietary software as well as across the MetaTrader suite:

- Moneta Platform – The in-house developed WebTrader platform is a comprehensive solution that supports novice and experienced traders alike. It combines a range of over 45 technical indicators and six chart types with an in-built client portal for account opening, deposits and withdrawals.

- AppTrader – Trading forex, shares, indices and more is possible with the Moneta AppTrader. The mobile terminal can be downloaded for free to Android and Apple devices from the Google Play Store or the Apple App Store. The application shares the same features as the WebTrader platform including a full suite of charting and drawing tools. Account management, including deposits and withdrawals, is easily done on the app.

- MetaTrader 4 – MT4 is an extremely popular platform due to its comprehensive range of indicators, drawing tools and the possibility for backend testing and automation. The MT4 dashboard is fully customisable and the native MQL4 scripting language allows traders to code custom indicators or use EAs (expert advisors) from the MT4 codebase.

- MetaTrader 5 – MT5 is the successor to MT4 and hosts an advanced range of order types, over 30 indicators and 21 timeframes. Essentially, MT5 is a sensible option for experienced swing traders. Both MT4 and MT5 can be downloaded as free mobile trading applications.

Trading Fees

Moneta Markets charges a spread that varies depending on the asset, the account type and market conditions. Spreads on the ECN account start at 0.0 pips whereas the minimum spread on the STP account is 1.2 pips. When we checked, the average spread for EUR/GBP was 0.36 pips on the ECN account and 1.56 on the STP account.

Swap rates are a rollover interest rate that is paid or earned for holding a position overnight. Overnight fees are updated weekly and are based on prevailing market conditions. You can view swap rates on the MetaTrader platforms by selecting an instrument and clicking “Properties” (“Specification”) on MT5. On the WebTrader, select an instrument and click the “Information” tab above the chart.

On the ECN account, a commission of $3 is charged per 1 lot on most assets. Share CFDs are charged a commission on both account types which varies depending on whether the share is from the US, the UK or Australia.

Account Types

Moneta Markets offers two account types: STP and ECN. The STP solution offers access to the full range of markets along with a $50 minimum deposit, spreads from 1.2 pips and zero commissions. The ECN account has a minimum deposit of $200, spreads from 0.0 pips and a set commission of $3 per lot per side.

Moneta Markets also offers a 50% deposit bonus on deposits of $500 or more. Deposits over $1,000 receive an additional 10% bonus.

Regulations require new users to provide documents to prove their identity and address. These might include photographs or scans of a passport, a driving license or utility bills. If you are unable to provide a clear copy of these documents your registration may be blocked.

Accounts are available in nine base currencies: AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY and HKD. Both account types are available as swap-free solutions for traders of the Islamic faith. Money managers can use Moneta Market’s PAMM account to open and close positions using their client’s investments.

Moneta has also partnered with HokuCloud to provide a free forex VPS solution for traders who deposit at least $500 and trade a minimum of 5 FX lots or equivalent in a calendar month.

Demo Account

You can register for a demo account on Moneta Markets’ proprietary WebTrader if you want to use the platform and hone your skills before opening a live account.

To do this, select the white “Demo” button on the official website and complete the application form. This account is active for 30 days before it expires.

Payments

Deposits and withdrawals can be made through the Client Portal using a variety of methods. These include bank wire transfer, Visa, Mastercard, FasaPay, JCB, Stocpay, Skrill, Neteller and other e-wallets. Moneta Markets does not charge any fees for deposits or withdrawals but you may incur fees charged by your financial institution.

Depending on your chosen method, withdrawal times will be within one to three business days.

Education

Moneta Markets offers a wide range of trading tools and research materials. There is an economic calendar, daily technical analysis, market sentiment alerts, and regular video insights on WebTV and Moneta TV.

The firm also offers DupliTrade, a copy trading software that allows clients to automatically mirror the positions of proprietary traders. This is a great option for beginners looking to explore new markets or refine swing trading strategies.

Market Sentiment

Customer Support

If you need help and support, or simply need to delete your account, Moneta Markets offers several channels for getting in touch:

- Phone (UK) – +44 (113) 3204819

- Phone (International) – +61 2 8330 1233

- Email – support@monetamarkets.com

The customer support team is multilingual and available 24 hours a day, five days a week. There is also a live chat function on the broker’s website which we found helpful and responsive upon testing.

Finally, you can get in contact with Moneta Markets through social media channels like Twitter, Facebook and LinkedIn.

Security & Regulation

Moneta Markets is the trading name of Vantage International Group Limited which is regulated by the Cayman Islands Monetary Authority (CIMA). Regulations require clients’ funds to be held in a segregated account with a top-tier Australian bank.

Vantage Global Prime LLP is also regulated by the Financial Conduct Authority (FCA) in the UK though Moneta Markets does not fall under this regulatory oversight.

Importantly, the firm has consistently positive reviews on Trustpilot and addresses and resolves any negative feedback.

Advantages

Pros of trading with Moneta Markets include:

- VPS account

- Tight spreads

- STP and ECN account

- Wide range of research materials

- Several base currencies available

Disadvantages

Cons of opening an account with Moneta Markets include:

- Only CFD products available

- No top-tier regulation

Moneta Markets Verdict

Moneta Markets is a well-rounded forex and CFD broker suitable for beginners and established investors. The option of two different execution types allows traders to capitalise on the pricing structure that best suits their trading strategy. Off-shore regulation can sometimes seem risky, but the firm’s associations through the Vantage Group mean it can be trusted.

FAQ

Is Moneta Markets A Legitimate Company?

Moneta Markets is a licensed CFD broker registered under the name Vantage International Group Limited and by the Cayman Islands Monetary Authority (CIMA).

What Is The Minimum Deposit At Moneta Markets?

The minimum deposit with Moneta Markets is $50 for the STP account and $200 for the ECN account. This is in line with the industry and makes it a good option for beginners.

In What Currencies Are Moneta Markets Accounts Available?

There are nine base currencies available: AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY and HKD. Deposits made outside of these currencies may incur an additional charge.

What Payment Methods Are Available At Moneta Markets?

Using the Client Portal on the Moneta Markets homepage, you can deposit using several options including bank wire transfer, credit/debit card and e-wallets such as Neteller and Skrill.

Can I Use A VPS With Moneta Markets?

Moneta Markets offers a free forex VPS service for users who deposit $500 or more. Further details on the VPS can be found upon account registration and login.