Nadex, or the North American Derivatives Exchange, is one of only a few legal, licensed binary options exchanges in the United States. The CFTC-regulated broker offers binary options trading and two other unique instruments to clients that wish to speculate on the price movements of forex, commodities, indices and economic events. This 2025 Nadex review explores each market and contract type in detail, before looking at the broker’s platform, pricing structure and customer service.

What Is Nadex?

Company Details

Nadex is one of the only CFTC-licensed exchanges for binary options trading in the US. The broker offers American and international residents a secure, regulated platform for binary options day and swing trading. Also, complex variants like Nadex knockouts and call spreads improve on the standard selection of instruments.

The broker operates as an exchange, which means that clients bet against other traders, rather than with traditional over-the-counter (OTC) market maker contracts.

History

Nadex, formerly known as HedgeStreet, was founded in California in 2004. Originally, the platform was created as an online marketplace for a range of financial derivatives. UK broker IG Group purchased the firm in 2007 and began turning it into the first American binary options exchange. The North American Derivatives Exchange launched fully-fledged in 2009.

Crypto.com recently announced that they are acquiring the Nadex company in a deal worth $216 million. Once the takeover is complete, traders can expect cryptocurrency trading functionality to be added. This should encompass popular coins like Bitcoin, Ripple, Ethereum and Shiba Inu.

Markets

Nadex facilitates binary options trading on the following markets:

- Commodities: Gold, silver, crude oil and natural gas futures

- Foreign Exchange: 11 currency pairs, six majors, four minors and one exotic

- Stock & Equity Indices: Eight global equity index futures, with US indices as e-mini futures. Examples include the S&P 500, Wall Street 30, Nikkei (Japan) 225, China A 50 and Dax 40

- Economic Events Speculation: 15 major US economic events, including weekly unemployment figures, GDP estimates, corn yields and crude oil stock changes

Nadex Instruments

Traders have three derivatives instruments to choose from: binary options, knockouts and call spreads. These all range from five-minute to one week expiry times.

Binary Options

Nadex binary options are American-style, which means that clients can exit them early. Consequently, there are greater opportunities for strategies and payouts than with European-style binary options. The broker supports contracts with payouts greater than 100%, while capping losses at the initial premium.

Knockouts

Knockouts are a unique derivative created by Nadex. These are much like traditional options but with built-in boundaries at which the contracts are automatically closed. The upper limit forms a take profit level, while the lower limit forms a stop loss to prevent excessive losses.

Each market begins the week with four knockouts that have distinct boundaries. These contracts will last a week unless the price exceeds a limit, in which case the contract is closed.

Unlike traditional options contracts, knockouts have capped gains and losses, which are dictated by the upper and lower boundaries. Depending on whether a trader opts to buy or sell a Nadex knockout contract, either limit can trigger a full payout or loss.

Call Spreads

Nadex also offers call spread contracts, which are not too dissimilar from knockout products. However, these are closer to binary options in terms of payouts and expirations. Call spread boundaries cap gains and losses by purchasing and selling contracts simultaneously, rather than closing positions. Therefore, traders can protect their capital but still wait until the expiry time for more opportunities to be proven right by the market.

Trading Platforms

The Nadex exchange platform is well laid out and easy to navigate. Large, uncomplicated text and clear charts greet traders, making the contracts and instruments accessible. The software also provides ample historical market data, technical indicators and trading tools to carry out sophisticated analysis.

Nadex exchange platform

Mobile App

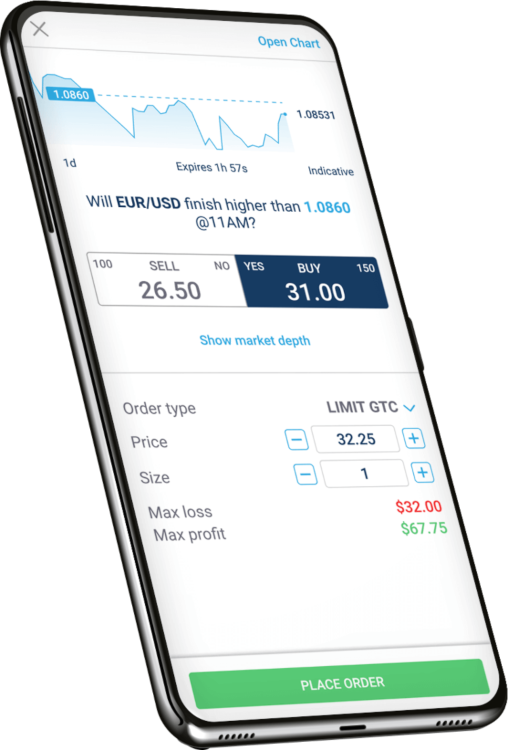

The brokerage also offers the NadexGo mobile app for flexible, convenient trading. The application offers all the same functionality as the primary platform, including several tools and indicators. Unlike traditional mobile platforms, clients cannot download NadexGo from the Apple App Store (iOS) or Google Play Store (APK). Instead, it is available for iPhone, iPad and Android devices as a web-based solution within a mobile’s browser application.

Nadex mobile app

The broker provides tutorials for both the main exchange platform and NadexGo to help clients get to grips with the terminals available. Nadex also offers on-demand webinars with walk-throughs and examples of the trading process.

Trading Accounts

Getting started with Nadex is straightforward, with only two accounts to choose from. The broker offers a US individual account and an international individual account, for residents of the other countries it services. Both accounts support all markets, instrument types and features. Signing up simply requires identification verification, which may entail uploading documentation.

Demo Account

Prospective clients can open a demo account to explore Nadex’s services and platform before risking real money. This paper trading account uses digital funds in a real-time market environment to provide a risk-free experience. As a result, clients can test contracts out and get to grips with the broker’s tools without risking cash.

Fees

Clients can expect a $1 commission charge for all contract purchases and positions, regardless of instrument type. Nadex charges a further $1 for closing positions early. If a position expires out of the money, the broker waives the commission, so clients will only lose the premium. The broker does not charge inactivity fees.

Payments

Deposits

Traders can deposit funds via debit card, cheque, ACH transfer or wire transfer. The firm processes debit card payments instantly, while wire transfers can take up to 24 hours and cheques up to five working days. ACH transfers process up to $500 instantly, while any additional funds will require up to five working days to clear. All deposits are free.

Withdrawals

The broker supports all the same methods for withdrawals, except cheques. Requests will require additional customer verification to comply with money laundering and terrorism funding regulations. Processing can take up to five working days and wire transfers are subject to a $25 flat fee.

Nadex Regulation

Nadex differentiates itself from most other binary options brokers through strong financial regulation. The Commodity Futures Trading Commission (CFTC), which is the primary regulator for US derivatives markets, oversees the firm. This suggests that the broker is legitimate and unlikely to be a scam.

Security

The broker holds client funds in segregated accounts with major US banks to protect traders from insolvency or fund misuse. Nadex uses industry-standard or greater encryption and security protocols to protect personal data. The platform’s login is protected via a secure portal but two-factor authentication (2FA) is not supported.

Educational Content & Analysis

The Nadex website features a wealth of educational content and platform tutorials to help clients learn the ropes. The education centre consists of blog posts and webinars that provide useful tutorials and articles on topics like how to make money on high probability trades, scalping 101 for dummies, the master course of trading secrets and top tips explained for a deeper understanding. Moreover, there are dedicated pages on 60 second, 5 minute, 20 minute, 1 hour, 2 hour and weekly binary options, spread calls and hedging strategy advice.

Clients can also find a wealth of information online with PDFs, forums, trading rooms, advice from self-proclaimed millionaires and pro signals providers. Check these out for daily binaries strategies and economic news highlights. You can also find taxes and tax reporting help and information on how to build your own trading system, mastery training classes and complex approaches like the iron butterfly strategy, long OTM, iron condor and hourly volatility systems.

Promotions

Nadex offers new traders a $100 bonus if their first deposit exceeds $1,000. To access this, clients must make five total trades within 30 days of the initial deposit. Once you receive the bonus, there are no wagering requirements.

Advantages

Reasons to register for a Nadex account include:

- CFTC-regulated

- Educational content

- $100 welcome bonus

- Market event options

- Demo account support

- Binary options in the US

- Knockouts and call spreads

- Limited reported payment problems

- Strong binary options trading reviews

Disadvantages

Downsides to opening a Nadex trading account include:

- Limited funding methods

- Limited range of assets

- No signal software

- Withdrawal fees

- Capped gains

Trading Hours

Nadex opening hours run from 18:00 EST on Sundays to 16:15 EST on Fridays. There is a daily one-hour break between 17:00 and 18:00 EST. Hours may vary on US holidays like Christmas and Independence Day. Hours will be different for each asset, with forex running 24/5 and indices governed by respective exchanges. Commodities follow NYMEX and COMEX futures trading hours.

Customer Service

Nadex clients can contact customer support via a live chat window or email. The team is knowledgeable and responsive, which is great if you have any withdrawal issues or account troubles. The broker does not provide a phone number for technical support.

- Email: customerservice@nadex.com

Nadex Verdict

Nadex is a unique, CFTC-regulated American binary options broker. The firm offers binary options contracts and special derivatives on forex, commodities, indices and economic events. The trading platform is sleek without scrimping on sophistication and the fee structure is transparent and competitive. There is also an attractive welcome bonus and cryptocurrencies are on their way to the exchange. Check out the demo account today to trial Nadex’s services for free.

FAQ

Does Nadex Support Automated Trading?

Unfortunately, Nadex does not offer automated or algorithmic trading through EAs, robot traders or API integration.

Is There A Nadex Trading App?

The NadexGo trading app is designed to facilitate easy-access mobile trading, with many of the same features as the desktop platform. The broker does not ask you to download this application on iOS or Android, as it is a web-based platform.

Can I Open A Nadex Demo Account?

Nadex encourages new clients to practice trading through its risk-free demo account before speculating with real funds. Simply follow the login process and get started. If you review the account and would like to start again, you can reset it at any time.

Does Nadex Provide Leverage?

No – the binary options, knockouts and call spreads offered by Nadex are not compatible with leverage and margin trading.

Where Can I Open A Nadex Account From?

Nadex is unique in that it offers regulated binary options contracts within the US. However, the exchange is not just limited to America and non-US residents can open accounts. For example, UK residents and traders from Japan and India can use the broker. Unfortunately, the firm does not accept clients from Canada, Indonesia or Kenya.

What Are The Nadex Minimum Deposit And Withdrawal Limits?

Nadex does not impose minimum deposit or withdrawal limits. Users are free to invest what they can afford.