Best Swing Trading Brokers With PAMM Accounts 2026

Looking to capitalize on market swings without managing every trade yourself? PAMM (Percentage Allocation Management Module) brokers offer the perfect middle ground, combining the profit potential of mid-term market moves with the convenience of professional account management.

We reveal the best PAMM brokers tailored for swing traders who want smart, strategic returns without the daily grind.

PAMM Brokers for United States

How SwingTrading.com Chose The Top PAMM Account Providers

We reviewed each broker’s PAMM service in detail, documenting key features such as transparency, investment requirements, usability, fees, and support. Using this data and our wider testing observations, we ranked providers by the highest overall ratings to the lowest.

How To Pick A PAMM Account

- When evaluating swing trading PAMM brokers, one of the first things to consider is whether the PAMM managers use proven swing trading strategies. Ideally, their trades should be held for 2 to 10 days, targeting price moves between major support and resistance levels. Effective strategies often incorporate technical methods such as trendline breaks, Fibonacci retracements, or moving average crossovers. It’s also important to avoid managers who place an unusually high number of trades or rely on timeframes under 15 minutes—these are often scalping strategies incorrectly presented as swing trading.

- Transparency in performance metrics is equally vital. A reputable broker should provide detailed data such as average trade duration (which should reflect multi-day holdings), a profit factor above 1.5, and risk-adjusted performance indicators like the Sharpe or Sortino ratio. Maximum drawdown should be visible and well-managed, ideally staying below 25%. These figures offer insight into how consistently and responsibly a swing trading strategy is executed over time.

- Since swing trades are typically held overnight, swap and rollover fees can significantly affect profitability. It’s important to review whether the PAMM manager trades in the direction of positive swaps—also known as carry trades—or against them. The best brokers either minimize overnight fees or offer swap-free account options. Pairs like EUR/USD or USD/JPY tend to carry more favorable conditions, making them preferable for long-duration trades.

- Strong risk management tools should also be available to investors. Leading PAMM brokers offer features such as equity stop-losses that automatically close your investment if losses reach a certain level, allocation scaling that lets you adjust exposure to higher-risk strategies, and the flexibility to withdraw funds without penalties if the manager deviates from the advertised trading approach. These options allow investors to stay in control without needing to micromanage trades.

- Regulatory oversight is a non-negotiable factor. Well-known financial authorities, such as the FCA in the UK, ASIC in Australia, or CySEC in the EU, license trustworthy brokers. These brokers typically offer segregated client accounts, audited records, and access to investor compensation schemes. In contrast, offshore brokers operating under lax or nonexistent regulation often lack accountability, exposing your capital to unnecessary risk.

- Platform reliability and execution quality also play a crucial role in swing trading success. Since trades are often entered and exited at key technical levels—sometimes during volatile sessions like the London or New York opens—fast, accurate order execution is critical. Brokers should support stable platforms such as MT4 or MT5, which offer custom indicators, multi-timeframe charting, and comprehensive trade logs. Look for brokers with low latency, minimal slippage, and competitive spreads that don’t widen drastically during major news events.

- Historical performance should show consistency, not hype. The most reliable PAMM managers demonstrate a steady equity curve, controlled drawdowns, and predictable growth. Be cautious of those showing dramatic, short-term gains—these may be the result of excessive leverage or unsustainable risk-taking, which rarely align with disciplined swing trading strategies.

In my experience, using a swing trading PAMM broker strikes a rare balance—you’re not glued to the charts, but you’re still part of a strategy that respects timing and market structure.It’s not set-and-forget, but it rewards patience, especially when the manager sticks to a disciplined approach and avoids chasing quick wins.

What Is A PAMM Account?

A PAMM account is a trading system where one master trader manages multiple investors’ funds from a single trading account. Each investor’s capital is pooled but tracked separately, and all trades placed by the manager are automatically mirrored across the investors’ accounts in proportion to their allocations.

For example, if the manager opens a 1-lot trade and you’ve invested 10% of the total pool, your account will reflect a 0.1-lot position. Profits and losses are distributed based on these exact percentages after each closed trade.

PAMM accounts allow investors to benefit from strategic, multi-day positions without executing trades themselves. However, it’s important to monitor metrics like trade duration, drawdown, and swap costs—especially since swing trades often span overnight and weekend sessions where additional fees and risks apply.

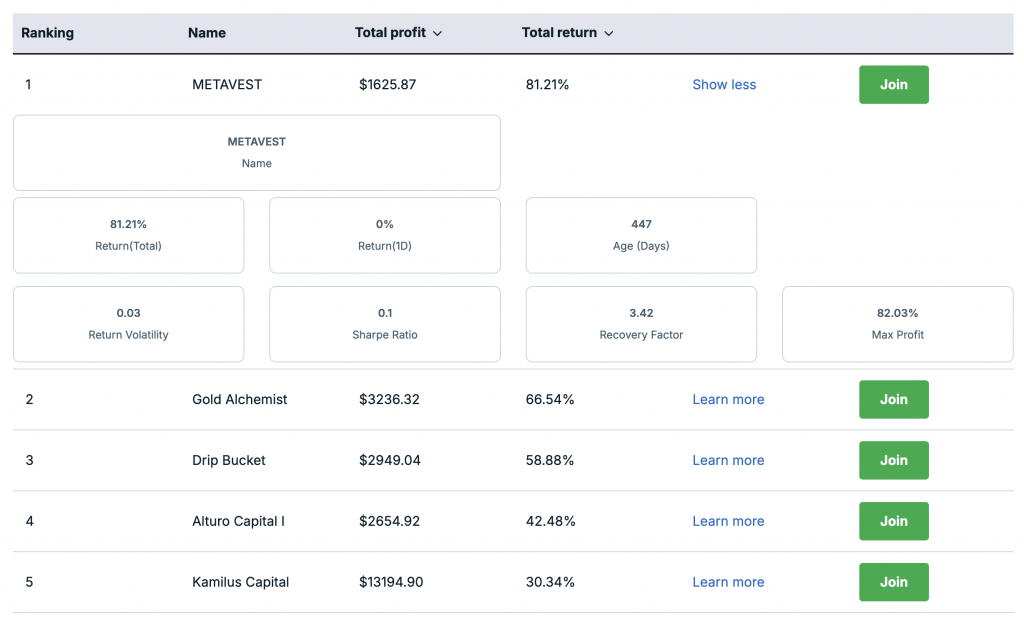

GO Markets conveniently ranks performance data for each PAMM account

Pros Of Using A PAMM Account For Swing Trading

- Strategic market timing without the work: Swing trading managers typically use multi-timeframe analysis, combining daily and 4-hour charts with indicators like RSI divergence, Fibonacci retracements, or price action near key levels. As a PAMM investor, you benefit from these more calculated entries and exits—often timed around technical setups and fundamental catalysts—without needing to monitor charts or manage risk manually.

- Balanced risk & reward: Swing trading PAMM strategies typically target price swings that last from a few days to a couple of weeks, aiming for trades with risk-reward ratios of 1:2 or higher. This time frame allows for better technical confirmation (e.g., support/resistance, moving average crossovers) while reducing exposure to the noise and slippage often seen in lower time frames like M1 or M5.

- Lower trade frequency, lower costs: Because swing traders execute fewer trades—often just a few per week—PAMM accounts using these strategies reduce cumulative costs from spreads and commissions. Additionally, fewer trades mean less exposure to execution risks like requotes or slippage during high-frequency events, which is common in scalping-heavy PAMMs.

Cons Of Using A PAMM Account For Swing Trading

- Overnight & weekend risk exposure: Swing trades are held for multiple days, meaning positions are often open overnight or across weekends. This exposes your investment to gap risk—sharp price moves that occur when markets reopen, which can trigger larger-than-expected losses, especially during major news events or geopolitical developments.

- Swap & rollover fees accumulate: Since trades are held longer, swap (or rollover) fees—interest charged or earned for holding a position overnight—can add up, particularly on exotic pairs or if the position goes against the interest differential. Over weeks, these fees can significantly reduce net profitability, especially if the strategy doesn’t account for them.

- Slower performance feedback loop: Swing strategies have fewer trades, which means it can take weeks or months to assess a manager’s performance accurately. This slower feedback loop makes it harder to quickly identify underperformance or strategy drift, requiring more patience and trust in the PAMM manager’s long-term edge.

What surprised me most about investing through a PAMM account as a swing trader was how much smoother the equity curve felt compared to high-frequency strategies. You still get exposure to meaningful market moves, but without the emotional rollercoaster of constant trade activity—it’s a slower rhythm, but with purpose behind every entry.

Bottom Line

The best swing trading PAMM brokers offer you a smart way to tap into medium-term market moves without active trade management. By partnering with skilled managers who hold positions for several days, you can benefit from carefully timed trades designed to capture significant price swings.

Choosing the right PAMM broker means focusing on strategy transparency, risk controls, and execution quality—ensuring a balance between growth potential and capital protection.

Ultimately, PAMMs provide a disciplined, hands-off approach that suits swing traders seeking steady, well-managed exposure to the markets.

FAQ

How Do I Know If A PAMM Manager Swing Trades?

Look closely at the manager’s trade history and performance metrics. Swing trading typically involves holding positions from a few days up to two weeks, with lower trade frequency and a focus on capturing larger price moves.

Avoid managers with very high trade counts or average trade durations under one day, as these are usually scalpers or day traders. Detailed metrics like average trade duration, drawdown patterns, and risk-reward ratios can help verify the strategy style.

What Risk Controls Should I Look For In A PAMM Account?

Key features include equity stop-loss settings that automatically protect your capital if losses exceed a set limit, the ability to scale your investment allocation based on risk appetite, and flexible withdrawal options without penalties.

Additionally, it’s important that the broker provides transparent reporting and enforces consistent strategy rules for managers to minimize unexpected risk shifts.