Best Swing Trading PayPal Brokers 2026

PayPal has become a go-to digital wallet for making fast and secure payments. For swing traders who need flexible, reliable banking options, PayPal offers a fast and hassle-free way to move money in and out of broker platforms – I know I’ve used it for my own trading.

This guide breaks down the top PayPal-friendly brokers, focusing on transaction speed, mobile access, support quality, and other key factors.

How SwingTrading.com Chose The Best Brokers That Accept PayPal

We check the specific payment methods offered by every broker we review and shortlisted only those that support PayPal.

These brokers were then ranked by their overall ratings, based on countless data points and criteria relevant to swing traders, including fees, execution speed, and platform quality.

What Is PayPal?

PayPal is a widely used digital payment platform that allows you to send, receive, and store money online.

Known for its speed, security, and ease of use, PayPal supports transactions in multiple currencies and is accessible across most devices. With millions of users worldwide, it’s a trusted tool for both personal and business payments—and increasingly, for financial services like trading.

It offers near-instant deposits and relatively fast withdrawals, helping you respond to market opportunities without delay. Unlike traditional bank transfers, PayPal also provides an added layer of privacy, as you don’t need to share your full banking details with brokers.

For brokers, integrating PayPal as a payment method broadens their appeal, particularly among traders seeking convenience and speed. It also helps reduce barriers for newer traders who may not want to commit to more complex or slower funding methods.

While not every broker supports PayPal due to associated fees or regional restrictions, many top-tier platforms do, making it a competitive feature in today’s trading landscape.

How PayPal Works

PayPal functions as a digital payment gateway that facilitates transactions between users and merchants—including trading brokers—without directly exposing sensitive financial details.

When you link a bank account, credit card, or debit card to your PayPal account, PayPal stores and encrypts that data.

During a transaction, PayPal processes the payment on your behalf, acting as an intermediary to authorize and transfer funds while masking the original payment source.

For trading brokers that integrate PayPal, the platform utilizes API endpoints to connect with PayPal’s servers securely. This allows real-time communication for payment confirmation, settlement, and withdrawal requests.

When you initiate a deposit, PayPal verifies your account balance or funding source, authorizes the transaction, and instantly notifies the broker of successful payment, often crediting your trading account within seconds.

On the withdrawal side, brokers trigger a PayPal payout request through the same integration, which moves funds from the broker’s PayPal merchant account to your personal PayPal wallet. From there, you can either hold the funds or transfer them to a linked bank account.

This technical infrastructure ensures transactions are secure, fast, and traceable—important features for swing traders who rely on timely capital movement to execute their strategies.

Transaction Times

When depositing funds into your trading account via PayPal, the transaction is typically processed instantly or within a few minutes.

This is because PayPal uses real-time processing systems and tokenized payment authorizations, allowing brokers to credit your account as soon as PayPal confirms the transaction.

Withdrawals via PayPal are generally faster than traditional bank transfers, though not always instantaneous. Most brokers batch withdrawal requests and require internal processing time for compliance and anti-fraud checks, which can take several hours up to 1–2 business days.

Once your broker releases the funds, PayPal usually delivers them to your wallet within minutes. From there, transferring funds to a linked bank account can take another 1–3 business days, depending on your bank and country.

PayPal’s speed advantages are partly due to its direct API integrations with trading platforms and its use of automated clearing and settlement mechanisms. This reduces manual processing and makes it possible to support nearly instant deposits and comparatively fast withdrawals.

However, the exact timing can vary depending on broker-specific cut-off times, account verification status, and regional PayPal policies. For swing traders, this means it’s possible to fund positions quickly, but planning ahead for withdrawals is still wise to avoid liquidity delays.

IC Markets offers PayPal funding options in 10 different base currencies

Is PayPal Secure For Trading?

PayPal is considered a highly secure payment method, particularly in the context of trading brokers. It uses multiple layers of security to protect user data and transactions, including end-to-end encryption, fraud detection algorithms, and two-factor authentication (2FA).

When you deposit funds through PayPal, your banking or card details are not shared with the broker. Instead, PayPal acts as a tokenized intermediary, which reduces the risk of sensitive information being exposed or intercepted.

From a technical standpoint, PayPal complies with PCI DSS (Payment Card Industry Data Security Standard) Level 1, the highest level of certification for payment processors.

It also monitors transactions in real time using machine learning to detect unusual patterns that may indicate fraud or account compromise. This adds a layer of protection for traders, especially when dealing with brokers in different jurisdictions or new platforms.

For brokers, integrating PayPal adds credibility and an additional layer of trust. Many traders feel more comfortable funding their accounts through PayPal than entering card or bank details directly on a broker’s website.

However, it’s important to note that security also depends on the broker’s own handling of PayPal integration, including whether they use secure API endpoints, SSL encryption, and proper KYC/AML procedures.

Is PayPal Easy To Use?

PayPal is highly convenient for trading, especially when it comes to funding and withdrawing from broker accounts. The platform is designed for quick, user-friendly transactions.

Once you link a bank account, credit card, or debit card to your PayPal wallet, deposits to a trading broker can be made in just a few clicks.

Many brokers even offer PayPal as a one-click funding method, integrated directly into their platforms via PayPal’s API. This eliminates the need to re-enter payment details each time, reducing friction and saving time—perfect for acting quickly on market setups.

On the withdrawal side, PayPal also streamlines the process. Funds sent from the broker’s merchant account are deposited directly into your PayPal balance, typically within minutes to a few hours after processing.

From there, you can either spend the funds online or transfer them to your linked bank account. The mobile app adds further convenience, allowing you to monitor and manage transfers on the go, which is especially useful when trading from multiple devices or while traveling.

That said, convenience can vary slightly depending on the broker’s integration quality and internal processing times. While PayPal supports instant transactions, some brokers apply manual review or batch processing for security or compliance reasons, which can introduce delays.

Still, compared to traditional bank wires or even credit card transfers, PayPal stands out for its ease of use, mobile-friendliness, and fast access to funds—all of which align well with the pace and flexibility required in swing trading.

I’ve used PayPal to fund many trading accounts and value how quick and easy deposits are, especially when timing a swing trade.It’s not perfect, fees can surprise me and withdrawals sometimes take longer than expected. Still, the security and convenience keep me using it.

Is PayPal Free To Use?

PayPal is free to use for basic personal transactions, but fees can apply depending on how it’s used—and this is especially relevant when funding or withdrawing from trading brokers.

For most traders, depositing funds into a broker account via PayPal is free from PayPal’s side when the money comes from a linked bank account or PayPal balance.

However, if the deposit is funded with a credit or debit card, PayPal typically charges a processing fee (around 2.9% + a fixed fee, depending on the country and currency).

When it comes to withdrawals, PayPal generally does not charge you to receive funds from brokers, but the broker may apply its own withdrawal fee.

Additionally, PayPal may charge a currency conversion fee—usually in the range of 3–4% above the base exchange rate—if your trading account and PayPal wallet operate in different currencies.

Technically, brokers using PayPal are charged merchant fees by PayPal for each transaction, which is why some may limit or discourage its use through withdrawal limits or added fees.

If you move funds in and out of your trading accounts frequently, these costs can add up, making it important to review the broker’s fee schedule as well as PayPal’s own terms before relying on it as a primary funding method.

Does PayPal Have Transfer Limits?

PayPal does impose transfer limits, and these can be important for traders to understand—especially when dealing with larger deposits or withdrawals to and from trading brokers.

For unverified accounts, PayPal places strict limits on how much you can send, receive, or withdraw. These limits vary by country but are typically in the range of a few thousand dollars per month.

To lift these restrictions, you must complete a verification process, which involves linking and confirming a bank account or card and submitting identity documents.

PayPal doesn’t always publish hard caps publicly, but daily or per-transaction sending limits for verified users can reach up to $10,000 or more, depending on account status, transaction history, and regulatory region.

However, brokers may impose their own deposit or withdrawal limits per transaction or per day, which could be lower than PayPal’s internal limits.

It’s also worth noting that PayPal can apply temporary limits or flags based on unusual activity, large one-time transfers, or compliance checks—which can delay transactions.

If you need predictable liquidity to manage positions efficiently, it’s advisable to verify your PayPal account and understand both PayPal’s and the broker’s specific policies on transfer limits.

Planning ahead helps avoid funding delays that could affect time-sensitive trades.

At one point, I was caught off guard by PayPal’s transfer restrictions, which interrupted my ability to quickly fund a trade. It was a good lesson in making sure all account verifications are complete before trading—once that was sorted, the process became much more reliable.

Bottom Line

PayPal is a strong choice for swing traders needing fast, secure, and convenient fund transfers. Its quick deposit and withdrawal capabilities allow you to react promptly to market setups, while its built-in security reduces the need to share sensitive financial data with brokers.

Many trading platforms support PayPal, making it easy to connect and manage funds. Beyond payments, PayPal has expanded into crypto, signaling its broader ambition to become a one-stop financial hub—something swing traders may find increasingly valuable.

FAQ

Do All Brokers Support PayPal Deposits & Withdrawals?

No, not all brokers support PayPal for deposits and withdrawals. While many well-established and regulated platforms offer PayPal due to its speed and security, others avoid it because of transaction fees, regional restrictions, or integration costs.

Support for PayPal also varies by country, so you should always check whether it’s available with your chosen broker and account type.

What Currencies Does PayPal Support?

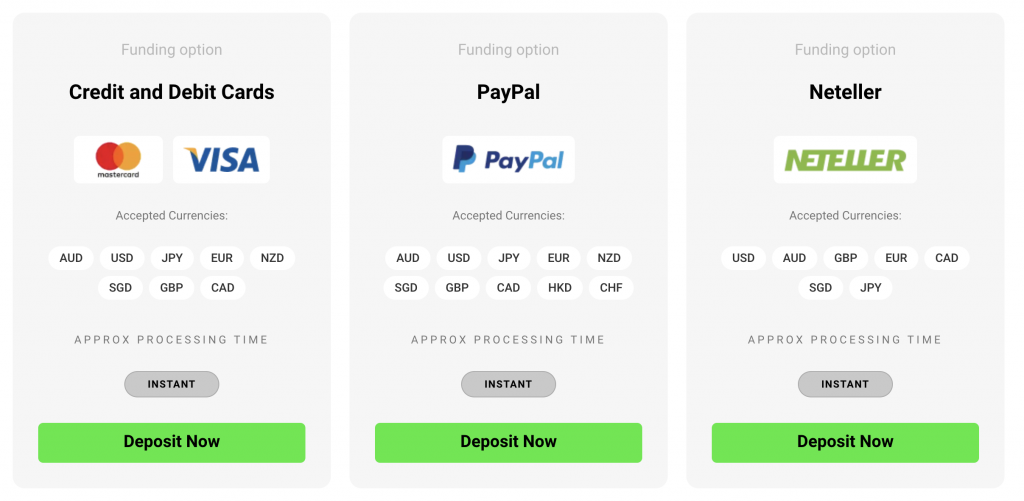

PayPal supports transactions in over 20 major currencies, including USD, EUR, GBP, JPY, AUD, and CAD. This makes it convenient if you trade across global markets.

However, currency conversion fees may apply if your PayPal balance or broker account uses a different currency, typically around 3–4% above the base exchange rate.

Always check both PayPal’s and your broker’s currency policies before transacting.