Best Swing Trading Signal Providers 2025

Swing trading signals, offered by brokers and independent platforms, have become a go-to resource for traders of all skill levels.

We reveal the best swing trading signal providers based on real-world testing. You’ll also learn how to evaluate signal services and integrate them into your trading strategy to boost confidence and performance.

How SwingTrading.com Chose The Top Signal Providers

We investigated a wide range of swing trading signal providers, analyzing the availability of their signals, then recording key details of each provider’s offering. Each was assigned an overall rating based on hands-on testing, and ranked accordingly.

Our evaluation considered over 200 individual factors, with a focus on criteria that matter most to swing traders. As part of our evaluation process, we opened accounts and tested platforms to assess how well each provider supports swing traders.

What Are Swing Trading Signals?

Trading signals are alerts or recommendations from third-party providers that indicate potential buying or selling opportunities in financial markets.

Generated through technical analysis, chart patterns, algorithmic models, or a blend of both, these signals help traders identify key moments to act – ideally before significant price movements occur.

Timing is everything for swing traders, who aim to capitalize on short- to medium-term trends lasting from a few days to a few weeks. Trading signals can provide that edge by filtering through market noise and highlighting setups with the highest probability of success.

One unique appeal of using signal providers is the added layer of discipline. Many traders struggle with emotional decisions, such as exiting too early, entering too late, or overtrading.

A quality signal acts like a trading compass, helping you stick to a plan instead of chasing the market. For newer swing traders, signals can also serve as a learning tool, offering real-time examples of technical setups and market behavior in action.

Whether automated or human-generated, trading signals offer more than alerts—they provide structure, consistency, and potentially a shortcut to more informed decision-making.

Get free trade signals from Trading Central directly in your broker platform

How Do Swing Trading Signals Work?

Swing trading signals from third-party providers are designed to simplify decision-making by delivering timely trade recommendations directly to your phone, inbox, or trading platform.

Rather than scanning charts and interpreting technical indicators yourself, these services use pre-programmed strategies to detect potential trading opportunities – often in real time.

For example, you might subscribe to a provider that specializes in US stocks. One morning, the provider signals: “Buy AMD at $110, target $117, stop-loss $106.”

All you need to do is check your brokerage app, see that the setup aligns with broader market sentiment, and place the trade.

AMD rallies as expected over the next few days, hitting the target price. In this case, the signal saved you hours of chart analysis while delivering a well-timed setup.

Some providers we’ve tested offer more context alongside each alert. A signal might include a note like, “Bullish MACD crossover with volume surge on the daily chart,” giving you insight into the technical reasoning behind the call. This not only builds trust but also helps you learn by example.

Using these services doesn’t mean turning off your brain – you should still review each alert through your lens.

However, signal providers offer a strategic shortcut – especially if you have limited time or less technical experience – while helping reinforce consistency, reduce emotional bias, and improve timing in fast-moving markets.

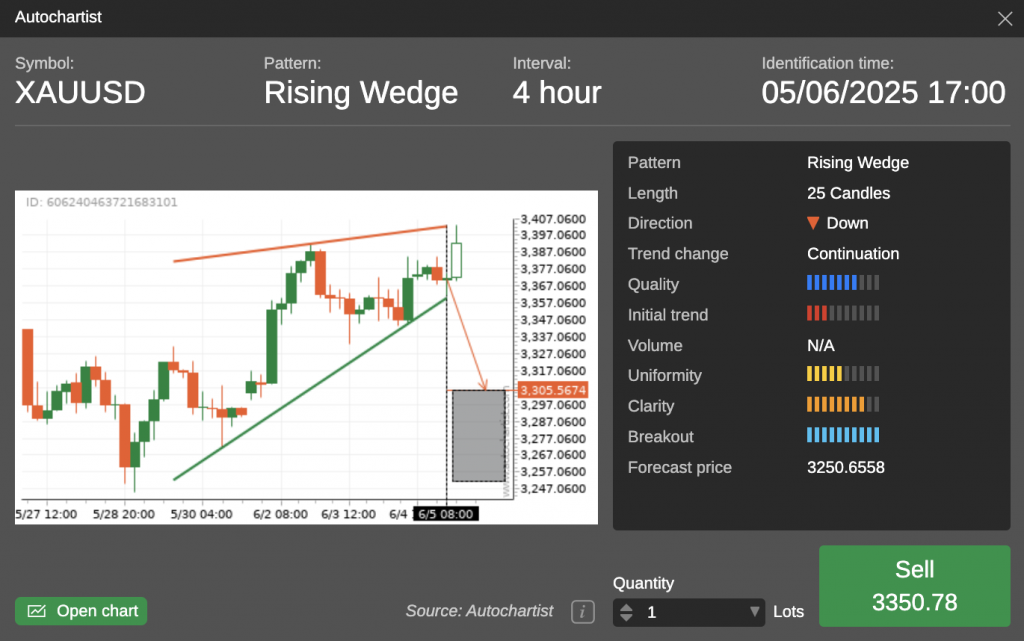

Spot high-probability setups fast with Autochartist’s automated trade ideas

Swing Trading Signals Versus Copy Trading

While swing trading signals and copy trading might seem similar on the surface – both offer guidance to help you make trades – they operate quite differently.

Swing trading signals are essentially trading ideas or alerts. A provider tells you what to trade, when to enter, where to place a stop loss, and the target.

But you’re the one who manually executes the trade and decides whether or not to follow the recommendation.

I remember testing a swing trading signal service that specialized in small-cap stocks. I’d get a few alerts each morning before the US session opened with complete trade setups. I still had to assess whether the market conditions matched the signal and enter the trade myself. It gave me flexibility and control but required more active involvement and discipline.

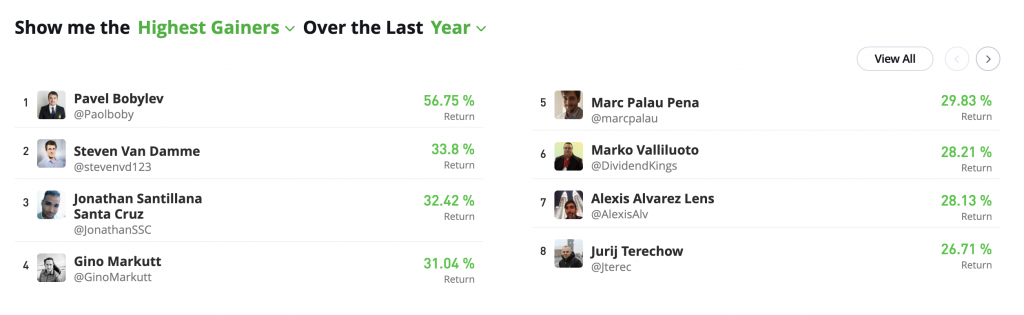

Copy trading, on the other hand, is far more hands-off. It automatically allows you to mirror another trader’s trades in real-time.

Once you’ve linked your account to a trader you want to follow, every trade they make is replicated in your portfolio – entry, exit, and position size. It’s essentially set-it-and-forget-it, assuming you trust the trader you’re copying.

I experimented with copy trading on eToro, NAGA, and ZuluTrade platforms. After choosing high-performing swing traders with consistent histories, I let the platforms handle everything. While convenient, I realized I was learning little about why trades were made. That hands-off nature is appealing to passive investors, but it’s less ideal if your goal is to develop your swing trading strategy.

In short, trading signals offer informed suggestions while keeping you in the driver’s seat. Copy trading hands over the wheel entirely. Which one is better depends on your goals – whether you want to grow as a trader or simply seek exposure to the markets with minimal effort.

Copy top-performing traders automatically with eToro’s copy trading feature

How To Compare Swing Trading Signals

We’ve spent many hours evaluating providers of trading signals, here’s what to look at:

Markets

Market or asset choice is essential when comparing swing trading signals because not all providers specialize in the same markets – or perform equally well across them.

Some focus on US equities, while others target forex, crypto, or commodities. The type of asset influences volatility, trading hours, liquidity, and risk, all of which affect the performance and reliability of signals.

For example, if you’re based in the US, following a signal provider that focuses on Asian markets may be impractical. Trade alerts could arrive at night, making responding in real time or managing positions challenging.

Fees

Fees for swing trading signal providers can vary widely depending on the service’s quality, delivery method, and reputation.

Premium providers that offer in-depth analysis, higher accuracy, or tailored alerts often charge a monthly subscription (from $10 to over $250), while others operate on a freemium model (free if you use their preferred broker).

However, some top-tier signal services – like Trading Central, Autochartist, and Signal Centre – are often included for free through partnered brokers.

When I started using a broker offering integrated signals, it was a game-changer because I gained access to professional-grade alerts without any extra cost. This made me realize how important it is to check what your broker already provides before committing to paid signal services. It’s a simple step that can save both money and hassle.

Accessibility

Accessibility is a key factor when evaluating swing trading signal providers, as the way signals are delivered can impact how quickly and effectively you act on them.

Most providers send signals via email, mobile apps, SMS, or directly through trading platforms. Some also offer dashboards or Telegram channels for real-time updates.

However, delivery delays or poor notification systems can cause you to miss the ideal entry point, especially in fast-moving markets.

It’s essential to choose a provider with a reliable and timely delivery method that fits your routine – whether you’re at your desk or trading on the go.

Accountability

Accountability is essential when selecting a swing trading signal provider. The most reputable services provide transparent, verified performance reports showing their track record over time.

These reports help you evaluate accuracy, risk management, and consistency before committing.

Early in my trading journey, I experimented with a popular Telegram signal group that promised high returns. At first, their reported results looked impressive. Still, I soon noticed discrepancies – trades were being ‘edited’ or selectively shown to highlight only winning signals, while losses were downplayed or omitted entirely.

To avoid falling for these scams, it’s crucial to read numerous reviews from real users and seek out third-party verification whenever possible.

Thorough research upfront can prevent costly mistakes and help you find a trustworthy, accountable signal provider.

Customer Support

Customer Support is also an important factor when choosing a swing trading signal provider. Popular providers we’ve used offer responsive support through multiple channels – such as live chat, email, phone, and social media – to address questions or issues quickly.

Many also include trading education resources to help you understand the signals better and improve your skills. Reliable support and educational tools enhance the trading experience and build greater trust in the service.

Bottom Line

Finding the right swing trading signal provider can significantly impact your trading success by saving time, improving decision-making, and enhancing consistency.

With a variety of options available – from free services included with brokers to premium, subscription-based platforms – it’s important to consider factors like market focus, cost, delivery methods, and transparency.

Prioritizing providers that offer clear performance records, strong customer support, and educational resources will help you choose signals that align with your trading goals and experience level and become a valuable part of your strategy.

FAQ

Are Swing Trading Signals Legit Or A Scam?

Swing trading signals aren’t a scam – they’re tools offering trade ideas based on analysis. The problem lies with some providers who promise guaranteed profits or fake their results to attract users.

It’s important to research thoroughly, trust only verified services, and view signals as helpful guides rather than guarantees. They can be a valuable part of your trading strategy when used wisely.

Are Paid Swing Trading Signals Better Than Free Ones?

Paid swing trading signals typically offer more detailed analysis, higher accuracy, and better support than free signals, as many paid services use advanced algorithms or experienced analysts to provide tailored alerts.

However, free signals – especially those included by reputable brokers – can still be useful for beginners or those on a budget.

Ultimately, the quality varies widely between free and paid options, so it’s important to evaluate each provider’s track record and fit with your trading style before deciding.