Best Brokers With Volatility Index 2026

Experienced swing traders often turn to brokers with volatility indexes like the VIX to identify profitable setups when markets turn turbulent. Known as the market’s “fear gauge,” the VIX doesn’t just reflect investor anxiety – it can signal prime opportunities for well-timed trades.

We reveal the best brokers with volatility indexes and explain how swing traders can leverage these tools to help spot short—to medium-term moves during uncertain market conditions.

Brokers With Volatility Index forUnited States

How SwingTrading.com Chose The Best VIX Brokers

Our rankings are built from in-depth hands-on testing and analysis of 200+ data points, with a focus on brokers that offer volatility indices.

We looked closely at what matters to swing traders: availability of instruments like the VIXx, quality of execution, leverage and margin terms, and the stability of the platform when markets move fast.

We also opened accounts with each broker to see how they actually perform. That means exploring platform tools for timing swings, and digging into features that can help elevate the user experience.

What Is A Volatility Index?

A volatility index, often called the VIX (Volatility Index), measures the market’s expectation of future volatility based on options pricing – typically on the S&P 500.

It’s not a directional tool like a stock chart but a real-time sentiment gauge that reflects how uncertain or fearful investors are about near-term market movements.

For swing traders, this information is gold. Volatility indexes help determine whether market conditions are likely to favor range-bound setups, breakout plays, or sudden reversals.

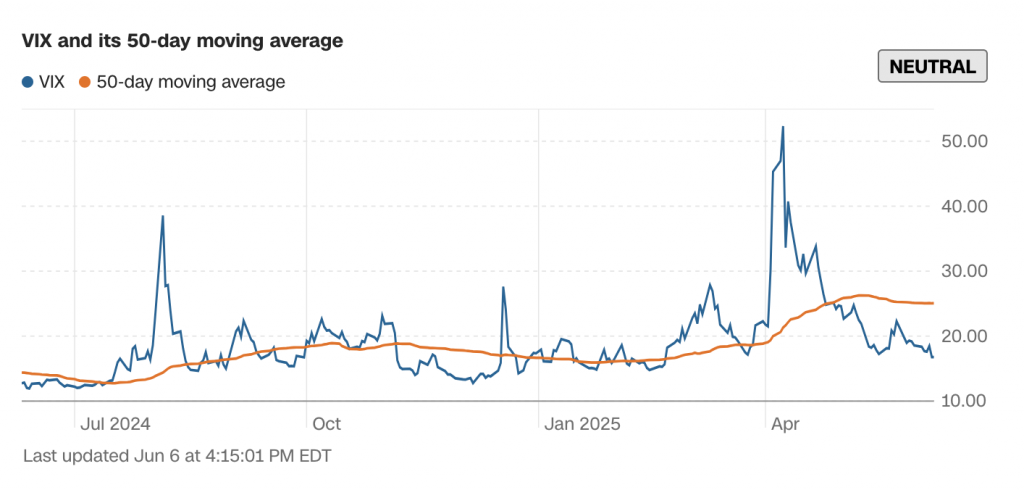

When the VIX is low, it typically suggests complacency in the market—often a sign that a big move could be brewing. Conversely, a high VIX points to panic and large price swings, creating sharp entry and exit opportunities for nimble traders.

In my experience, trading around the VIX requires more than just reading the number. Watching how the index reacts at key levels—like the 20 or 30 mark—can signal when fear is peaking or cooling off.

For example, you might look for reversal patterns or fading momentum in high-beta stocks or ETFs during periods when the VIX spikes and then begins to taper off. Understanding the rhythm of volatility can help anticipate setups before they become apparent on a price chart.

Ultimately, volatility indexes give swing traders an edge not by predicting the market’s direction but by revealing the intensity of its mood—an invaluable clue when timing entries and exits over a few days to a few weeks.

The VIX is typically low in bull markets and high in bear markets

How Does A Volatility Index Work?

A volatility index measures the market’s expectations for price fluctuations over the next 30 days. Specifically, it calculates implied volatility using real-time options data—typically from S&P 500 index options.

Rather than tracking past volatility, it reflects what traders think is coming based on the premiums they’re willing to pay for protection or speculation.

When option premiums rise, it signals that traders anticipate larger moves in the market—hence, the VIX goes up. The market expects quieter conditions when premiums fall and the VIX drops. This makes the VIX a forward-looking sentiment tool, not just a reactionary one.

This matters for swing traders because volatility impacts both risk and timing. For example, during a VIX surge, support and resistance levels become less reliable, and price moves accelerate—ideal for traders who can quickly identify momentum shifts.

On the other hand, when the VIX stabilizes or falls, markets often consolidate, favoring range-bound strategies like mean reversion.

I’ve found that understanding how the VIX interacts with key levels—like how it reacts to economic data or earnings season—offers early warning signs before major price moves. For instance, a sudden spike in the VIX without a corresponding drop in the S&P 500 can indicate hidden stress, prompting me to tighten stops or wait for confirmation before taking a swing position.

Should I Trade The VIX?

Volatility indexes offer a unique way to trade market sentiment rather than just price direction.

While most traders focus on what the market is doing, volatility indexes focus on how it’s behaving—capturing the intensity of fear or complacency.

This makes them especially valuable during periods of uncertainty, such as before economic reports, earnings seasons, or geopolitical developments.

This edge can’t be overstated for swing traders. Volatility indexes like the VIX often move inversely to equities, making them powerful tools for hedging or timing reversals.

If the VIX rises sharply, it’s usually a signal that traders are rushing for protection, leading to exaggerated price moves—perfect for swing setups that capitalize on overreactions or snapback rallies.

In my own trades, I’ve used VIX-based ETFs or futures during sudden spikes to fade panic—waiting for confirmation that fear is peaking and then entering positions in oversold stocks. Conversely, when the VIX grinds lower over a few sessions, it often signals a narrowing window of opportunity. That’s usually my cue to lock in gains or tighten my stop-losses, especially if the trade is nearing resistance.

Beyond just a directional play, volatility indexes can help you adjust your strategies based on the market’s mood. You might widen your profit targets in high-volatility conditions and allow more room for swings. In low-volatility stretches, you might stick to tighter ranges and faster exits.

This adaptability is a key reason why trading volatility—or at least tracking it—should be part of every serious swing trader’s toolkit.

Learn to trade the VIX with IG and explore how volatility impacts the markets

How To Trade A Volatility Index

1. Understand The Instruments

You can’t trade the VIX or FTSE 100 VIX directly—they’re indexes. Instead, swing traders use ETFs like VXX, UVXY (for the Cboe VIX), or FTSE 100 VIX futures/ETFs available on specific European platforms.

These products track short-term volatility futures, not the spot index, so understanding contango and backwardation is crucial.

2. Monitor Market Conditions

Volatility indexes spike during uncertainty. You should watch macro events like Fed decisions, CPI data, or geopolitical risk.

When markets get twitchy, you can check if the VIX rises naturally or spikes irrationally. A rapid VIX surge for swing traders can signal a short-term panic bottom, a high-probability setup for a bounce in equities.

3. Watch Key Levels

Every volatility index has behavioral thresholds. For example:

- Cboe VIX above 30 = panic

- VIX below 15 = complacency

- FTSE 100 VIX near 25-30 can indicate UK market stress

From experience, I wait for the VIX to stall or reverse at these levels before taking a contrarian swing position. Jumping in mid-spike is risky—you’ll often buy at the peak of fear.

4. Time The Entry

After a volatility spike, you should wait for a confirmation candle or divergence—e.g., the VIX makes a higher high, but the S&P 500 doesn’t make a lower low. That’s a classic exhaustion signal. Then, you can potentially swing into inverse VIX plays or long equity setups.

5. Set Realistic Exit Targets

Volatility moves fast—don’t expect to hold for weeks. I typically aim for 2–5 day holds depending on the size of the VIX move and overall market structure. Once the VIX starts dropping sharply, those volatile product profits evaporate just as fast.

6. Manage Risk Aggressively

Volatility trading is not passive. Use tight stop-losses, especially if trading leveraged ETFs. The goal isn’t always to be right—it’s to survive and strike when fear creates opportunity.

Volatility moves are often short-lived. They’re emotionally charged, so you’ll get your best swing trades not by chasing volatility but by fading extreme sentiment once it shows signs of cracking.

Bottom Line

For swing traders seeking to capitalize on market uncertainty, choosing a broker that offers reliable access to volatility products is essential.

The right platform will provide tools to trade VIX-related instruments and deliver the speed, charting, and execution needed to stay ahead of fast-moving setups.

Volatility often marks the beginning of major price shifts, so having the right broker can turn market fear into a well-timed opportunity.

FAQ

Is VIX Trading Suitable For Beginners?

Not really. VIX trading involves complex instruments like futures and leveraged ETFs, which can quickly move and lose value. Before risking real money, beginners should first understand how volatility works and practice with non-leveraged products or paper trading. It’s better suited for traders with some market experience under their belt.

What Makes A Good Broker For Trading Volatility Indexes?

Look for brokers that offer VIX-linked products like ETFs, futures, or options. Fast execution, real-time data, and solid charting tools are essential for timing swings in volatile conditions.

Can I Trade The VIX directly?

No—you can’t trade the VIX itself. However, top brokers offer ways to trade its movement through products like VXX, UVXY, or VIX futures and options. Ensure your broker supports these and explains how they work since they behave differently than stocks.