Best Options Swing Trading Brokers 2025

Are you looking to capitalize on short—to medium-term market moves? Swing trading options could be your sweet spot. They offer the flexibility of timing and the potential for strong returns without the pressure of day trading.

But success in this strategy hinges on more than just your trading skills—it starts with choosing the right broker. We’ll break down the best options swing trading brokers based on the tools, pricing, speed, and support that matter most to swing traders.

How SwingTrading.com Chose The Best Brokers For Swing Trading Options

Our picks for the best options swing trading brokers are based on an in-depth analysis of data compiled by SwingTrading.com, incorporating over 200 unique metrics.

We focus on factors that affect swing traders using options, including option-specific margin requirements, contract fees, and platform tools.

The brokers featured in this list stand out for their overall performance—like intuitive interfaces and responsive customer service—and for offering the leverage, risk controls, and charting capabilities that serious swing option traders rely on.

How To Choose A Broker For Swing Trading Options

Regulation & Safety

Regulation and safety should be a top priority when choosing a broker for swing trading options. You’re not just trusting a platform with your trades—you’re trusting it with your capital, personal data, and the integrity of your investments over time.

A broker regulated by reputable authorities like the SIPC and FINRA in the US, or bodies such as the FCA (UK) or ASIC (Australia), offers a level of investor protection you can’t afford to overlook.

SIPC, for instance, protects your account for up to $500,000 (including $250,000 for cash) if your broker fails—not to be confused with protection against trading losses.

For example, suppose you’re swing trading SPY options on a platform like TD Ameritrade (now integrated into Charles Schwab). In that case, you’re trading through a FINRA-regulated broker that offers SIPC protection—giving you peace of mind while holding positions overnight or over several days.

Beyond regulatory oversight, the platform should implement strong security protocols, like two-factor authentication (2FA), encryption, and device authorization controls.

If you’re holding a multi-leg options position—a vertical call spread that relies on precise timing—you want to know your account is protected financially and digitally.

Options Contracts

When choosing a broker for swing trading options, one of the most important—but often overlooked—factors is the range of markets and underlying assets the platform supports.

To execute strategies effectively, swing traders need access to highly liquid instruments with tight spreads, flexible expiration dates, and broad market exposure.

At a minimum, the broker should offer options on major US equities and ETFs, such as large-cap tech stocks, index funds, and high-volume names with established option chains. These assets provide better liquidity, making it easier to enter and exit trades with minimal slippage.

Look for access to index options, sector ETFs, and volatility instruments, which can be helpful when swing trading macroeconomic trends or market sentiment.

Trading options on financials, energy, tech, or other sectors or instruments that track volatility enables you to hedge or take advantage of moves across different parts of the market.

This is especially valuable during earnings seasons or market conditions driven by broader themes rather than individual company news.

A key feature for swing traders is a wide range of expiration dates. Weeklies, monthlies, and longer-dated options (such as LEAPs) allow you to tailor trades to your specific time horizon.

For instance, building a diagonal spread requires precise control over expiration dates. This allows you to profit from time decay while maintaining a directional bias. A well-designed option chain should include various strike prices with clear bid-ask spreads.

You may also want access to international markets or sector-specific instruments outside the US. Diversifying your strategy across multiple regions or asset classes—such as commodities or currency-linked equities—can open up new opportunities and reduce exposure to domestic volatility.

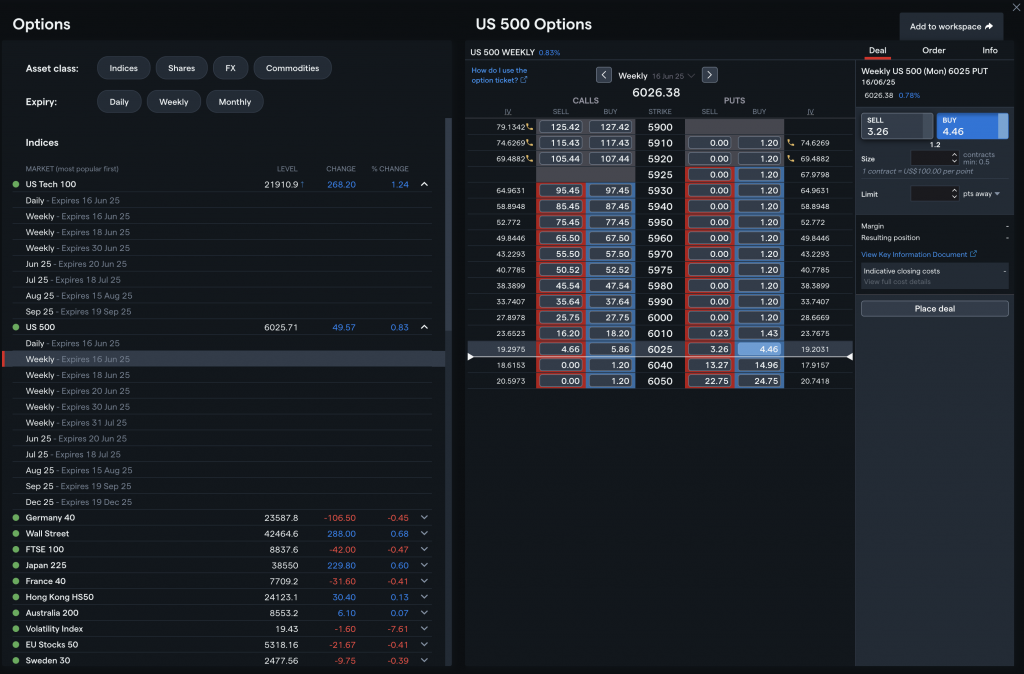

IG offers a broad selection of options on stocks, indices, forex and commodities

Trading Platforms

Your trading platform is more than just a tool for swing trading options—it’s your strategy hub. Whether you’re analyzing charts, building multi-leg option trades, or setting exit orders, the right platform can significantly enhance your ability to execute consistently.

The best brokers offer platforms that combine advanced analytical features, efficient order entry, and intuitive interfaces tailored to the pace and precision of swing trading demands.

Swing traders rely heavily on technical analysis, so a strong platform must offer advanced charting with customizable indicators like RSI, MACD, moving averages, and trendlines.

TradingView (integrated with several brokers) is known for its powerful, flexible charting environments.

I often set up a daily chart to confirm the overall trend and then use a 4-hour chart to time my entry based on RSI divergence. With these tools, I can do this in seconds, which makes it perfect for my visual swing trading approach.

One of the defining features of a good swing trading platform is a well-structured option chain with robust data, such as open interest, implied volatility, delta, and more.

Swing traders benefit from advanced order types even if they’re not making intraday moves. Platforms like Interactive Brokers’ Trader Workstation support features like GTC (Good ‘Til Canceled), bracket orders, OCO (One Cancels the Other), and trailing stops—all of which help you automate your exits and manage risk.

Let’s say you enter a short put spread anticipating a bounce—placing a GTC limit order to take profits at 50% and a stop-loss at 30% gives you a clear plan and removes emotional decision-making from the equation.

In today’s market environment, a strong mobile trading platform is a must. As a swing trader, you don’t need to monitor every tick, but being able to adjust open trades, roll options, or check charts on the go can be the difference between locking in profits or letting a trade go against you.

Webull offers a sleek, easy-to-use mobile app that appeals to newer traders. At the same time, Interactive Brokers Mobile cater to more advanced users who want full platform functionality from their phones or tablets.

Margin Requirements

Understanding margin requirements is crucial when choosing a broker for swing trading options. Margin determines the capital needed to open and maintain positions and impacts the ability to implement multi-leg option strategies and manage risk effectively.

Margin rules for options differ significantly from those for stocks. Brokers typically calculate margin based on the options strategy’s maximum potential loss, meaning defined-risk spreads generally require less margin than naked option positions.

Platforms that display margin requirements upfront before trade execution help you size positions properly and avoid unexpected margin calls.

For swing trading strategies like calendar spreads, brokers that provide real-time updates on required margin—reflecting changes in implied volatility or the underlying asset’s price—enable more proactive risk management. This transparency lets you adjust or roll positions to stay within risk limits.

Margin requirements also influence trade planning. Higher margin demands can reduce the number of concurrent trades you can hold, potentially limiting diversification.

Fees, Spreads & Commissions

While commissions may seem straightforward at first glance, several layers of fees can quietly impact your bottom line—especially when trading multi-leg option strategies or managing several trades over a month.

Start by examining the per-contract commission fees for options trades. While most brokers today offer zero commissions on stocks, they still charge $0.50 to $1.00 per contract for options.

It’s also important to check whether additional charges, such as assignment or exercise fees, could apply depending on how your trades play out.

Equally important is the bid-ask spread, which represents the difference between what you can buy and sell a contract for. In swing trading, you typically hold positions for several days or weeks, so tight spreads help you enter and exit positions with minimal slippage.

Brokers that offer smart routing, mid-price order types, or access to deep liquidity pools often provide better fills and lower effective trading costs.

Some platforms also pass through regulatory and exchange fees, which can vary depending on the number of contracts and type of order. While usually small, these charges can compound if you’re actively trading and scaling in or out of positions.

I once entered a 4-leg iron condor on a mid-cap stock using a platform that offered $0.65 per contract commission. After placing the order and reviewing the fill, I noticed that between commission, regulatory fees, and a slightly wider spread than expected, the total round-trip cost approached $25.

It’s important to check the advertised fees and the real execution cost, including spread slippage and small regulatory charges that can affect profitability—especially on tightly risk-managed swing trades.

Bottom Line

Choosing the right broker for swing trading options is about more than low fees—it’s about finding a platform that supports smart decision-making, efficient execution, and effective risk control.

The best brokers offer powerful tools, clear margin rules, and tight spreads, making it easier to manage multi-day trades with confidence.

From platform reliability to fee transparency, every detail matters when holding options overnight. A strong broker gives you the edge to act decisively, manage risk efficiently, and stay focused on the strategy—not the platform.

With the right fit, you’re better equipped to capture opportunities and grow consistently as a swing trader.

FAQ

How Do Fees And Spreads Affect Swing Trading Options?

Even small costs—like $0.65 per contract or slightly wide bid-ask spreads—can add up over time and eat into profits, especially if you’re trading spreads or rolling positions.

Wide spreads also increase slippage, reducing the overall edge in your trade. Choosing a broker with tight spreads, low or no base commissions, and transparent all-in pricing can significantly improve long-term profitability and reduce trade friction.