Best Swing Trading Brokers With A Low Minimum Deposit 2026

Finding the right broker can be the key to unlocking your swing trading potential, and the best part is – you don’t need a massive upfront investment to get started.

Dig into our selection of the top swing trading brokers with low minimum deposits. Whether you’re a beginner eager to test the waters or a seasoned trader looking for a cost-effective edge, these brokers offer the ideal balance of accessibility and performance.

How SwingTrading.com Selected The Top Low Deposit Brokers

To identify the best low deposit brokers for swing trading, we began by verifying the minimum deposit requirements for every online brokerage in our database.

Since swing trading involves holding positions over several days, we focused on platforms that support strong technical analysis tools, stable execution, and effective risk management features.

We then combined this deposit data with our overall ratings – built from in-depth testing – to ensure the brokers we recommend don’t just offer low-cost access, but also provide a reliable trading environment suited to swing trading strategies.

What Is A Broker’s Minimum Deposit?

A broker’s minimum deposit is the smallest amount of money you need to fund your account before you can start trading. This threshold can range widely – from as little as $1 to several thousand dollars, sometimes even exceeding $10,000.

The exact requirement often depends on the broker’s policies and the payment method you use. For instance, funding your account via debit card, bank wire transfer, or e-wallet may come with different minimums, as third-party providers often impose their limits.

Once your account is funded, you can use the money you deposit to swing trade many assets, such as stocks, forex, cryptos, and CFDs. However, before hitting that ‘deposit’ button, it is crucial to review the broker’s terms and conditions.

Some brokers might require you to keep the initial deposit locked in your account until you’ve completed a certain number of trades.

For example, a brokerage might allow you to deposit $100 but prevent you from withdrawing that amount until it has been used in live trades – a key detail to check before committing your funds.

For swing traders, brokers with low minimum deposit requirements can be particularly attractive. They allow you to test the waters of real-time market conditions without committing large sums of money..

Should I Use A Low Deposit Broker?

The top reasons to register with a broker offering a low minimum deposit are:

- Test Swing Trading Strategies Without Big Risk: A low minimum deposit lets you experiment with real money trades in a live environment without committing a large sum. For instance, when I first tested my moving average crossover strategy on a $50 deposit with a low-deposit broker, I was able to experience real market fluctuations, slippage, and spreads. This gave me a realistic feel for my strategy’s strengths and weaknesses – something a demo trading account couldn’t replicate.

- Diversify And Mitigate Risk: You can open multiple accounts or trade across different asset classes with a smaller capital requirement. For example, I split a $500 budget between a forex-focused broker with a $10 minimum deposit and a stock broker with a $50 minimum. This let me practice swing trading both major currency pairs and high-volatility stocks, helping me diversify my exposure and spread risk.

- Gradually Build Confidence And Skill: Starting with a low deposit allows you to build confidence through incremental learning. I recall starting my swing trading journey with just $100 in a low-deposit broker. Over time, I added more funds as I gained experience, moving from simple trades on EUR/USD pairs to more advanced setups involving multiple timeframes and tighter stop-losses. This gradual approach helped me avoid costly mistakes while sharpening my skills.

What Are The Drawbacks Of Low Deposit Brokers?

The downsides of signing up with a brokeager that offers a low minimum deposit include:

- Limited Access To Advanced Trading Tools: Many brokers with low minimum deposit options hide their best tools and features behind higher deposit thresholds. For example, when I opened an account with just $50, I quickly realized that essential swing trading resources – such as advanced charting tools, detailed technical indicators, and real-time market data – were locked behind a paywall unless I upgraded my account with a larger deposit. This made it harder to analyze trends effectively and execute trades, forcing me to seek out third-party tools to fill the gaps.

- Higher Trading Costs And Spreads: Brokers that cater to low-deposit traders often recoup costs through wider spreads or higher fees. I noticed this firsthand when swing trading with a broker that allowed me to start with only $10 – the spreads on major currency pairs were noticeably wider, cutting into my potential profits on small price movements. This made it challenging to execute tighter swing trades effectively, especially when using smaller position sizes.

- Restricted Withdrawal And Funding Options: Low-deposit brokers sometimes have withdrawal conditions that can catch traders off guard. In one case, after testing a broker’s live environment with a $25 deposit, I realized I couldn’t withdraw funds until I completed a certain number of trades – locking in my capital longer than I intended. This could mean being stuck with a broker even when better opportunities arise elsewhere.

How To Choose A Swing Trading Broker With A Low Minimum Deposit

Although trading platforms with low minimum deposits can be attractive, it’s important to consider other key factors as well:

Assets

The best online brokers with low minimum deposits often grant access to a broad range of assets and markets—perfect for swing traders looking to diversify their strategies.

For example, I tested a momentum-based swing trading approach using CFDs on major indices like the S&P 500 while simultaneously trading forex pairs such as EUR/USD to hedge risk.

Also, low-cost brokers targeting beginners often offer fractional shares, allowing you to build positions in high-priced stocks like Netflix and Costco with a small deposit.

eToro offers over 5,000 instruments from a wide range of asset classes

Leverage

Swing traders often use leverage to amplify their potential returns by controlling larger positions than their initial deposit would allow.

For instance, when I first applied leverage in my swing trading, I could open a $10,000 position on EUR/USD with a $1,000 deposit using 1:10 leverage.

Many leading brokers provide high leverage, with some offering up to 1:1000. However, trading with such high leverage comes with significant risks, including the possibility of magnified losses.

Recognizing this, top regulators like CySEC in Europe and the UK’s FCA enforce limits, capping leverage at 1:30 for retail traders to safeguard those with less experience.

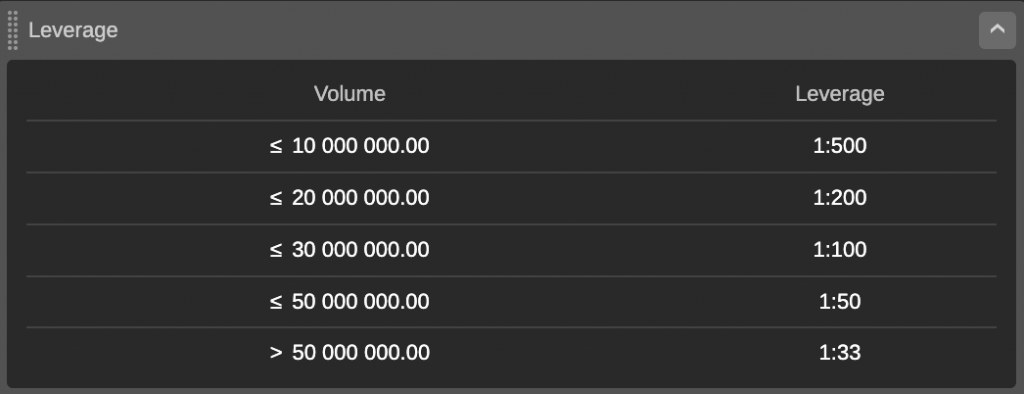

Many brokers like TopFX offer dynamic leverage that adapts to your trading volume

Payments

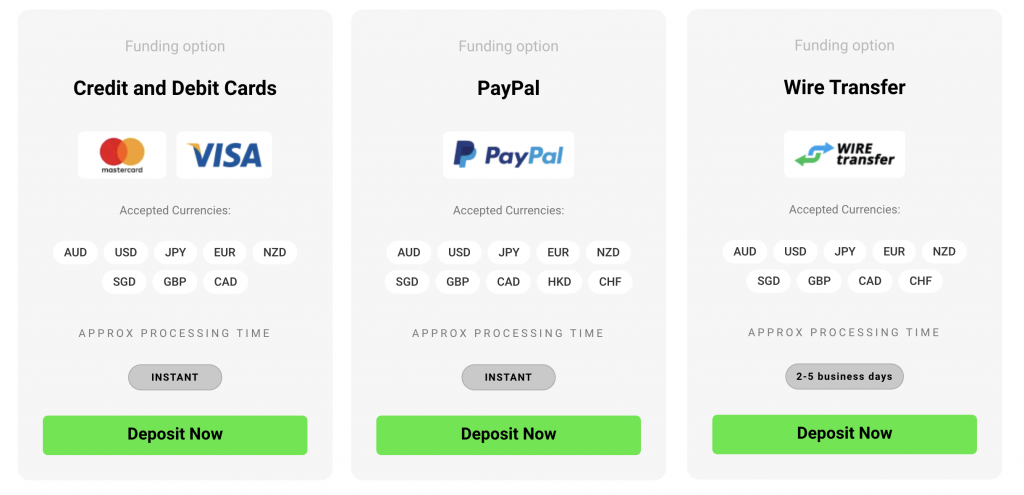

Leading brokers make it easy to fund and access your accounts, offering multiple deposit and withdrawal methods, including debit and credit cards, bank transfers, and popular e-wallets like PayPal.

From my swing trading experience, I’ve found that having diverse funding options is essential for maintaining flexibility. For instance, during a volatile swing trade on GBP/JPY, I quickly funded my account with a PayPal deposit to seize an opportunity.

However, it’s important to remember that payment providers often have their own minimum deposit rules, which may be separate from the broker’s requirements, so it’s wise to check both before depositing funds.

IC Markets offers multiple funding options with fast processing times

Customer Support

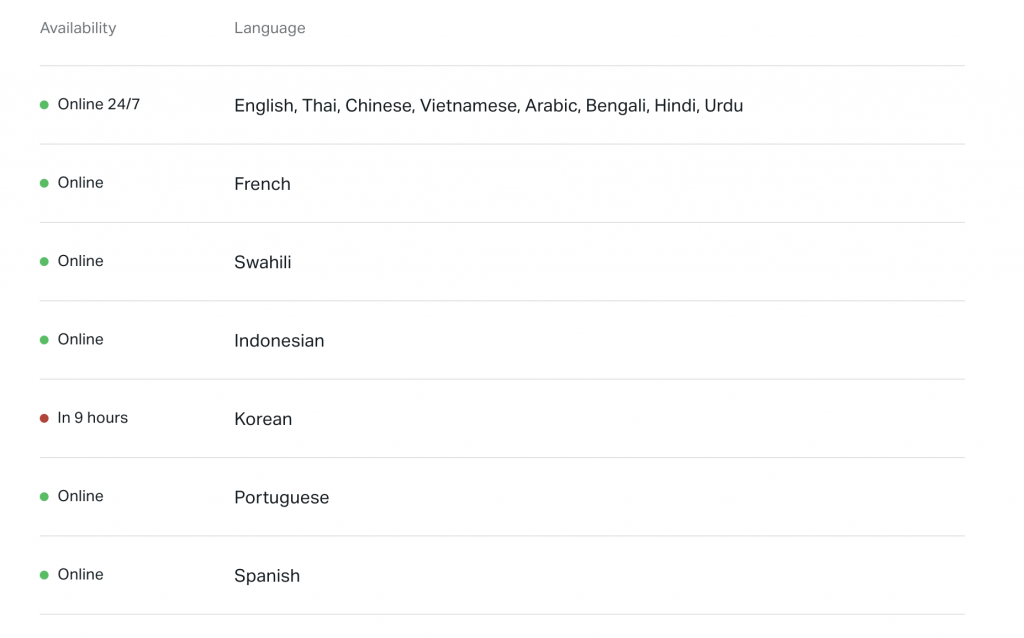

When considering brokers, having access to a responsive and knowledgeable customer support team is essential.

I’ve occasionally needed urgent assistance – like during a volatile market move when my stop-loss order didn’t trigger correctly.

Brokers offering 24/7 support through live chat, phone, email, and even social media proved invaluable in resolving these issues quickly.

For beginners, a broker with dependable customer service can make a huge difference. It can provide guidance and reassurance when unexpected challenges arise in real-time trading.

Exness support is available 24 hours a day, 7 days a week, in 14 languages

Educational Resources

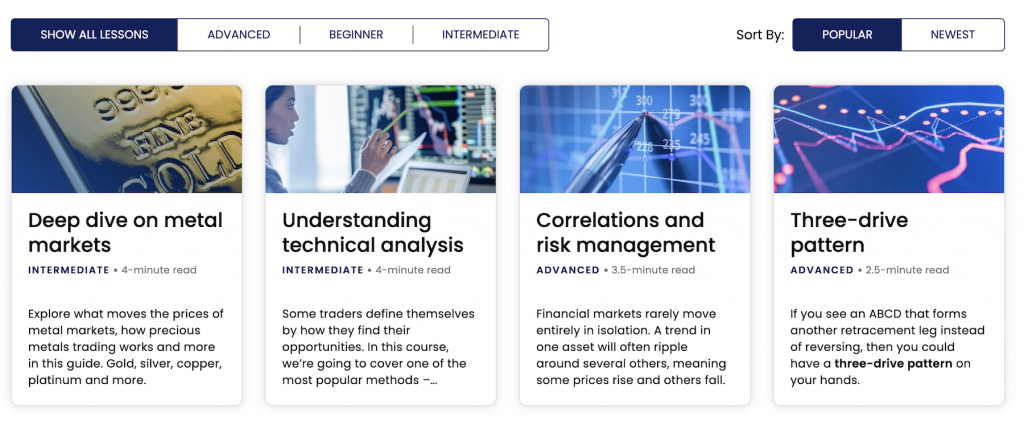

Whether you’re a seasoned swing trader or just starting, brokers that offer comprehensive educational resources create the ideal learning environment.

In my trading journey, video tutorials were invaluable when I learned how to execute swing trades and use technical indicators like RSI and MACD.

These tutorials walked me through platform navigation and strategy implementation, making transitioning from theory to practice easier.

Additionally, brokers who regularly update their blogs with market news and analysis will help you stay informed about major events – such as central bank announcements – that can impact swing trading decisions.

This combination of educational content and timely updates can be instrumental in refining your trading approach.

FOREX.com provides a wealth of lessons for traders of all experience levels

Regulation

The top forex brokers that require little to no initial deposit are typically regulated by reputable authorities such as CySEC (Cyprus), ASIC (Australia), or the FCA. (UK) To verify a broker’s legitimacy, consult the official websites of these regulatory bodies.

Regulated brokers are generally considered safer because they adhere to strict industry standards that promote transparency and fairness.

It’s also wise to check for extra protective measures, such as negative balance protection, which helps prevent losses beyond your account balance, and compensation schemes like the FSCS that provide financial security if the broker becomes insolvent.

When evaluating brokers, we prioritize regulatory oversight and reputation for reliability alongside low starting deposits. We recognize that long-term success in swing trading hinges not just on accessibility but also on the safety and security of your funds.

Bottom Line

Whether you aim to trade stocks, explore forex markets, or experiment with alternative assets like commodities, swing trading brokers with low minimum deposits can offer an accessible entry point, especially for new traders.

However, the best platforms offer low barriers to entry and robust features such as regulation by top-tier financial authorities, a diverse range of tradable assets, responsive customer support, and powerful trading tools that can help you succeed.

By selecting a broker that combines accessibility with quality, you’ll be better equipped to navigate the markets confidently and effectively.

FAQ

Why Do Swing Trading Brokers Require A Minimum Deposit?

Brokers require a minimum deposit to cover operational costs, manage risk, and ensure traders are serious about engaging with the platform. This helps brokers filter out inactive accounts, reduce administrative overhead, and maintain liquidity.

Additionally, certain features or services – like premium tools or lower spreads – may only be offered to accounts that meet specific deposit thresholds.

Is The Broker With The Lowest Minimum Deposit The Best For Swing Trading?

Not necessarily. While a broker with a low minimum deposit can make it easier and more affordable to start trading, it doesn’t guarantee the best experience for swing trading.

Factors like trading platform quality, fees, spreads, asset variety, customer service, and order execution speed are equally important.

While a low minimum deposit might be appealing, you should prioritize brokers offering reliable tools and conditions tailored to your strategies.