Best Swing Trading Demo Accounts 2026

Imagine seizing the pulse of the markets, making smart moves over days or weeks, and reaping the rewards – all without risking a single dollar of your hard-earned money.

That’s the magic of a swing trading demo account. It’s your sandbox where you can test strategies, master timing, and hone your skills in the dynamic world of online trading.

This deep dive reveals the best swing trading demo accounts, why they’re essential, how to maximize their potential, and what advantages and pitfalls you can expect.

Best Swing Trading Brokers With Demo Accounts for United States

How SwingTrading.com Chose The Best Demo Accounts For Swing Trading

Our rankings are based on a combination of overall ratings and data across 200+ individual factors. Key criteria include whether a broker offers a paper trading mode, access to demo trading competitions, platform usability, and tools suited for swing trading strategies.

We also open and use demo accounts ourselves as part of our testing process to perform hands-on evaluations – assessing the real platform experience, charting features, and other tools.

What Is A Swing Trading Demo Account?

A demo account is a simulated trading environment that allows you to practice your swing trading skills and test strategies without risking real money.

When you open a demo account, you’re typically credited with a virtual balance ranging from $10,000 to $100,000. This simulated capital enables you to place trades across various markets – such as stocks and forex – just as you would with real funds.

Swing trading demo accounts closely mimic real market conditions by using live market data. You’ll see price fluctuations, order execution speeds, and bid-ask spreads.

Most platforms also offer access to technical analysis tools, such as moving averages, oscillators, price charts, news feeds, and economic calendars. This realistic environment lets you experience how markets move and respond to news or economic events.

For example, suppose you’re testing a swing trading strategy that involves holding positions for several days or weeks. In that case, a demo account allows you to enter a trade, apply stop-loss and take-profit levels, and monitor how the trade unfolds.

You can adjust strategies based on market performance, all within a risk-free setting. However, remember that profits and losses are simulated – no real money is gained or lost in a demo account.

Should I Use A Demo Account?

The top reasons to use a demo swing trading account are:

- Risk-Free Practice: Demo accounts let you trade with virtual money, so you can test swing trading strategies and get comfortable with market movements without risking real capital. This is essential for building confidence and refining your approach.

- Familiarity With The Platform: A demo account helps you learn the broker’s interface, tools, and order types before moving to a live account. This familiarity reduces errors and improves execution when real money is on the line.

- Strategy Testing And Improvement: Demo accounts provide real market data, allowing you to try different swing trading techniques, analyze outcomes, and adjust your methods in a low-pressure environment, ultimately helping you develop a more effective trading plan.

What Are The Drawbacks Of A Demo Account?

The drawbacks of using a demo swing trading account are:

- Lack Of Real Emotional Pressure: Since you’re trading with virtual money, the emotional intensity – like fear and greed – that comes with risking real funds is missing. This can lead to overly aggressive or careless trading habits that don’t translate well to live markets.

- No Real Market Impact: Demo accounts often don’t reflect issues like slippage, order execution delays, or liquidity constraints that can occur in live trading, so your results might be more idealized than reality.

- Limited Time And Features: Some demo accounts expire after a short period or restrict access to certain advanced features, limiting your ability to test swing trading strategies over longer market cycles thoroughly.

How To Open A Swing Trading Demo Account

Most brokers we’ve tested make signing up for a demo account as easy as possible because they hope to transition you into a live account – and, eventually, to deposit real funds.

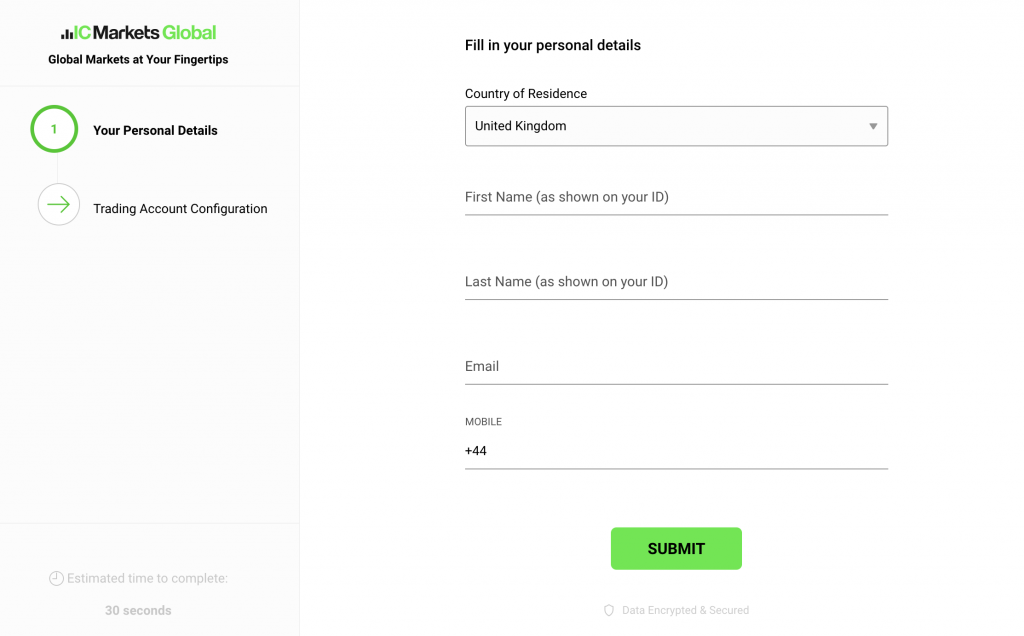

Typically, you only need to provide your name, email address, phone number, and country of residence. Unlike live trading accounts, you usually won’t be asked for detailed Know Your Customer (KYC) documents like proof of identity or a home address, which speeds things up.

Remember that brokers design demo accounts as a stepping stone toward live trading. While demo accounts are invaluable for practice, brokers may encourage you to switch to a real-money account with frequent prompts or promotional offers.

Many brokers offer downloadable apps and browser-based platforms for demo trading, meaning you can choose the option that fits your preferences.

For example, platforms like cTrader, TradingView, and MT4 allow you to access your demo account directly through a web browser, eliminating the need to install software. This lets you start swing trading from virtually anywhere and on any device.

Once registered, the broker will provide demo login credentials and a virtual trading balance. With this virtual capital, you can begin placing trades and experimenting with different swing trading strategies in real-market conditions.

The goal is to practice spotting opportunities, managing risk, and executing trades over multiple days or weeks – all without risking your own money.

You should use your demo account to refine your swing trading skills before moving to live trading and risking actual capital.

Opening a demo account with IC Markets takes less than 30 seconds

How To Choose A Swing Trading Demo Account

The primary purpose of a demo account is to prepare you for live trading while fine-tuning your trading strategy. Establishing a clear plan outlining the steps needed to transition from a demo account to a real-money account is essential.

A structured plan helps ensure you’re using the demo environment effectively and prevents you from lingering too long in the virtual world, which can delay real trading experience and progress.

By sticking to this plan, you’ll focus on developing the skills and confidence necessary for live markets without getting stuck in an endless cycle of simulated trades.

When evaluating which platforms offer the most effective demo account experience, keep the following factors in mind:

Assets

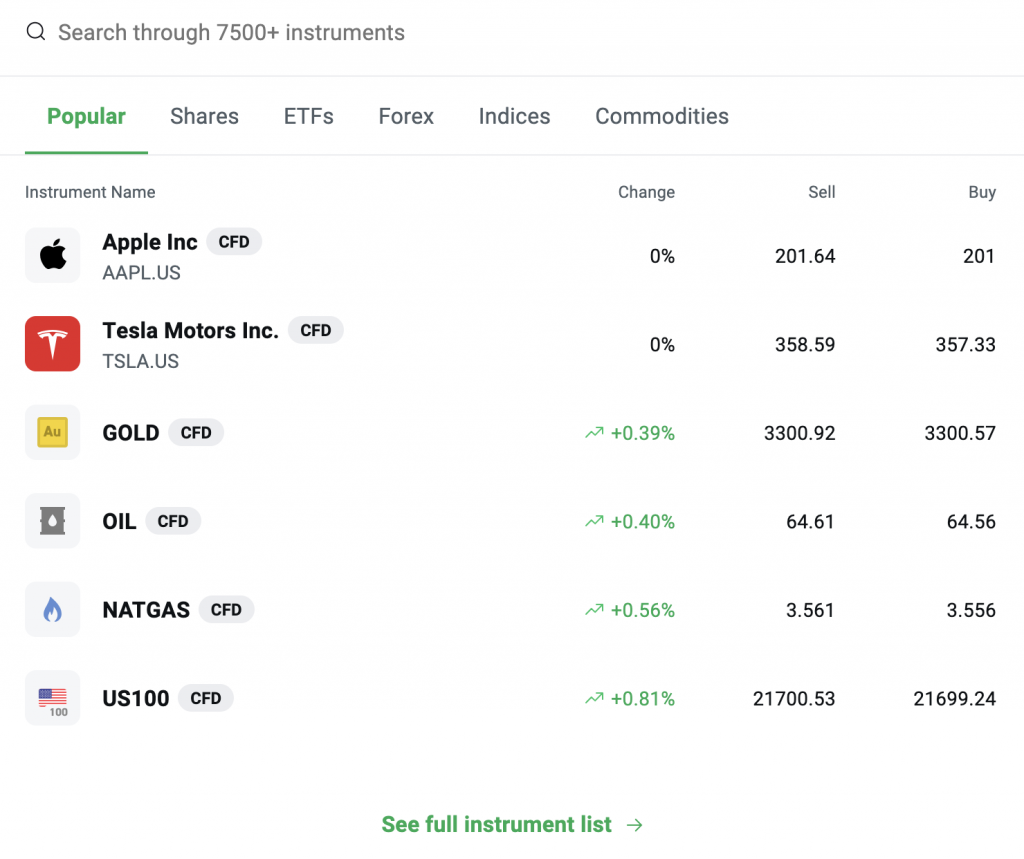

If you know which markets interest you, focus your demo trading on those instruments. For example, if your goal is to swing trade equities, concentrate on refining strategies with specific stocks or indices instead of dabbling in forex or cryptocurrencies.

When I first started swing trading, sticking to a few stocks allowed me to deepen my understanding and develop more consistent strategies.

Then, I switched to commodities, testing trades in gold and oil, which taught me about the impact of global news and supply-demand shifts. This variety helped me discover which markets aligned best with my trading personality.

This targeted approach helps you become familiar with the price patterns, volatility, and behaviors of the assets you plan to trade live.

XTB offers over 7,500 assets to trade in demo mode

Leverage

Swing traders often use leverage to increase their potential returns by controlling larger positions than their initial investment would allow.

For example, when applying leverage in my swing trading demo account, I opened a $15,000 position on GBP/USD with a $500 deposit using 1:30 leverage.

While many brokers we’ve tested offer very high leverage – sometimes up to 1:1000 – it’s important to remember that leverage amplifies profits and losses, increasing risk.

That’s why regulators like the UK’s FCA and Europe’s CySEC limit leverage to 1:30 for most retail traders, helping to promote responsible risk management.

Equally important is to practice using the same leverage in your demo account that you plan to use in live trading.

This approach ensures you get a realistic sense of how leverage affects your risk and helps you develop the discipline to manage your positions safely before committing real funds.

Platform Selection

When choosing a demo account, it’s smart to pick a broker you’d consider using for live trading.

From personal experience, I found that sticking with one platform made the switch to live trading much smoother – I didn’t have to relearn the system, so I could focus entirely on refining my swing trading strategies.

I started with cTrader, one of the most widely used platforms for forex and other instruments like stocks and metals. In my demo account, I practiced swing trading setups on pairs like EUR/USD and commodities like gold.

I appreciated how cTrader offered the same tools and features as a live account, so my learning directly translated when I switched to live trading.

Sticking with one platform, such as cTrader, makes switching to live trading easier

Features

A good demo account should provide features that closely replicate live trading. One important aspect is access to technical analysis tools.

Many demo platforms include indicators like moving averages, RSI, and MACD, allowing you to experiment with different strategies and refine your approach.

From personal experience, testing various indicators in a demo environment helped build confidence in my swing trading setups.

It’s also helpful to check if the platform supports different trading types, such as CFDs and futures. This flexibility allows you to practice managing leverage and risk safely.

Additionally, some brokers offer demo trading competitions, where participants compete to achieve the best returns.

This can be a fun, low-risk way to test your trading strategies under simulated pressure. Plus, the chance to win real capital is added extra motivation.

Time Limit

Some demo accounts offered by trading platforms come with expiration dates, sometimes lasting only a month, though more commonly around three months.

From my experience testing swing trading strategies in stocks, I know that this limited timeframe can be restrictive, especially when you must observe trades over several weeks to see how your setups perform under different market conditions.

For example, when refining my swing trades on the S&P 500 index, having continuous access to the demo account over multiple months was crucial to understanding price swings and swap fees, and adjusting my entries and exits accordingly.

Because of this, you should look for brokers like IG that offer demo accounts without expiration – many MetaTrader brokers, in particular, provide demo trading accounts that remain active indefinitely.

This gives you the flexibility to practice at your own pace without pressure.

Support

Reliable customer support is a crucial factor when choosing a trading platform.

During my time using hundreds of demo accounts to practice swing trading, I encountered issues like login glitches and questions about certain features.

Quick access to knowledgeable support made a big difference in efficiently resolving these problems.

While many platforms offer email support, waiting for replies can slow your learning process. What works best is having options like live chat, phone support, or WhatsApp channels where you can get instant help.

For example, brokers like IC Markets provide these faster support options, which helped me troubleshoot technical issues quickly and stay focused on testing my swing trading strategies without interruption.

Bottom Line

Although demo accounts have a few limitations, their advantages outweigh the downsides.

Using a demo account provides an excellent chance to build essential experience in complex markets without risking real money.

Since numerous platforms and brokers are available, you must research your options carefully.

The skills and knowledge gained from practicing on a demo account can significantly impact your performance when transitioning to live trading.

FAQ

What Is The Difference Between A Demo And Live Trading Account?

A demo account lets you trade virtual money in a simulated environment, allowing you to practice without financial risk. In contrast, a live account involves real money, where your profits and losses are actual.

Is A Demo Account Helpful Or Not For Swing Trading?

A demo account is invaluable, especially for beginners and those testing new swing trading strategies. It allows you to practice trading without risking real money, build confidence, and familiarize yourself with the platform and market conditions.

However, it can’t fully replicate the emotions and risks involved in live trading, so it’s essential to transition carefully to a real account.