Best Swing Trading Brokers For Micro Accounts 2025

Micro accounts let you trade smaller lot sizes and limit risk while you learn or test strategies. But our tests show not every micro account broker is worth your time.

That’s why we’ve rounded up the best micro account brokers for swing traders.

How SwingTrading.com Chose The Top Micro Accounts

We identified the best micro accounts by ranking brokers based on overall ratings, then combining relevant trading data points, including spreads, trade execution, and account flexibility, with our team’s hands-on testing insights.

This balanced approach ensures our picks reflect both measurable performance and practical trading experience.

What To Look For In A Micro Trading Account

Trade Size Flexibility

The whole point of a micro account is trading in small sizes. Not all brokers let you do this properly. Check if the broker supports micro lots (0.01 lot). Some even allow nano lots (0.001 lot).

The smaller the lot, the more precise you can be with risk. This is especially useful in swing trading, where stop losses can be wide. Without small lot options, you’ll risk too much per trade.

For example, if your account has $200, trading a full lot isn’t possible. However, with micro lots, you can risk just $1 to $2 per trade. This lets you stay in the game longer while testing your system.

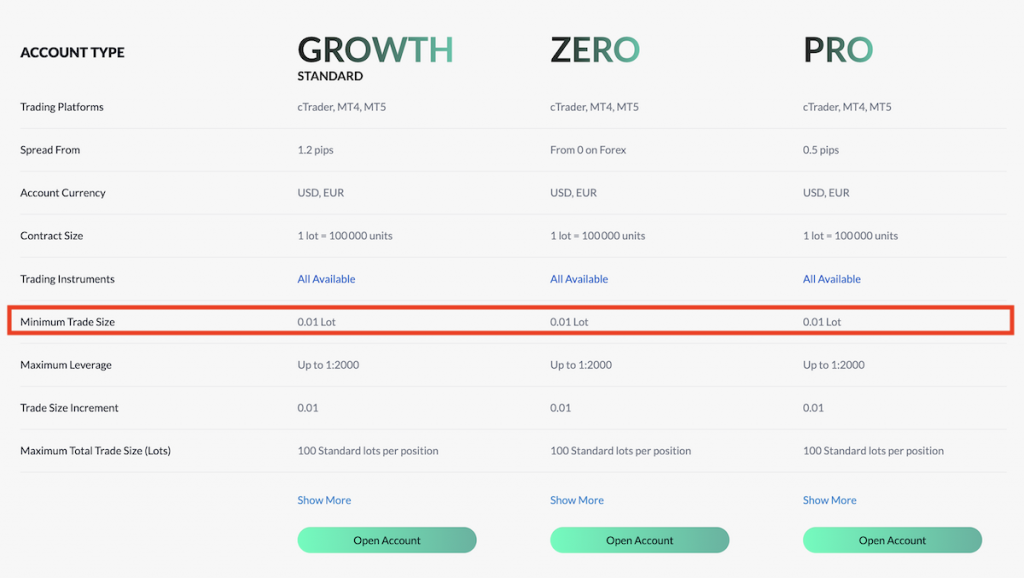

You can trade at TopFX with positions starting from just 0.01 lots

Spreads & Costs

Swing traders don’t trade as often as scalpers, but costs still add up. Every spread and commission eats into profit.

Micro accounts usually come with wider spreads than standard accounts. Compare spreads across brokers, especially on the pairs or markets you want to trade. Even a few tenths of a pip matter if you plan to hold multiple trades at once.

Imagine you open three trades across different pairs, each held for a week. A wider spread on all three could take $5 to $10 off your profit. That’s meaningful when your account is small.

Swap & Overnight Fees

Because swing trades last days or weeks, swap charges matter. Swap is the fee or credit you pay for holding a trade overnight. Some pairs have positive swaps, but many don’t.

A small negative swap may not hurt much on a short hold, but over weeks, it stacks up. Always check how the broker handles swaps on micro accounts. Some brokers offer swap-free options, but read the fine print to see if other fees replace them.

For instance, if you hold EUR/USD short for 14 nights and the swap is –$0.10 per micro lot, that’s $1.40 gone. On a small account, it matters.

Using a micro account for swing trading showed me how costs quietly eat into gains. Even small spreads and overnight fees matter when you hold trades for several days. It forced me to plan each move carefully and focus on setups that really make sense, instead of chasing every signal.

Order Execution Speed & Reliability

You won’t need split-second execution like a day trader. But you still need orders to fill at the price you set.

Swing traders often use pending orders, like buy stops or sell limits. If the broker delays execution or slips prices, it changes your risk.

Ensure the broker has a proven track record of consistent execution. This is especially key in fast-moving markets.

Platform & Tools

Swing traders need good charting. You’ll want to see daily, 4-hour, and weekly timeframes with clarity. A basic platform with limited charting capabilities makes analysis more challenging.

Look for brokers that offer solid charting tools. MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, or TradingView integrations are standard.

Also, check if you can use alerts, templates, or indicators you rely on. The platform should let you manage trades without friction.

Test strategies on cTrader with small micro lot positions before scaling up

Risk Management Features

Swing trades last longer, so a broker with excellent risk management tools is critical. You need stop losses and take profits that actually trigger at your set levels.

Some brokers have slippage issues, even on stops. Others may not offer guaranteed stop-losses on micro accounts.

Make sure the broker lets you control your exits without hidden limits. Being able to adjust trade size down to the micro lot is most important.

Account Minimums & Funding

Micro accounts are meant for small deposits. Check the minimum deposit requirement. Some brokers advertise micro accounts, but then require high deposits to open one. Others allow starts for $5 or $10.

Funding methods for trading also matter globally. Not every trader can use the same payment systems. Confirm the broker accepts the deposit and withdrawal methods you can actually use.

Leverage Options

Swing trading often needs wider stops. That makes leverage a factor. High leverage lets you place trades without tying up your whole balance. But with a micro account, you also want to avoid overleveraging.

Check if the broker offers flexible leverage settings. Too low leverage can block trades. Too high leverage can tempt mistakes. The right broker gives you a choice.

Market Access

Not all brokers offer the same markets on micro accounts. Some limit instruments to major forex pairs only. Others extend micro trading to indices, commodities, or even crypto.

As a swing trader, you may want more than just EUR/USD. Wider access gives you flexibility. Before opening an account, confirm which instruments are actually tradeable in micro size.

Scaling Up

A micro account often serves as a stepping stone. You start small, build skill, then grow. It’s worth checking how easy it is to scale up with the same broker.

Can you switch to a standard account without hassle? Will trading conditions improve as your balance grows? A broker that supports growth saves you from moving accounts later.

Trading swing setups on a micro account taught me patience more than anything else. The profits looked tiny at first, but the small size kept me from blowing up when a trade went wrong. It’s not glamorous, but it’s the most honest way I found to learn how swings actually play out over days and weeks.

Example Swing Trade Using A Micro Account

Let’s walk through a simple trade. Say you open a micro account with $250. You decide to trade EUR/USD.

- Analysis: On the daily chart, you see the pair bouncing off support at 1.0800. You believe it will climb back to 1.1000 in the next two weeks.

- Entry: You place a buy at 1.0820 with a stop loss at 1.0750 and a take profit at 1.1000.

- Position size: You choose 1 micro lot (1,000 units). At this size, each pip is worth about $0.10.

- Risk: Your stop loss is 70 pips below entry. That’s a risk of $7 (70 x $0.10). This equals less than 3% of your $250 account—reasonable for a swing trade.

- Reward: If price hits 1.1000, that’s 180 pips of profit, or about $18. You’re risking $7 to make $18, which is a decent ratio.

Over the 10 days you hold the trade, you pay a total of –$1.20 in negative swap. Your trade closes at the target, giving you a net gain of $16.80. On a $250 account, that’s about a 6.7% return on one trade, without risking too much.

This example illustrates why micro accounts are beneficial. You manage risk in small dollar amounts, but still take meaningful trades. With larger positions, you could have risked too much on the same setup.

Bottom Line

Choosing the best broker for swing trading with a micro account isn’t about hype. It’s about the basics: trade size control, fair costs, stable platforms, and access to markets.

Micro accounts are meant to limit risk and give flexibility while you grow. Focus on the details that matter most to swing trading—overnight costs, lot sizes, and order reliability.

If a broker checks these boxes, you’ll have a smoother start and a setup that supports your trading style.