Best Credit Card Brokers For Swing Trading 2026

Many traders worldwide use credit cards to deposit funds into their brokerage accounts. It’s fast, direct, and usually works across borders. But it also comes with risks.

Our trading experts break down the key points to choosing the best credit card brokers for swing trading, providing real-world examples of how a credit card can impact your swing trading.

Why Credit Cards Matter For Swing Traders

Swing traders often need quick access to trading funds. Opportunities can show up without much notice. If your broker accepts credit cards, you can fund your account in minutes instead of waiting days for a bank transfer.

Example scenario:

Let’s say you spot a strong technical setup on EUR/USD after market hours on a Sunday. If your account is short on margin, you can top it up with a credit card immediately and be ready to trade when the market opens.

But there’s a tradeoff. Credit card deposits typically incur higher fees, and some banks treat them as cash advances, resulting in additional interest. That’s why it’s important to check how your broker handles these payments.

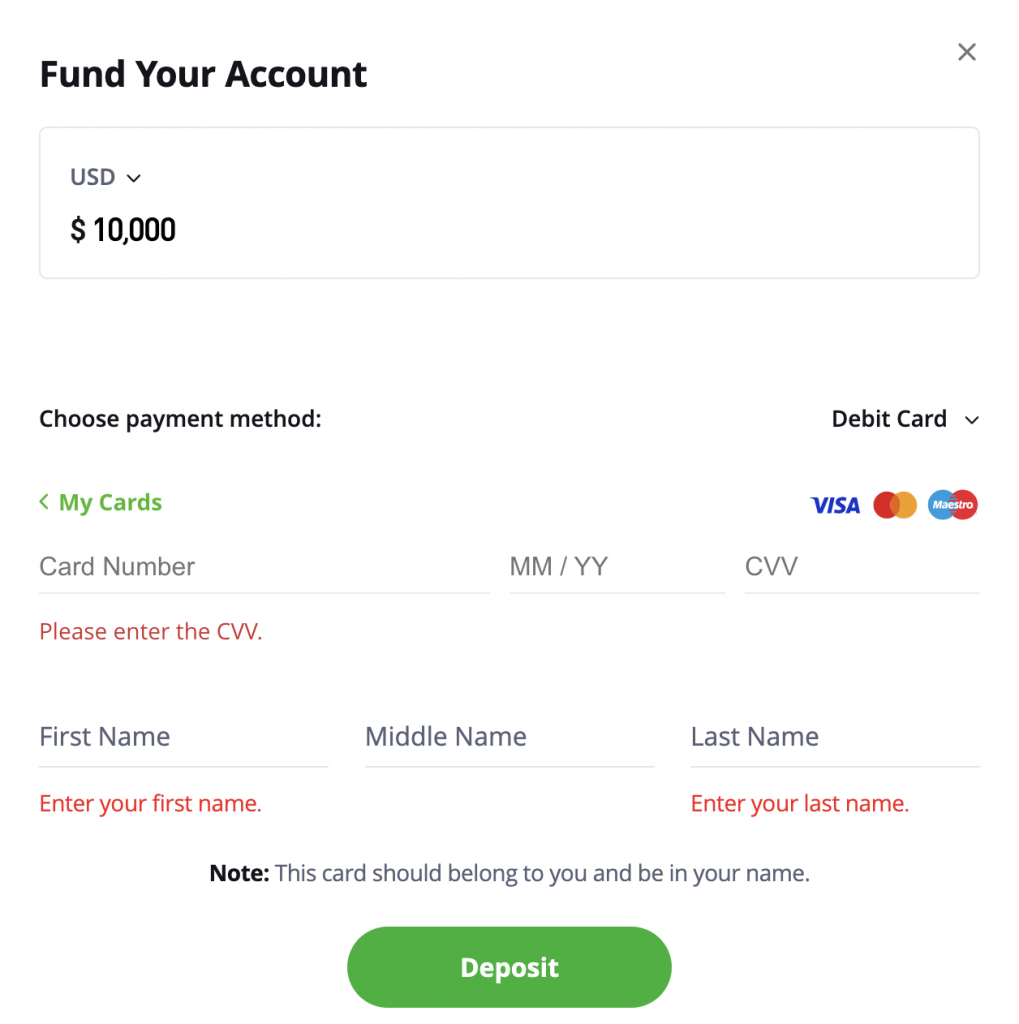

eToro makes it easy to fund your account instantly with a credit card

Deposit & Withdrawal Rules

A broker may allow you to deposit funds with a credit card, but withdrawals are a different story. Some only return funds to the same card up to the deposit amount. Profits might need a bank transfer or e-wallet.

This matters for swing traders because you’re likely to move funds in and out more often than a long-term investor. You don’t want delays when you need cash.

Example scenario:

You fund your account with $1,000 via credit card. After a few weeks, you grow it to $1,500. The broker may only return the original $1,000 to the card. The $500 profit may require additional time to withdraw via an alternative method. Will this setup align with your planned withdrawal frequency?

Using a credit card made topping up my trading account instant, which was great for reacting quickly. But I quickly learned that withdrawals and profits don’t always return as smoothly, so you have to plan for the extra steps.

Fees That Can Eat Into Profits

Credit card payments are rarely free. Brokers may pass on the processing fee, which typically ranges from 2% to 4%. On a $1,000 deposit, that’s $20–$40 gone before you even make a trade.

For swing traders, who often work on thin profit margins, these costs add up. If you make five deposits a month, you could lose over $100 in fees. That’s a chunk of capital you’ll never see again.

Some brokers absorb the fee themselves. However, if they do, they may be able to recover through wider spreads or other charges. It’s worth reading the fine print.

I once funded a swing trade with my credit card to capitalize on a setup that looked too good to pass up. The trade worked out, but the card fees cut deeper into the profit than I expected. It taught me that speed is useful, but borrowing for trades is a slippery slope.

Transaction Speed & Timing

Speed is the leading reason traders use credit cards. A card payment clears instantly. Bank wires can take two to five business days, which is a lifetime in trading.

But instant doesn’t always mean smooth. Some brokers may take extra time to review large deposits for fraud checks. Others may block certain card providers (such as American Express) or restrict payments from specific countries.

Example scenario:

You see a stock breaking out of a resistance level. You fund the order with your credit card at 03:00 and place the trade before the US markets open. That speed gives you a real edge compared to waiting days for a transfer.

Limits & Restrictions

Every broker has deposit limits. Credit cards often come with lower caps compared to bank wires. This can limit position sizing if you’re trading bigger accounts.

On the other hand, limits can protect beginners from overextending themselves with borrowed money.

Example scenario:

If your card only allows $2,000 per transaction and you need $5,000, you may need to make multiple deposits. That slows you down and may result in increased fees.

It’s also common for brokers to set regional rules. In some countries, credit card deposits are banned for trading accounts altogether. Always check if the option is available in your country before committing.

Currency Conversion Costs

If you’re outside the broker’s base currency, the card issuer may charge foreign exchange fees. These are often hidden. You might think you deposited $1,000, but only $980 lands in your account after conversion costs.

Swing traders who take positions across markets need to pay close attention here. Currency drags cut into your available margin and may even trigger margin calls if your balance falls below the required level.

Risk Of Debt

It’s easy to forget, but using a credit card means you’re trading with borrowed money. If trades go bad, you still owe the bank. Interest rates can be steep, especially if your bank marks the deposit as a cash advance.

Example scenario:

You fund with $2,000 from a credit card, planning to pay it off after profits. Instead, the trade loses $500. Now you have less capital and a bill that accrues annual interest until paid off.

This is why many traders use credit cards only for the speed, not as a means to borrow money.

Security & Fraud Protection

Credit cards have built-in fraud protection. If a broker mismanages your deposit or if there’s unauthorized use, you may have recourse through your card provider. This is safer than wiring money to an unknown account.

Practical Checklist

When picking a broker that accepts credit cards for swing trading, ask:

- What are the deposit and withdrawal rules?

- What are the fees, and who covers them?

- How fast are deposits cleared?

- What are the card limits?

- Are there hidden currency charges?

- How does the broker handle profits on withdrawals?

- Is the broker regulated in a known jurisdiction?

When Credit Cards Make Sense

Credit cards work best for swing traders who:

- Trade smaller account sizes.

- Need instant deposits to catch setups.

- Live in countries where other funding options are limited.

However, if you trade larger amounts, frequently withdraw profits, or aim to minimize fees, a bank transfer, debit card, or e-wallet may be a better option in the long run.

Bottom Line

Credit card brokers can make swing trading more flexible, but they also bring extra costs and risks. The key is to strike a balance between speed and safety.

If you treat your credit card like a quick funding tool—not a loan—you’ll avoid the debt trap that hurts many beginners.

Look for a broker that is transparent about fees, clear on withdrawal rules, and reliable in transaction speed. That way, you can focus on the real work of swing trading: spotting patterns, managing risk, and growing your account step by step.