Best Swing Trading Debit Card Brokers 2026

Debit cards are one of the fastest and easiest ways to fund and withdraw from your trading account. Widely accepted by brokers and backed by nearly all banks, they offer a seamless and accessible payment option for swing traders of all levels.

In this guide, we’ll break down the advantages and disadvantages of using this payment method for online trading and reveal the best swing trading brokers accepting debit card deposits.

How SwingTrading.com Chose The Top Brokers With Debit Cards

We reviewed each broker’s payment options and confirmed whether they accept debit card deposits and withdrawals. Only brokers supporting debit cards were shortlisted.

These were then ranked by overall ratings, factoring in platform performance, fees, execution speed, and other elements important to swing traders.

How Debit Cards Work

Debit cards function as a direct payment method linked to your bank account, allowing you to transfer funds instantly to and from your swing trading broker.

When you initiate a deposit, the broker’s payment processor contacts your bank to authorize the transaction in real-time. Once approved, the funds are deducted from your account and typically reflected in your trading balance within minutes.

For withdrawals, brokers usually send the funds back to the same debit card used for the initial deposit, following anti-money laundering (AML) and Know Your Customer (KYC) protocols.

However, not all brokers support debit card withdrawals—some may require an alternative method, such as a bank transfer, especially if profits exceed the original deposit amount.

Most brokers process debit card payments using major card networks like Visa and Mastercard. These networks use encrypted communication and tokenization to protect cardholder data.

You should also be aware of potential processing fees, daily transaction limits, and currency conversion charges, especially when trading with offshore brokers or funding accounts in different currencies.

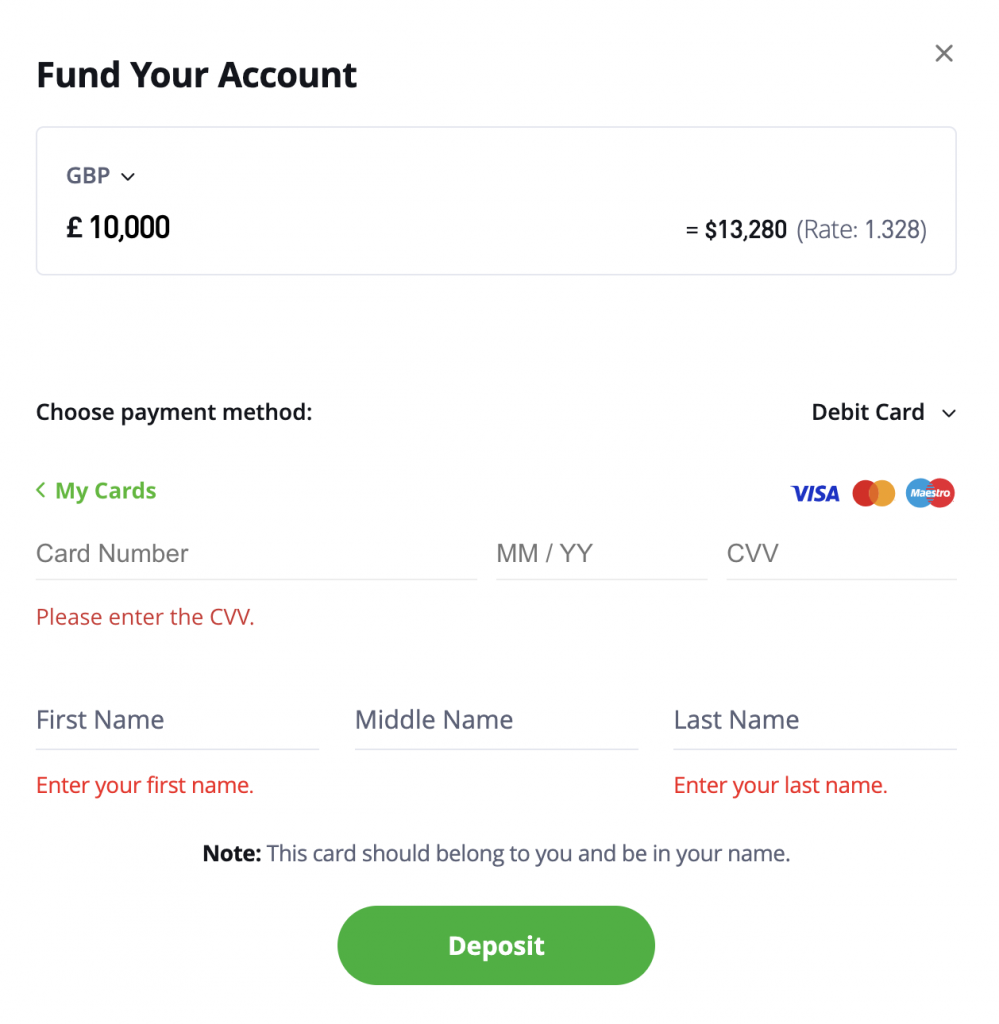

eToro displays the debit card deposit conversion rate upfront for transparency

Debit Card Transaction Times

When funding a trading account with a debit card, transaction times are typically instant to a few minutes, depending on the broker’s processing system and payment gateway.

Most brokers use automated systems linked to major card networks like Visa, Mastercard, or Maestro, allowing near-instant authorization and clearing of deposits. This speed is especially beneficial for active traders who need to capitalize quickly on market setups.

However, withdrawal times via debit card are slower. While some brokers can process same-day withdrawals, most take 1–5 business days. This delay is due to internal broker review processes (for compliance, fraud checks, and anti-money laundering measures) and the time it takes card networks and banks to settle the funds back into your account.

Additionally, some brokers enforce a ‘return-to-source‘ policy, meaning withdrawals will first go back to your debit card up to the amount deposited before other methods (like bank transfer) can be used for withdrawing profits.

Are Debit Cards Secure?

Debit cards are generally secure for funding and withdrawing from trading accounts, provided you’re using a regulated broker and following best practices.

Most brokers that accept debit cards process payments through encrypted gateways that comply with PCI DSS (Payment Card Industry Data Security Standards), which safeguards cardholder data during transmission and storage.

Card networks like Visa and Mastercard use multiple layers of security, including tokenization, CVV verification, and 3D Secure (like Verified by Visa or Mastercard SecureCode) to authenticate transactions.

These systems help prevent unauthorized use by requiring an extra layer of user validation, such as a one-time password (OTP) or app-based approval.

However, security also depends on the broker’s internal controls. Reputable trading platforms will implement two-factor authentication (2FA), SSL encryption, and strict KYC/AML procedures to prevent account breaches and fraud.

Still, you should be cautious because debit cards draw directly from your bank account. So, unlike credit cards, there’s less protection against disputed or fraudulent charges if something goes wrong with an unregulated or offshore broker.

Are Debit Cards Free To Use?

While using a debit card to fund your trading account often feels convenient and straightforward, it’s important to understand the potential costs involved.

Most brokers do not charge a direct fee for debit card deposits, making it seem like a free service. However, underlying fees may apply, such as interchange fees charged by card networks and processing fees passed on by the broker’s payment gateway.

These costs are sometimes absorbed by the broker but may indirectly impact your trading through slightly wider spreads or other fees.

On the withdrawal side, brokers are more likely to impose fees for returning funds to your debit card, especially if the transaction involves currency conversion or cross-border transfers. These fees can range from a fixed amount per withdrawal to a percentage of the transaction value.

Additionally, your bank may charge fees for certain debit card transactions, particularly international payments, which can add to the overall cost. Being aware of these charges will help you manage your funding expenses effectively and maintain profitability.

Do Debit Cards Have Transfer Limits?

Debit cards typically come with transfer limits that you need to consider when funding your accounts or making withdrawals. These limits are set both by the issuing bank and sometimes by the broker’s payment processor.

Daily or monthly deposit caps can vary widely depending on the card type (e.g., standard debit versus prepaid), the bank’s policies, and regional regulations.

For swing traders, these limits can impact how much capital you can quickly move in or out of your trading account. Many brokers enforce their maximum deposit thresholds per transaction or per day to reduce fraud risk, which can sometimes be lower than your bank’s limits.

For example, a broker might limit debit card deposits to $5,000 daily, even if your bank allows higher transactions.

Withdrawals via debit card often have stricter limits and longer processing times due to compliance checks. You should verify these limits with both your broker and bank to avoid transaction failures or delays, especially when managing larger swing trades that require timely capital movements.

I learned the hard way that my bank doesn’t just set debit card limits—brokers often impose their caps. During a key swing setup, I couldn’t fund my account fast enough to enter at my planned level.Now, I always confirm broker-side limits before funding, especially when trading larger positions.

What Is a Prepaid Debit Card?

A prepaid debit card is a payment card loaded with a fixed amount of money before use, rather than being linked directly to a bank account.

Unlike traditional debit cards that pull funds from your checking account, prepaid cards limit spending to the preloaded balance. This offers a practical way to control risk and manage trading budgets without exposing your main bank accounts.

Prepaid cards operate on major payment networks such as Visa and Mastercard, making them widely accepted by brokers for deposits. For example, brokers like eToro and Coinbase accept prepaid debit cards, allowing you to fund accounts securely and with ease.

However, many brokers restrict withdrawals back to prepaid cards due to anti-fraud and compliance policies, requiring alternative withdrawal methods instead.

While prepaid cards provide added security and spending control, they may come with fees—such as activation charges, reload fees, or monthly maintenance—that you should factor into your costs.

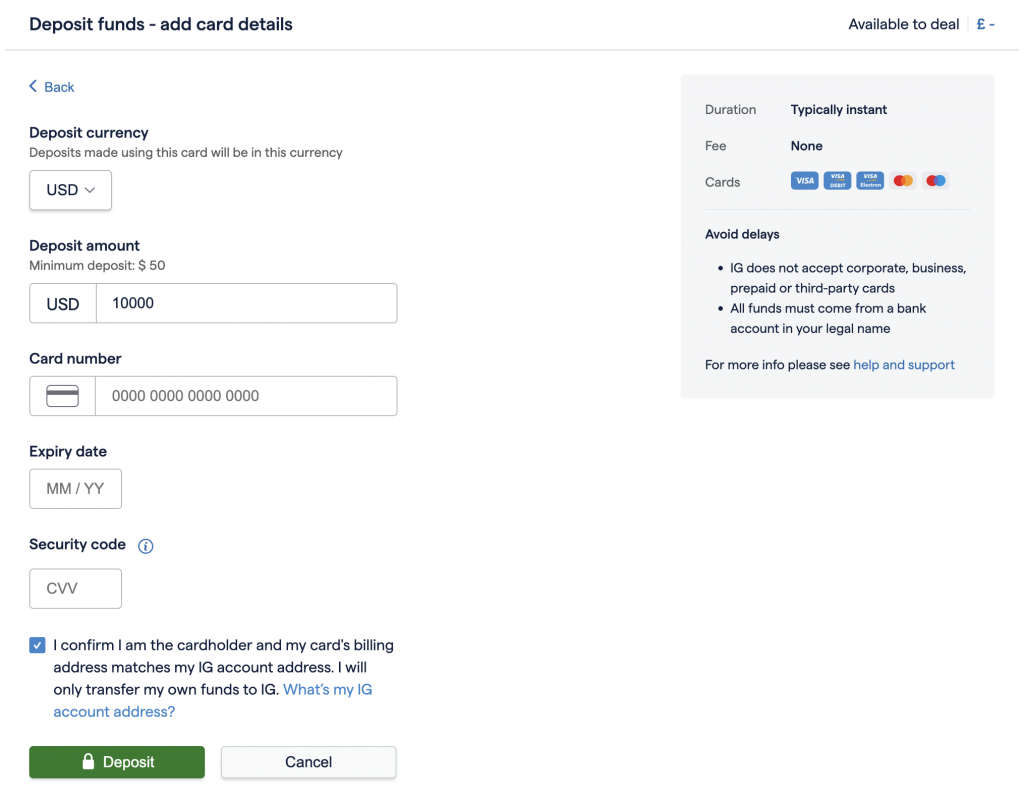

IG does not accept corporate, business, prepaid, or third-party cards

Debit Cards vs Credit Cards

When funding a trading account, debit and credit cards may appear similar on the surface, but they function very differently behind the scenes—something swing traders should be aware of.

Debit cards draw money directly from your bank account, meaning you can only spend what you have. This provides natural budget control and faster access to deposited funds, making debit cards a popular choice for managing fixed capital and avoiding debt exposure.

Credit cards, on the other hand, allow you to borrow funds from the issuing bank up to a preset limit. This can offer flexibility if your cash is temporarily tied up, but it also introduces risks, particularly if the market moves against your position and you’re using borrowed capital.

Interest charges and cash advance fees can also apply to credit cards, primarily if the broker processes the transaction as a cash-equivalent purchase.

Brokers may treat these cards differently in their payment systems. Withdrawals are often restricted to the original funding method, and credit card refunds may take longer due to bank policies.

Additionally, some brokers may decline credit card deposits altogether to comply with AML regulations, or may impose higher transaction fees on credit cards compared to debit cards.

Bottom Line

To choose the best swing trading debit card brokers, focus on regulated platforms that offer fast, low-fee deposits and withdrawals via major card networks like Visa or Mastercard.

Also, check for clear card transaction limits, secure payment processing, and strong customer support to handle funding issues promptly.

FAQ

Do All Brokers Support Debit Card Deposits & Withdrawals?

No, not all brokers support both. While most accept debit cards for deposits, withdrawals are less consistent and often require alternative methods like bank transfers.

Availability can also depend on your location, card type, and the broker’s regulatory framework. Always check a broker’s payment policy to ensure debit card support for both funding and withdrawals.