Fastest Execution Swing Trading Brokers 2025

In swing trading, seconds don’t just count – they compound. I know from firsthand experience that the right broker can mean the difference between catching the breakout and watching it slip away.

Explore the fastest execution swing trading brokers for traders who thrive on precision.

How SwingTrading.com Picked The Fastest Brokers

Every broker we reviewed had to meet our Execution Quality & Efficiency benchmark, balancing speed, reliability, and order quality.

We tested brokers, looking at key factors for swing traders — execution time, slippage, and requotes. We also considered:

- Broker stats published on their sites for transparency

- Trader feedback from clients and peers

- Ongoing research to keep results current

Brokers were then ranked by overall performance, with top picks showing consistently fast, accurate, and stable execution – crucial in fast-moving markets.

How To Pick A Broker For Order Execution

These are the key factors to weigh when picking a broker based on their execution:

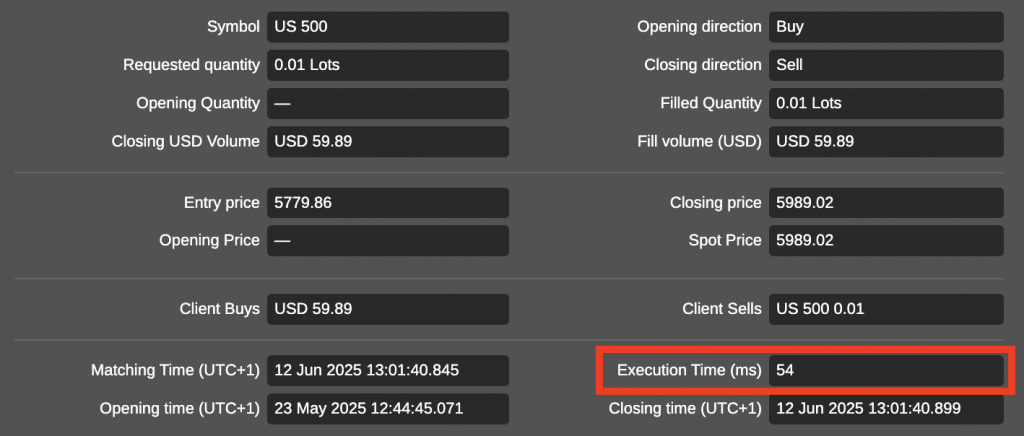

- Average Execution Speed (Milliseconds To Fill): Broker-reported execution times often represent ‘ideal’ conditions, not peak volatility. Look for independent third-party tests or run your own fills log—anything under 100 ms is fast, but consistency matters more than a one-off number.

- Order Routing & Market Access: Fast brokers usually avoid internalizing orders and send them straight to the market via DMA or efficient smart order routers. Be wary of brokers that profit from order flow—they may prioritize routing for rebates over raw speed.

- Slippage Control: Even the fastest broker can’t avoid slippage entirely in a fast-moving market. What matters is how it handles it—tight slippage parameters, fast order acknowledgment, and rejection of partial fills that drift too far from your target price.

- Fill Rate & Price Improvement: A high fill rate is meaningless if fills consistently exceed quoted prices. Look for brokers that not only execute quickly but can show a history of genuine price improvement, not just matching the NBBO (National Best Bid and Offer).

- Server Location & Proximity To Exchanges: Execution speed drops the further the broker’s servers are from the exchange’s matching engines. Brokers with colocated servers (same building as the exchange) will almost always beat those relying on distant data centers.

- Platform & API Performance: Even with lightning-fast routing, a slow or laggy trading platform will kill your execution speed. Stress-test your broker’s platform or API during high-volume periods to see if it queues or delays orders.

- Execution Speed Under Stress: Some brokers look great in calm markets but choke when spreads blow out or news drops. Test your broker during the open, close, and major news events—fast-execution brokers perform reliably when others slow down.

- Order Type Processing: Certain brokers process market, limit, and stop orders differently, with varying priority and routing logic. For swing traders, the ability to trigger stops and limits instantly—without hidden delays—can save multiple ticks per trade.

- Data Feed Synchronization: A broker’s execution speed is useless if its price feed lags behind the real market. Always compare the broker’s live quotes to a trusted independent data source to spot feed latency before it costs you fills.

- Queue Positioning In The Order Book: In electronic markets, your place in the queue can decide whether your order fills at all. Some brokers’ routing strategies and matching algorithms help you jump ahead, while others leave you buried behind slower participants.

The difference a fast execution broker makes is subtle but powerful—it’s not just about speed, but how consistently your orders hit the price you expect, especially during volatile swings.I’ve learned myself that brokers who prioritize transparent routing and real-time fills let me focus on my swing trading strategy instead of firefighting execution delays.

What Is Fast ExecutionTrading?

Fast execution trading refers to the speed at which an order is transmitted from your trading platform to the market, acknowledged, and filled—measured in milliseconds (ms).

For swing traders, this speed minimizes adverse selection and slippage, preserving planned entry and exit levels and maintaining accurate risk-reward ratios.

True fast execution comes from low-latency order routing, direct market access (DMA) where possible, and minimal queuing in the broker’s matching engine.

It’s especially critical during high-volatility events or in thinly traded instruments, where a 200–300 ms delay can mean crossing the spread or getting filled several ticks away from your intended price.

Consistently quick order fills will help your swing trading strategy

How Fast Execution Protects Your Swing Trade

Imagine you spot a breakout setup on a mid-cap stock trading at $50, and your strategy says to enter once it breaks $51 with a stop at $49.50 and a target at $55.

Using a fast execution broker, when the price hits $51, your buy stop order triggers instantly and fills close to that exact level—say, $51.02 instead of $51.20 or worse.

Why does this matter? That 18-cent difference might seem small, but it affects your risk calculation and position size.

With a tight fill, your $1.50 stop loss remains valid, preserving your planned risk-reward ratio. If execution lags or slippage is high, your stop loss effectively widens, forcing you to reduce your position size or risk more capital than intended.

Plus, when it’s time to take profits near $55, a fast broker ensures your limit sell order fills quickly—even if the stock price dips back momentarily—locking in gains rather than letting the price slip through your fingers due to slow order processing.

Fast execution helps maintain the integrity of your trading plan by reducing ‘hidden costs’ like slippage and widened stops, which silently erode profits over multiple trades. This means better confidence in your entries and exits, and a clearer understanding of how your strategy performs in real market conditions.

When markets spike or plunge, execution speed becomes your safety net. I’ve seen trades saved—or lost—because my broker could handle sudden volume surges without freezing or delaying orders.For swing traders, dependable execution isn’t optional—it’s what keeps your strategy intact when it matters most.

Bottom Line

When swing trading, execution speed isn’t just a nice-to-have—it directly impacts your ability to enter and exit positions at planned prices, preserving your edge.

Choosing a broker with consistently fast order execution means less slippage, tighter fills, and better control over your risk and rewards.

While speed alone won’t make you profitable, it’s an important foundation for any serious swing trader looking to maximize returns and minimize costly delays.

FAQ

How Do I Know If A Broker’s Execution Speed Is Fast?

Look beyond marketing claims and check for hard metrics like average execution time (in milliseconds) and order fill rate. Test it yourself with a demo or small live account—track how often your fills match the quoted price during both calm and volatile markets.

Pay attention to any systematic slippage—even minor delays can compound into significant losses over time.

Does Ultra-Fast Execution Matter For Swing Trading?

While swing trades aren’t opened and closed in seconds, execution speed still impacts profitability. Delays can cause worse fills on stop entries, limit orders, or profit targets—especially in fast-moving markets or low-liquidity stocks.

Over months, avoiding just a few ticks of unnecessary slippage per trade can meaningfully improve your edge and risk-adjusted returns.