Best DMA Brokers For Swing Trading 2026

The right DMA (Direct Market Access) broker can make all the difference for swing traders, offering faster execution and transparency that gives you an edge.

We’ve nailed down the best DMA brokers for swing trading to help you capture bigger moves with confidence.

How SwingTrading.com Chose The Top DMA Brokers

We identified the best brokers for DMA accounts by assessing market access, pricing transparency, and the quality of order execution, then testing platforms to evaluate speed, liquidity, and control over trades.

By combining data analysis with hands-on experience, we highlighted brokers that offer genuine, professional-grade direct market access rather than limited or restricted versions.

How To Pick A DMA Broker

Execution Speed & Reliability

While swing traders aren’t scalping, latency still matters when testing support/resistance zones or reacting to earnings or news.

DMA brokers with low-latency connections reduce the risk of partial fills or price gaps, which can distort stop-loss levels or limit orders in volatile swing setups. Consistency over milliseconds adds up over multiple trades.

Market Depth & Transparency

Access to full Level 2/3 order books reveals true liquidity clusters and hidden orders.

This allows you to gauge potential price reactions at key levels, estimate realistic slippage, and avoid chasing fake breakouts caused by market makers masking order flow.

Commission Structure & Total Costs

DMA spreads are narrow, but per-trade commissions can make high-volume swing trading costly. You should calculate the effective spread—spread plus commission—relative to typical swing move sizes.

Some brokers offer tiered volume pricing that can significantly reduce total costs for multi-day swing strategies.

Range Of Tradable Instruments

The broker’s instrument coverage affects strategy flexibility. For example, if you’re focused on high-beta stocks, you’ll benefit from brokers with access to smaller-cap equities and real-time NASDAQ/NYSE depth.

If you’re swing trading forex, you’ll need access to tight interbank spreads with deep liquidity to minimize slippage during overnight market gaps.

Margin & Overnight Financing Terms

DMA brokers usually require higher capital, but financing costs can erode returns for positions held for several days.

You should evaluate leverage limits, overnight swap rates, and the broker’s margin maintenance rules to ensure your swing positions are cost-effective and not at risk of forced liquidation.

Platform & Order Type Functionality

DMA platforms often provide institutional tools like iceberg, hidden, and pegged orders, plus advanced routing options.

You can use these to scale into positions discreetly or execute partial exits without alerting other market participants, maintaining cleaner risk management and minimizing market impact.

Regulation & Counterparty Risk

Valid DMA claims are meaningless if the broker isn’t regulated or uses a dealing desk model behind the scenes.

Strong regulatory oversight (e.g., FCA, ASIC, CySEC) ensures client fund segregation, audit transparency, and adherence to DMA execution promises, mitigating the risk of slippage manipulation or execution delays.

Switching to a DMA broker transformed my swing trading—not just with cleaner spreads, but by showing me real liquidity on the order book.It sharpened my entries and exits, though I quickly learned the real edge comes from choosing a broker that pairs solid execution with fair financing costs.

What Is A DMA Broker?

A DMA broker routes your orders straight to the exchange order book, bypassing dealer intervention and internalization—unlike STP brokers that send orders to liquidity providers or ECN brokers that match traders anonymously.

This means true market depth, the ability to place limit orders inside the spread, and greater execution transparency than with market makers.

Though commissions are higher, the payoff is cleaner fills, reduced slippage on multi-day holds, and tighter control over execution when trading around liquidity zones.

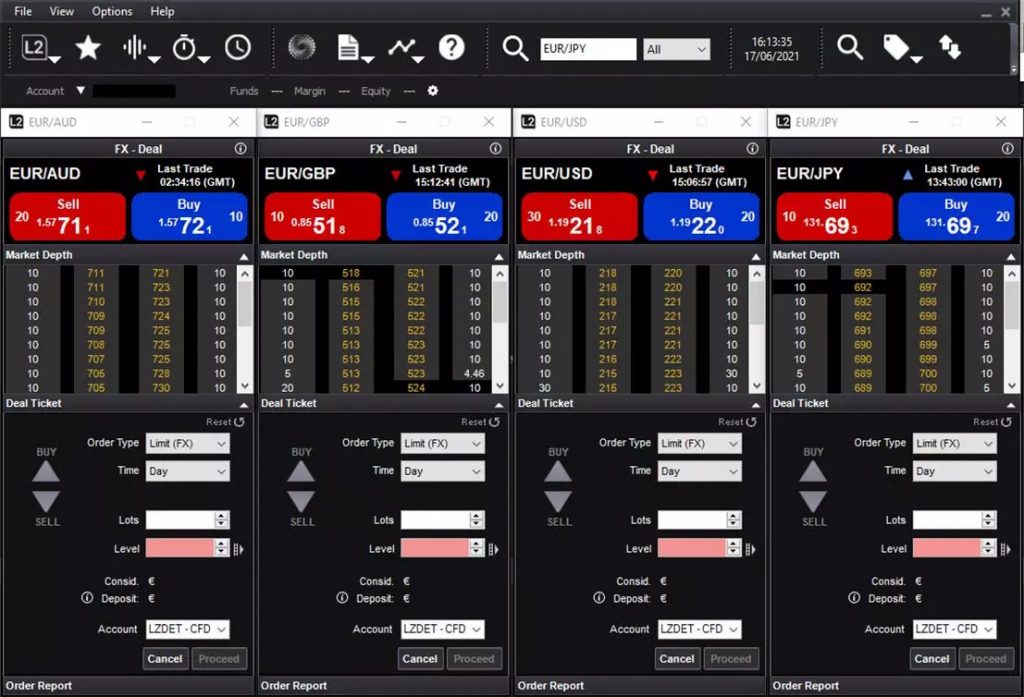

IG uses its L2 Dealing platform for DMA trading of forex

Pros Of DMA Brokers For Swing Trading

- Direct order book access for smarter entries & exits: DMA brokers route orders straight to the exchange’s order book, letting you see true depth of market (DOM). Unlike market makers, there’s no artificial spread padding or hidden dealing desk. This transparency can help you time entries and exits more precisely around liquidity zones—important for swing strategies that rely on clean technical setups near support/resistance levels.

- Faster, cleaner execution with reduced slippage: Because orders go directly to the market, execution speeds are generally faster and slippage lower compared to brokers who internalize flow. When you’re holding positions over days or weeks, shaving off even a few pips or cents per trade compounds into significant performance gains—especially when scaling in/out of positions at key swing points.

- Advanced order types & flexibility for trade management: DMA platforms often support institutional-style order types and more nuanced routing options. This gives you the ability to layer orders strategically around technical levels without revealing full position size to the market. It’s a subtle edge, but in swing trading—where patience and positioning matter—it can help avoid front-running and maintain cleaner execution.

Cons Of DMA Brokers For Swing Trading

- Higher trading costs & commissions: DMA brokers typically charge per-trade commissions rather than widening the spread. When scaling in and out of positions or trading multiple instruments, these costs can add up quickly. While execution quality improves, the higher fee structure can erode profit margins unless the strategy consistently captures strong moves.

- Steeper learning curve & platform complexity: DMA platforms expose you to full market depth, advanced order types, and raw pricing feeds. While powerful, this can overwhelm swing traders who don’t need—or aren’t ready to manage—such granular control. Without experience, poorly placed advanced orders can backfire and distort trade execution.

- Higher capital & margin requirements: DMA brokers often require larger minimum deposits and enforce stricter margin rules compared to CFD brokers. When you hold positions overnight or across multiple days, this ties up more capital and increases financing costs. It makes DMA less accessible to smaller accounts, limiting flexibility if you’re not trading with significant size.

DMA brokers give you unmatched transparency and order control, but they’re not always the easiest or cheapest option. For swing trading, the real challenge is weighing that extra precision against higher costs and complexity, and deciding if the edge justifies the trade-off.

Bottom Line

DMA brokers give swing traders a real edge with faster execution, transparent pricing, and advanced order control—but they’re not without higher costs, complexity, and stricter requirements.

For traders with the experience and capital to take advantage, DMA can sharpen entries and exits and boost long-term consistency. The key is matching the best DMA broker to your swing trading style and goals.