LiteForex Investments, also known as LiteFinance, is a leading multi-asset broker offering global trading opportunities. Investors can trade 150+ popular assets including currency pairs, global shares, indices and commodities. Swing trading clients can also access the industry-recognised MT4 and MT5 terminals on the web or mobile. Our LiteForex Investments review will cover regulation, analysis tools, how to register for a live account, deposit and withdrawal methods, and more.

What is LiteForex Investments?

The LiteForex Group was founded in 2008. Today, the broker has a global customer base, offering services in over 215 countries while the number of live clients sits at more than half a million. Offices can be found in Lagos, Nigeria with its European headquarters located in Cyprus.

The brokerage strives to offer innovative technology alongside advantageous trading conditions with high-speed executions. Clients can trade via the direct-to-market ECN pricing model with orders sent directly to top-tier liquidity providers.

The group consists of two entities;

- LiteFinance Global LLC (LiteForex Investments) incorporated in St Vincent & the Grenadines

- LiteForex Europe Limited, registered as a Cyprus Investment Firm and regulated by the Cyprus Securities and Exchange Commission (CySEC)

Markets

LiteForex Investments offers various asset classes to retail clients. These are suitable for all types of strategy including swing trading. Below we outline the key financial markets available:

- Forex – Speculate on 40+ currency pairs; majors and minors

- CFDs – Enter contracts for difference on stocks across key exchanges: NYSE, LSE and Euronext

- Cryptocurrencies – Speculate on 30+ recognised digital currency coins against the USD including Litecoin, Ethereum and Bitcoin

- Commodities – Access trading opportunities on energies and precious metals including Silver, Gold, Brent Oil and Crude Oil

- Indices – Speculate on some of the world’s largest markets across global index groups including DAX 30, S&P 500 and NASDAQ 100

Note, access to asset classes may vary by trading entity and country of residency.

LiteForex Investments Platforms

LiteForex offers swing trading clients access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both terminals are available for download to desktop devices such as PC and Mac or can be used as a webtrader via browsers.

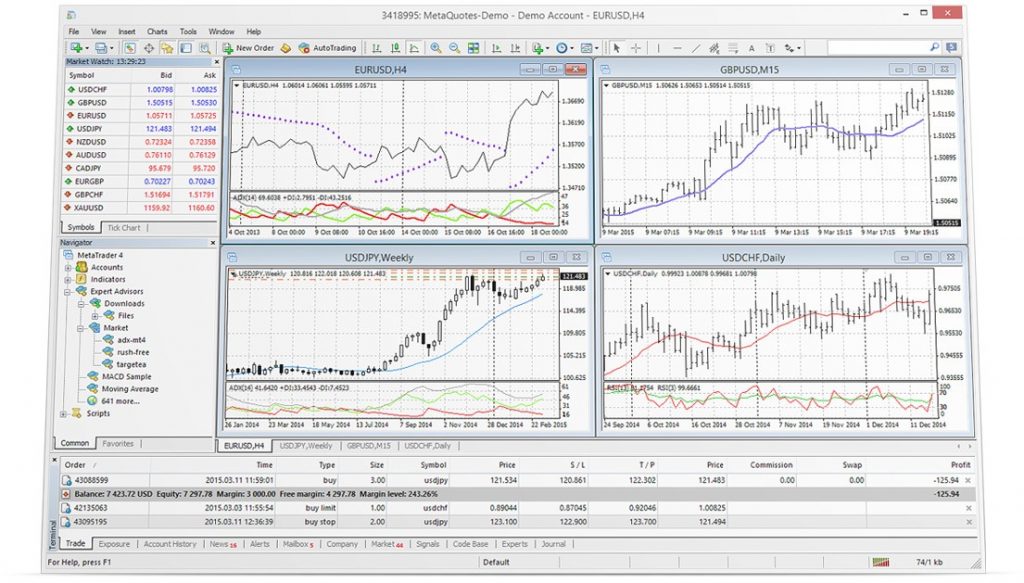

MetaTrader 4

MT4 is a globally established, popular platform. The terminal boasts a multilingual interface with easy-to-use navigation and practical search tools. Functions include:

- Nine timeframes

- Price movement alerts

- Fully customisable charts

- Four pending order types

- One-click order execution

- Three order execution types

- MQL4 programming language

- 30+ built-in technical indicators

- Hedging tools and trading lots from 0.01

- Automated trading via Expert Advisors (EA)

MetaTrader 4

MetaTrader 5

MT5 is a multi-asset derivatives platform for trading forex, futures, stocks and CFDs. It is the most powerful online trading software from MetaQuotes. Features include:

- 21 timeframes

- Price movement alerts

- Six pending order types

- One-click order execution

- Hedging and netting tools

- Built-in economic calendar

- Four order execution types

- MQL5 programming language

- 38+ built-in technical indicators

- Advanced Market Depth feature

- Automated trading via Expert Advisors

- Unlimited number of customisable charts

MetaTrader 5

Forex Social Trading

LiteForex Investments also offers a Social Forex Trading system. You can capitalize on successful investors and synchronize your account to duplicate profits. The LiteForex copy trade platform is ideal for new investors, in particular.

View rating information and investment history of registered traders and choose one that suits your strategy and objectives. The minimum deposit required to use the terminal is $500. A useful calculator is also provided to understand margin, risks and profits.

Note, download and step-by-step set up tutorials for all platforms including MetaTrader 4 are available on the LiteForex Investments website.

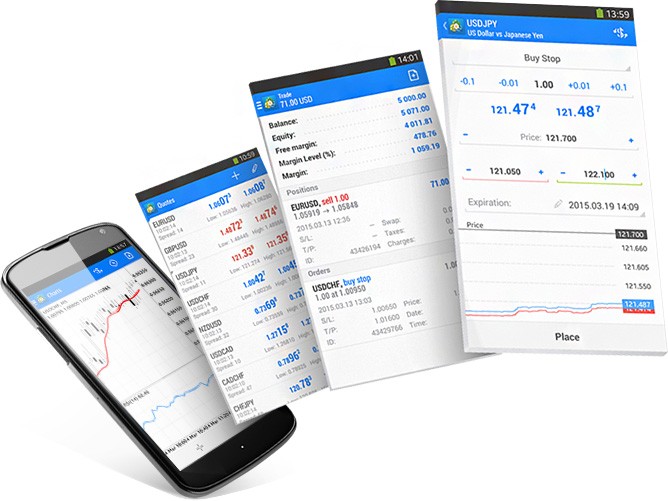

Mobile Trading

LiteForex offers a proprietary mobile app available for free download to iOS and Android (APK) devices. The application allows traders to install tools with daily analysis, trading signals and strategies. You can also access information in eight global languages including English, Spanish and Indonesian.

In addition, MetaTrader 4 and MetaTrader 5 are available as mobile apps. These can be downloaded from the relevant Google or Apple app store. Simply sign in to the platform to access the tools, features and functionality found on the web terminal or desktop platform. You can manage your real or demo account, open and close positions, check live pricing and manage alerts while on the go.

MetaTrader 4 Mobile App

LiteForex Investments Accounts

Live Accounts

LiteForex offers two real account types; Classic and ECN. Access all assets with a minimum deposit requirement of $50 or equivalent currency. Accounts can be denominated in all major currencies including USD, PLN, EUR and GBP. Both solutions are similar, the main difference being the pricing model.

It is quick and easy to sign up and open a new live trading account. Traders must complete an online registration form, upload identity documentation such as a passport, and provide proof of residency. Once details have been approved, you can start trading immediately.

Below we outline ECN vs Classic account features:

Classic

- No commission

- Minimum lot size 0.01

- Margin call level 100%

- Social trading available

- Floating spreads from 2 pips

ECN

- Scalping available

- Minimum lot size 0.01

- Margin call level 100%

- Commission charged

- Social trading available

- Floating spreads from 0.0 pips

- Trades delivered directly to liquidity providers

Demo Account

LifeForex Investments also offers a free demo account to prospective traders on the MT4 and MT5 platforms. Unlimited virtual funds are available to practise swing trading strategies risk-free. You can also learn platform features and tools.

The paper trading account offers real quotes from liquidity providers and live trading conditions. This includes floating spreads and social trading tools. A simple online registration form is required to get started.

Fees

Fees vary by account type. The ECN Account offers tight, floating spreads from 0.0 pips. Major currency pairs including EUR/USD are offered at 0.2 pips and trading opportunities on the S&P 500 index are offered at 0 pips.

The Classic Account provides a floating spread model starting from 2 pips. The EUR/USD pair, for example, is offered at 2.2 pips. Commissions also apply to the ECN Account:

- Oil – $0.50 per lot

- Metals – $20 per lot

- Majors – $10 per lot

- Minors – $30 per lot

- Crosses – $20 per lot

- Stock Indices – $0.50 per lot

Unfortunately, LiteForex Investments commission fees are higher vs competitors including XM and FXTM.

Rollover charges are also applied to trades held overnight. In addition, a $10 inactivity fee is charged to dormant accounts with no executions in two or more months.

Leverage

Leverage is available to swing trading clients, however, maximum rates vary by entity due to regulatory restrictions. Typically, investors trading with LiteFinance can access higher margins as there are no capping limitations. We were offered up to 1:500 leverage on some major forex pairs.

Customers trading under the regulation of the Cyprus Securities and Exchange Commission will be subject to ESMA’s limits. This includes 1:30 for major currency pairs and 1:20 for global stock indices.

It’s important to utilise risk management strategies when trading with high leverage as losses may be amplified.

LiteForex Investments Payments

Deposits

LiteForex covers all third-party payment charges while the minimum deposit requirement for both account types is $50. All deposits are also processed in the secure Client Cabinet offering financial data security. Accepted account funding currencies include EUR, GBP, USD, RUB, JPY, CAD and AUD.

Payment methods vary by country but include:

- E-Wallets including Neteller and Skrill – accepted globally, instant processing

- Bank Wire Transfer – accepted globally, typical processing 1-3 working days

- Debit/Credit Cards – including VISA and MasterCard, accepted globally, instant processing

- Cryptocurrencies – accepted by the international entity only, instant processing but dependant on blockchain confirmation times

Note, PayPal is not currently supported.

Withdrawals

The broker does not have any withdrawal fees, however third-party charges may apply. Our withdrawal review found minimum limits apply for some payment methods including a $10 minimum for credit and debit cards.

Processing times vary by payment method. Bank wire transfers and credit card withdrawals can take up to five working days while e-wallets often provide faster fund processing. Exchange rate conversion fees also apply if account currencies differ from the withdrawal request.

Regulation

The LiteForex group is regulated by various authorisations depending on entity location. LiteForex (Europe) Limited is regulated by the Cyprus Securities and Exchange Commission (CySEC). This is a top-tier regulatory body offering clients negative balance protection, segregated funds and FSCS investor compensation up to €20,000. The broker also operates following the Markets in Financial Instruments Directive (MiFID).

International clients trade under the LiteFinance LLC entity. This includes residents of Iran, Kenya, Ghana, India, Tanzania, Vietnam, Malaysia and Nigeria. The global entity is supervised by the Financial Services Authority (SVG FSA). When applying to a non-EU entity, traders will not be subject to European client protections. This includes leverage capping limits. Also, your funds may not be covered by investor compensation schemes.

Security

LiteForex Investments provides a safe and secure online trading environment. Two-factor login authentication (2FA) and Secure Sockets Layer encryption protocols are applied on MT4 and MT5 accounts. Personal and financial data are also exchanged via encryption between LiteForex and the terminals. The broker uses Hypertext Transfer Protocol Secure data encryption within the My LiteForex personal profiles to ensure safe transfers.

Educational Content & Analysis

LiteForex offers several educational tools, blog content and tutorials, ideal for beginners. This includes a forex glossary, e-books, tutorial courses and an introduction to strategy. Various topics are covered including understanding forex rebates, margin calls and utilising EAs. These can be accessed directly from the website. It would also be good to see YouTube supporting videos in the future.

In addition, the broker provides various trading tools. These include an economic calendar, technical and fundamental forex analysis, trading calculators and the latest financial news.

Forex VPService

LiteForex provides an API VPS tariff service to enable clients to control trades while a computer device is switched off. The uninterrupted server will run round the clock with a qualified support team on hand 24 hours per day, if required. This is available for $15 per month.

LiteForex Investments Promotions

Access to LiteForex bonus incentives varies by account registration location. Swing trading clients investing from regions including the UK or Europe will be restricted due to ESMA laws. These rules limit the use of financial incentives for new or existing customers.

Global clients can access various contests and promotions including welcome bonuses, promo codes, or no deposit bonuses upon registration. Historical rewards include a $200/£100 bonus upon sign up. In addition, prize competitions are held throughout the year with various technology and cash rewards.

Always check minimum threshold requirements and understand terms and conditions before opening a live account.

Advantages

Reasons to start trading with LiteForex Investments include:

- Mobile app

- VPS available

- Reputable licenses

- Social trading terminal

- 24-hour customer support

- MT4 and MT5 trading platforms

- Halal Islamic trading account available

- Various trading tools and educational content

- Demo account with real-time market conditions

Disadvantages

Downsides to opening an account with LiteForex Investments include:

- USA not supported

- High trading commissions

- No proprietary trading platform

- Global entity regulation is not as comprehensive

Trading Hours

Trading hours vary by instrument. Typically, forex market opening hours offer 24/5 access. LiteForex provides a list of trading hours per asset including upcoming holidays and market closure dates. The MetaTrader terminals operate on a GMT +2 server time and GMT +3 in the summer months.

Customer Support

LiteForex Investments offers several customer contact options, available 24 hours per day. Office working hours are 9 AM – 9 PM Monday to Friday (GMT+2). Head office support services are also multilingual.

Contact details can be found on the contact us logo on the broker’s homepage. These include email, telegram and live chat:

- Skype: liteforex.support

- Email: clients@litefinance.com

- Live Chat: Available 24 hours a day, Monday to Friday

- Head Office Address: First Floor, First St Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines

Alternatively, swing trading clients can visit the FAQ page for self-help guidance. Topics include how to action an internal transfer, personal details admin, how to delete an account, verification documents, plus deposit and withdrawal problems. The broker is also present on social media channels including Facebook and Twitter.

LiteForex Investments Verdict

LiteForex is a top candidate in the online broker landscape. Clients can be assured of top-tier regulation, an excellent choice of assets, comprehensive education and responsive customer support. The broker is also tailored to both new and experienced investors with copy trading tools available. Importantly though, non-EEA residents should understand the differences in regulation, assets and trading conditions with LiteFinance.

FAQ

Is LiteForex Investments A Good Broker?

LiteForex is a safe and legitimate brokerage. It operates with relevant regulations from global authorisations. Peer forum sites also rated the broker positively, highlighting responsive customer service as a key perk.

Does LiteForex Offer A Demo Account?

What Trading Instruments Does LiteForex Investments Offer?

LiteForex offers various global assets. This includes commodities like oil, precious metals such as gold, plus stock indices.

What Is The Minimum Deposit Requirement To Open A LiteForex Account?

Both account types (ECN and Classic Account) have a $50 minimum deposit requirement.

What Payment Methods Does LiteForex Investments Accept?

You can deposit to your LiteForex account via several payment methods. This includes credit/debit cards, bank wire transfers and electronic wallets such as Skrill and Neteller.