Best Swing Trading Demo Competitions 2026

Trading demo competitions are a smart way to sharpen your swing trading skills without putting real money on the line. Using virtual funds and live market data, these contests enable traders to compete on an equal footing—often for real prizes.

This 2026 guide shows you how trading demo competitions work, what you can win, and how to find the best ones to join.

Top Brokers With Demo Trading Competitions for United States

How SwingTrading.com Chose The Best Demo Trading Contests

We continuously test and review brokers, tracking whether they offer demo trading contests as part of their promotions. Only brokers running contests were shortlisted. These were then ranked based on overall broker quality, including platform features, fees, and user experience for swing traders.

What Are Trading Demo Competitions?

Trading demo competitions offer a unique opportunity to trade markets such as forex, cryptocurrencies, commodities, and indices without risking your own money.

These contests are hosted by brokers who provide virtual accounts loaded with simulated funds, allowing participants to trade under real market conditions.

The aim is to grow the account as much as possible within a defined timeframe, often measured by return, consistency, or risk-adjusted performance.

Based on our research, competitions can run for as little as a single day or extend over months, with longer events often offering the most substantial prizes. That said, shorter contests can still provide meaningful rewards, especially for those testing new strategies.

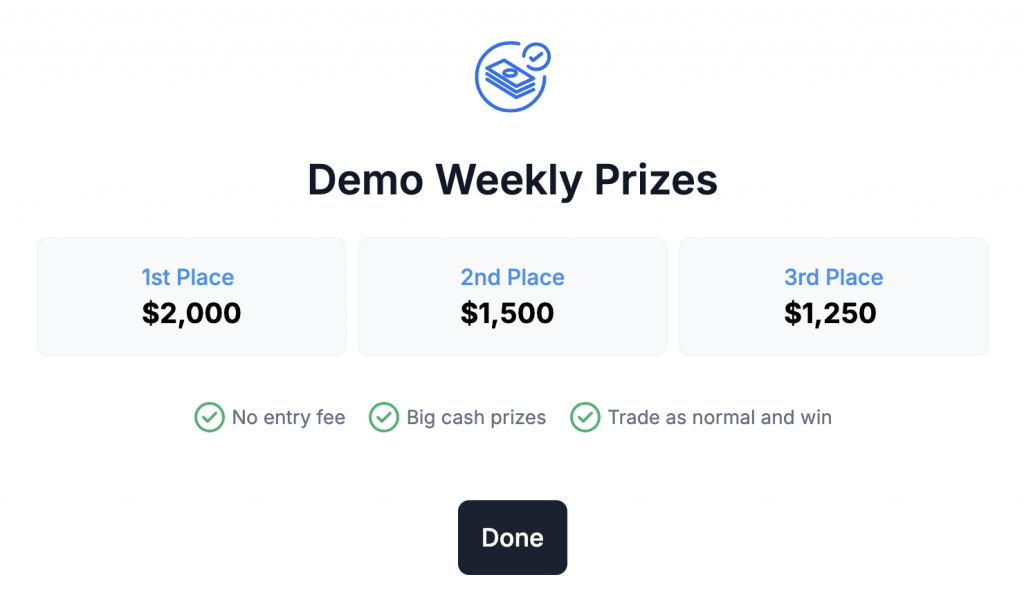

Once the contest ends, rankings are finalized based on the leaderboard, and prizes—ranging from cash to funded accounts—are distributed to top performers. Many competitions even reward multiple high-ranking traders, not just the winner.

For swing traders seeking to sharpen their edge, build discipline, and potentially earn real rewards, demo competitions offer a risk-free yet competitive environment for growth.

How Do Demo Trading Competitions Work?

Most demo trading competitions open with a registration window—usually lasting several days—during which you can sign up and review the rules, prize structure, and participant details.

As a swing trader, you must verify whether the contest duration allows for holding trades over multiple days and whether any restrictions apply to leverage, instruments, or trading styles.

Some brokers require participants to hold a live account to join, and many competitions are limited to a specific trading platform to ensure fairness.

Once registered, you will receive a new demo account funded with virtual capital. The account becomes active when the competition begins. From there, the objective is straightforward: grow your demo balance as much as possible by the end date, typically over days or weeks, which aligns well with swing trading strategies.

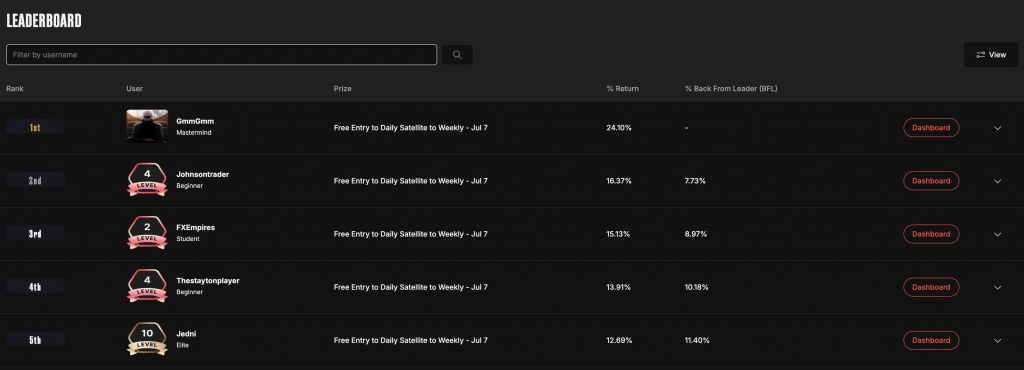

During the contest, leaderboards display how you compare to other traders. This real-time feedback can help you adjust risk exposure or lock in gains as the competition nears its end. Historical data from past competitions may also provide insight into the typical returns required to place.

At the end of the event, all trades are closed automatically, and final account balances determine the rankings. Prizes—ranging from cash payouts to trading credits—are awarded based on the leaderboard.

In some cases, traders may be disqualified for rule violations, so it’s worth checking the final standings even if you just missed the cut.

XM offers over $100,000 in cash prizes every month

What Makes A Good Trading Demo Competition?

A good trading demo competition for swing traders aligns with the rhythm and strategy of swing trading itself, focusing on capturing price movements over several days rather than rapid intraday trades.

The range of available instruments also plays a key role. A trading demo competition should offer access to markets that align well with swing trading strategies, such as forex pairs, stock indices, commodities, and major cryptocurrencies.

These markets tend to offer the liquidity, volatility, and price trends that swing traders look for when planning multi-day trades.

Equally important is the flexibility in trading conditions. Swing traders benefit from competitions that allow overnight and weekend positions, reasonable leverage, and minimal restrictions on trade duration.

A stable and reliable trading platform is also crucial, since swing trades require precise execution and consistent performance over more extended holding periods.

Competitions that reflect real-world trading conditions, and reward consistency and risk management—not just aggressive short-term gains—tend to be the best fit for serious swing traders.

Track your performance and compare it with others on Bullrush’s leaderboard

Terms & Conditions

Before entering a demo trading competition, especially as a swing trader, it’s important to understand that each broker sets its own rules and guidelines.

These rules outline crucial aspects, including the contest’s structure, performance metrics used to determine winners, the competition’s duration—which may not align with swing trading timeframes—the eligibility criteria, and the process for claiming any prizes.

Since demo contests can vary widely, brokers typically provide detailed terms and conditions on their websites.

While these documents may appear dense, it is essential to pay close attention to key details like who qualifies to participate (e.g., geographic restrictions or account status), restrictions on trading styles or assets, minimum or maximum trade durations, and any conditions tied to prize payouts, such as withdrawal limits or verification steps.

Thoroughly reviewing these terms ensures that you know precisely what is expected and how to maximize your chances of success in the contest.

I once placed in the top five of a demo competition, only to find the prize was locked behind a high-volume trading condition I hadn’t noticed.Since then, I have always read the terms and conditions—especially the prize and trading rules—before entering any contest.

Authenticity & Reliability

Before registering for any demo trading competition—especially if you’re a swing trader planning to hold positions for several days—it’s essential to make sure the broker is reputable and reliable.

This is particularly important if prizes are awarded as trading credit, since you’ll need to use the broker’s platform to trade and potentially convert those rewards into withdrawable funds.

Pay special attention to any complaints about platform outages or withdrawal issues, as these can severely impact your ability to trade effectively over the swing timeframes you’re targeting.

Regulation is another key factor. Reputable brokers are typically licensed by well-known financial authorities such as the FCA (UK), ASIC (Australia), or CySEC (Europe).

These regulatory bodies help ensure fair practices and client fund protection, both of which are critical when your prize or trading capital is at stake.

Additionally, evaluate the broker’s technical reliability, including stable trade execution, secure handling of deposits and withdrawals, and protection of client funds, as these are all essential requirements.

For swing traders in particular, platform stability is non-negotiable—sudden downtime or glitches during a multi-day trade could mean missed opportunities or unexpected losses.

How To Transition From Demo To Live Trading

Transitioning from demo to live trading is a critical step for any swing trader, and doing it properly can make the difference between long-term success and early setbacks.

While demo competitions help build confidence and refine your strategy, they can’t fully replicate the emotional and psychological pressure of trading with real money. That’s why it’s essential to treat your first steps into live trading as a gradual shift, not an all-at-once leap.

Start by trading with a small amount of capital—just enough to keep you emotionally invested, but not so much that a mistake would be financially damaging.

Stick to the same swing trading strategy that worked during your demo experience, and don’t make unnecessary changes just because real money is involved.

The goal is to build trust in your method and develop consistency under real conditions, including handling slippage, spreads, and overnight risk.

Also, pay close attention to how your mindset changes when money is at stake. You may find yourself closing trades too early or hesitating on setups you would have taken confidently during a demo.

Recognizing these shifts is key. Keep a trading journal, track your decisions, and adjust your strategy gradually. The discipline you developed in demo trading is valuable, but applying it consistently in live markets is what makes you a real trader.

When I made the switch from demo to live swing trading, the most challenging part wasn’t the strategy—it was staying calm when real money was at risk.The emotional pressure taught me more than any demo ever could.

Bottom Line

For swing traders, demo trading competitions are especially valuable—they offer a risk-free way to test multi-day strategies, refine trade timing, and compete for real prizes like cash or funded accounts.

With no financial risk and the chance to practice in realistic environments, they’re an ideal training ground for building consistency and confidence in swing trading.

FAQ

Do I Need To Pay To Enter A Trading Demo Competition?

Most trading demo competitions are free to enter, especially those designed to attract new traders. Some brokers may require you to open a live account, but no real money is needed for the competition itself.

Always check the entry requirements, as some contests may have small fees or specific eligibility conditions.