Best Swing Trading Brokers With KWD Accounts 2025

Swing traders who use Kuwaiti dinar (KWD) accounts face different requirements than traders using USD or EUR.

Our trading experts keep it simple and show you what matters when choosing a swing trading broker with KWD accounts.

Why KWD Accounts Matter

If you live in Kuwait or hold most of your funds in KWD, using a KWD account makes sense. It saves you from converting money back and forth to USD, EUR, or GBP every time you trade.

Currency conversion fees add up. For swing traders who hold trades for days or weeks, these costs can gradually erode returns.

Example scenario: Say you fund your account with 1,000 KWD. A broker that only accepts USD forces you to convert your funds. If the rate is 1 KWD = 3.25 USD, you get 3,250 USD. But you’ll also pay a conversion fee—maybe 0.5% or more. That’s about 16 KWD gone before you even trade. If you withdraw later, you will incur an additional charge.

Check If The Broker Supports KWD Funding

Not all brokers support KWD deposits. Some list KWD on their website, but in practice, they only allow deposits in USD or EUR.

When checking:

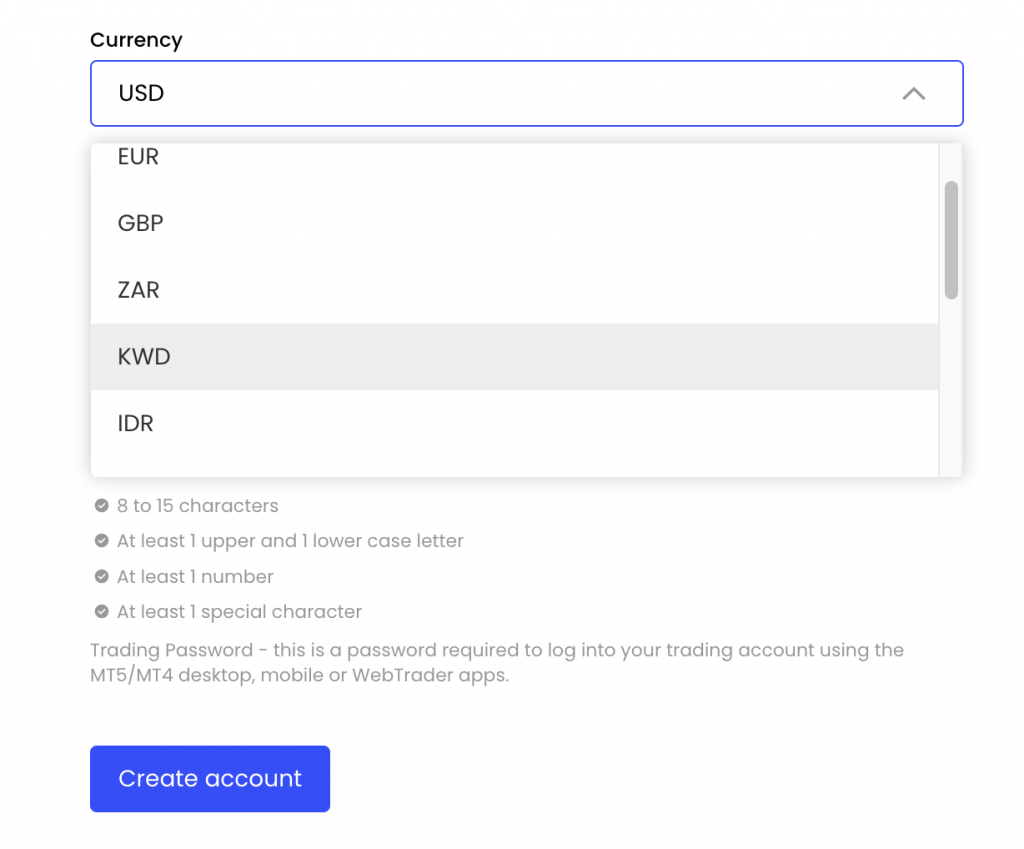

- Look for KWD listed under base currencies in account types.

- Test with a small deposit if possible.

- Ask support if KWD withdrawals are sent directly to your bank or if they are first converted.

If a broker forces conversion, you’re not really holding a KWD account.

Trade with a KWD base currency account at JustMarkets—no conversion needed

Local Payment Methods

Swing traders frequently move money in and out. A true KWD account should support local payment methods in Kuwait.

This means:

- Direct bank transfers to Kuwaiti banks.

- Local cards issued in KWD.

- Avoiding third-party currency swaps.

If the broker only lets you use international wires or USD-based cards, you’ll likely face hidden charges.

Example scenario: You open a KWD swing trade account and fund it with your local card. If the card is settled in USD, your bank may convert it twice—first from KWD to USD and then from USD back to KWD. That’s an extra cost. Always ask if deposits remain in KWD from start to finish.

Trading Fees In KWD Accounts

Broker fees look different when your account base is in KWD.

You need to check:

- Spread costs: Are they stable when quoted in KWD?

- Swap or overnight charges: Swing traders often hold trades for several days. If swaps are calculated in USD and then converted to KWD, you may incur additional costs.

- Withdrawal fees: Are they fixed per transaction, or a percentage? Fixed fees hurt more in KWD if they’re pegged to USD values.

Example scenario: Holding a EUR/USD swing trade for five days may cost $12 in swap charges. If your account is in KWD, the broker converts that $12 back to KWD at their rate. Sometimes that’s worse than the market rate. Over dozens of trades, it adds up.

Platform & Charting Tools Still Matter

Swing traders need decent charting. MT4, MT5, cTrader, TradingView or web-based platforms are standard. But the question here is: does the platform handle KWD balances cleanly?

Some platforms display your account balance in USD by default, even if you have funded in KWD. That means you don’t see your actual equity in your home currency. For planning swing trades, this process can be confusing.

Ask the broker if the platform:

- Shows balances and profit/loss in KWD.

- Lets you set margin and risk levels based on KWD, not just USD.

Regulation & Local Access

Global traders often overlook this part. Swing trading in KWD isn’t only about fees. It’s also about whether your broker can actually serve Kuwaiti residents.

Points to check:

- Does the broker accept clients from Kuwait?

- Are they regulated in a region where KWD funding is supported?

- Will they allow direct KWD withdrawals back to a Kuwaiti bank?

Security Of Funds In KWD Accounts

Some brokers keep KWD balances in segregated accounts. Others convert deposits into another currency internally, even if they let you ‘see’ your balance in KWD.

Ask directly:

- Does the broker hold actual KWD funds in their bank, or are they just displaying KWD in the platform?

- If the company fails, how is KWD refunded—in dinars or in converted currency?

For swing traders who plan to keep funds in the account for weeks or months, this is a significant consideration.

Liquidity & Order Execution

Swing traders don’t need lightning-fast scalping execution, but they do need reliable fills. If the broker routes all KWD accounts through USD liquidity first, you may experience slight delays or slightly different spreads.

It’s worth testing:

- Place a trade during regular hours.

- Compare your fill price against a real-time chart.

- Note if slippage feels higher than expected.

It doesn’t need to be perfect, but consistency matters.

Example Swing Trade In A KWD Account

Let’s walk through a simple swing trade:

- You deposit 2,000 KWD into a broker account that fully supports the KWD.

- You open a position on GBP/USD with a stop loss 100 pips away.

- You risk 2% of your account, or 40 KWD.

- Because your account is in KWD, the platform calculates margin, risk, and potential profit directly in KWD.

- You hold the trade for four days. Swap charges are applied in USD, then converted to KWD. With a broker that handles KWD well, you see these fees clearly in KWD.

Now compare: if your broker didn’t support KWD, you’d have first converted to USD, then calculated risk in USD. When you withdraw, you’d convert back again. That’s two extra layers of cost and confusion.

Bottom Line

Swing trading with KWD accounts isn’t complicated, but it is a specialized approach. The main goal is simple: keep your money in KWD from deposit to withdrawal, and ensure that all trading costs are transparent in your own currency.

Don’t pick a broker because it’s popular worldwide. Pick one that actually supports your base currency. That alone can save you steady costs over time and make swing trading smoother.