Best Brokers For Traders With No Time

While some investors would like to make trading their full-time career, the reality is that another job is often needed. Traders may also have other time commitments that limit their capacity to research the financial markets and execute positions. Fortunately, the best brokers for traders with no time offer user-friendly tools that reduce the effort needed, from alerts and signals to automated copy trading solutions. In this guide, we run through some of the innovative services offered by online brokers. We also explain how to compare top providers.

Top Brokers For Traders With No Time for United States

Trading When You Have No Time

Swing trading, like any type of investing, often requires a significant investment of both time and money. To be successful, investors need to research particular markets, such as forex or precious metals, to identify trends and patterns. And even before you start trading, you need to find the right broker and strategy.

Unsurprisingly, all these factors can make it difficult for part-time investors to effectively navigate the financial markets. This is where the best brokers for traders with no time come in. Intelligent tools can reduce the amount of time that needs to be spent researching and placing trades.

Signals

One way to reduce the workload is by using trading signals, which is essentially a trigger to buy or sell an asset. Available at many of the best brokers for traders with no time, signals are automatically generated and can be sent directly to your mobile device.

Signals are generated through analysis, either via mathematical algorithms or seasoned traders studying technical indicators. A signal could suggest you buy 10 troy ounces of gold at $X, for example. It could then alert you when it believes the trend is about to reverse, so you can sell your position.

Importantly, signals take away the heavy lifting with traders simply needing to decide whether to execute the suggested position and in what size. Pepperstone and VantageFX are among the best brokers that offer trading signals.

Copy Trading

Signals can be taken a step further with copy trading, which allows investors to automatically replicate the positions and strategies of other traders. For traders with no time, this provides a hands-off approach to investing. The best copy trading platforms also vet strategy providers and publish details of historic profit and loss, maximum drawdown, risk appetite, and more. This makes it easy for clients to find a suitable trader to follow.

Copy trading has become extremely popular in recent years, with beginners in particular, using services to replicate the success of veteran traders. Importantly, the trader you follow will normally take a small cut of any winnings or a percentage of the volume traded. Social networks also let users create groups so you can message peers and mentors to exchange tips and trading ideas.

AvaTrade and eToro both offer top-rated copy trading solutions.

Automated Trading

Many of the best brokers for traders with no time also offer automated trading services. Sophisticated algorithms, also known as bots, will scan the markets and execute orders based on agreed instructions and criteria. Clients are able to set specific rules for entry and exit points, alongside risk management parameters.

Unsurprisingly, automated trading bots can significantly reduce the amount of time that needs to be spent actively trading. And while an initial time investment may be needed to get the program running as intended, once it’s set up, it can be left to buy and sell securities around the clock.

Automated trading systems can be downloaded for free, bought for a one-off fee or paid for with a monthly subscription, depending on the provider. The MetaTrader Market alone is home to 1,700+ trading bots while the MQL4 integrated programming language lets clients develop and test automated trading strategies.

RoboForex and XM are among the top brokers that specialize in automated trading.

Managed Accounts

Managed accounts are another good option for traders strapped for time. As the name suggests, managed accounts are run by a professional trader. Clients simply need to open an account, invest funds and then the account manager will pool your funds with other investors’ and use it to speculate on the financial markets.

Most managed accounts publish information about their trading strategies before you deposit funds, for example, markets they specialize in, instruments they use, plus target profit and potential downside. Also make sure a clear fee schedule is provided before you sign-up.

For traders with no time, managed accounts are arguably the most hands-off approach to investing available. The best brokers that offer managed accounts include Pepperstone and CMC Markets.

Mobile Trading

Mobile trading allows you to trade any time, any place, providing flexibility for investors with less time. Fortunately, almost all brokers now provide some form of mobile application, whether it is bespoke or developed by a third party like MetaTrader.

Simply check the app is compatible with your iOS or Android device before you hit download. Also check whether there are any restrictions in terms of features. Can you still make deposits and withdrawals, for example? Can you make use of charts and technical analysis tools? Also check you can apply stop-loss and take-profit orders.

Eightcap and FXCC both have a strong mobile offering.

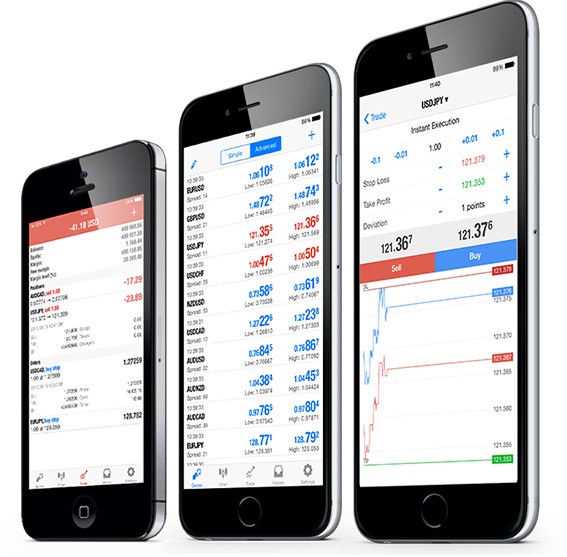

MetaTrader 4 App

How to Trade With Little Time

If you have limited time to commit to online trading, think carefully about the strategies you will employ. Intraday trading and scalping, for example, are both time-intensive and require frequent monitoring of the markets. However, longer-term swing trading using a buy and hold approach requires less time.

Implementing appropriate risk management tools can also save time. Stop-loss and take-profit orders and perfect for this. They allow you to specify pre-determined exit points to either limit losses or realize profits. This means you do not have to monitor the markets to decide when is the right time to buy or sell as positions will be automatically closed.

XTB is a good broker for longer-term investing with access to a wide range of assets.

Comparing Brokers For Traders With No Time

As well as the solutions listed above, also consider the following elements when choosing a provider:

- Do they offer a demo account? A demo account is the perfect place to practise trading. It allows you to invest in live markets using virtual currency. This means there is no risk of losing funds and you can test out new strategies.

- What is the minimum deposit? Brokers for traders with no time will require different minimum deposits. Try to find an account with a minimum deposit that aligns with your budget. XTB, for example, requires no minimum deposit, whereas eToro requires a deposit of $200 in some countries.

- Can you set up time-saving tools? Signals, copy trading and automated investing bots are all services that will help reduce the trading workload. Make sure they are supported by your chosen broker and that they come with positive reviews from other users.

- Are the fees reasonable? Look into the various fees associated with each broker. Some may charge for deposits and withdrawals while others may charge a commission on each trade. If you plan on using any of the solutions listed above, such as signals, managed accounts or copy trading, consider the price when forecasting potential profits.

- What assets and instruments do they offer? Check the list of products and markets available. Can you trade on stocks, forex, commodities, cryptos, bonds, ETFs and CFDs, for example? Alternatively, if you want to trade binary options, choose a broker like Pocket Option.

Bottom Line on Brokers For Traders With No Time

The best brokers for traders with no time offer slick investing solutions like copy trading apps, real-time signals and managed accounts. They essentially automate part of the trading workload or hand it over to another investor. But while they can save you time when they are running smoothly, it’s worth investing the time upfront to find the right broker and solution for your needs. Use our guide above to get started today.

FAQ

Does Swing Trading Require Time?

Successful traders normally commit plenty of time over many months and years to become consistently profitable. Many of these investors will also tell you there is no shortcut to profits. However, recent years have seen an increase in the number of retail trading tools that reduce the time commitment required. Popular tools include signals, automated trading bots, copy trading applications, plus managed accounts.

Are Managed Accounts Good?

If you don’t have time to actively trade, a managed account could be the way to go. A professional trader will essentially manage your portfolio and make investments for you. The downside is the sometimes large fees and no guarantee of returns. Pepperstone and CMC Markets both offer popular managed account solutions.

Which Brokers Are Good For Automated Trading?

Which Is The Best Broker For Traders With No Time?

There is no straightforward answer as to who is the best broker for traders with no time. This is because investors have different needs and objectives. With that said, we would recommend a platform that offers one of the time-saving tools outlined above, such as signals, managed accounts, plus automated and copy trading. In our list of top picks are Pepperstone, CMC Markets, RoboForex, XM, Eightcap and FXCC.

Can I Trade Without Spending Much Time?

There are trading services available for investors with less time. See our guide above for recommendations. It could also be worth adopting a longer-term trading strategy with a buy and hold approach. This requires less time than active, short-term trading.