Short Term Trading

Short term trading applies to a range of investing styles, including intraday scalping and swing trading. This guide covers the basics of short term trading, with popular strategies for beginners across forex, stocks, commodities and cryptocurrencies. We also explain how to compare the top online brokers and platforms.

Best Brokers For Short Term Trading for United States

Short Term Trading Explained

Short term trading is essentially any strategy that is not a long-term investment. Timeframes typically range from several seconds to a few days or weeks. The most popular systems can be split into two categories:

- Day trading: this is the practice of buying and selling securities in a single day, often requiring consistent focus

- Swing trading: positions are usually held over multiple days or weeks. This investing style is particularly popular among traders with other time commitments

Standard instruments used in short term trading include forex, cryptocurrency, stocks and commodities like gold. CFDs (contract for differences) based on these assets are also frequently used by short term traders.

Price changes over shorter periods are generally small in value. So to boost earnings, many traders use leverage. Leverage or margin allows you to borrow money from your broker against the future price of an asset. The margin is the amount of capital needed to open a position. Leveraged trading can increase profits, but it can also lead to larger losses.

Short Term Trading Vs. Long Term Trading

Markets can be volatile over shorter time scales. As a result, strategies often use technical analysis to identify patterns and capitalise on trends. In comparison with longer term investments, the fundamentals are often more important.

Since short term trading can be very risky, a clever strategy is essential for financial success. Investors typically employ a range of charts and various indicators to try and predict future market movements. Risk management techniques are also crucial. Popular systems include setting stop loss and limit orders to protect profits and curtail losses.

Tip: those new to short term trading can practice on a free demo account to get familiar with the assets they’re interested in and find strategies that work. Books and 101 tutorial PDFs are also a good way to learn to new ideas, find stock picks, and get recommendations and lessons from other investors.

Examples & Markets

Stocks

Stocks -or equities- are shares representing the ownership of a fraction of publicly traded companies. Shares are traded on exchanges like the New York Stock Exchange (NYSE), the London Stock Exchange (LSE), and the Australian Securities Exchange (ASX).

The best stocks to buy when short term trading typically see high volumes and a degree of volatility. Volume is essentially a measure of the number of trades made over a period, with increasing volumes often linked to major price movements. Volatility is the extent to which prices fluctuate. Both will help ensure decent profit potential for short term traders.

There are also several equity-based derivatives that are popular, including exchange-traded funds. ETFs measure the performance of an index, like the S&P 500 or the FTSE 100. ETFs are popular in swing trading as they are relatively stable. Mutual funds can also be used as alternatives to ETFs.

CFDs are financial contracts that state that the buyer must pay the seller the difference between the value of an asset when purchased versus the value at expiry. Many online brokers offer CFDs to retail day traders and swing traders. They appeal to beginners, in particular, as they’re easy to understand and investors don’t actually own or take hold of the underlying asset, such as a stock.

Forex

Forex (foreign exchange) is a popular short term trading instrument. FX markets are usually open for trading 24-hours-a-day Monday through Friday. Forex platforms typically offer several majors, crosses, and exotics. Beginners generally opt for major pairs like EUR/USD, as they offer decent liquidity. Liquidity makes it easier to enter and exit positions quickly, which is good for short term trading. They also usually have lower trading fees with tighter spreads.

Cryptocurrency

Short term crypto traders can profit from the price variation of digital currencies like Bitcoin and Ethereum. Cryptos can be traded around the clock, 7 days a week. Of course, digital currency trading requires discipline, risk management, and a careful strategy. It’s also worth pointing out that the crypto markets are highly volatile and unregulated in many major trading jurisdictions.

The top crypto brokers for short term trading include Binance, Coinbase and eToro.

Options

Options contracts are based on an underlying security, giving the choice to trade a set amount for a set price at a set time. Retail traders with less capital can use options to speculate on a range of financial markets.

Still, short term options trading can generate both large profits and significant losses. This is because the total value of the option can be seriously affected by small movements in the price of the underlying security. As a result, effective trading strategies are essential.

Options are usually split into two categories:

- Put option: gives you the option to sell

- Call option: gives you the option to buy

Volatility trading is a popular short term strategy. Volatility trading exploits the fact that options prices depend on the estimated future volatility of the underlying asset. A high level of implied volatility will result in a higher options price, while a depressed level of implied volatility will usually result in the opposite.

Strategies & Tips

Momentum Trading

Momentum refers to an acceleration in price movement. As the value of a security grows, an increasing number of traders will want to profit from the upwards trend and this will drive the price higher. When the market becomes overbought, the price starts to fall again. Downward trends attract short-sellers, pushing the price low before it rebounds.

Momentum traders seek to profit from these strong trends. Investors can also take both long and short positions depending on the expected market movement. When swing trading, investors generally hold positions for days or weeks before the market reverses. Swing traders essentially capitalize from only a ‘chunk’ of a particular trend. This lowers the risk of losing money from negative price movements.

Momentum trading strategies often use technical analysis tools, specifically momentum indicators. The RSI (Relative Strength Indicator) is one popular momentum indicator. It helps to determine if a security is overbought or oversold. The RSI ranges between 0 and 100 and values greater than 70 and under 30 indicate overbought and oversold conditions, respectively. Oscillator indicators like the RSI also help anticipate future changes in price direction.

Support & Resistance

Range trading capitalizes on smaller oscillations in price movement. Instead of moving strongly in one direction, the price of an instrument fluctuates within a channel. The upper and lower limits of this channel are the support and resistance lines. At these levels, the price appears to reverse direction. Support and resistance levels are strengthened each time the price ‘bounces off’ of them. Short term trading strategies can involve aligning entry and exit points with these two levels.

However, range trading can be difficult when:

- Identifying breakouts – when the price begins to trend strongly again

- Correctly determining the support and resistance levels – thanks to trading psychology, these often sit at nice ‘round’ numbers

Suitable short term indicators for range trading are Bollinger Bands and Fibonacci levels. Bollinger Bands relate to simple moving averages, which calculate the average price of an asset across a set time frame. The Bollinger Band plots a pair of lines two standard deviations away from the moving average. A narrowing of the band indicates upcoming volatility; potentially up to a breakout. If the price moves closer to the upper or lower bounds, it shows overbought or oversold conditions and the possibility of a large market movement.

Fibonacci levels help to identify support and resistance levels. They assume that prices will often retrace certain percentages within a trend before changing direction. The support and resistance levels often align with the Fibonacci ratios of 23.6%, 38.2%, and 61.8% (as well as 50%).

Reversals

Reversals occur when strong trends in the price of an instrument change direction. They are often used in swing trading and short term trading within exit and entry strategies. Misleading signals in the date can make it difficult to determine whether or not a reversal is genuine. A pullback happens if the price instead returns to its initial trend.

Exponential moving average crossovers are a useful way to spot potential reversals. Like simple moving averages, exponential moving averages calculate the average price of an instrument in a certain window (5 days, 10 days, etc). Exponential moving averages weigh recent trades more heavily. Different moving averages crossing over each other can indicate future trends.

Consider using two moving averages, one short term and one long term. If the short term average moves above the long term average, more people are buying, and the trend could move up.

Pros and Cons of Short Term Trading

Benefits

Advantages of short term trading include:

- Suitable products and instruments are available on top trading apps and platforms

- With leverage, traders can make larger profit margins in shorter time-frames

- Short term trading teaches discipline and risk management

- Short term investing can be done part-time or remotely

Disadvantages

Downfalls of short term trading include:

- It can carry larger risks than long-term trading due to increased volatility

- It can be stressful and labor-intensive

Choosing a Broker

Before signing up with a short term trading broker, you should research the markets, fees, leverage, and platforms they offer. It’s also worth double-checking the reputation and regulatory status of online brokerages and groups to avoid fraudsters and legal violations.

Demo Account

Short term trading is particularly risky for inexperienced traders. Fortunately, many brokers offer free demo accounts which provide a risk-free environment in which to practice trades and get familiar with market dynamics. Most demo accounts are pre-loaded with a set amount of virtual cash. More advanced traders can use these simulators to test out new strategies.

Fees

Online short term trading fees are usually low and can be broken down into:

- Fixed or floating spreads

- Commission per trade

- Deposit and withdrawal fees

- Overnight holding charges

- Account inactivity fees

Fee structures vary from broker to broker. Some platforms (STP-type) take commission through the spread, and some platforms (ECN-type) charge a flat fee per trade. Overall, the costs tend to be roughly the same, but active traders might benefit more from ECN-type accounts.

Trading fees are the main cost consideration for ultra short term day traders who open many positions per day. Swing traders should pay attention to overnight fees, which are used to pay off the interest from leveraged trades. Note that some markets, including crypto exchanges- never close, suppressing overnight fees.

Depending on the transfer method, some brokers also charge clients for deposits and withdrawals. Checking the relevant details on their payment systems can help avoid any unnecessary charges.

Leverage

Most retail brokers offer some form of leverage to clients. Restrictions on the maximum leverage for retail traders vary internationally (leverage on major forex pairs is capped at 1:30 in the UK, EU, and Australia, and 1:50 in the US). Offshore-based brokerages often have generous leverage limits but they also have light regulations and rules. As a result, traders should approach these platforms prudently. Large leverages can also be offered to high-capital accounts for professional traders.

Product Range

Online brokers provide their clients with access to different markets depending on their speciality. Your short term trading style will affect which broker you choose. Forex brokers generally feature a few dozen currency pairs as well as cryptos. Larger platforms tend to offer an extensive range of dividend stocks, indices, precious metals (gold and silver), plus energies (oil and gas).

Trading Platform

When short term trading, access to technical analysis tools is key. Detailed data and fast execution speeds can also help while navigability and user-friendliness are important for new traders. In addition, some brokers allow traders to create short term trading algorithms – programmable scripts for executing strategies autonomously.

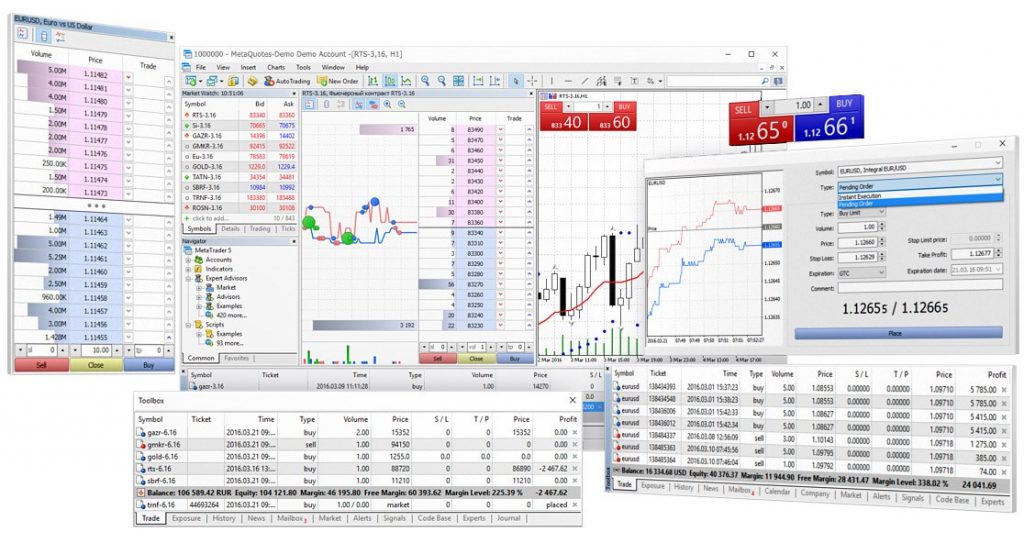

The two leading short term trading platforms are MT4 and MT5 (MetaTrader 4 and MetaTrader 5). MT4 was created for forex trading, while MT5 is optimized for stocks, futures and options. Other popular trading platforms include NinjaTrader and ZuluTrade, a social trading platform.

MetaTrader 5

Mobile App

Mobile trading apps can be a useful tool for busy traders, as they allow them to monitor and execute trades remotely. Most brokers offer at least one trading application to their clients, either developed in-house or by third parties. Things to look out for in a trading app include:

- Reliability – does the app crash frequently?

- Clean, uncomplicated interface

- Fast execution speeds

- Good search function

- Interactive charting

Security & Regulation

To avoid online trading scams when short term trading, it’s best to choose a regulated broker. Regulated firms offer multiple benefits, including negative balance protection and investor insurance. They also have a legal responsibility to act ethically. Look out for fraudulent or exaggerated claims by checking details listed on broker websites.

Final Thoughts

Short term trading can be a great way to exploit volatile, dynamic markets. Of course, it is not without risk. Successful short term trading requires patience, determination, and a careful strategy. Choosing a suitable broker is also important – make sure they suit your trading style and offer competitive fees.

FAQ

What Does Short Term Trading Mean?

Short term trading refers to buying and selling securities for a finite duration versus long term investments. Short term trading includes day trading and swing trading. Trades can last anywhere from a few seconds to several weeks.

Is Short Term Trading Haram Or Halal?

Short term trading is generally considered Halal in Islam. However, many top brokers offer swap-free Islamic accounts to help Muslim traders avoid paying interest charges. Consult a qualified spiritual authority for the final word on the religious ethics of short term trading.

Do I Have To Pay Tax On Short Term Trading Earnings?

Short term trading earnings may be taxable, though this varies internationally from the USA and Canada to India and Malaysia. You may have to pay capital gains tax or income tax on any profits made.

What Is The Best Short Term Trading Strategy?

There is no one-size-fits-all best strategy for short term trading. Successful traders use a variety of indicators, charts, patterns, strategies and investing methods to inform their decision-making.

How Many Days Does Short Term Trading Last?

There is no precise timeframe for short term trading, meaning trades can last anywhere from minutes to weeks. It is ultimately a generic term to capture investing activity focussed on short-term metrics and timeframes.