Brokers With Low Spreads

Brokers with low spreads can enhance profits for traders. With investors often executing multiple positions a day, wider spreads can cut into returns. This article looks at how online brokers make money, including through floating and fixed spreads. We also list the brokers with the lowest spreads on assets like forex, stocks and gold.

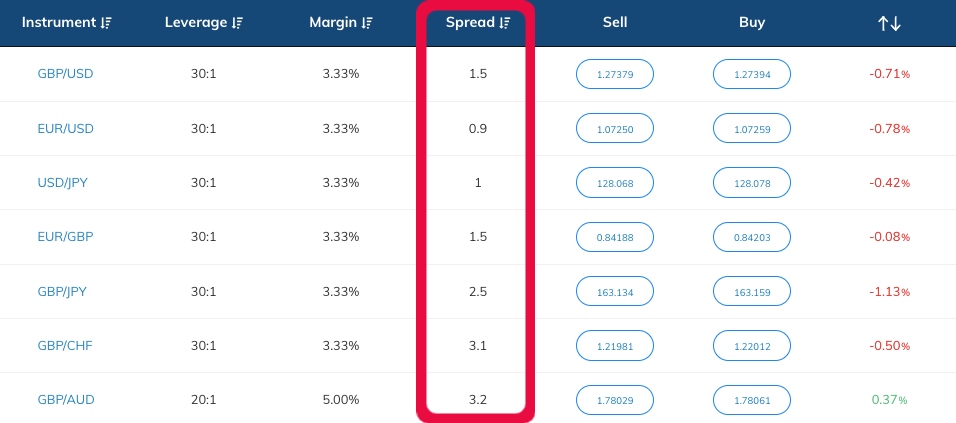

Brokers With The Tightest Spreads for United States

How Spreads Work

Most financial assets have a buy (bid) and sell (ask) price. The spread is the difference between the bid and ask price. The wider the spread, the longer it takes before a trader breaks even. In other words, trading brokers with low or tight spreads make it easier for investors to turn a profit.

The spread is usually calculated in pips (percentage in point), which is the change in the fourth decimal place of a currency pair, for example. So 1 pip is equal to 0.0001. The key divergence from this norm is forex pairs with the Japanese Yen, where it is quoted in two decimal places.

Example

The EUR/USD is the most liquid currency pair, which helps ensure some of the tightest spreads in the forex market. Now let’s say the EUR/USD bid price is 0.1055 and the ask price is 1.1057. In this example, the spread is 2 pips – the difference between the fourth decimal place in the bid and ask price.

Fixed Spreads

A fixed spread remains constant despite market fluctuations. This means greater price transparency for traders – potential profit and loss can be calculated before opening a position. However, in return for greater price certainty, fixed spreads tend to come in higher than floating spreads in stable and liquid markets. With that said, fixed spreads may prove cheaper during periods of unexpected market volatility.

Floating Spreads

Floating (or variable) spreads are popular with online brokers. This is where the spread fluctuates in line with market liquidity and volatility. At particularly liquid times of the trading day, floating spreads can present better value. For example, the GBP/USD forex pair between 8 am and 12 pm EST (when the New York and London markets overlap), often offers the lowest spreads.

AvaTrade spreads

Factors Influencing Spreads

Two key considerations are liquidity and volatility:

- Liquidity – Assets and derivatives can be bought and sold easily in liquid markets, for example, major forex pairs. As a result, brokers have greater price confidence and can offer tighter spreads to traders. Illiquid markets, on the other hand, such as exotic currency pairs, normally have wider spreads.

- Volatility – Instability in the market can widen spreads as buyers and sellers struggle to agree on the true value of an asset. This is why spreads on cryptocurrencies, for example, are generally higher than spreads on popular stocks and forex pairs.

How Trading Brokers Make Money

There are two main ways brokers make money: spreads and/or commission. Brokerages may also charge other fees like deposit and withdrawal rates but spreads and commission are the primary income generators.

Trading platforms make money from spreads by imposing a mark-up on the bid and ask price. This means the bid price comes in slightly above the underlying market while the ask price is slightly below the underlying market. Now while this fee might be small on each trade, over many thousands of orders, this can add up.

One important consideration when looking at brokers with low spreads is that many firms also charge a commission. This is usually a flat fee per trade and can compensate for tighter spreads.

Below we list some of the key brokerage models, which can influence how spreads are charged and quoted.

ECN Brokers

Many brokers with low spreads use an ECN (Electronic Communication Network) model. This system connects buyers directly with liquidity providers. Liquidity providers then compete against each other for the buyers’ order, often leading to more competitive spreads for investors, sometimes coming in at close to zero pips.

Importantly, the interests of an ECN broker do not conflict with those of the trader. This contrasts with the market maker model (details below), where firms take the opposing side of an investor’s trade.

In return for the lowest spreads, ECN brokers normally charge a commission per trade and require a higher minimum deposit. This can make it harder to find forex brokers, for example, with low spreads and low minimum deposits.

STP Brokers

STP (Straight Through Processing) brokers share many similarities with ECN platforms. They are both no dealing desk (NDD) brokers, which means they do not act as the counter-party to a trade – they are simply an intermediary.

With that said, one key difference between STP and ECN brokers is their use of spreads and commissions. Whereas ECN brokers with low spreads typically charge a commission on each trade, STP providers generally impose a mark-up on the spread. As a result, spreads at STP brokers are usually higher.

Market Makers

Dealing desk brokers are also referred to as market makers. They take the opposing side of a trader’s position, i.e. they will buy the stock you want to sell. Importantly, market makers fix the bid and ask price to ensure trades are profitable for them. This means that market makers generally have higher spreads than ECN platforms. It also means market makers make money when traders’ take out losing positions – arguably creating a conflict of interest.

Pros of Brokers With Low Spreads

- Easier to generate profits (subject to commission rates)

- Lower costs for those making multiple trades (e.g scalpers)

- Reliable trading experience as prices quoted are closer to the real market value of an asset

Cons of Brokers With Low Spreads

- ECN brokers with low spreads often charge a commission too

- Low spreads can widen quickly during periods of market volatility

- Less active traders may not benefit a huge deal from minor price discrepancies

Comparing Brokers With Tight Spreads

With a long list of brokers now offering low spreads, it is important to consider other key elements of a firm’s offering:

Commission

Brokers with low spreads may compensate for any gains with a hefty commission. This is typically a fixed fee for a given volume traded. So make sure you calculate the total cost of a trade, i.e. the spread plus the commission. Traders can then work out to what extent the market needs to move to make money.

Other Fees

In addition to the commission, brokers may impose other fees to compensate for their low spreads. So check deposit and withdrawal fees – ideally, you want a broker that offers fee-free payments. Other charges include currency conversion fees and overnight rates (relevant for swing traders holding positions over multiple trading days).

Markets

The lowest spreads are generally found in the most liquid markets, for example, major forex pairs and precious metals like gold. Traders looking to speculate on more volatile or illiquid markets should look to see if fixed spreads offer better value for money. The best brokers will offer all or most of the following:

- Forex

- Indices

- Stocks

- Commodities

- Cryptocurrencies

Trading Platform

Some of the most well-known trading platforms supported by brokers with low spreads are MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Check the breadth of indicators and charts on offer. Other features to consider include copy trading, algorithmic investing and mobile compatibility.

Trade Execution

Placing an order is not the same as executing a trade. The price at which the trade is executed may be different to the price you were quoted on your screen (known as slippage).

A key factor influencing the speed of executions is whether your broker offers market execution or instant execution. Despite its name, instant execution can be slower as it often involves the trader receiving re-quotes. With market execution, on the other hand, there are no re-quotes and the trade is executed at the best price closest to the price quoted.

Customer Support

Although choosing a reputable broker with low spreads should reduce the likelihood of things going wrong, it is always good to know there is someone on-hand to deal with any issues you may encounter. Live chatbots can be a quick way to get in touch with brokers and some firms make this feature available 24/5. Traders should also be able to contact their broker by email, phone or social media.

Bottom Line on Brokers With Low Spreads

Brokers with very low spreads can increase profits for investors, particularly for high-volume traders. Investors looking for the lowest spreads may want to sign up with an ECN broker and trade liquid markets. Remember though, ECN brokers might charge a commission on top of the spread. Also, minimum deposit requirements are usually higher.

FAQ

What Is A ECN Broker?

An ECN (Electronic Communication Network) broker links buyers directly with liquidity providers. ECN platforms generally offer lower spreads than market makers, though they often charge a commission.

What Are Fixed Spreads?

Fixed spreads do not change when the market fluctuates. They may be better value for traders in illiquid or volatile markets.

How Are Spreads Measured?

Spreads are measured in pips (percentage in point). 1 pip is normally equal to 0.0001, which means it measures the change in the fourth decimal place (except for Japanese currency pairs where the change in the second decimal place is measured).

Are There Nasdaq 100 Brokers With Low Spreads?

Yes – AvaTrade offers a Nasdaq 100 CFD with a spread of 1 pip. CMC Markets’ Nasdaq 100 (cash price) is slightly higher at 2 pips.

What Are The Forex Brokers With The Lowest Spreads In Nigeria?

Many forex brokers offer services to customers in Nigeria. An example of a platform with spreads as low as 0 pips on major currency pairs is XM.