Social Trading Platforms And Brokers

Social trading allows investors to benefit from the experience of professional traders. Online platforms and mobile apps essentially connect seasoned investors with beginners looking to learn about the forex, stock or crypto markets. This guide to social trading explains how it works, alongside the benefits and risks. We also list the top brokers and exchanges in 2026.

Top Brokers For Social Trading for United States

Social Trading Explained

Social trading networks are designed to bring like-minded investors together. As well as interacting to exchange investing tips and tricks, users can also subscribe to professional traders and replicate their positions. This process can help aspiring investors learn about new instruments, strategies and risk management techniques.

Importantly, social trading comes in different forms. Some companies and fintechs offer signals that simply notify users of the trades that professional investors make. Alternatively, other platforms offer automated copy trading, which mirrors positions across live accounts.

Today, social trading platforms are rivalling traditional brokers like Robinhood, providing a modern, technology-enabled way to invest in popular financial markets. They are also growing in popularity across the globe, with brands extending their customer base to the USA, UK, Canada, Germany, Hong Kong, Singapore, India and the Philippines, among others.

Importantly, social trading is legal and regulated, much like the rest of the financial services industry. The best social trading organisations and websites hold licenses with trusted agencies, including the Cyprus Securities & Exchange Commission (CySEC), the UK Financial Conduct Authority (FCA) and the Australian Securities & Investment Commission (ASIC).

History

Social trading has been around in some form for a long time. A few decades ago traders might grab a drink together and discuss the positions they had opened that day, exchanging information for free. One trader could tell the community about a particular position that seemed a shoo-in to make a profit. The other traders might then copy that trade and take out a position the next day.

The modern social trading business model has simply evolved in line with technology. First came email, then chat rooms, forums, blogs, vlogs and videos on YouTube. As the years have passed, more tools and widgets have become available for traders to spread quotes and information. With each advancement, professional traders and market leaders are able to tell more people about their positions and trading statistics.

It wasn’t long before online brokers saw an opportunity to create user-friendly platforms to bring traders together. eToro was among the first big players to make a move in this space, launching the OpenBook platform in 2010. This allowed traders to share details of their trading activities, as well as view the positions of expert investors in real-time. Other platforms have since caught up, with brokers like IG, XM, LiteForex and XTB all offering top-rated solutions. Independent platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5) and TradingView also support social trading services.

Social trading also hit the mainstream media in 2021 as Reddit users went against a hedge fund and conducted a short squeeze on GameStop stocks. This group of traders were able to increase the value of GameStop from $17.25 to over $500 per share. Whilst not a typical example, it shows the potential impact social trading can have in that it fuels market speculation.

How Social Trading Works

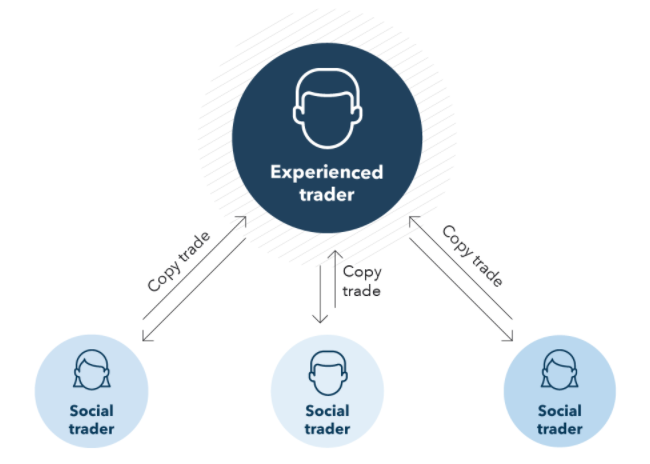

Professional traders essentially share their activities and positions in a bid to get new traders to hit ‘follow me’. The users on the network then choose the investors that they would like to subscribe to and see the activity of. Customers can also use fully integrated systems such as copy trading, which mirrors the positions of professional traders.

Let’s say you subscribe to trader A. You would receive a broadcast or list of all the positions they open. So if trader A invests in Meta Platforms Inc, you would be notified of this along with the underlying details, for example, position size, timings, plus stops and limits. You can then choose whether to replicate that position in your own account or if you’re using an automated copy trading system, that position will be opened automatically for you.

IG Trading Example

Copy Trading

Copy trading and social trading after often thought of as the same. But while it is true that all copy trading is a form of social trading, social trading is not always copy trading.

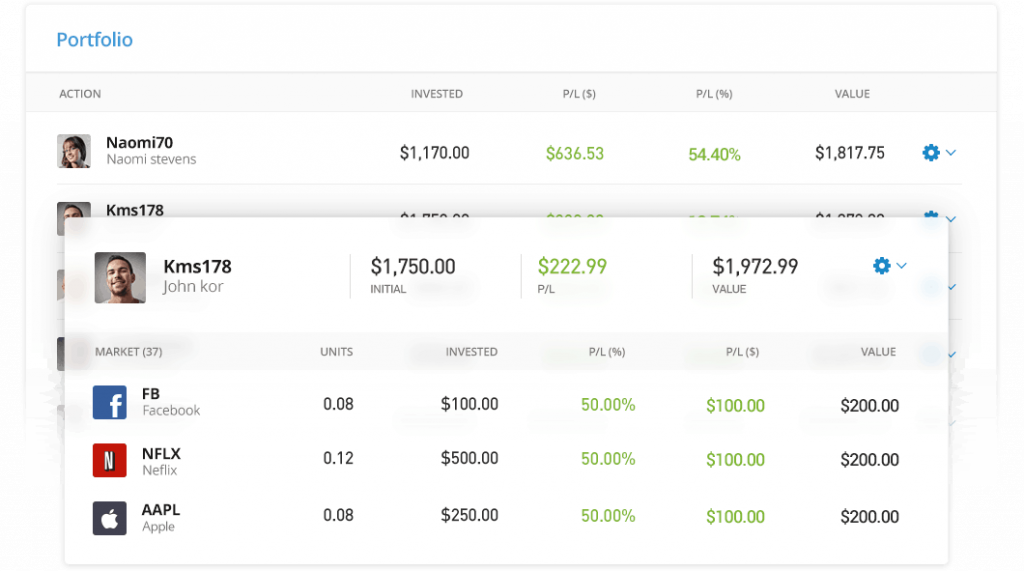

On copy trading platforms, users follow investors and automatically place the same trades. Professional traders are ranked against different criteria, such as profitability, maximum drawdown (the greatest loss of funds after a run of poor positions), number of followers and more.

New traders, or those who are struggling, can use this information to decide which professional trader they wish to copy. Equally, they can also decide what percentage of capital they wish to invest in the same positions. For example, if they set a 10% rate, a $50 trade by the professional would be copied as a $5 trade for the beginner. Positions are automatically closed at the same time as the trader, so the profit or loss is relative.

Mirror Trading

Mirror trading is particularly popular in forex trading. And while it sounds similar to copy trading, there are some differences. The most important of these is that in mirror trading you do not mirror a trader; you mirror a strategy.

A trader will weigh up factors such as the currencies they wish to trade, their risk appetite, how much they wish to make and how much they are willing to lose. They can then use this information to select a trading strategy that suits their needs.

Each strategy also has a developer. When the developer opens a position, that trade is automatically placed by the investor. For example, if the investor decides to short the USD/GBP forex pair, the same position is opened in the investor’s account.

Mirror trading can require a large amount of capital due to it being fully automated with high trading volumes. As such, it can be risky and tends to be used by experienced forex traders.

Signals

Signals are a more manual form of social trading. Signals are provided by professional and experienced traders, either for free or through a subscription service. But importantly, the customer or subscriber does not automatically open the same positions.

Swing traders can subscribe to signals for many different markets, including forex, stocks, commodities and cryptocurrencies. Signals are either generated by traders themselves through research and analysis, or through an algorithm. They are then typically sent to subscribers through an email or text, and the trader can decide whether to place the same trade. Importantly, any delays can result in the positions being outdated and unprofitable.

Signals are arguably the safest form of social trading. They retain some form of autonomy and do not relinquish full control to a professional trader.

Market Access

Social trading was first used to mirror successful forex strategies. However today, it can be applied to any market, from major FX pairs and US stocks to precious metals like gold, futures, options and ETFs. At an exchange like Binance and Kucoin, traders can also copy positions on Defi assets like Bitcoin. The IQ Option and Pocket Option platforms even facilitate social trading for binary options.

Benefits

The main advantages of social trading include:

- Profit from the knowledge of trading gurus

- Regulations govern online trading brokers

- Interact with like-minded investors

- Brokers offer ranking leaderboards

- Capitalise on market trends

- Teaches decision making

- Removes emotion

- Builds confidence

Risks

Our research did flag some potential drawbacks too:

- Downplays the knowledge required to trade financial markets

- Hinges on other traders being successful

- Can risk lots of capital

eToro Social Investing Platform

How to Compare Social Trading Platforms

Many online brokers support social trading in 2026. To help you decide which platform is best, we have compiled a list of key considerations:

- Fees – This is one of the most important factors. You need to look at the spreads for different assets, any deposit and withdrawal fees, plus the commission charged by the professional trader you follow

- Minimum deposit – Try to find a broker with a minimum deposit that you are comfortable with. Beginners normally use a broker with a low minimum deposit, such as XTB

- Funding methods – Most brokers accept multiple forms of payment. Ensure your chosen platform supports a method you are familiar with, such as PayPal or bank transfer

- Leverage – If you want to increase profits, you may want to trade with leverage. Compare the various levels of margin available at top brokers. Note, if the online broker is located in the EU, leverage will likely be limited to 1:30

- Currencies – Check you can fund your account in the currency you use day-to-day. So if you are investing from a less well-known trading country, say Poland, check whether they accept the Zloty

- Customer service – Customer support will be important if you encounter issues, so ensure your broker has reliable and responsive customer service representatives. Pepperstone, for example, offers 24/7 support online

- Assets – Social trading brokers often specialise in different assets, from forex to stocks and indices. Find a platform that supports trading in the markets that you’re interested in

- Mobile app – If you are going to be trading on the move, check the broker has an accessible mobile app. Exness, for example, has an application that you can download for free on iPhone (iOS) and Android (APK) devices

Tip: trial social investing brokers using a demo account before risking real cash

Social Trading Verdict

Social trading websites help new investors get involved in the financial markets by leveraging the expertise of seasoned traders. But as with any form of trading, it is not without risks – even professional investors can have off days. Follow our guide to find the best social trading broker for you.

FAQ

Is Social Trading Good?

Social trading has many positive qualities, including that it opens up investment opportunities to beginners. However, it does have some drawbacks, particularly as it downplays the knowledge required to trade financial markets.

What Is The Best Social Trading Broker?

There is no simple answer to this question. Each social trading broker has different pros and cons. Read our reviews of top brands like eToro and Pepperstone to find the best option for you.

Is Social Trading Risk-Free?

Social trading is not risk-free. Even the most experienced investors can have bad days and suffer losses. As a result, it’s important to employ effective risk and money management techniques.

Is Social Trading The Same As Copy Trading?

Social trading and copy trading are similar but not quite the same. Copy trading is a form of social trading, where the subscriber places all the same trades as the person they are following. In contrast, social investing services normally give users the option to replicate positions and apply their own parameters.

What Can I Invest In With Social Trading?

Social trading platforms were originally used to trade forex, but they have since expanded. Today, almost any asset can be followed, including stocks, ETFs, commodities and cryptocurrencies.