Best Forex Brokers For Swing Trading 2026

Choosing the right forex broker is the first step to successful swing trading currencies. But I know from personal experience that finding the right fit can be tough, with many platforms claiming to offer the best FX tools and lowest fees.

That’s why we reveal the best forex brokers that combine reliability, performance, and user-friendly features to help you swing trade confidently.

Forex Brokers for United States

How SwingTrading.com Chose The Best Forex Brokers

Our selection of the best swing trading forex brokers is based on a thorough evaluation process incorporating over 200 distinct data points. This includes an in-depth review of forex-specific features to identify platforms catering to currency swing traders.

Key factors include trading costs (such as spreads on major currency pairs), the number of forex assets, and mobile app ratings.

Through extensive hands-on testing, we’ve identified brokers that deliver strong overall performance – like intuitive platforms and responsive customer support—and offer the tools and features that matter most to serious forex swing traders.

How To Compare Forex Brokers

Regulation & Safety

In forex swing trading, where positions often stay open for days or weeks, it is essential to choose a broker that prioritizes regulation and safety.

One of the biggest lessons I’ve learned from years of swing trading forex is that broker reliability isn’t a luxury – it’s a necessity. Holding trades through volatile news cycles or weekend gaps means you’re vulnerable to the market and your broker’s integrity and stability.

This is why swing traders should only consider brokers regulated by top-tier financial authorities. Trusted regulators like the UK’s FCA, Australia’s ASIC, and CySEC in the EU impose strict standards on capital reserves, client fund segregation, and operational transparency.

These protections help ensure that your broker will not fold under pressure or mishandle your funds when the market gets rough.

Beyond regulation, look for brokers offering segregated client accounts, meaning your money is kept separate from the broker’s finances. Negative balance protection is also crucial – it prevents you from owing money if a leveraged trade turns sharply against you, especially during low-liquidity market gaps.

Another often overlooked point is transparency on margin requirements and overnight financing fees. Swing traders live and die by these details. Even if you’re 100 pips in profit, unexpected swap fees or unclear margin calls can quietly chip away at your gains. The best forex brokers make this information easily accessible and don’t hide critical terms in fine print.

Top brokers also invest in digital security, including two-factor authentication (2FA) and encrypted account access. When you’re holding multiple trades and managing risk across time zones, the last thing you want is to worry about account breaches.

In swing trading forex, your broker’s regulatory standing and safety practices aren’t just background details—they’re part of your edge.

Forex Assets

For swing traders in the forex market, access to a wide range of currency pairs and related assets is key to capitalizing on medium-term price trends.

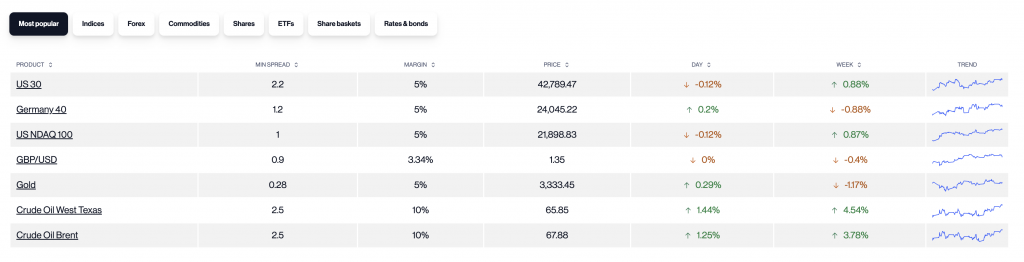

Top forex brokers offer more than just major pairs like EUR/USD or GBP/JPY—they also provide cross pairs, exotics, and sometimes even correlated assets like commodities or indices for broader strategy execution.

Most swing traders use CFDs or other leveraged instruments, which allow you to speculate on price movements without owning the underlying asset. This is ideal for swing trading, where the goal is to capture price swings over several days to a few weeks.

While forex is the core focus, swing trading strategies can extend across related markets. Here’s how:

- Forex: Currencies tend to move in reaction to macroeconomic trends, central bank decisions, and geopolitical shifts. For example, a well-timed swing trade on a major currency pair following a central bank decision can play out over several days and deliver significant gains. Success in these scenarios often comes down to patience and a solid grasp of the underlying market drivers.

- Commodities: Many forex traders watch gold or oil as part of a macro play. If inflation data is expected to rise, a long gold position held through the week can be a smart swing trade that complements your broader currency thesis.

- Indices: While not strictly forex, global indices often influence currency sentiment. If you’re trading EUR/USD, tracking the DAX or S&P 500 can give insight into risk appetite—potentially justifying a longer-term bullish or bearish stance on the euro or dollar.

That said, not all brokers are created equal regarding asset access. A strong forex broker will provide diverse currency pairs, including majors, minors, and exotics, competitive spreads, and reasonable swap rates for holding positions overnight.

Ultimately, a swing trader’s edge often comes from choosing the right market at the right time—so your broker must offer that flexibility.

CMC Markets offers over 12,000 financial instruments, including over 330 forex pairs

Trading Platforms

Even with tight spreads and a wide selection of currency pairs, a subpar trading platform can quickly sabotage a forex swing trading strategy—especially when margin is involved.

When swing trading forex, timing and precision are everything. A laggy interface, delayed data feed, or clunky order system can mean missing an ideal entry or getting stopped out too late, turning a well-planned setup into a frustrating loss.

This is especially risky when trading with leverage, where minor missteps can escalate into margin calls or unexpected drawdowns. That’s why you need more than just a basic platform—you need a reliable, feature-rich environment built to handle multi-day trades with accuracy and control.

From personal experience, accessing advanced charting tools, customizable indicators, and smooth execution is non-negotiable. For instance, I managed a swing trade on USD/JPY over four days using a strategy based on the 14-day RSI and trendline confluence. A responsive platform helped me set precise entry and exit levels, while real-time swap rate visibility ensured I stayed in profit despite holding the position through a weekend.

Effective swing trading platforms should allow for deep technical analysis across multiple timeframes, real-time price data, and integrated risk tools like stop-loss, take-profit, and trailing stops. Seeing your margin usage and adjusting position sizes on the fly is critical when the market moves fast.

Most reputable brokers offer access to both proprietary and third-party platforms. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are staples in the forex world, especially if you value advanced indicators, script-based automation (Expert Advisors), and detailed trade management.

Platforms like cTrader should appeal to those who prefer a sleek interface with more transparent order book depth and intuitive order types.

TradingView, on the other hand, is ideal for planning setups. Its clear multi-timeframe charts and Pine Script features allow you to design and test swing trading ideas across currency pairs and correlated assets like gold or major indices.

Some FX brokers also offer proprietary platforms explicitly built for active traders. These often include features like a real-time economic calendar, integrated news feeds, margin calculator, and alerts for volatility spikes or margin thresholds—all beneficial when swing trading forex around events like non-farm payrolls or central bank announcements.

Your trading platform is your control center. For swing trading forex, you need one that’s fast, flexible, and fully equipped to handle both the analysis and the execution—because in this game, the right tools can be the difference between catching a clean move and watching it slip away.

TradingView offers powerful charts, custom indicators, and real-time data

Margin & Leverage

Margin and leverage play a central role in swing trading forex. Since swing traders typically aim to capture price movements over several days or weeks, leveraging allows you to open larger positions than your account balance would otherwise permit—amplifying potential profits (and losses).

In forex, brokers often offer leverage ratios ranging from 1:10 to 1:5000, depending on your location and the broker’s regulation. A relatively small capital margin can control a much larger trade size.

Swing traders must know overnight financing charges (swaps) and margin requirements. These costs can quietly eat into your profits if not accounted for, especially on longer trades. A strong understanding of margin calls, stop-out levels, and position sizing is key—because swing trading is not about over-leveraging; it’s about holding smart, calculated positions with room to breathe.

I once opened a swing trade on EUR/GBP using 1:50 leverage. The setup was based on a double bottom pattern forming near a key support zone. With a relatively tight stop-loss and a multi-day target of 120 pips, I only needed a modest margin outlay to take a meaningful position size. The trade played out over four days, and because my margin was managed correctly, I avoided unnecessary stress—even when the price briefly dipped near my stop-loss level.

Leverage is a powerful tool for swing trading, but it must be used responsibly. When combined with technical setups, proper risk controls, and an understanding of market drivers, margin can help you make the most of multi-day forex moves without exposing your account to unnecessary danger.

Fees, Spreads & Commissions

When swing trading forex, your profits are often made over multiple days—sometimes from moves of 100 to 1,000 pips or more. While you’re not entering and exiting dozens of trades a day like scalpers, trading costs still matter, especially over time. If you’re not careful, small fees can quietly add up and eat into your long-term returns.

Spreads—the difference between the bid and ask price—are significant when entering a trade.

I once took a swing position on EUR/AUD following a confirmed breakout on the 4-hour chart. The trade setup looked ideal, but I didn’t account for the wider-than-usual spread during late trading hours. By the time the trade turned profitable, I had already lost 20 pips to the spread alone. That trade taught me to always factor in spread variation based on time and liquidity.

Commissions also come into play, particularly with ECN or raw spread accounts. These accounts often offer tighter spreads but charge a flat fee per lot traded. This can be cost-effective if you place fewer trades, especially if the position sizes are consistent and well-managed.

Overnight fees—swap or rollover rates—are another hidden cost many new swing traders overlook.

On a trade in GBP/JPY, I held a long position for six days. While the trade hit my target with a solid 180-pip gain, I had to factor in five days’ worth of negative swaps, which reduced my overall profit. If I had held the same position in the opposite direction, the swap would have been positive—so understanding swap structures is key when planning multi-day trades.

The best FX brokers for swing trading are transparent with their pricing. They offer competitive spreads, reasonable swap rates, and commission structures that don’t punish more extended holding periods. Many even display real-time fee estimates in the trade ticket, which helps you plan your trades more precisely.

In swing trading currencies, your edge isn’t just in the strategy—it’s also in controlling costs. Lower trading expenses mean you can afford to be more selective, let your trades run longer, and focus on setups with real potential—without losing ground to unnecessary fees.

Bottom Line

To choose the best swing trading forex broker, focus on overall reliability, not just flashy features. Look for platforms that combine strong regulation, competitive trading costs, and smooth execution.

Ensure it supports multi-day strategies with tools for technical analysis, flexible leverage, and fair overnight fees. The right broker should align with your trading style, risk tolerance, and long-term goals.

FAQ

Should I Only Use A Regulated Swing Trading Forex Broker?

While it’s generally safer to use a regulated forex broker for swing trading—due to fund protection, transparent practices, and oversight—some traders intentionally choose unregulated brokers for high leverage or access to specific currency pairs.

However, this comes with increased risk, including weaker fund security and less accountability. You should only think about accepting these trade-offs if you’re an experienced trader with a high-risk tolerance.

What Features Should I Look For In A Swing Trading Forex Broker?

When choosing a forex broker for swing trading, look for features that support holding positions over several days.

Key considerations include competitive spreads, fair overnight swap rates, reliable order execution, and access to a wide range of currency pairs.

Ultimately, the best broker matches your strategy, risk tolerance, and trading style.