Best Margin Swing Trading Brokers 2025

Swing traders use margin accounts to supercharge their trades, borrowing funds to catch big moves over days or weeks. While this can boost profits fast, it also raises the stakes.

Margin requirements vary by region, so choosing the right broker matters. Find out which margin swing trading brokers give you the best shot at maximizing gains.

Best Brokers For Margin Trading for United States

How SwingTrading.com Chose The Best Margin Brokers

Our selection of the best margin swing trading brokers is based on comprehensive broker ratings from SwingTrading.com, which are derived from over 200 individual data points. As part of this evaluation, we examine more than eight margin-specific criteria to ensure each platform is well-suited for margin swing trading.

These criteria include trading fees (including spreads on major assets), available leverage, and any promotional offers geared toward margin traders.

Based on our in-depth testing, the platforms highlighted excel not only in overall performance – such as user experience and customer support – but also in features that matter most to swing traders using margin.

How To Compare Margin Trading Brokers

Regulation & Safety

A margin trading broker is more than just a platform – it’s your gateway to leveraged swing trades. These brokers let you borrow capital to amplify your positions, allowing you to take advantage of price moves that unfold over days or weeks.

One of the most overlooked yet critical aspects when comparing brokers is safety. You’re exposed to market risk for extended periods when trades are left open overnight or across weekends.

That makes the broker’s reliability and security essential. You need to know that your funds are protected, your data is secure, and that the broker won’t fail you during periods of high volatility.

After years of swing trading with margin, I’ve learned the hard way that transparency around margin requirements, stop-out levels, and overnight fees isn’t just fine print – it directly impacts your profitability. Over time, those hidden costs can quietly eat into your gains if you’re not paying attention.

A smart way to manage this risk is to stick with brokers regulated by well-established financial authorities.

Not all regulators are equal – some are notorious for being lax – but respected bodies like the UK’s FCA, Australia’s ASIC, and Europe’s CySEC enforce strict rules on how brokers operate, hold client funds, and manage risk.

These layers of oversight offer swing traders a much-needed buffer against unexpected issues.

The best margin brokers for swing trading also go beyond regulation. They keep client funds in segregated accounts, ensuring your money isn’t mingled with the broker’s operational capital.

They offer negative balance protection, a lifesaver if a position suddenly goes against you during a market spike or gap. They also implement modern security measures like two-factor authentication and encrypted connections to protect your account from breaches.

Markets & Assets

Top-rated margin swing trading brokers provide access to a broad spectrum of financial markets, allowing you to profit from short- to medium-term price movements – without taking ownership of the underlying assets.

Through CFDs or other leveraged instruments, you can open long or short positions based on your market outlook, amplifying potential gains (as well as risks).

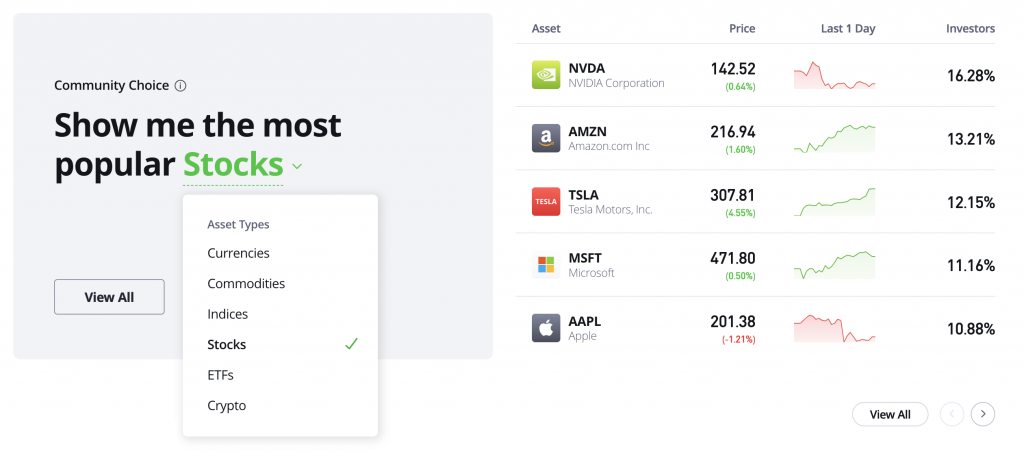

Swing traders commonly operate across the following asset classes:

- Stocks: Equities can capitalize on earnings cycles, sector rotations, or breakout patterns. For example, you might buy Tesla CFDs after a bullish earnings surprise, planning to hold the position for several days until the momentum fades.

- Forex: Currency pairs like USD/JPY or EUR/GBP often exhibit clear trends within weekly ranges. You can use margin to exploit moves triggered by central bank announcements or macroeconomic data releases.

- Indices: Benchmarks such as the Nasdaq-100 or FTSE 100 offer a way to swing trade broader market sentiment. If you anticipate a short-term recovery after a market-wide sell-off, you might go long on the S&P 500 with a stop-loss just below recent lows.

- Commodities: Volatile instruments like gold, silver, or crude oil are frequently traded on margin due to their rapid price swings. For instance, you might short oil CFDs in response to a surprise inventory build reported by the EIA.

- Cryptocurrencies: Digital assets like Ethereum and Bitcoin present high-risk, high-reward swing trading opportunities, particularly around key events like ETF approvals or regulatory updates.

While most brokers offer access to these major markets, some cater to specific segments. A broker specializing in US equities may offer extended-hours trading, advanced screeners, or lower commission structures – ideal for stock-focused swing strategies.

Conversely, a commodity trader may favor a broker that offers granular charting tools and low spreads on gold or oil CFDs.

Before opening any live margin account, I ensure the broker supports margin trading on the specific assets I plan to trade. It might seem like a small detail, but overlooking it can seriously disrupt your strategy – especially if you trade gold or a specific stock index. It’s a simple step that takes just a few minutes but can save you from wasted time, missed opportunities, and unexpected limitations.

Assess key features like leverage limits, overnight financing fees, and order execution speed. Testing these variables in a swing trading demo account can help ensure the broker’s environment aligns with your trading objectives.

eToro boasts a huge asset library for swing traders, from stocks to crypto

Trading Platforms

Even with a broker that offers competitive spreads and a diverse asset selection, a poorly performing trading platform can undermine your swing trading strategy – especially when using margin.

When swing trading, precision matters. A slow or unreliable platform can lead to missed entry points, delayed exits, and potentially costly errors that could have been avoided with better tools.

When leverage is involved, these issues are amplified, as minor mistakes can result in significant losses or even margin calls.

Swing traders relying on margin accounts need a platform that offers a stable and responsive trading environment, advanced charting features, and robust risk management tools.

It is crucial to be able to analyze multi-day price action, apply technical indicators like moving averages or RSI, and enter or exit trades quickly.

Additionally, having access to real-time data, precise margin requirements, and risk-control tools – such as stop-loss and take-profit settings – is vital for navigating short – to medium-term market swings.

Most reputable brokers provide access to in-house proprietary platforms and popular third-party software. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) remain industry standards if you prefer highly customizable charts, a wide range of indicators, and automated strategy options through expert advisors.

A platform like cTrader, on the other hand, offers a modern, user-friendly interface and enhanced market depth tools, making it well-suited for swing trading forex and indices.

TradingView, with its clean charts and powerful scripting language, is another platform ideal for planning and visualizing swing setups across multiple timeframes, especially for trading assets like gold, the Nasdaq, or Bitcoin.

Meanwhile, some brokers offer proprietary platforms with features designed specifically for active traders. These may include built-in news feeds, economic calendars, integrated risk calculators, and real-time margin tracking – features that can provide an edge when managing leveraged trades around high-impact events.

Swing trade on MT5 and catch market moves with powerful tools

Margin Requirements

Margin and leverage are powerful tools that can significantly enhance a swing trader’s ability to capitalize on market movements.

When you trade on margin, you’re essentially borrowing funds from your broker to increase your position size beyond your actual account balance. Leverage is the ratio that determines how much larger your trade can be compared to your invested capital.

For example, a leverage of 1:10 allows you to control a position worth $10,000 with just $1,000 of your own money.

Unlike day trading, where positions might open and close within minutes or hours, swing trading involves holding positions for several days or weeks.

This means you must be mindful of how leverage affects your exposure over time, including overnight financing costs that brokers charge for leveraged positions that are held beyond the trading day.

I’ve often spotted tech stocks quietly consolidating and taken a 1:5 leveraged position with margin. For example, turning $2,000 into a $10,000 trade meant a 6% price move could boost my actual return by around 30%. But I’ve also learned that when things go south, those losses multiply, too, so I never trade without tight stop losses and keeping a close eye on my margin.

Successful margin swing trading requires spotting the right market opportunities and understanding how leverage impacts your risk and rewards.

You must adjust your position size relative to your risk tolerance and be prepared for the costs and responsibilities of trading on margin over several days.

Fees, Spreads & Commissions

When swing trading with margin, fees, spreads, and commissions can quietly eat into your profits – or amplify your losses – over time.

Since swing trades are typically held for several days or weeks, these costs accumulate more noticeably than in short-term scalping or day trading.

Understanding how your broker charges and where those costs show up is crucial to maintaining a profitable strategy.

Spreads are the difference between the bid and ask price. While this cost is often negligible on highly liquid instruments like major forex pairs, it can become significant when trading less liquid assets or during volatile periods.

Commissions are another layer. Some brokers charge a flat fee per trade, while others charge based on trade volume.

Suppose you’re trading gold CFDs with a broker that charges a $5 commission per side. That’s $10 round-trip. This cost might seem small on a $30,000 position opened with 1:20 leverage using $1,500 of your capital.

Still, when combined with a spread and overnight financing, it can quickly reduce your gains – especially if your price target is relatively modest.

Then, there are overnight fees (also called swap or rollover fees), often overlooked by newer swing traders. Because leveraged positions involve borrowing capital from the broker, you pay interest every night you hold the trade open.

Let’s say you’re swing trading the S&P 500 index with a $20,000 position using $4,000 of margin, and you have it for a week. Even with a modest overnight rate, you could pay $30–$50 in financing charges just for holding the position. If your target profit was $400, those fees took a 10% bite out of your return.

Experienced swing traders always factor in these costs when setting targets, stop-loss levels, and calculating risk-reward ratios.

I’ve learned to avoid overtrading and instead focus on setups with enough room for profit that fees and spreads won’t ruin the trade. It’s not just about finding good entries – it’s about ensuring the cost of doing business doesn’t quietly erode your edge.

Bottom Line

To choose the best margin broker for swing trading, focus on their reputation for consistent trade execution and the quality of their customer support.

Consider their range of markets and whether their platform suits your specific trading style and strategy.

It’s also important to carefully review their fee structure, including overnight financing and commissions, to ensure your costs don’t affect your profits.

FAQ

Should I Only Use A Regulated Margin Swing Trading Broker?

Using a regulated margin swing trading broker is generally the safest choice, as it ensures client fund protection, transparent margin rules, and oversight by financial authorities.

However, some high-risk or highly experienced traders may consider non-regulated brokers for access to high leverage, looser restrictions, or niche markets. Remember that this comes with significantly greater risk, and due diligence is essential.

What Features Should I Look For In A Margin Swing Trading Broker?

When choosing a margin swing trading broker, look for transparent margin requirements, competitive spreads, and reliable order execution to ensure your trades enter and exit smoothly.

Robust risk management tools like stop-loss orders and real-time margin alerts are essential for controlling leveraged positions. Additionally, a user-friendly platform with advanced charting and technical analysis features will help you identify swing opportunities effectively.