Cheapest Brokers For 2026

Understanding how trading brokers make money is essential for anyone entering the financial markets. The cheapest brokers for swing trading stocks, forex and CFDs attract a lot of attention, particularly from beginners looking to minimise costs.

Low fees are appealing, but choosing a broker based solely on pricing can be shortsighted – I know from personal experience.

Dig into our selection of the swing trading brokers with the lowest fees based on cost structure and overall service quality. We also explain how trading platforms generate revenue, helping you recognize where costs might be hidden.

CFD Brokers for United States

How SwingTrading.com Chose The Cheapest Brokers

To identify the brokers for swing trading with the lowest fees, we evaluated more than 10 types of trading costs across key asset classes commonly used by swing traders – including stocks, forex, cryptos, and CFDs.

Our analysis focused on fees that matter most to swing traders, such as spread costs, round-trip commissions, overnight financing charges (swap rates), and less obvious charges like inactivity or withdrawal fees.

Each broker was assigned a cost score from 0 to 5 (with 5 being the most cost-effective). We combined these scores with insights from our hands-on platform tests to highlight brokers offering a balance of low trading costs and user-friendly tools suited to swing trading strategies.

How Do Swing Trading Brokers Earn Money?

Swing trading brokers, like any financial service provider, generate revenue through a variety of trading-related fees.

While day traders may focus on speed and frequency, swing traders typically hold positions for several days to weeks—so the cost structure that affects them is slightly different.

These are the five main ways brokers earn money from swing traders:

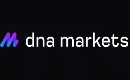

1. Spreads

Many brokers we test build their profits into the spread, which is the difference between the buy (ask) and sell (bid) price of an asset.

Swing traders might not be as sensitive to small spread differences as scalpers or day traders, but over time, wide spreads can still eat into returns—especially when trading high-volume or lower-volatility instruments like blue-chip stocks or major forex pairs.

Pepperstone – Forex Spreads

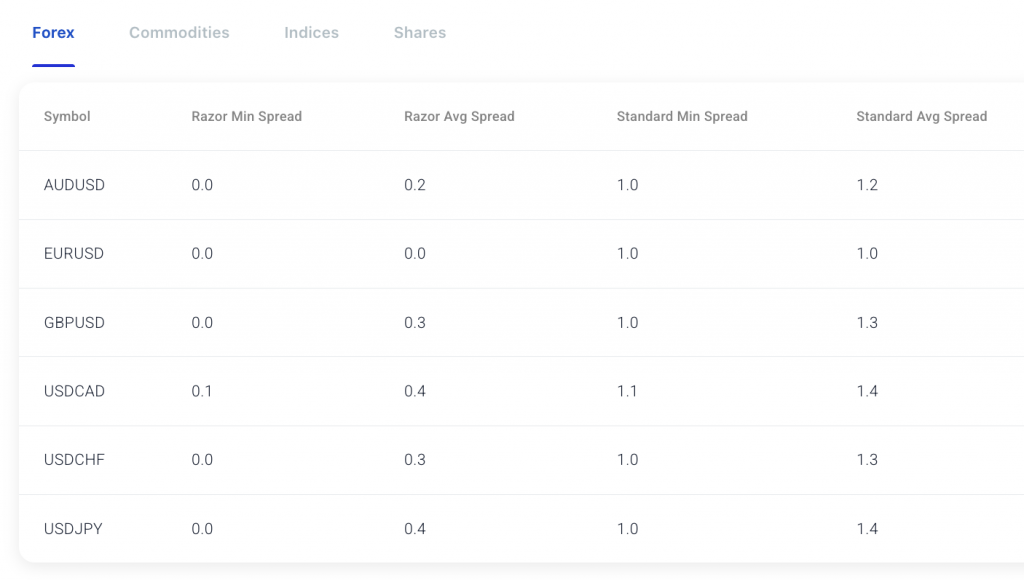

2. Commissions

Some brokers, particularly those offering ECN or DMA access, charge a fixed commission per trade instead of (or in addition to) widening the spread.

This model appeals to swing traders who want transparency and often trade larger position sizes. For example, you might pay a flat fee of $7 per trade or a percentage of the transaction volume.

Pepperstone – Forex Commissions on MetaTrader

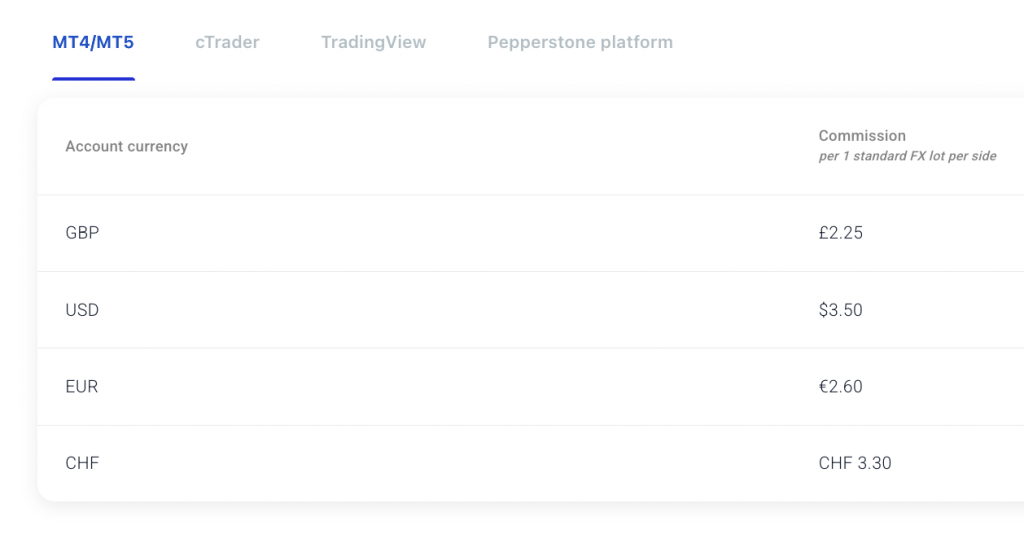

3. Overnight Financing (Swap) Fees

Perhaps the most swing trading-specific cost is the overnight financing fee, also known as a swap or rollover rate. Since swing traders hold positions overnight—often for several days—these charges can accumulate quickly.

Brokers apply these fees for leveraged positions to cover the cost of borrowing the capital. This is especially relevant when trading forex or CFDs, and rates can vary significantly between brokers and asset classes from our analysis.

Pepperstone – Overnight Fees

4. Inactivity and Maintenance Fees

Some brokers charge inactivity fees if an account is dormant for a set period, such as three or six months. While not directly tied to swing trading, it’s a hidden cost to consider if you trade infrequently or take breaks between trades.

Other potential charges include withdrawal fees, account maintenance fees, or data subscriptions for advanced charting tools.

5. Currency Conversion Fees

If you’re trading international stocks or forex pairs that differ from your base account currency (e.g., buying US tech stocks with a GBP-funded account), you may incur currency conversion costs.

These can subtly reduce profitability over time, especially for swing traders who are holding and closing multiple positions across different currencies.

As an experienced swing trader, I’ve learned to look beyond just the headline spread or commission when evaluating brokers.

The true cost of swing trading includes not only entry and exit fees but also ongoing costs tied to holding positions—making it essential to choose a broker that minimizes swap rates and hidden charges.

How to Choose a Low-Cost Broker for Swing Trading

After personally testing dozens of platforms and breaking down their swing trading fee structures, here are the key considerations to focus on when choosing a low-cost broker:

Overnight Financing

If you’re swing trading CFDs or forex, swap rates are arguably your most important cost to monitor. These are daily charges applied to positions held past market close, and they vary not just by asset, but by broker and even market conditions.

In our testing, we found that some brokers offer relatively low or even positive swap rates (you get paid to hold), especially on major currency pairs. Others can quietly charge over 2% annually in overnight costs—enough to erode gains from well-timed trades.

Tip: Always check a broker’s published swap rate list (often buried in their platform or website). Better still, test it in a demo account or a small live account to see how much is deducted day by day.

Commissions & Spreads

We see some brokers make bold claims about “zero commission” trading—but much to our irritation, then they widen the spread (the difference between buy and sell price) to make up for it. Others charge tight spreads but add a clear commission per trade, often $3–$6 per side.

We personally favor brokers with transparent pricing—either raw spreads plus fixed commissions (ideal for larger positions), or ultra-tight all-in spreads.

For swing trading, spreads matter less than ultra-short-term trading strategies, but they still affect your entry and exit points, especially in volatile markets like indices or gold.

Look for brokers with fixed or consistently low spreads, especially during off-peak hours when spreads can widen unexpectedly.

Market Access

Swing trading opportunities often come from macro trends, earnings releases, or technical patterns. That’s why it’s vital your broker gives you access to a wide range of instruments, including major stock indices (like the S&P 500), large-cap equities (like Apple), forex pairs (like EUR/USD), and ETFs (like WisdomTree Physical Silver)

During testing, we’ve seen that some “discount” brokers limit you to a narrow set of CFDs or only forex, which can restrict your strategy. Others offer thousands of tradable assets with competitive pricing—without charging extra for the variety.

Hidden Fees

While less visible, account management fees can quietly eat into your swing trading profits—especially if you only trade occasionally.

These include:

- Inactivity fees (common after 3–12 months of no trading)

- Withdrawal charges (especially for international transfers)

- Currency conversion fees (if your account base currency differs from the trading asset)

Some swing trading brokers we’ve reviewed are completely free of these charges, while others charge $10/month for inactivity or take 1–2% on currency conversion.

These seemingly minor fees can pile up over time—I’ve learned that firsthand through years of swing trading, where even small recurring charges can quietly eat into overall returns.

Platform Functionality

Low-cost shouldn’t mean low-quality. As a swing trader myself, I rely on platforms that offer good technical analysis tools, clear charting, and the ability to manage risk with stop-loss and take-profit orders.

While some brokers cut costs by offering only a basic web platform, others support MT4, MT5, TradingView or cTrader (my personal favorite)—all of which give you the power to analyze and time your trades effectively.

Bonus: Look for brokers with built-in economic calendars, sentiment tools, or pattern scanners to help find swing setups without needing multiple apps.

Account Tiers: Don’t Overpay for “Premium” Perks

Some swing trading brokers offer tiered account types—and while the perks can be appealing (lower commissions, tighter spreads, dedicated support), they often require large deposits or high trading volume.

We’ve evaluated both standard and VIP-style accounts. In some cases, the cost savings were worth it—but in others, the standard account had 90% of the benefits with none of the commitment.

If you’re not trading large positions daily, a standard account with no hidden fees might be more cost-effective than chasing elusive “pro” rates.

Regulation & Broker Safety: Low Fees Can Come at a Cost

It’s easy to be drawn in by brokers advertising ultra-low fees—but from our own testing, we’ve seen that some of the cheapest platforms come with serious trade-offs in safety and service quality.

Several offshore brokers we tested offered attractive pricing structures, only to fall short on key areas like execution speed, customer support, or fund protection. If you experience major slippage and delayed order fills, that can completely undermine the cost savings.

That’s why we recommend choosing a swing trading broker regulated by trusted authorities like the SEC (US), FCA (UK), ASIC (Australia), or CySEC (EU).

These regulators enforce strict standards on client fund segregation, leverage limits, and operational transparency—providing an extra layer of protection for swing traders, especially when holding larger positions overnight or over weekends.

Warning: Offshore brokers under weak or no regulation may not offer recourse if something goes wrong—whether that’s platform downtime, denied withdrawals, or unfair execution.

When testing brokers, we include regulatory status and reputation for reliability as core criteria—not just pricing—because long-term success in swing trading depends just as much on safety as it does on cost-efficiency.

Bottom Line

Low-cost brokers continue to attract attention—and for good reason. They offer a practical way to minimize trading expenses, allowing more of your capital to be invested in actual market exposure rather than fees.

However, our evaluations show the cheapest option doesn’t always mean the best overall value. Some discount brokers cut corners in other areas to keep costs low.

This might include a stripped-down platform, fewer educational resources, limited customer support, or a restricted list of tradable assets.

In some cases, low-cost brokers operate with light regulatory oversight, which can raise concerns about security and transparency. Hidden costs—such as inactivity fees, wide spreads, or deposit and withdrawal charges—can quietly eat into profits.

The key takeaway is that cost should be one part of a broader decision-making process. Finding the right broker for swing trading involves weighing fees alongside platform functionality, support quality, asset variety and regulatory protections.

FAQ

Is The Cheapest Broker The Best For Swing Trading?

While low-cost brokers can save money, we’ve found they may lack advanced tools like trading signals, screeners, or economic calendars. Some also rely on basic platforms that limit in-depth technical and fundamental analysis.

So, while price is important, it should not be the only factor when choosing a broker.