Best Swing Trading Simulators 2025

Want to master swing trading without risking a dime? Step into the world of swing trading simulators – your safe haven to test strategies, sharpen skills, and build confidence.

Whether you are a curious beginner or a seasoned trader, we rank the best swing trading simulators in 2025 to take your skills from average to expert.

Best Swing Trading Brokers With Simulators for United States

How SwingTrading.com Chose the Best Trading Simulators

Our list of the top trading simulators is built on SwingTrading.com’s rigorous evaluation system, using 200+ data points and hands-on tests to assess the overall quality and user experience for those making simulated trades.

The simulator providers listed and have been ordered by their overall ratings.

What Is A Swing Trading Simulator?

A trading simulator is an interactive platform designed to mirror real market dynamics but with virtual money.

It lets you buy and sell financial instruments—stocks, forex, and cryptocurrencies—without any actual risk to your capital. Think of it as a sandbox to experiment, refine your strategies, and build confidence before stepping into live markets.

Simulators aren’t just for beginners—they’re also powerful tools for experienced traders.

I’ve relied on simulators to practice handling sudden market reversals and unexpected gaps during fast-moving markets when prices can shift wildly in minutes. It’s an invaluable way to sharpen my reaction skills and stay prepared for real trading scenarios.

Imagine testing how a stock swing trade would react to a sudden earnings miss or a geopolitical event. With a simulator, you can fast-forward through these scenarios and refine your decision-making in a risk-free environment.

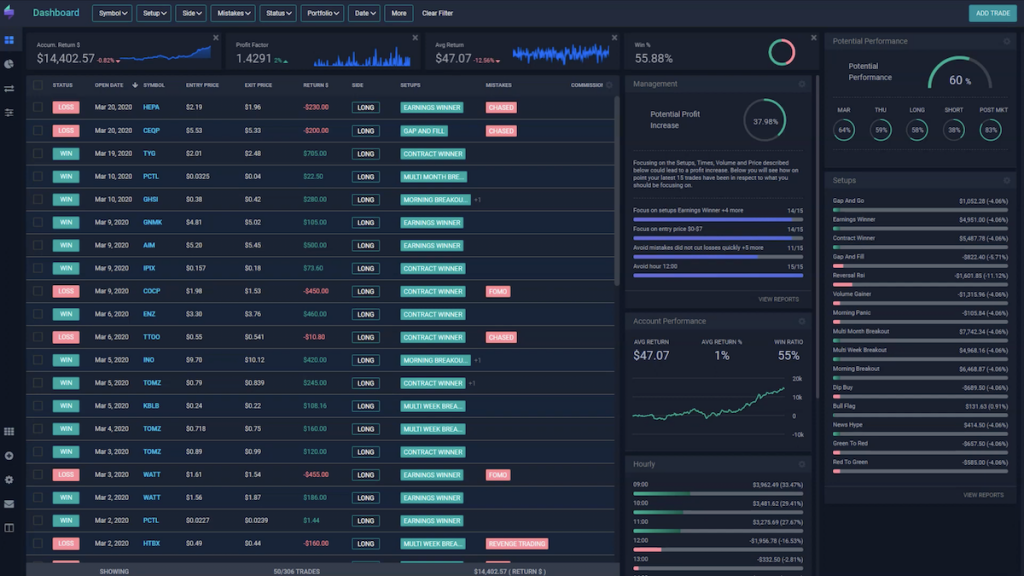

Simulators like TraderSync help you practice and improve strategies risk-free

Is A Trading Simulator The Same As A Demo Account?

A trading simulator is a tool that largely operates separately from any broker. Its primary purpose is education and strategy development, offering a risk-free environment to practice and experiment.

The best trading simulators provide flexible platforms for practicing swing trading across various markets. These simulators often include historical data, market replays, and customizable scenarios, making them ideal for new and seasoned traders.

For example, you could use a simulator to practice trading through historical events like flash crashes or unexpected earnings releases, which often trigger sharp price swings.

These scenarios help swing traders learn to manage trades during high-volatility periods. Broker demo accounts typically don’t offer this level of flexibility.

When testing my swing setups, I realized that trading simulators give me a lot of room to experiment with trade entries and exits using past data. Meanwhile, demo accounts let me test how well those setups translate into broker environments with live conditions. Using both tools helped me identify weaknesses I might have missed otherwise.

In contrast, a broker’s demo account replicates the broker’s live trading platform, mirroring real-time pricing, execution, and asset availability.

While the range of assets might be narrower, these demos provide a realistic environment for getting comfortable with order execution, platform features, and overall market behavior.

For swing traders, an innovative approach is to start with an independent simulator to build strategy confidence, then switch to a broker demo to practice execution in real-time conditions.

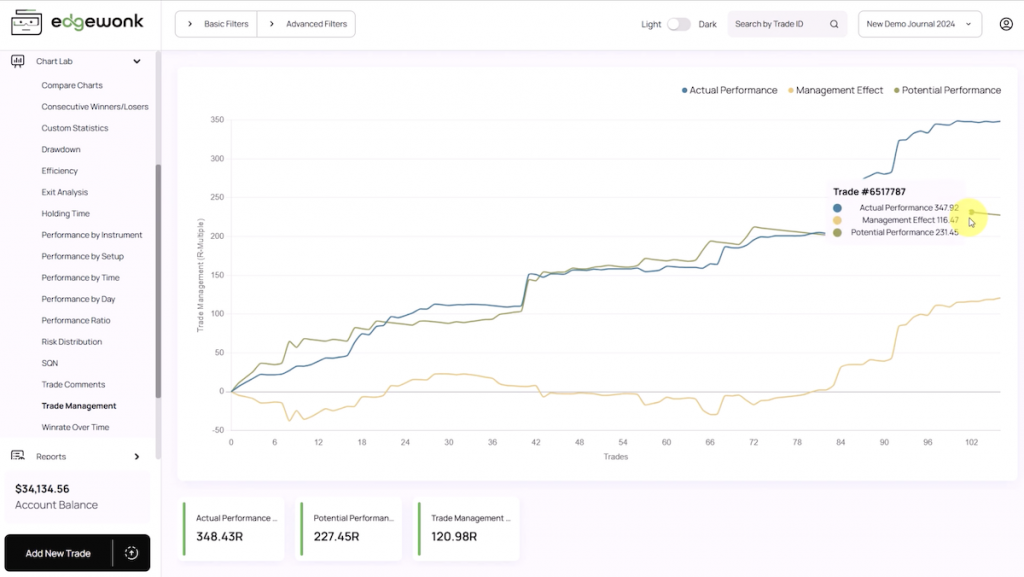

EdgeWonk offers in-depth strategy optimization tools

How To Choose A Swing Trading Simulator

Selecting the right swing trading simulator means looking deeper than flashy features or user interface.

The goal is to find a tool that equips you to navigate the complexities of real markets and helps you build strategies that work under live conditions.

To make the best choice, focus on factors that align with the unique demands of swing trading—like managing trades over several days, handling market gaps, and reacting to news-driven price swings.

We’ve outlined key criteria to guide your decision, with real-world examples to illustrate why each matters for developing practical swing trading skills:

Interface Simplicity And Accessibility

A well-designed interface is crucial when choosing a swing trading simulator. If the platform feels overly complicated or too simplistic, it might hinder your ability to focus on strategy development.

Ideally, the simulator should mirror the look and feel of real-world platforms offered by brokers like IG, Pepperstone, or IC Markets, especially if you plan to trade through those channels.

Look for a simulator with a clean layout, intuitive navigation, and easy access to essential tools like candlestick charts, RSI, MACD, and moving averages.

I’ve used simulators that let me quickly switch between chart types and adjust indicator settings—just like I would when managing a live swing trade.

Fast and simple order entry, including the ability to pre-set stop-loss and take-profit levels, is also key to making your practice sessions feel as realistic as possible.

Market And Asset Availability

When selecting a simulator, it’s important to pick one that offers the asset classes you plan to trade.

For example, if you’re a US-based swing trader, you’ll probably want access to popular stocks like Apple or Tesla and major forex pairs such as EUR/USD or USD/JPY. Having these options allows you to practice strategies that fit your preferred markets.

Don’t overlook the importance of key indices like the S&P 500 or DAX, which many swing traders use to gauge overall market trends or execute index-based trades.

Additionally, if your approach includes diversification, look for simulators that provide access to ETFs or bonds—these can help you practice managing a balanced portfolio and adjusting to different market cycles.

From my experience, the more asset classes a simulator offers, the better you can adapt your swing trading techniques to various market environments.

For example, switching between equities and forex during different market conditions has helped me identify which instruments respond best to specific technical setups or news events.

Market Data Accuracy And Order Processing

An effective trading simulator must replicate live market conditions as accurately as possible.

It should include realistic factors like spreads that widen during volatile periods, order execution delays, slippage, and authentic price fluctuations.

For swing traders, these elements are crucial because trades often span multiple days, and understanding how orders fill—or sometimes don’t fill as expected—can make a big difference in managing risk and timing exits.

It’s also important that the simulator operates during actual market hours and doesn’t rely on outdated or oversimplified data.

I’ve seen simulators with delayed pricing fail to capture overnight gaps or sudden news-driven moves, which can lead to an unrealistic sense of security.

When you’re swing trading, preparing for these real-time shifts is key to executing strategies that hold up in live markets.

Backtesting And Market Replay

A strong swing trading simulator should offer both backtesting and market replay capabilities.

Backtesting lets you apply your strategies to historical price data, giving insight into how your setups would have performed during key market events like sudden earnings surprises or geopolitical tensions.

Replay tools allow you to revisit past trading days and watch price action unfold as if it were happening live.

Choose a simulator that lets you replay past sessions at different speeds.

I’ve used simulators to slow down a volatile trading day—like when a major stock index reacted to unexpected central bank comments—and analyze my trade entries and exits. Then, I replayed the same session at full speed to test how quickly I could spot opportunities and make decisions.

This hands-on practice helps refine your timing and boosts your confidence for real-market conditions.

Personalized Settings And Risk Controls

A high-quality swing trading simulator should allow you to customize trading variables like account size, leverage, and risk controls.

For example, if you’re trading under FCA or CySEC regulations in the UK or EU, you’ll need to account for leverage limits—like a maximum of 1:30 on major forex pairs.

Choosing a simulator replicating these real-world constraints is key to building habits aligning with live trading rules.

I’ve found configuring stop-losses, take-profits, and trailing stops within the simulator is invaluable. When simulating a multi-day trade on a volatile stock, these tools helped me practice managing risks effectively and protect profits during sharp market reversals.

These customizable settings make it easier to fine-tune your strategies and prepare for the unpredictability of real trading conditions.

Pricing, Availability And Usage Limits

The cost and accessibility of a trading simulator are important factors to weigh.

While some platforms offer free access, others have limitations, such as time-restricted trials or requiring a subscription to unlock advanced features.

For example, suppose you’re planning to refine your swing trading strategy over several weeks or months. In that case, it’s worth checking whether the simulator continues to provide complete functionality after the trial period expires.

In my experience, while free simulators can be an excellent starting point, some lock advanced features—like multi-timeframe charting or in-depth performance analytics—behind a paywall.

If you’re serious about swing trading, it might be worth investing in a subscription that offers uninterrupted access and full functionality to develop and test your strategies properly.

Bottom Line

The best swing trading simulators offer a valuable opportunity to gain practical experience without the risk of losing capital.

They allow you to experiment with trading strategies, observe how markets behave, and develop the emotional discipline needed for success—all without putting real money on the line.

For swing traders, simulators are especially useful for practicing trades over several days, analyzing how positions react to overnight news, and managing gap risks.

By replicating realistic market scenarios, these tools let you refine your setups, test new techniques, and identify weaknesses in your approach.

A good simulator is more than just practice—it’s a sandbox where you can sharpen your skills, gain confidence, and prepare to tackle real-world trading with a well-tested plan.

FAQ

What Key Features Make A Swing Trading Simulator Effective?

When evaluating simulators, focus on realistic market data, execution speed, and comprehensive asset coverage. Look for platforms offering key tools like backtesting, market replay, and customizable risk settings.

These features allow you to practice holding positions overnight, react to news events, and refine stop-loss and take-profit strategies—just like in real swing trading.

Are Free Simulators Enough For Serious Swing Traders?

Free simulators can be a great way to start learning, but they often come with limitations, such as fewer advanced tools, restricted access to real-time data, or locked features.

For serious swing traders, a paid simulator may offer more flexibility. It may include replays of past market sessions, detailed performance analytics, and support for a wider range of assets—all of which can be invaluable for fine-tuning your strategies over time.